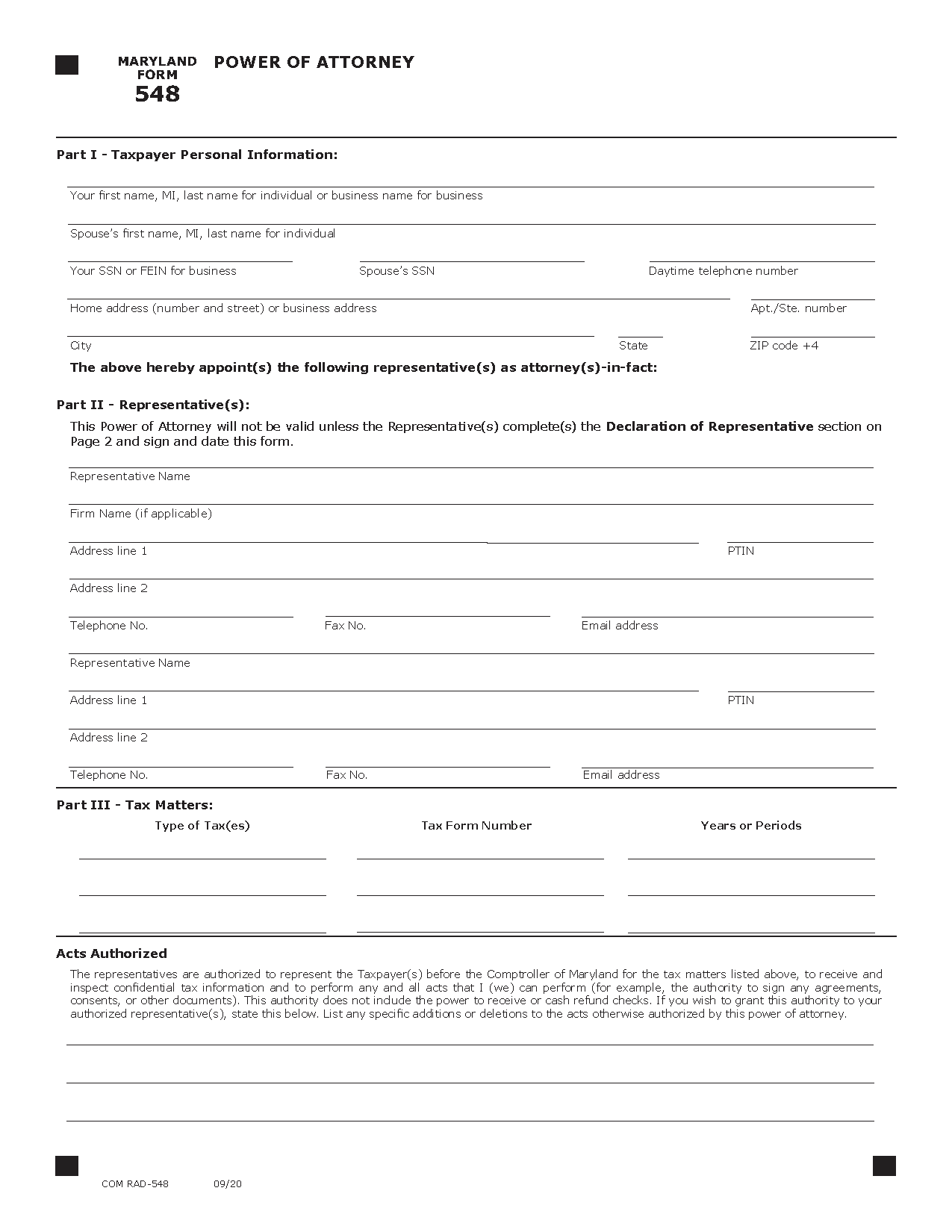

Maryland Tax Power of Attorney (Form 548)

A Maryland tax power of attorney (Form 548) is used to designate a representative to manage tax matters for a taxpayer or business. The document authorizes one or two representatives to obtain confidential tax information, sign tax-related documents, and represent the taxpayer in legal proceedings.