How to Send the Return Letter

In general, a security deposit return letter should be delivered by certified mail with the refund amount enclosed. Doing so ensures there is proof that the deposit was sent on time and that the tenant received it.

What a Landlord Can Deduct From a Security Deposit

The deductions a landlord can make will depend on the terms of the lease agreement and both state and local laws. With exceptions for everyday wear and tear, deductions are typically allowed for the following reasons:

- Unpaid rent

- Property damage

- Outstanding utility bills

- Unauthorized property alterations

- Lease violations resulting in legal fees

The return letter must describe the landlord’s deductions and the amounts for each. To avoid disputes, it’s best to include supporting documents like photos or receipts to back up the charges.

Sample

Download: PDF, Word (.docx), OpenDocument

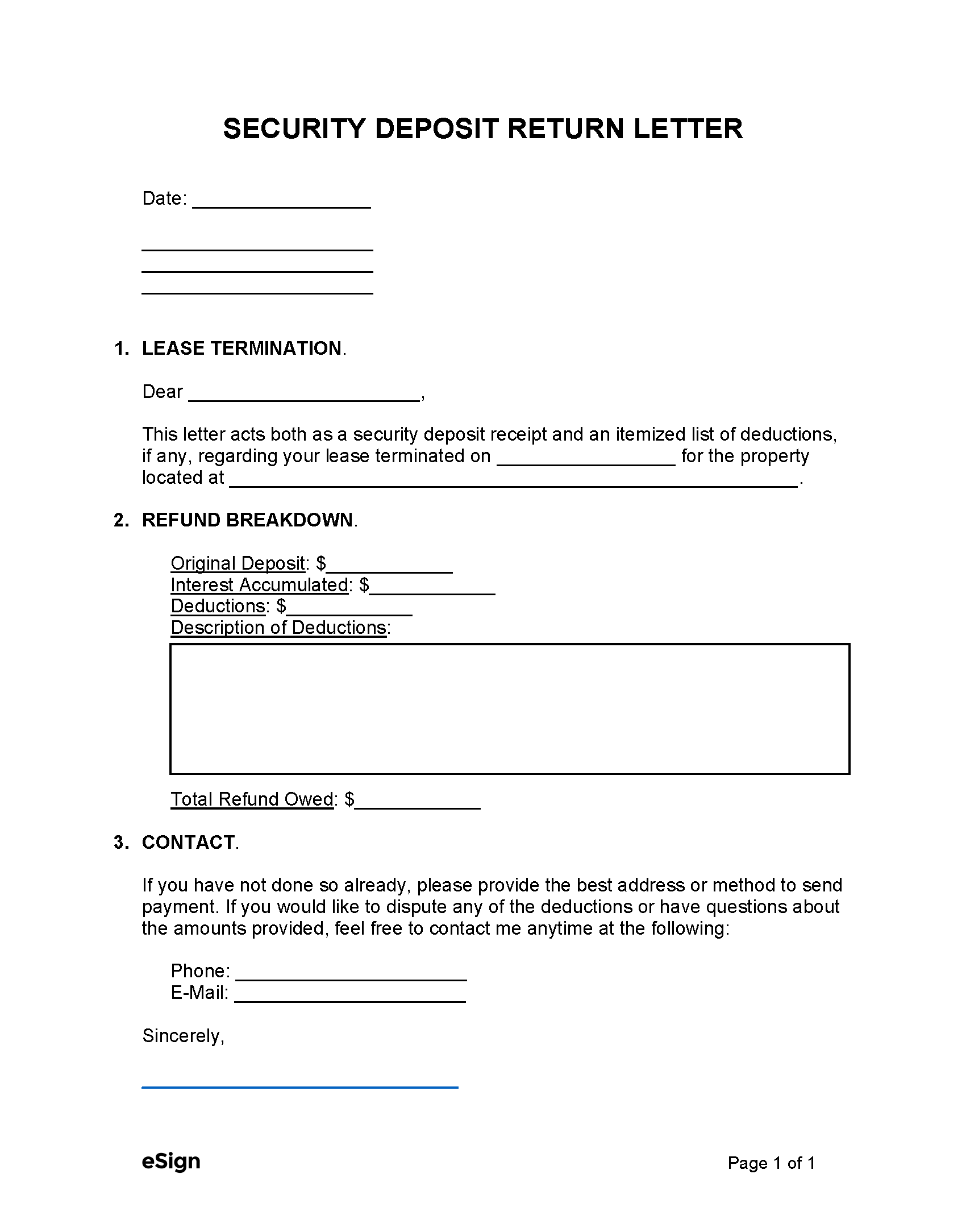

SECURITY DEPOSIT RETURN LETTER

Date: [DATE]

[LANDLORD’S NAME]

[LANDLORD’S STREET ADDRESS

[LANDLORD’S CITY, STATE, ZIP]

1. LEASE TERMINATION.

Dear [TENANT’S NAME],

This letter acts both as a security deposit receipt and an itemized list of deductions, if any, regarding your lease terminated on [LEASE TERMINATION DATE] for the property located at [RENTAL PROPERTY ADDRESS].

2. REFUND BREAKDOWN.

Original Deposit: $[AMOUNT]

Interest Accumulated: $[AMOUNT]

Deductions: $[AMOUNT]

Description of Deductions: [DESCRIBE DEDUCTIONS]

Total Refund Owed: $[AMOUNT]

3. CONSIDERATION.

If you have not done so already, please provide the best address or method to send payment. If you would like to dispute any of the deductions or have questions about the amounts provided, feel free to contact me anytime at the following:

Phone: [LANDLORD’S PHONE]

E-Mail: [LANDLORD’S E-MAIL]

Sincerely,

___________________

Security Deposit Return Deadlines

The following list outlines the timeframes within which a landlord must return a tenant’s security deposit:

- AL – 60 Days (§ 35-9A-201(b))

- AK – 14 or 30 Days (§ 34.03.070(g))

- AZ – 14 Days (§ 33-1321(D))

- AR – 60 Days (§ 18-16-305(a))

- CA – 21 Days (§ 1950.5(g)(1))

- CO – 1 Month or 60 Days (§ 38-12-103)

- CT – 15 or 21 Days (§ 47a-21(d)(2))

- DE – 20 days (Title 25 § 5514(f))

- FL – 15 or 30 Days (§ 83.49(3)(a))

- GA – 30 Days (§ 44-7-34(a))

- HI – 14 Days (§ 521-44(c))

- ID – 21 or 30 Days (§ 6-321(2))

- IL – 30 or 45 Days (765 ILCS 710/1(a))

- IN – 45 Days (§ 32-31-3-12(a))

- IA – 30 Days (§ 562A.12(3)(a))

- KS – 14 or 30 Days (§ 58-2550(b))

- KY – 30 or 60 Days (§ 383.580(6)(7))

- LA – 1 Month (§ 9:3251(A))

- ME – 21 or 30 Days (§ 6033(2))

- MD – 45 Days (§ 8–203(e))

- MA – 30 Days (Ch. 186 § 15B(4))

- MI – 30 Days (§ 554.609)

- MN – 3 Weeks (§ 504B.178(Subd. 3))

- MS – 45 Days (§ 89-8-21(3))

- MO – 30 Days (§ 535.300(3))

- MT – 10 or 30 Days (§ 70-25-202)

- NE – 14 Days (§ 76-1416(2))

- NV – 30 Days (NRS 118A.242(4))

- NH – 30 Days (RSA 540-A:7(I))

- NJ – 30 Days (§ 46:8-21.1)

- NM – 30 Days (§ 47-8-18(C))

- NY – 14 Days (§ 7-108(1-a)(e))

- NC – 30 or 60 Days (§ 42-52)

- ND – 30 Days (§ 47-16-07.1(3))

- OH – 30 Days (§ 5321.16(B))

- OK – 45 Days (§ 41-115(B))

- OR – 31 Days (§ 90.300(13))

- PA – 30 Days (§ 250.512(a))

- RI – 20 Days (§ 34-18-19(b))

- SC – 30 Days (§ 27-40-410(a))

- SD – 2 Weeks (§ 43-32-24)

- TN – 60 Days (§ 66-28-301(f))

- TX – 30 Days (§ 92.103(a))

- UT – 30 Days (§ 57-17-3(2))

- VT – 14 or 60 Days (§ 4461(c))

- VA – 45 Days (§ 55.1-1226(A))

- WA – 30 Days (§ 59.18.280(1)(a))

- WV – 45 or 60 Days (§ 37-6A-2(a))

- WI – 21 Days (§ 134.06(2))

- WY – 15 or 30 Days (§ 1-21-1208(a))