By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

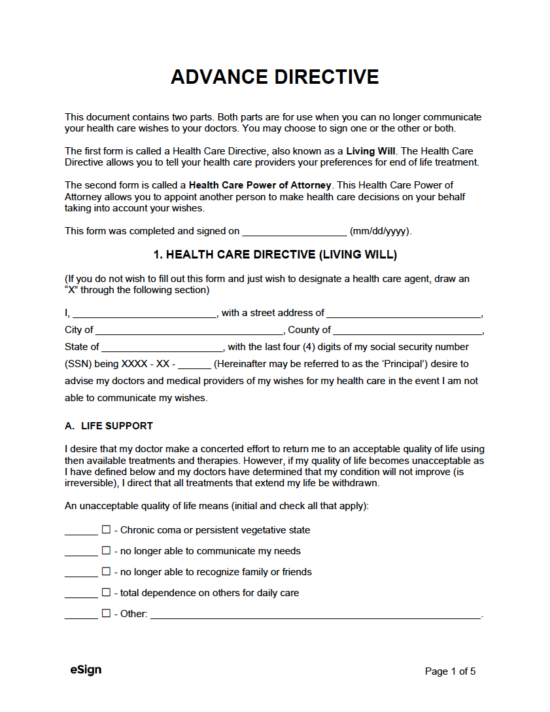

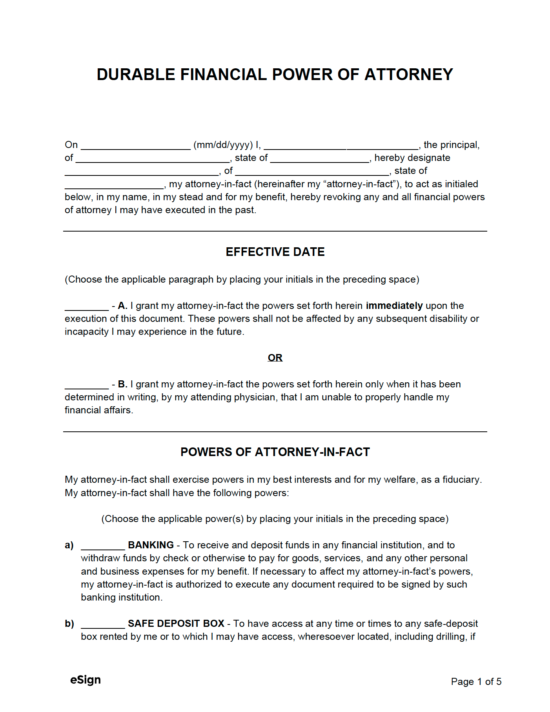

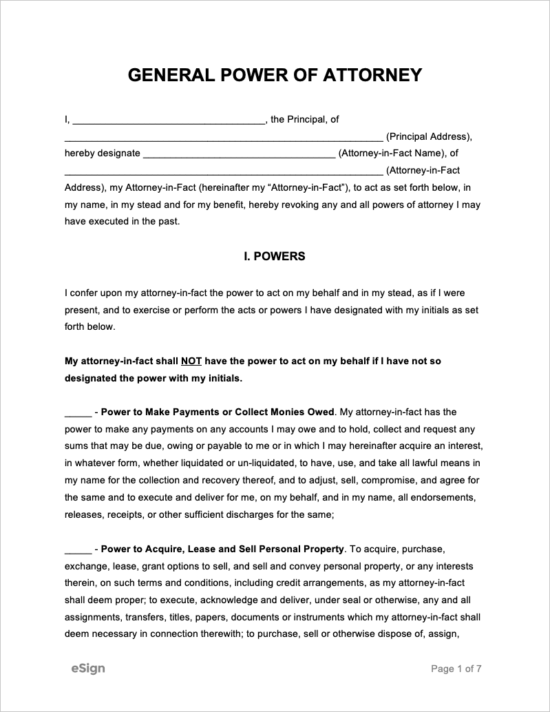

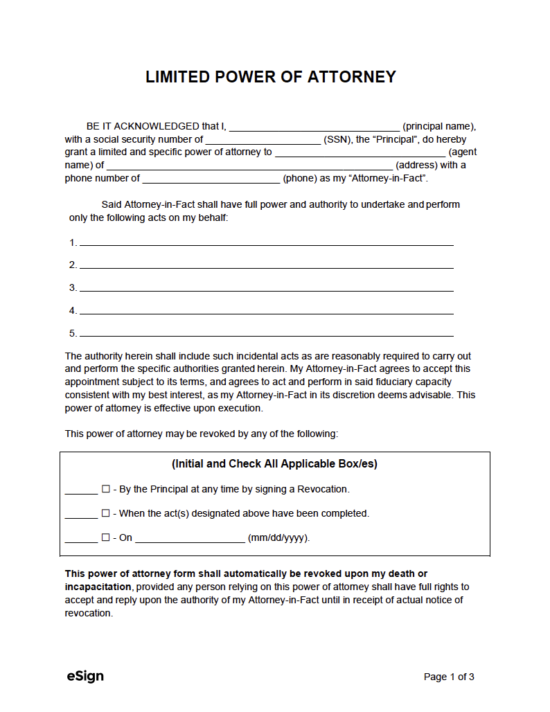

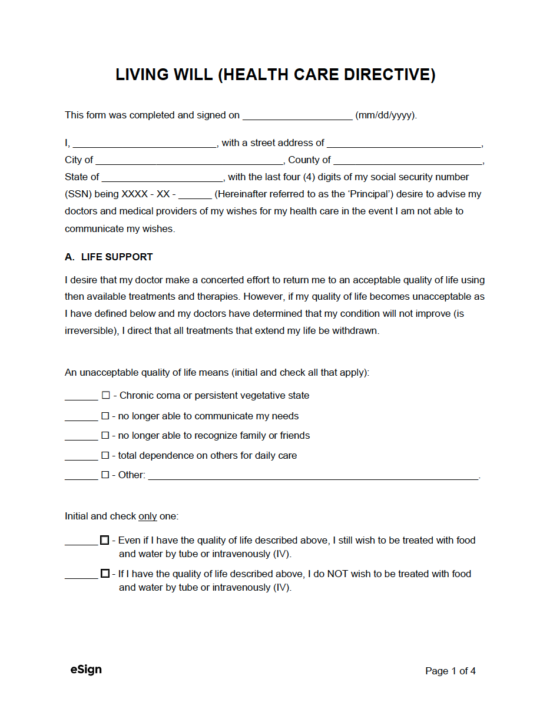

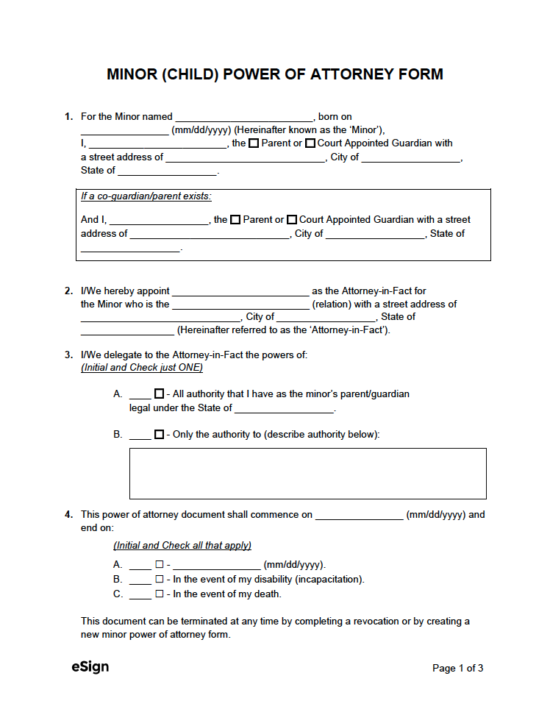

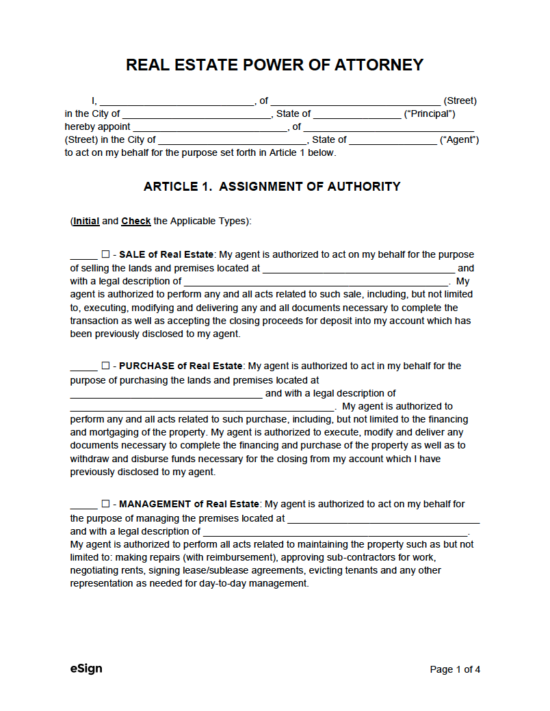

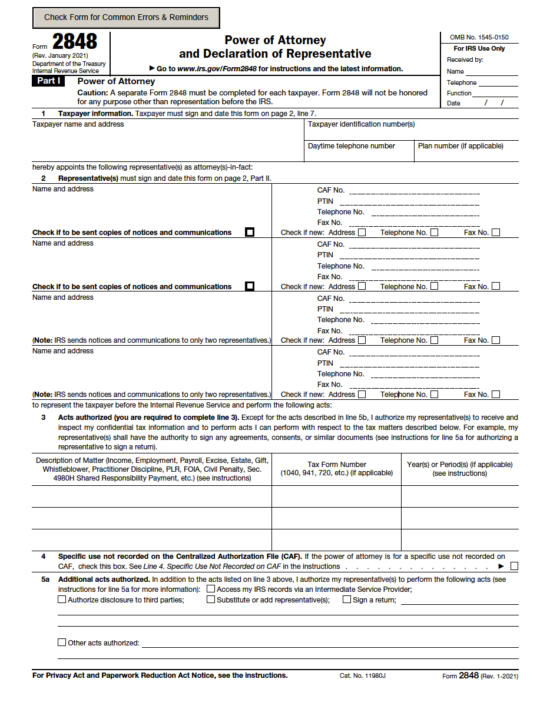

By Type (11)

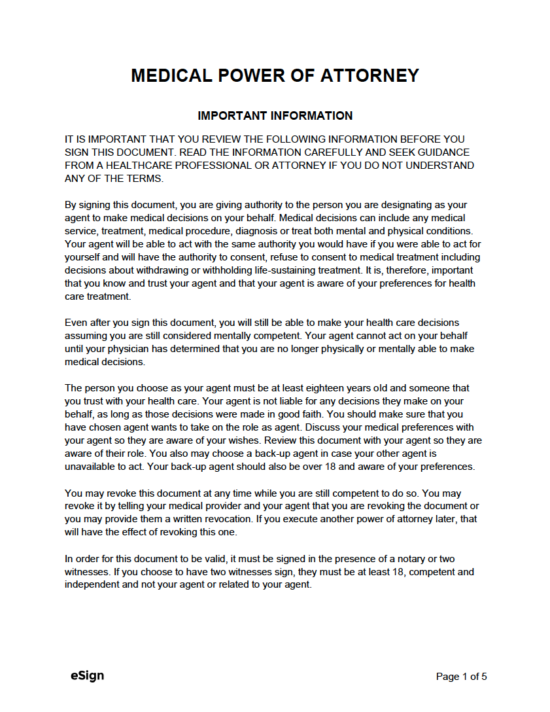

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

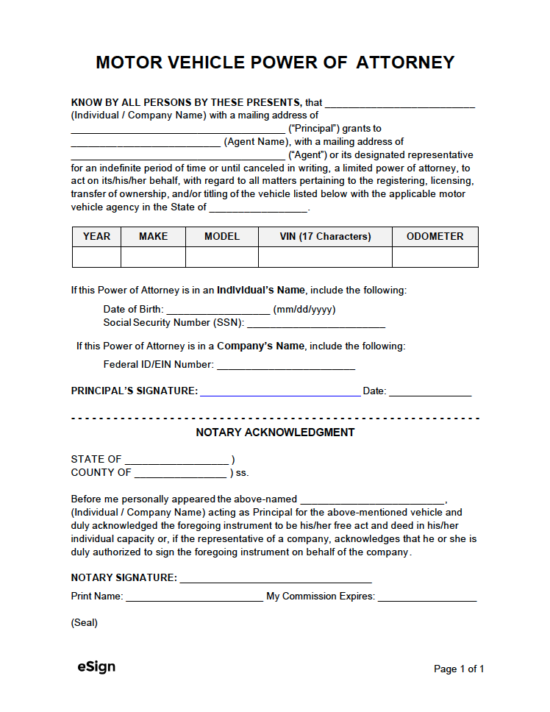

Download: PDF

Download: PDF, Word (.docx), OpenDocument

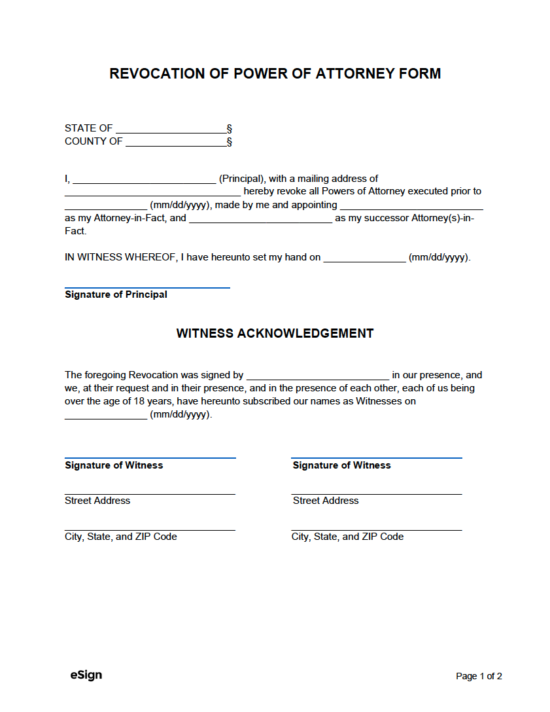

Terminating a Power of Attorney

Download: PDF, Word (.docx), OpenDocument

Contents |

What is a Power of Attorney?

A power of attorney is a form used for providing a person (agent) with the authority to represent another person. The document is most commonly used for electing someone else to handle financial transactions or medical decisions. The most popular type of designation, known as a “durable power of attorney,” allows the appointment to remain active even if the principal should become incapacitated.

Durable vs Non-Durable

It’s very important to understand the difference between a power of attorney being durable versus non-durable. A power of attorney document that is durable gives the principal’s agent the power to make decisions even if the principal is unable to make decisions on their own, a term referred to as being incapacitated. Therefore, the agent will have the power to act on the principal’s behalf at their sole discretion. It’s important that the agent comprehends the wishes and preferences of the principal so they can represent them to the best of their ability in the event of incapacitation.

It should stated explicitly somewhere on the form whether or not the power of attorney executed by the principals is durable or non-durable.

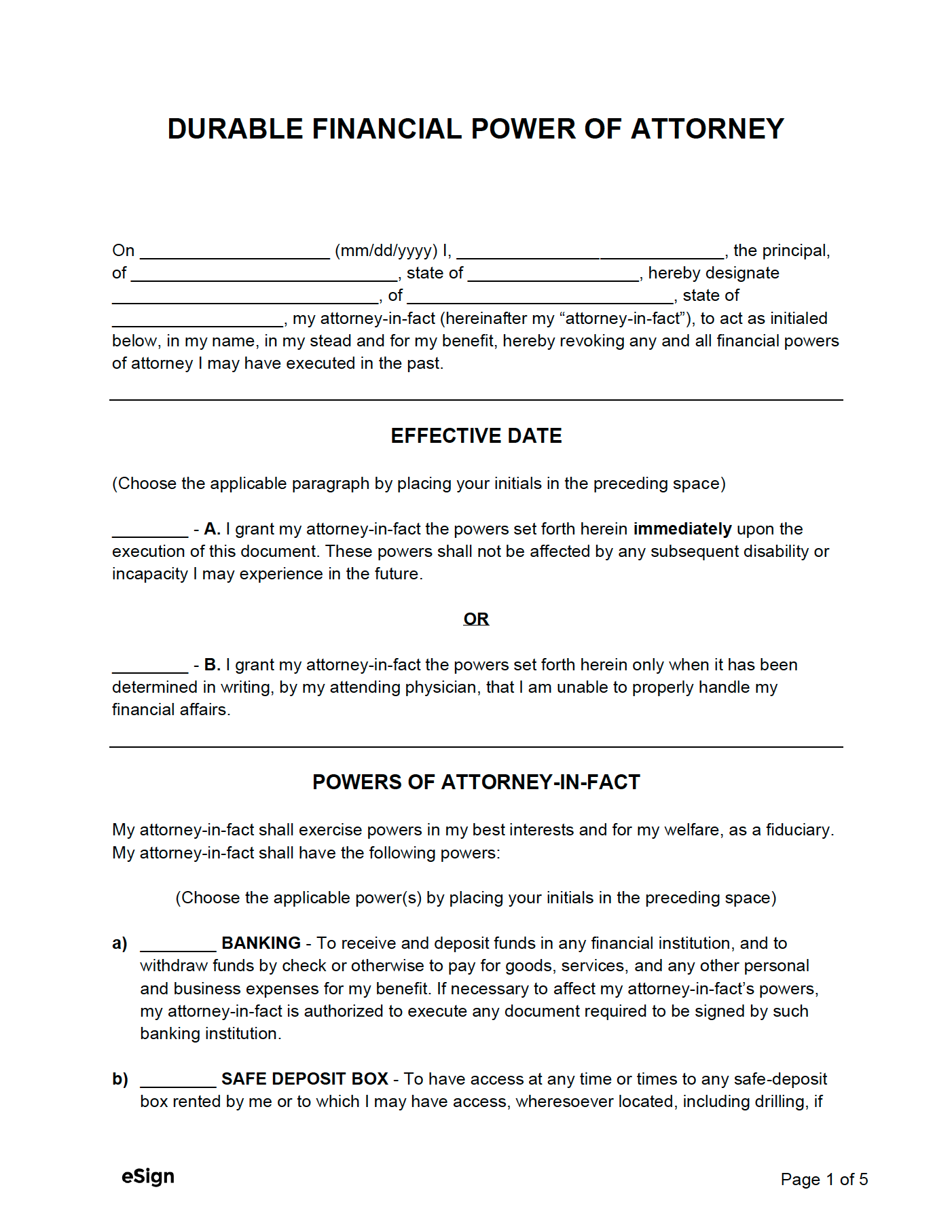

Which Power of Attorney Is for Me?

The flow chart below can be used to decide which power of attorney document best suits one’s needs:

How to Get Power of Attorney

Getting power of attorney requires a principal to select a trusted person to handle specific responsibilities on their behalf. The powers and terms of designation are written in a document called a “power of attorney form,” which must be signed under the laws of the state in which it is executed. Once signed, the agent may use the form whenever they act in the place of the principal.

- Step 1 – Select an Agent

- Step 2 – Choose Powers

- Step 3 – Complete the Power of Attorney Form

- Step 4 – Sign the Document

- Step 5 – Register and Use

Step 1 – Select an Agent

An agent, also known as an “attorney-in-fact” or “surrogate,” may act on behalf of the principal for financial or medical-related decisions. When selecting an agent, the principal should choose someone that they believe to be trustworthy and that appreciates their values. Therefore, the principal might appoint their spouse, a family member, or a close friend as their agent.

If the principal is having a difficult time selecting their agent, an individual named as a beneficiary in their Last Will and Testament is sometimes a suitable option.

Step 2 – Choose Powers

Decide the powers that the agent will have during the term of the power of attorney. Depending on the form, this may be wide-ranging financial responsibility or the ability to make health care decisions for someone else. No matter the role, the principal will ultimately decide what the agent can and cannot do on their behalf.

Step 3 – Complete the Power of Attorney Form

Once the powers have been agreed upon it’s time to meet with the agent and complete the documents. The agent should be made aware of the intentions of the principal and what they expect them to do as their agent. Once the agent understands the wishes and plans of the principal, the documents should be signed.

It’s highly recommended to use the power of attorney documents specific to the state in which the principal resides.

Step 4 – Sign the Document

Each state has its own signing requirements, and each power of attorney document has its own specifications as well. Most power of attorney forms require signatures to be inscribed before a notary public, witnesses, or both. Some states have further requirements that family members, beneficiaries, and medical staff cannot be considered witnesses. Therefore, the principal would be wise to read their state laws to ensure the power of attorney document will be legally binding.

Step 5 – Register and Use

In some states, such as California, a principal is able to protect themselves by registering the signed power of attorney with a government agency. For the agent to act on behalf of the principal, they must present a copy of the power of attorney each time they are completing an act as the principal’s attorney-in-fact. Some institutions, such as banks and hospitals, might allow the agent to file the power of attorney so that it does not have to be produced every time.

Uniform Power of Attorney Act

The Uniform Power of Attorney Act (UPOAA) was created by the Uniform Law Commission to provide the best possible legislation with regard to a power of attorney. Since being introduced in 2006, it has been enacted in 28 states with more states scheduled to enact the UPOAA.

The UPOAA only applies to financial powers and does not affect health care, guardianship, or conservatorship decisions.

| State | Year Enacted | Bill |

| Alabama | 2011 | SB 53 |

| Arkansas | 2011 | SB 887 |

| Colorado | 2009 | HB 09-1198 |

| Connecticut | 2016 | Public Act No. 15-240 |

| Georgia | 2018 | House Bill 897 |

| Hawaii | 2014 | SB 2229 |

| Idaho | 2008 | Title 15, Chapter 12 |

| Iowa | 2014 | S.F. 2168 |

| Kentucky | 2020 | KRS Chapter 457 |

| Maine | 2009 | Chapter 292 |

| Maryland | 2010 | SB 309 |

| Montana | 2011 | HB 0374 |

| Nebraska | 2012 | LB 1113 |

| Nevada | 2019 | NRS Chapter 162A |

| New Hampshire | 2017 | SB230 |

| New Mexico | 2011 | SB 146 |

| North Carolina | 2017 | SB 569 |

| Ohio | 2012 | Chapter 1337 |

| Oklahoma | 2021 | HB 2548 |

| Pennsylvania | 2014 | HB 1429 |

| South Carolina | 2016 | SB 778 |

| South Dakota | 2020 | SB 148 |

| Texas | 2017 | HB 1974 |

| Utah | 2016 | HB 74 |

| Virginia | 2010 | SB 569 |

| Washington | 2017 | SB 5635 |

| West Virginia | 2012 | Chapter 39B |

| Wisconsin | 2010 | Chapter 244 |

| Wyoming | 2017 | SF0105 |

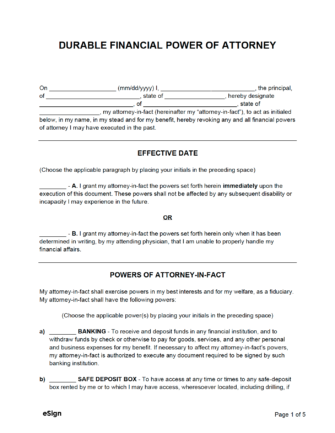

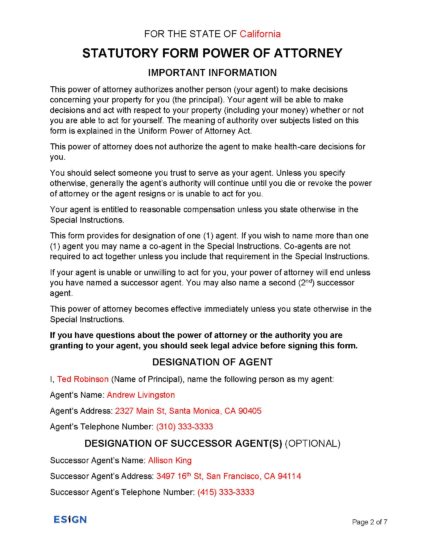

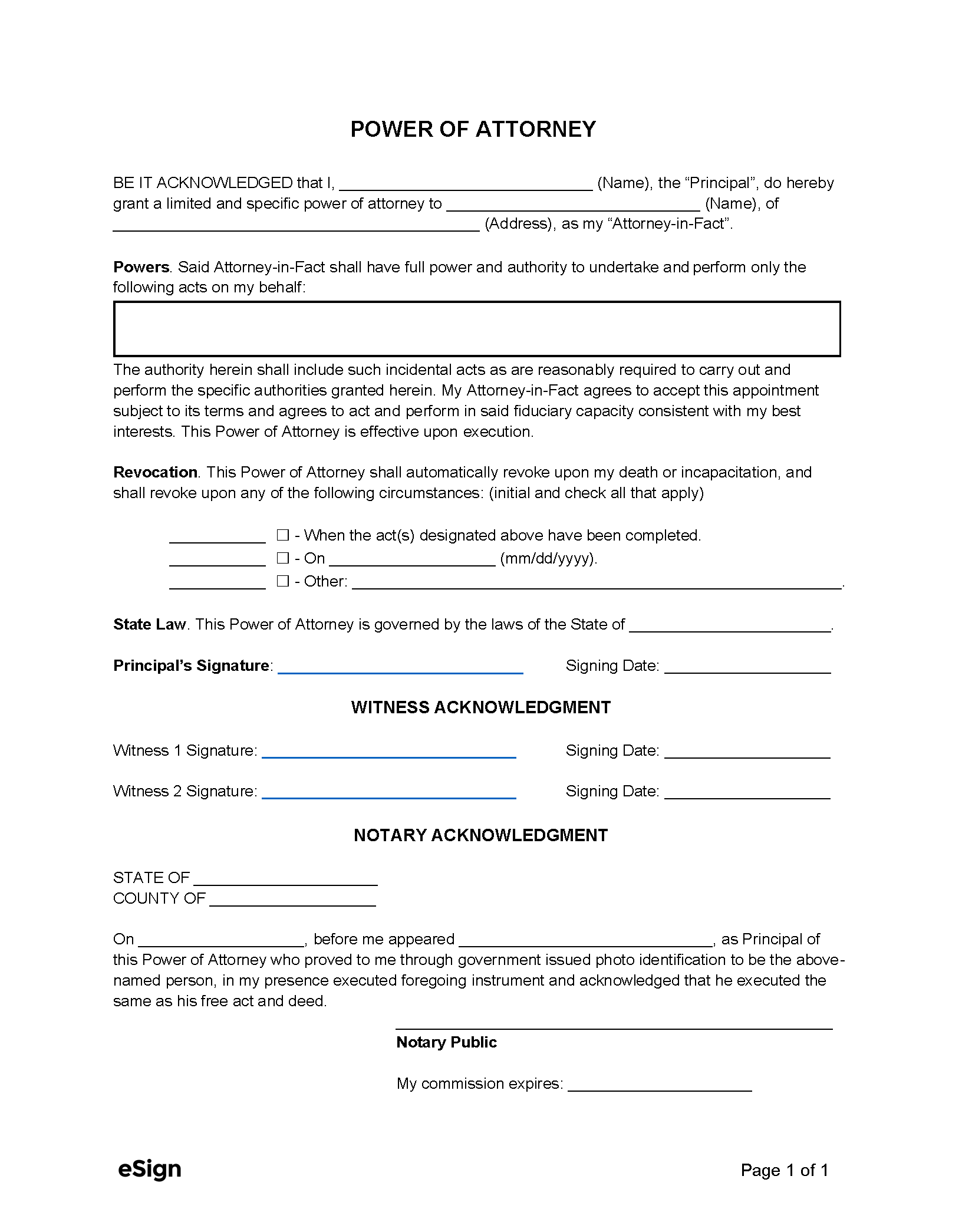

Sample

Download: PDF, Word (.docx), OpenDocument

How to Write

A power of attorney form should not be drafted from scratch, unless done so by an experienced attorney that has extensive knowledge in power of attorney law. This explanation on how to write a power of attorney details the steps a principal should take when filling out their power of attorney form.

Step 1 – Read the Power of Attorney Form

A power of attorney form should be detailed and tailored to the specific needs of the principal. If they need to create a power of attorney to give financial powers to an agent, they should be certain that they are not using a medical power of attorney. Once they are satisfied with the contents of the document, they can begin to complete all the mandatory fillable fields.

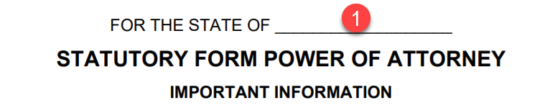

Step 2 – Make it State Specific

1. Since a power of attorney must be state specific, enter the state of where the principal resides.

Step 3 – Choosing an Agent

Provide the following information into the appropriate fields:

2. Full legal name of the principal. (The principal is the person giving power to the agent.)

3. The agent’s name. (This is the person that is being granted power of attorney.)

4. The agent’s address.

5. The agent’s phone number.

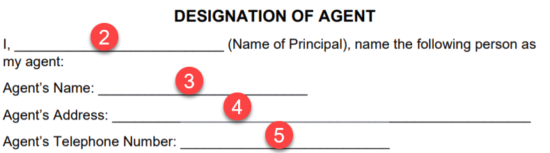

Step 4 – Successor Agent’s (Optional)

In the event that the primary agent dies or is unable to perform their duties, a backup agent will take their place(successor agent). And if the successor agent is unavailable, a second successor agent will be appointed. The following successor agent information must be provided:

6. The successor agent’s name.

7. The successor agent’s address.

8. The successor agent’s phone number.

9. The 2nd successor agent’s name.

10. The 2nd successor agent’s address.

11. The 2nd successor agent’s phone number.

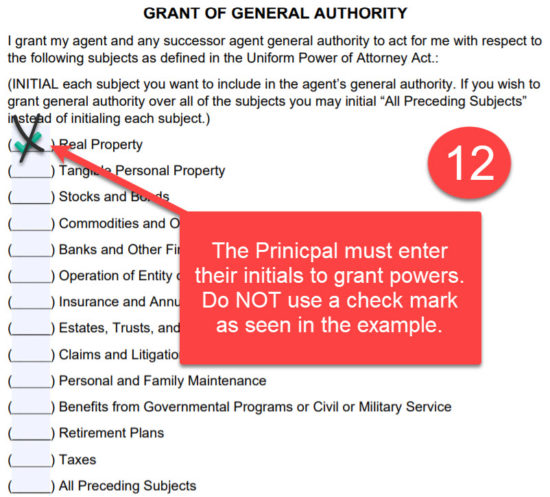

Step 5 – Grant Powers to Agent

12. The principal must initial next to each power that they wish to grant to their agent. As seen in the image above, do not use a check mark to grant powers.

Step 6 – Special Instructions

13. If it’s there are certain details not already included in the content of the document, the principal can enter them in the special instructions section. For example, if powers are granted to two (2) agents, the principal can state within the special instructions that they must act in conjunction with each other on all matters.

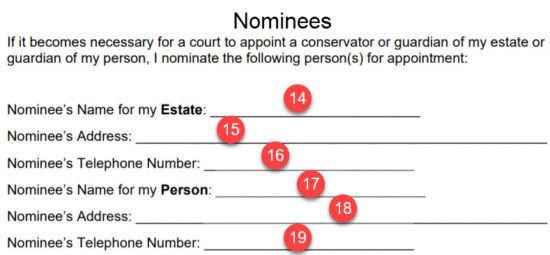

Step 7 – Nominees

A court of law may feel that it’s necessary to appoint an individual to handle the principal’s estate on their behalf (conservator) or a guardian of their person. The principal can use this section of the form to provide a nominee for these positions; however, the court ultimately has the final say in the matter.

14. The name of the nominee for conservator.

15. The address of the nominee for conservator.

16. The phone number of the nominee for conservator.

17. The name of the nominee for guardian.

18. The address of the nominee for guardian.

19. The phone number of the nominee for guardian.

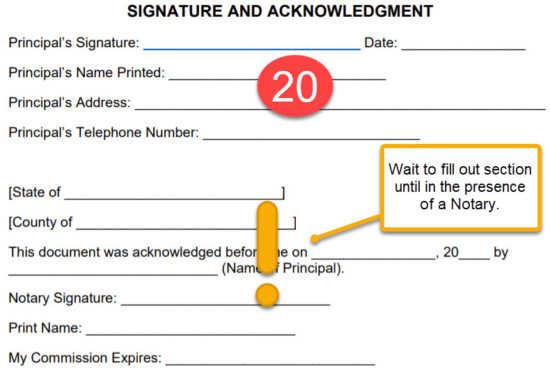

Step 8 – Principal’s Signature

20. In section 20, enter the personal information of the principal including name, date, address, and phone number. It’s better to wait to sign until in the presence of a Notary Public.

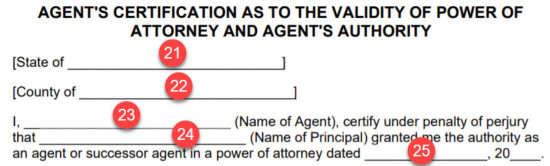

Step 9 – Agent’s Certification

The agent is required to make a statement under penalty of perjury that the principal did in fact grant them power of attorney. To do this, they must enter the following information into fields 21-25:

21. The state in which the agent resides. (It does not have to be the same state and county in which the principal lives.)

22. The county in which the agent resides.

23. The agent’s name.

24. The principal’s name.

25. The date this section was completed.

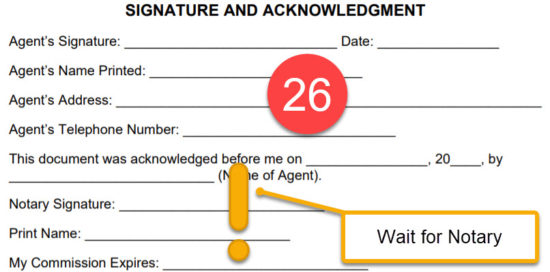

Step 10 – Agent’s Signature

26. The agent’s personal information must be entered in this section. If necessary, the agent must wait until in the presence of a notary to sign the document.