By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

By Type (14)

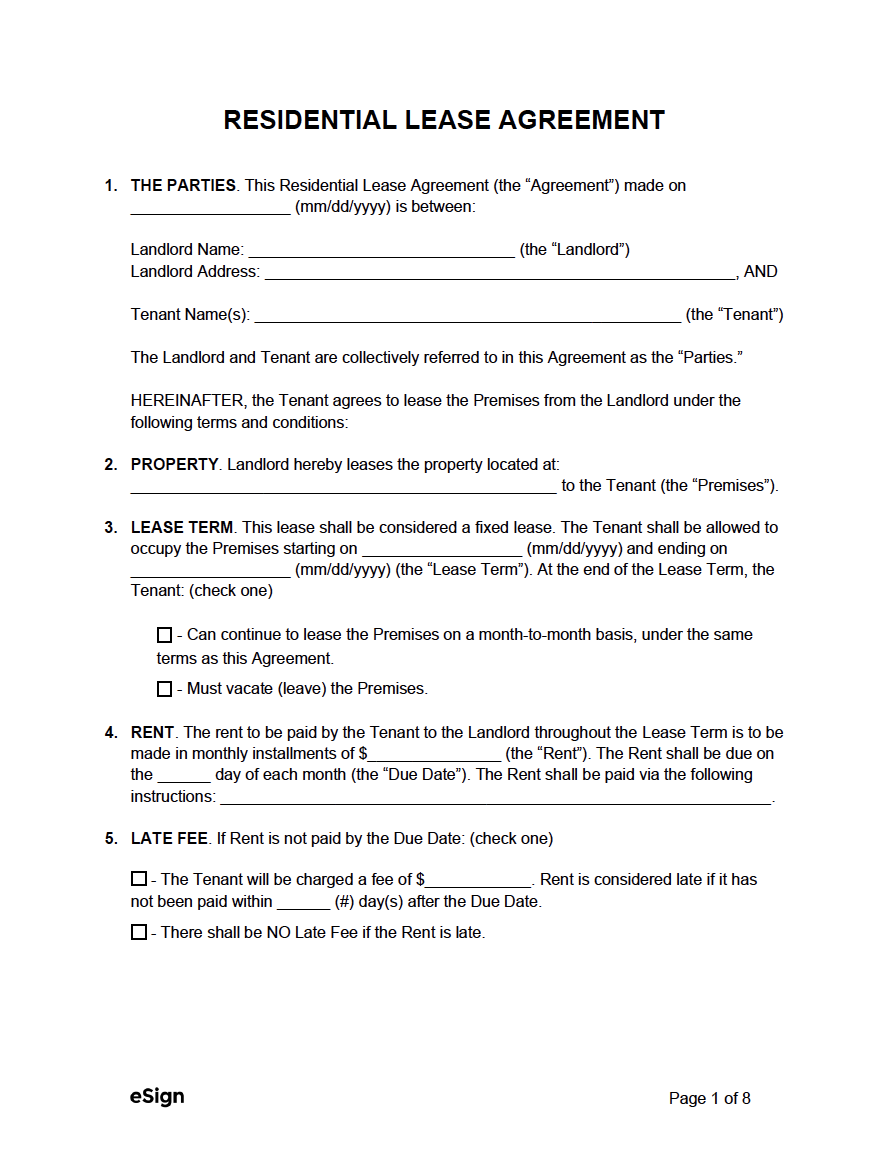

Standard Residential Lease Agreement – The most popular type of lease. A fixed-term contract for renting out property for a few months to a year or more. Standard Residential Lease Agreement – The most popular type of lease. A fixed-term contract for renting out property for a few months to a year or more.

Download: PDF, Word (.docx), OpenDocument |

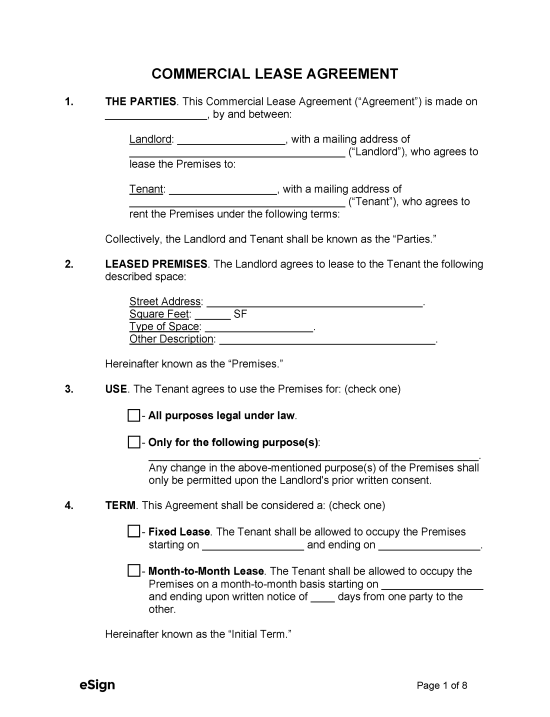

Commercial Lease Agreement – For any type of non-residential use such as retail, office, or industrial space. Commercial Lease Agreement – For any type of non-residential use such as retail, office, or industrial space.

Download: PDF, Word (.docx), OpenDocument |

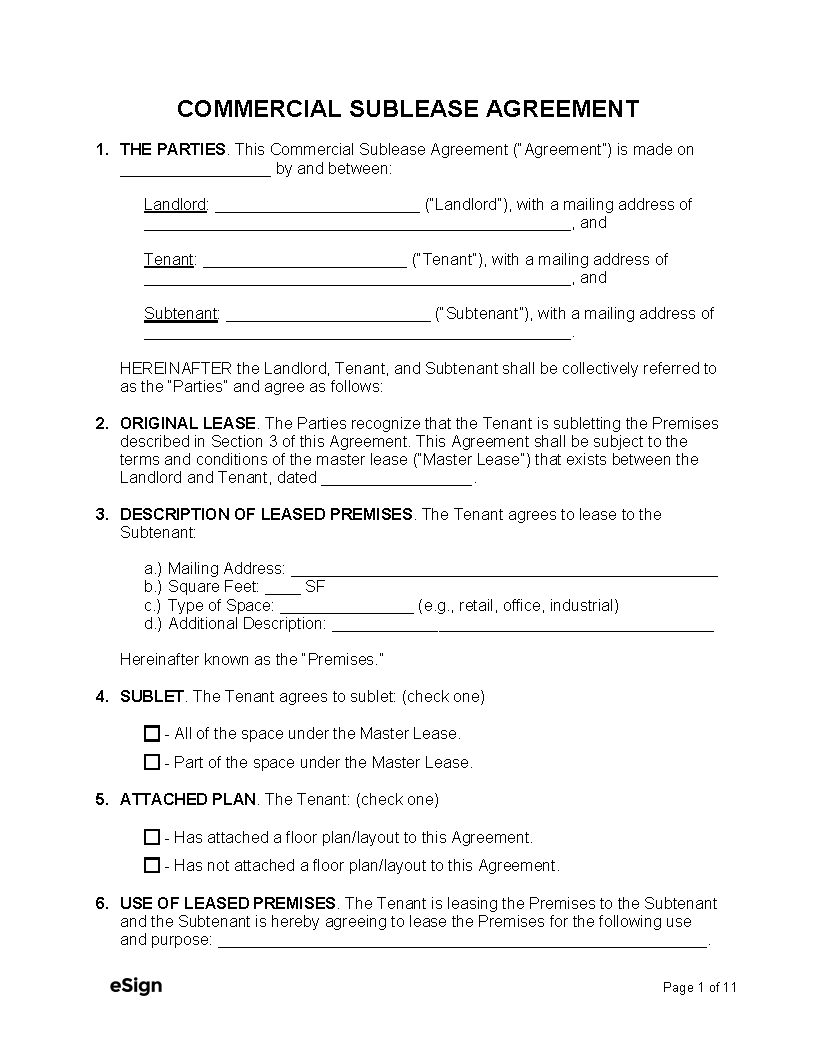

Commercial Sublease Agreement – Enables a commercial tenant to rent out the property they’re leasing to another individual or entity. Commercial Sublease Agreement – Enables a commercial tenant to rent out the property they’re leasing to another individual or entity.

Download: PDF, Word (.docx), OpenDocument |

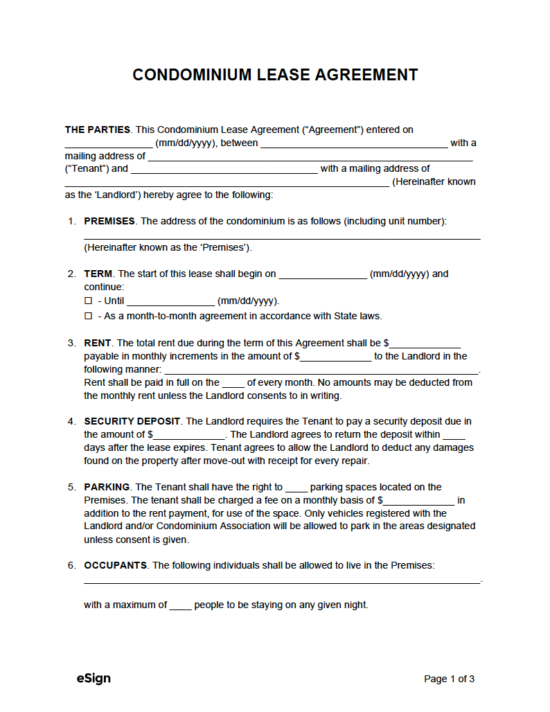

Condominium Lease Agreement – For a residential unit located in a condominium association. Condominium Lease Agreement – For a residential unit located in a condominium association.

Download: PDF, Word (.docx), OpenDocument |

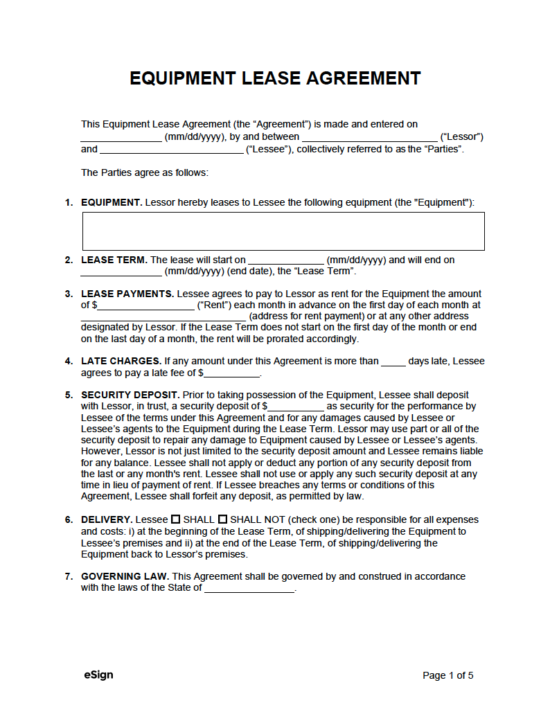

Equipment Lease Agreement – To rent tools or heavy machinery. Equipment Lease Agreement – To rent tools or heavy machinery.

Download: PDF, Word (.docx), OpenDocument |

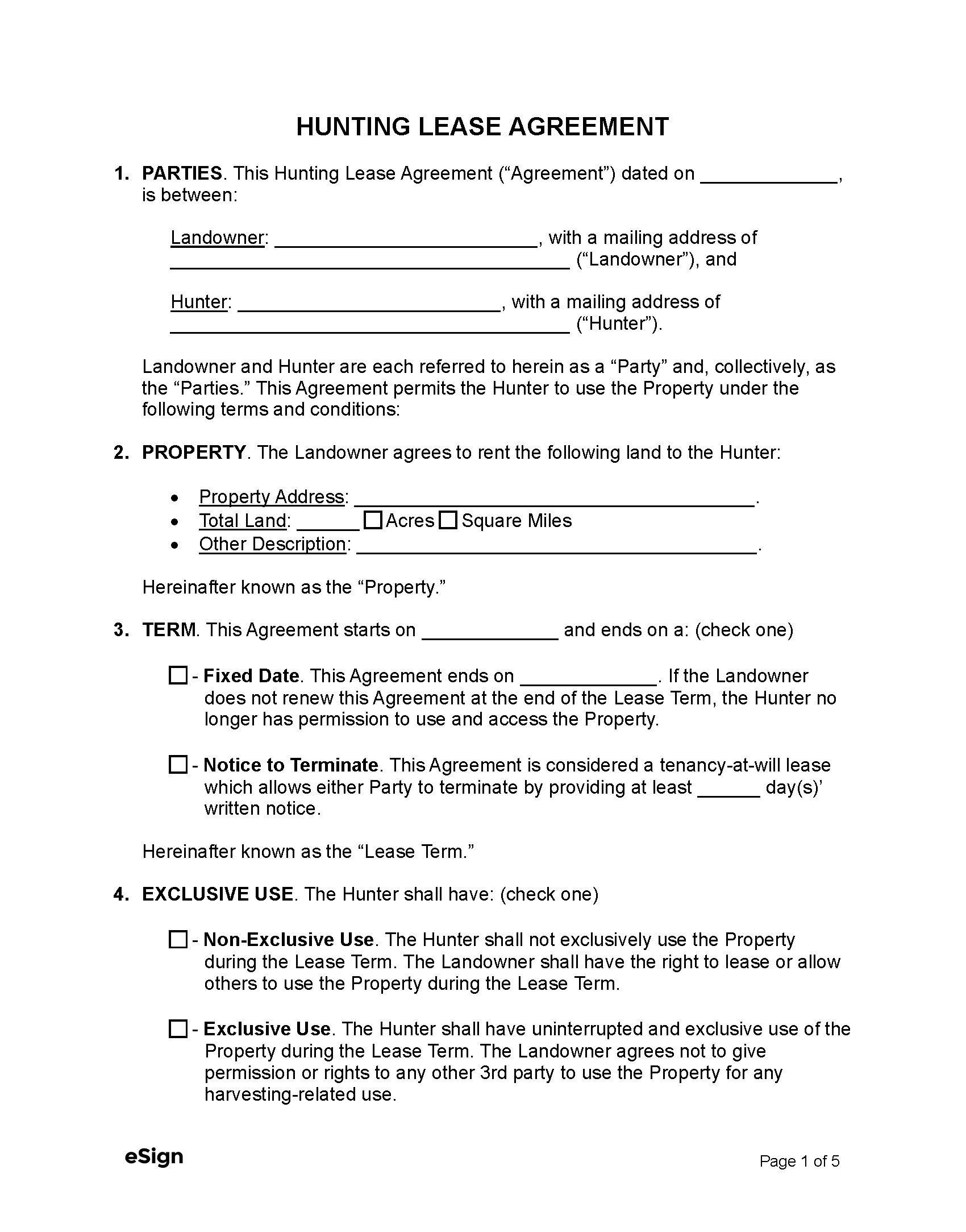

Hunting Lease Agreement – An agreement where a hunter pays a private landowner to hunt on their property for a fixed period. Hunting Lease Agreement – An agreement where a hunter pays a private landowner to hunt on their property for a fixed period.

Download: PDF, Word (.docx), OpenDocument |

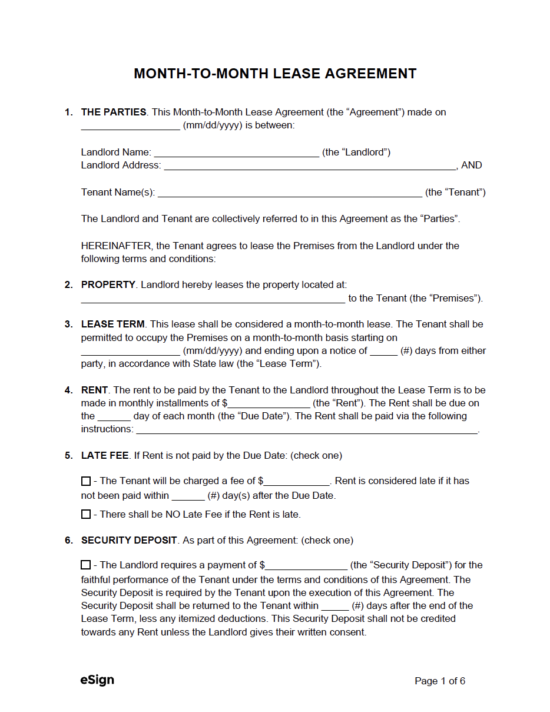

Month-to-Month Rental Agreement – Also known as a “tenancy at will,” continues until either the landlord or tenant gives notice to the other (30 days notice is the most common). Month-to-Month Rental Agreement – Also known as a “tenancy at will,” continues until either the landlord or tenant gives notice to the other (30 days notice is the most common).

Download: PDF, Word (.docx), OpenDocument |

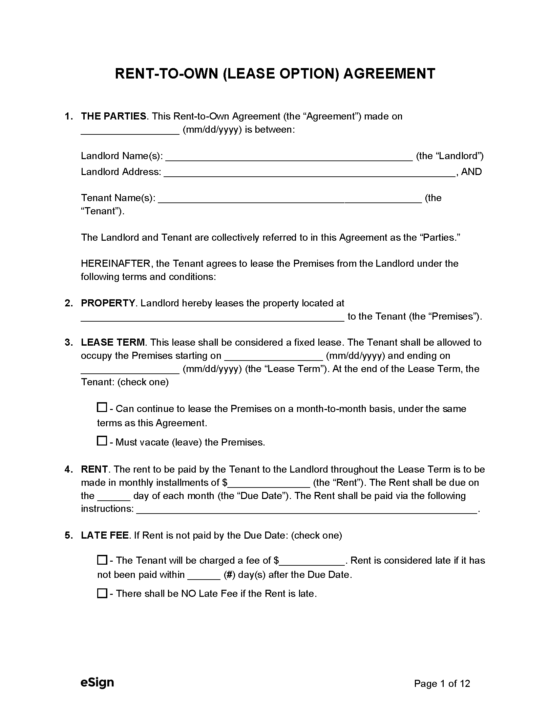

Rent-to-Own Agreement (Lease-Option) – Allows a tenant to purchase a rented property under predetermined terms and conditions. Rent-to-Own Agreement (Lease-Option) – Allows a tenant to purchase a rented property under predetermined terms and conditions.

Download: PDF, Word (.docx), OpenDocument |

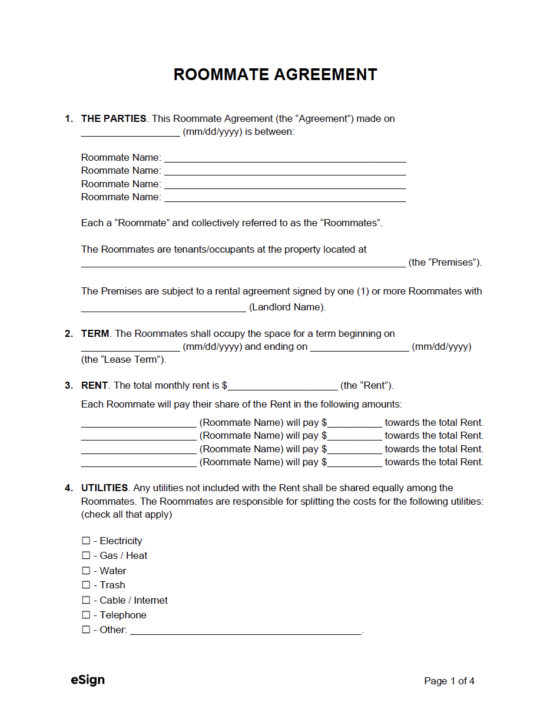

Roommate Agreement – Establishes financial and social rules between tenants sharing the same apartment or house. Roommate Agreement – Establishes financial and social rules between tenants sharing the same apartment or house.

Download: PDF, Word (.docx), OpenDocument |

Simple (1-Page) Lease Agreement – For setting a basic rental arrangement between a landlord and tenant. Simple (1-Page) Lease Agreement – For setting a basic rental arrangement between a landlord and tenant.

Download: PDF, Word (.docx), OpenDocument |

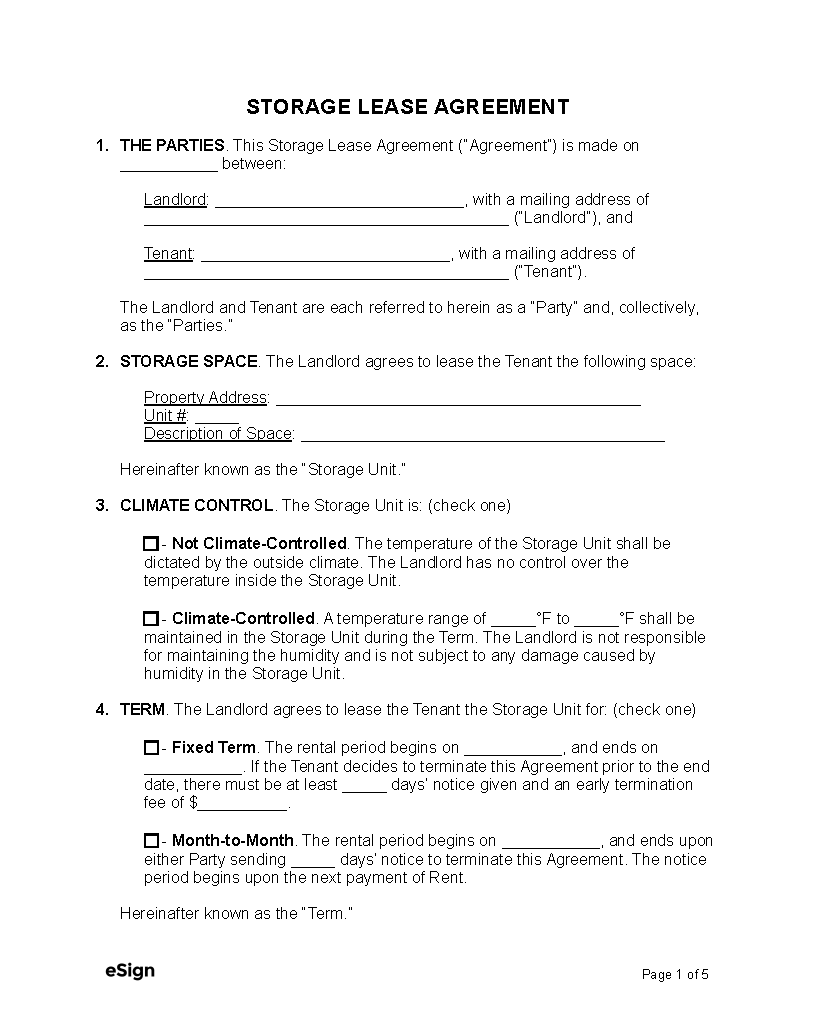

Storage Space Lease Agreement – Outlines the terms under which a landlord rents out a space for a tenant to store their belongings. Storage Space Lease Agreement – Outlines the terms under which a landlord rents out a space for a tenant to store their belongings.

Download: PDF, Word (.docx), OpenDocument |

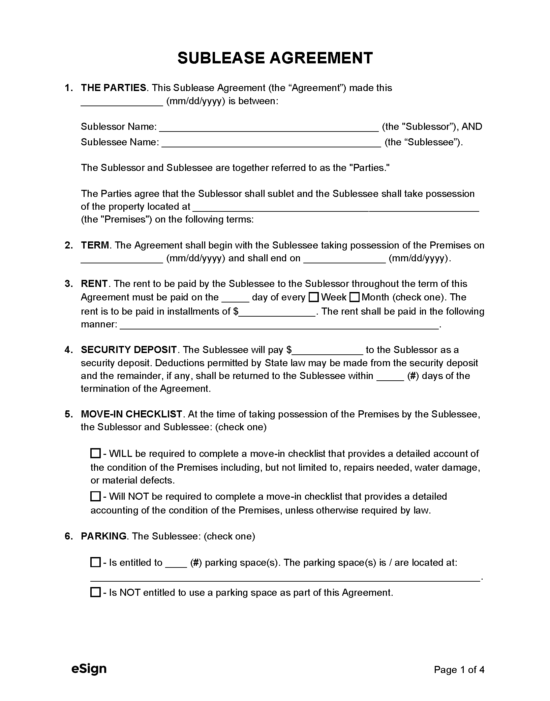

Sublease Agreement – Allows a tenant who has a lease to rent (sublet) a portion or the entirety of their rental unit to someone else. Sublease Agreement – Allows a tenant who has a lease to rent (sublet) a portion or the entirety of their rental unit to someone else.

Download: PDF, Word (.docx), OpenDocument |

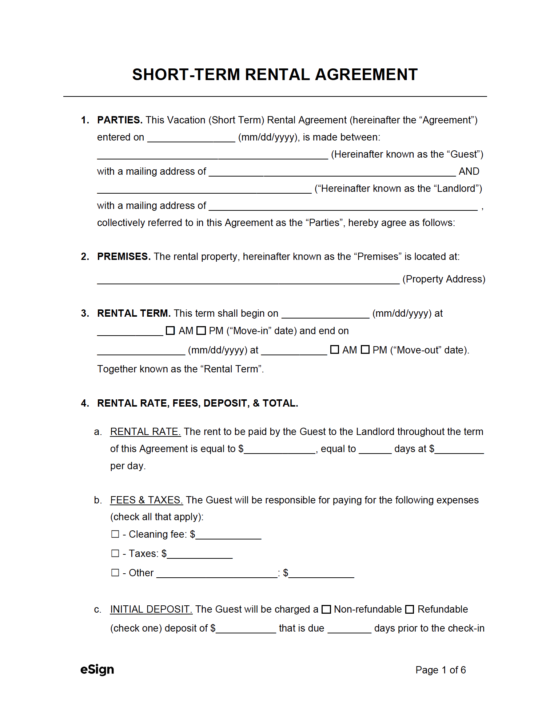

Short-Term / Vacation Lease Agreement – A basic rental arrangement for short-term stays. Short-Term / Vacation Lease Agreement – A basic rental arrangement for short-term stays.

Download: PDF, Word (.docx), OpenDocument |

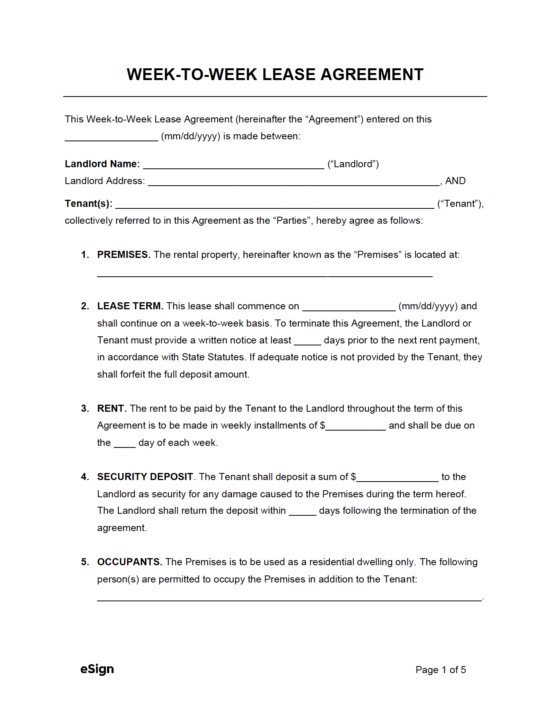

Weekly (week-to-week) Rental Agreement – An “at-will” arrangement that can be terminated by giving seven (7) days’ notice. Weekly (week-to-week) Rental Agreement – An “at-will” arrangement that can be terminated by giving seven (7) days’ notice.

Download: PDF, Word (.docx), OpenDocument |

How to Lease a Residence (10 steps)

Housing Facts (2023)

1. Marketing / Finding a Residence

As a landlord, taking great photos is the most important part of a listing. 19% of tenants in 2023 admitted to signing a lease without viewing the property in-person.[5]

Top Rental Websites (5)

2. Schedule a Showing

When scheduling a showing, it’s recommended to do so when the tenant isn’t home and to make sure is clean.

3. Screening the Tenant

It is recommended to run a consumer report on an applicant that includes their credit report, verifying employment, and a general search of public records. It is common to charge an applicant a non-refundable fee to generate this report.

Screen a Tenant (top 5 websites)

- MyRental ($30)

- RentPrep ($35)

- TenantAlert ($39.95)

- MySmartMove ($40)

- Avail.co ($45)

4. Approving or Rejecting the Tenant

After reviewing the tenant’s credit report, criminal history, and verifying references, it’s time to make a decision.

5. Negotiating

When negotiating a lease, it is a reminder that affordability is the most common negotiating point of a lease for 83% of renters.[6]

Tenants with “Fair” Credit

If the landlord would like additional security, they can request the tenant do the following:

- Additional Security Deposit – Requires an additional deposit in accordance with security deposit laws.

- Pre-Pay Rent – This is applied to the last months of a lease. For tenants with bad credit, the landlord can often request between 3-6 months of rent.

- Request a Co-Signer (use the Guarantor Addendum) – The tenant must find someone else to act as a “guarantor” who agrees to pay for any unpaid debts or damage if the tenant defaults.

7. Taking Occupancy

After the lease is signed and the security deposit and first month’s rent have cleared, the tenant can move-in on the 1st day of lease term.

8. Paying Rent

60% of tenants pay their rent online, and 69% of those who don’t pay online would prefer an online option.[9]

Accepting Rent Online (5 websites with no monthly fee)

- Apartments.com (Free ACH, 2.75% cc fees)

- Zillow (Free ACH, 2.95% cc fees)

- Innago.com ($2 ACH, 2.99% cc fees)

- Avail.co ($2.50 ACH, 3.50% cc fees)

- TurboTenant.com ($2 ACH, 3.49 cc fees)

9. Renewing / Terminating the Lease

At the end of the lease, the landlord must decide whether to lease the property to the tenant again.

2 Options

- Lease Renewal Agreement – An amendment extending the current lease for an additional period. The only change is commonly the rent amount.

- Letter NOT to Renew – Informs a tenant that they must move out at the end of the lease period.

10. Returning the Security Deposit

The landlord is required to return the security deposit. A landlord will commonly inspect the property and deduct any repairs from the amount.

Landlord-Tenant Laws

Rent Grace Periods & Late Fees |

|||

| STATE | GRACE PERIOD | LATE RENT | NSF FEE |

| Alabama | No grace period | No maximum | $30 (§ 8-8-15(b)) |

| Alaska | No grace period | No maximum | $30 (AS 09.68.115(a)(2)) |

| Arizona | No grace period | No maximum | $25 plus any bank fees incurred (§ 44-6852) |

| Arkansas | No grace period | No maximum | $30 plus any bank fees incurred (§ 4-60-103(b)) |

| California | No grace period | No maximum; landlords are advised not to charge more than the reasonable estimate of costs incurred (Tenant-Landlord Guide (p. 39)) | $25 for the first bounced check and $35 for each subsequent check (CIV § 1719(a)(1)) |

| Colorado | 7 days (§ 38-12-105(1)(a)) | $50 or 5% of the past due amount, whichever is greater (§ 38-12-105(1)(b), (c)) | $20 (§ 13-21-109(1)(b)(I)) |

| Connecticut | 9 days (§ 47a-15a) | No maximum; late fees must be fair and reflect actual expenses (CGA) | No statute |

| Delaware | 5 days (§ 5501(d)) | 5% of rent amount (§ 5501(d)) | $40 (§ 1301A(a)(2)) |

| Florida | No grace period | No maximum | 5% or a flat fee (based on check value) (§ 68.065(2)) |

| Georgia | No grace period | No maximum | $30 or 5% of the check, whichever is greater, plus bank fees (§ 13-6-15(b)) |

| Hawaii | No grace period | 8% of rent amount (§ 521-21(f)) | $30 (§ 490:3-506.5) |

| Idaho | No grace period | No maximum | 12% interest and $20 fee (§ 28-22-105) |

| Illinois | No grace period | No maximum | $25 (810 ILCS 5/3-806) |

| Indiana | No grace period | No maximum | $25 (§ 24-4.5-7-202) |

| Iowa | No grace period | $12/day (rent $700 or less) or $20/day (rent over $700) (§ 562A.9(4)) | No statute |

| Kansas | No grace period (§ 58-2545(c)) | No maximum | $30 (§ 60-2610(g)) |

| Kentucky | No grace period (§ 383.565(2)) | No maximum | $50 (§ 514.040(4)(b)) |

| Louisiana | No grace period | No maximum | $25 fee or 5% of the check amount, whichever is greater (§ 9:2782(B)) |

| Maine | 15 days (§ 6028(1)) | 4% of rent amount (§ 6028(2)) | No statute |

| Maryland | No grace period (§ 8-401) | 5% of rent amount (§ 8-208(d)(3)) | No statute |

| Massachusetts | 30 days (§ 186:15B(1)(c)) | No maximum | No statute |

| Michigan | No grace period | No maximum | $25 if paid within 7 days; $35 if paid within 30 days (§ 600.2952(3)) |

| Minnesota | No grace period | 8% of rent amount (§ 504B.177(a)) | $30 (§ 604.113 Subd. 2(a)) |

| Mississippi | No grace period | No maximum | No statute |

| Missouri | No grace period | No maximum | No statute |

| Montana | No grace period (§ 70-24-201(2)) | No maximum | $30 (§ 27-1-717(2)) |

| Nebraska | No grace period (§ 76-1414(3)) | No maximum | $10 plus bank fees (§ 28-611(5)) |

| Nevada | 3 days (§ 118A.210(4)(a)) | 5% of rent amount (§ 118A.210(4)(b)) | No statute |

| New Hampshire | No grace period | No maximum | If notice is given, tenant must pay the rent amount plus bank fees and mailing costs within 10 days (§ 544-B:1(I)(b)) |

| New Jersey | No grace period generally; 5 days for senior citizens (§§ 2A:42-6.1, 2A:42-6.3) | No maximum | No statute |

| New Mexico | No grace period | 10% of rent amount (§ 47-8-15(D)) | No statute |

| New York | 5 days (§ 238-A(2)) | $50 or 5% of rent amount, whichever is less (§ 238-A(2)) | $20 (§ 5-328(2)(a)) |

| North Carolina | 5 days (§ 42-46(a)) | $15 or 5% of rent amount, whichever is greater (§ 42-46(a)(1),(2)) | No statute |

| North Dakota | No grace period | No maximum | $40 (§ 6-08-16(2)(a)) |

| Ohio | No grace period | No maximum | No statute |

| Oklahoma | No grace period | No maximum | No statute |

| Oregon | 4 days (§ 90.260(1)(a)) | Reasonable flat fee, 6% of flat fee daily, or 5% of rent amount per 5 days (§ 90.260(2)) | $35 plus interest accrued at legal rate of interest (§§ 30.701(2),(5), 82.010) |

| Pennsylvania | No grace period | No maximum | No statute |

| Rhode Island | No grace period | No maximum | No statute |

| South Carolina | No grace period (§ 27-40-310(c)) | No maximum | $30 (§ 34-11-70(a)) |

| South Dakota | No grace period | No maximum | No statute |

| Tennessee | 5 days (§ 66-28-201(d)) | 10% of rent amount (§ 66-28-201(d)) | No statute |

| Texas | 2 days (§ 92.019(a)) | 12% or 10% of rent amount, depending on number of rental units (§ 92.019(a-1)(1)) | No statute |

| Utah | No grace period | 10% of rent amount of $75, whichever is greater (§ 57-22-4(5)(a)) | $20 (§§ 7-15-1(5), 7-15-2(2)) |

| Vermont | No grace period (§ 4455(a)) | If written in the lease, late fee can’t be more than actual expenses incurred (Handbook) | No statute |

| Virginia | 5 days (§ 55.1-1204(C)(5)) | 10% of rent amount or 10% of amount remaining, whichever is less (§ 55.1-1204(E)) | $50 plus interest and bank fees (§ 8.01-27.1(A)) |

| Washington | 5 days (§ 59.18.170(2)) | No maximum | No statute |

| West Virginia | No grace period | No maximum | $25 (§ 61-3-39e) |

| Wisconsin | No grace period | No maximum | No statute |

| Wyoming | No grace period | No maximum | $30 (§ 1-1-115(a)) |

Security Deposit Laws |

|||

| STATE | MAXIMUM | RETURNING | STATUTES |

| Alabama | 1 month’s rent | 60 days after the lease terminates | § 35-9A-201 |

| Alaska | 2 months’ rent | 14 days; 30 days if deductions are made | § 34.03.070 |

| Arizona | 1.5 months’ rent | 14 days after the lease terminates (not including holidays/weekends) | § 33-1321(D) |

| Arkansas | 2 months’ rent | 60 days after the lease terminates | § 18-16-305(a) |

| California | 2 months’ rent (unfurnished); 3 months’ rent (furnished) | 21 days after tenant moves out | § 1950.5 |

| Colorado | No limit | 1 month; up to 2 months if stated in the lease | § 38-12-103(1), § 38-12-104 |

| Connecticut | 2 months’ rent; 1 month’s rent if older than 62 | 15 days after receiving tenant’s new mailing address or 30 days after lease termination (whichever is later) | § 47a-21 |

| Delaware | 1 month’s rent for 1-year leases only | 20 days after the lease terminates | § 5514 |

| Florida | No limit | 15 days; 30 days if deductions are made | § 83.49(3)(a) |

| Georgia | No limit | 30 days after the tenant vacates | § 44-7-34(a) |

| Hawaii | 1 month’s rent | 14 days after the lease terminates | § 521-44(c) |

| Idaho | No limit | 21 days; up to 30 days if stated in the lease | § 6-321 |

| Illinois | No limit | 30 days if deductions are made; 45 days otherwise | 765 ILCS 710 |

| Indiana | No limit | 45 days after the lease terminates | § 32-31-3-12 |

| Iowa | 2 months’ rent | 30 days after the lease terminates | § 562A.12(3)(a) |

| Kansas | 1 month’s rent (unfurnished); 1.5 months’ rent (furnished) | 30 days after the lease terminates | § 58-2550(b) |

| Kentucky | No limit | 60 days after the lease terminates | § 383.580 |

| Louisiana | No limit | 1 month after the lease terminates | § 3251 |

| Maine | 2 months’ rent | 30 days for fixed-term lease, 21 days for periodic leases | §6032, §6033 |

| Maryland | 2 months’ rent | 45 days after the lease terminates | § 8-203 |

| Massachusetts | 1 month’s rent | 30 days after the lease terminates | Ch. 186 §15B |

| Michigan | 1.5 months’ rent | 30 days after the tenant moves out | §554.602, §554.609 |

| Minnesota | No limit | 3 weeks after the lease terminates | § 504B.178 |

| Mississippi | No limit | 45 days after the lease terminates | § 89-8-21 |

| Missouri | 2 months’ rent | 30 days after the lease terminates | § 535.300 |

| Montana | No limit | 10 days; 30 days if deductions are made | § 70-25-202 |

| Nebraska | 1 month’s rent | 14 days after the lease terminates | § 76-1416 |

| Nevada | 3 months’ rent | 30 days after the lease terminates | NRS 118A.242 |

| New Hampshire | 1 month’s rent or $100, whichever is greater | 30 days after the lease terminates | § 540-A:6 & § 540-A:7 |

| New Jersey | 1.5 months’ rent | 30 days after the lease terminates | §§ 46:8-21.2, 46:8-21.1 |

| New Mexico | 1 month’s rent | 30 days after the lease terminates or the tenant moves out, whichever is later | § 47-8-18 |

| New York | 1 month’s rent | 14 days after the tenant moves out | 576/74 § 6, § 7-108(e) |

| North Carolina | 2 months’ rent; 1.5 months’ rent for at-will leases | 30 days; 60 days if deductions are made | § 42-51, § 42-52 |

| North Dakota | 1 month’s rent; 2 months’ rent for pets | 30 days after the lease terminates | § 47-16-07.1 |

| Ohio | No limit | 30 days after the lease terminates | § 5321.16 |

| Oklahoma | No limit | 45 days after the lease terminates | § 41-115 |

| Oregon | No limit | 31 days after the lease terminates | § 90.300(13) |

| Pennsylvania | 2 months’ rent | 30 days after the lease terminates or the tenant moves out, whichever is earlier | § 250.511a, § 250.512 |

| Rhode Island | 1 month’s rent | 20 days after the lease terminates, the tenant moves out, or a forwarding address is provided, whichever is later | § 34-18-19 |

| South Carolina | No limit | 30 days after the lease terminates or the tenant moves out, whichever is later | § 27-40-410 |

| South Dakota | 1 month’s rent | 14 days; 45 days if deductions are made | § 43-32-6.1, § 43-32-24 |

| Tennessee | No limit | 30 days after the tenant moves out or 7 days after a new tenant moves in, whichever is earlier | § 66-28-301(g)(1) |

| Texas | No limit | 30 days after the tenant moves out | § 92.103(a) |

| Utah | No limit | 30 days after the tenant moves out | § 57-17-3(2) |

| Vermont | No limit | 14 days; 60 days for seasonal or vacation rentals | § 4461(c) |

| Virginia | 2 months’ rent | 45 days after the lease terminates | § 55.1-1226 |

| Washington | No limit | 21 days after the tenant moves out | § 59.18.280 |

| West Virginia | No limit | 60 days after the lease terminates or 45 days after a new tenant moves in, whichever is earlier | § 37-6A-2 |

| Wisconsin | No limit | 21 days after the lease terminates

|

§ 134.06(2) |

| Wyoming | No limit | 15 days after the landlord receives the tenant’s new address or 30 days from lease termination, whichever is earlier | § 1-21-1208 |

Landlord’s Access |

||

| STATE | Standard Access | Immediate Access |

| Alabama | 2 days’ notice (§ 35-9A-303(a), (c)) | No notice required for emergencies or by court order (§ 35-9A-303(b)) |

| Alaska | 24 hours’ notice (AS 34.03.140(c)) | No notice required for emergencies (AS 34.03.140(b)) |

| Arizona | 2 days’ notice (§ 33-1343(D)) | No notice required for emergencies (§ 33-1343(C)) |

| Arkansas | 24 hours’ notice (§ 18-17-602) | No statute. |

| California | Must be reasonable notice; 24 hours is considered reasonable (CIV § 1954(d)(1)) | No notice required for emergencies (CIV § 1954(e)(1)) |

| Colorado | No statute | No statute |

| Connecticut | Reasonable notice (§ 47a-16(c)) | No notice required for emergencies (§ 47a-16(b)) |

| Delaware | 48 hours’ notice (§ 5509(b)) | No notice required for emergencies (§ 5509(b)) |

| Florida | 24 hours’ notice (§ 83.53(2)) | No notice required for emergencies (§ 83.53(2)(b)) |

| Georgia | No statute | No statute |

| Hawaii | 2 days’ notice (§ 521-53(b)) | No notice required for emergencies (§ 521-53(b)) |

| Idaho | No statute | No statute |

| Illinois | 2 days’ notice (Chicago only) (§ 5-12-050) | No statute |

| Indiana | Reasonable notice (§ 32-31-5-6(g)) | No notice required for emergencies or by court order (§ 32-31-5-6(f)) |

| Iowa | 24 hours’ notice (§ 562A.19(3) | No notice required for emergencies (§ 562A.19(3) |

| Kansas | Reasonable notice (§ 25-2557(a)) | No notice is required for extreme hazards involving loss of life or severe property damage (§ 25-2557(b)) |

| Kentucky | 2 days’ notice (§ 383.615(3)) | No notice required for emergencies (§ 383.615(2)) |

| Louisiana | No statute | No statute |

| Maine | 24 hours’ notice (§ 6025(2)) | No notice required for emergencies (§ 6025(2)) |

| Maryland | No statute | No statute |

| Massachusetts | No notice period | No statute |

| Michigan | No statute | No statute |

| Minnesota | 24 hours’ notice (§ 504B.211, Subd. 2) | No notice required for safety, to prevent injury to people or property, or for unlawful activity. (§ 504B.211, Subd. 4) |

| Mississippi | No statute | No statute |

| Missouri | No statute | No statute |

| Montana | 24 hours’ notice (§ 70-24-312(3)) | No notice required for emergencies (§ 70-24-312(2)) |

| Nebraska | 1 day’s notice (§ 76-1423(3)(a)) | No notice required for emergencies (§ 76-1423(2)) |

| Nevada | 24 hours’ notice (§ 118A.330(3)) | No notice required for emergencies (§ 118A.330(2)) |

| New Hampshire | Adequate notice (§ 540-A:3(V)) | No notice required for emergencies or by court order (§ 540-A:3(V-d)(a)) |

| New Jersey | One day’s notice (§ 5:10-5.1(c)) | No notice is required for safety or structural emergencies (§ 5:10-5.1(c)) |

| New Mexico | 24 hours’ notice (§ 47-8-24(A)(1)) | No notice required for emergencies (§ 47-8-24(B)) |

| New York | No statute | No statute |

| North Carolina | No statute | No statute |

| North Dakota | Reasonable notice (§ 47-16-07.3(2)) | No notice is required for emergencies or when the tenant has abandoned the property or violated the lease (§ 47-16-07.3(1)) |

| Ohio | 24 hours’ notice (§ 5321.04(8)) | No notice required for emergencies (§ 5321.04(8)) |

| Oklahoma | One day’s notice (§ 41-128(C)) | No notice required for emergencies (§ 41-128(B)) |

| Oregon | 24 hours’ notice (§ 90.322(1)(f)) | No notice required for emergencies; if tenant is absent, notice must be provided after (§ 90.322(1)(b)) |

| Pennsylvania | No statute | No statute |

| Rhode Island | 2 days’ notice (§ 34-18-26(c)) | No notice required for emergencies and to protect the property if tenant is absent for more than 7 days (§ 34-18-26(b)) |

| South Carolina | 24 hours’ notice (§ 27-40-530(c)) | No notice required for emergencies (§ 27-40-530(b)(1)) |

| South Dakota | 24 hours is considered reasonable notice (§ 43-32-32) | No notice required for emergencies (§ 43-32-32) |

| Tennessee | No minimum notice period; tenant consent should be obtained (§ 66-28-403) | No notice is required for emergencies or to inspect for damages if utilities shut off. (§ 66-28-403(b), (c)) |

| Texas | No statute | No statute |

| Utah | 24 hours’ notice (§ 57-22-4(2)) | No statute |

| Vermont | No minimum notice period; tenant consent should be obtained (§ 4460(a)) | No notice is required if there is imminent danger to people or property (§ 4460(c)) |

| Virginia | 72 hours’ notice (§ 55.1-1229(A)(4)) | No notice required for emergencies (§ 55.1-1229(A)(4)) |

| Washington | 2 days’ notice (§ 59.18.150(6)) | No notice is required for emergencies or abandonment (§ 59.18.150(5)) |

| West Virginia | No statute | No statute |

| Wisconsin | 12 hours’ notice (§ 134.09(2)(a)) | No notice is required for emergencies or to protect property in tenant’s absence (§ 134.09(2)(b)) |

| Wyoming | No statute | No statute |

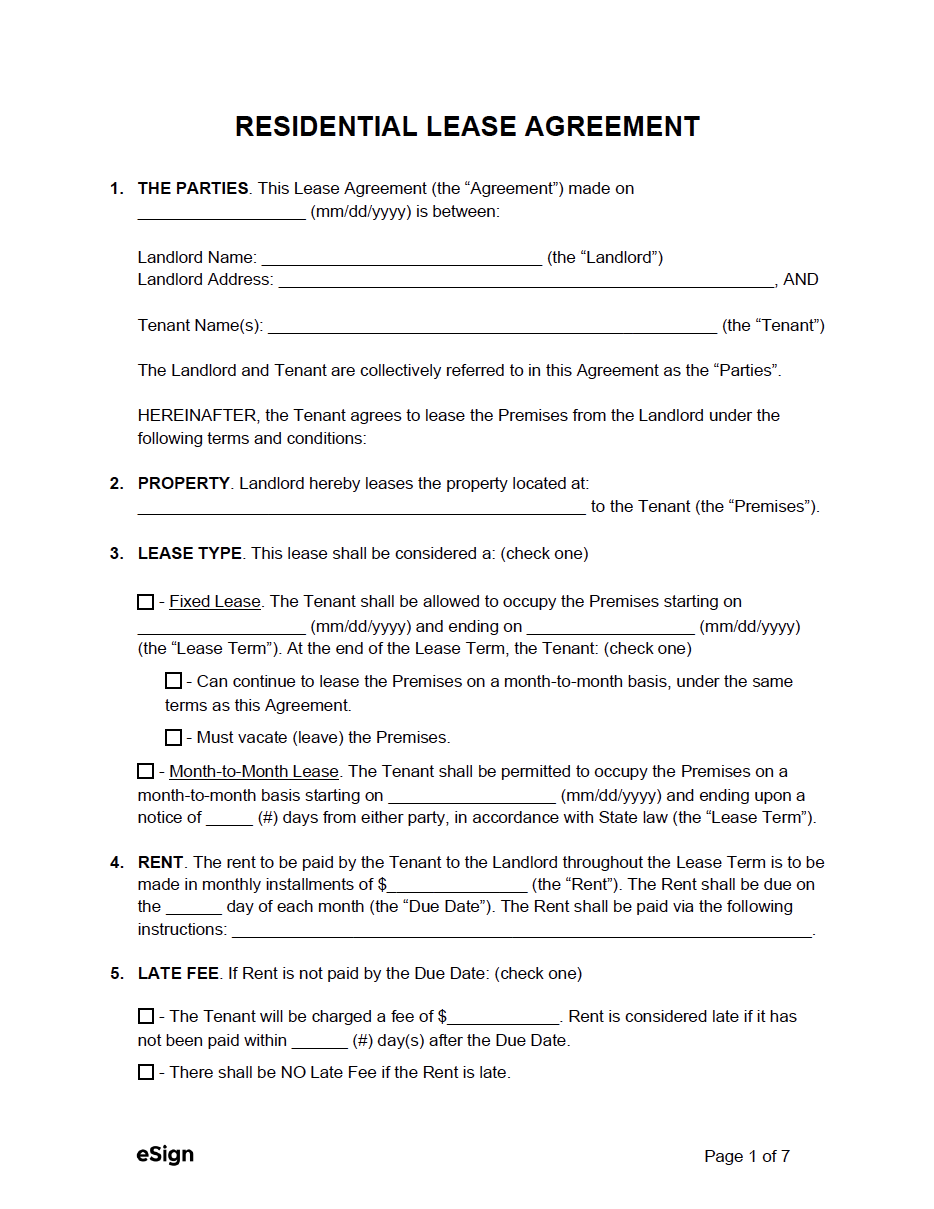

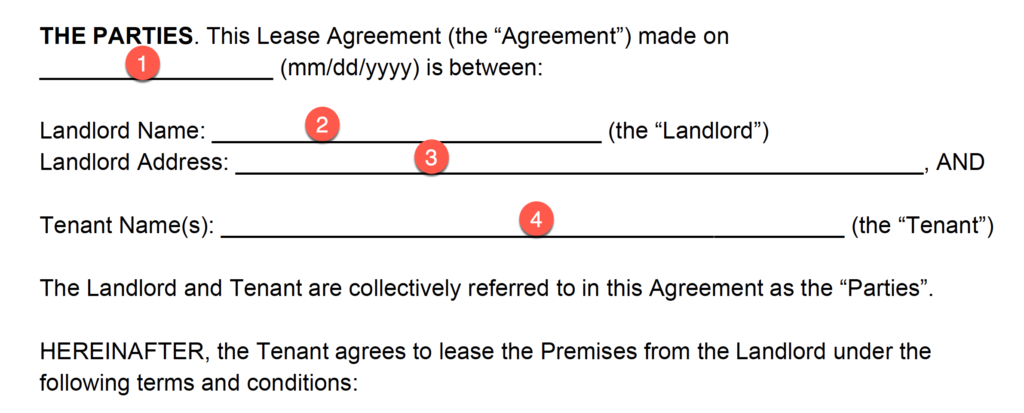

How to Write

View Instructions (29 steps) |

Note about colors:

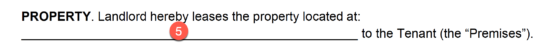

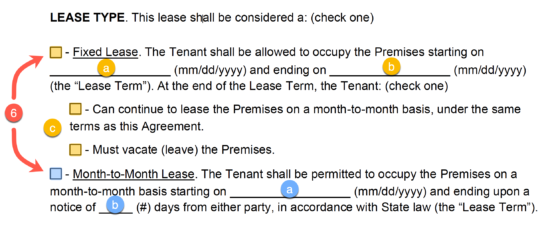

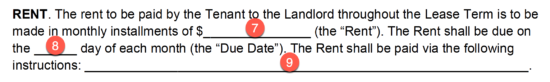

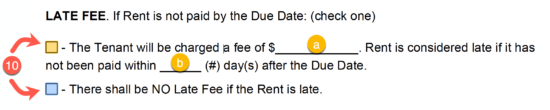

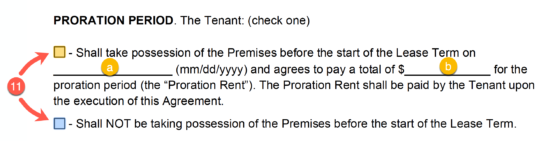

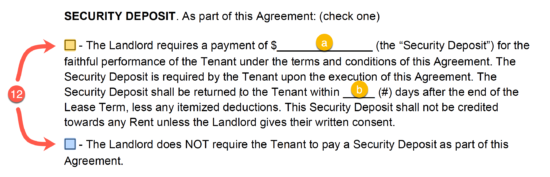

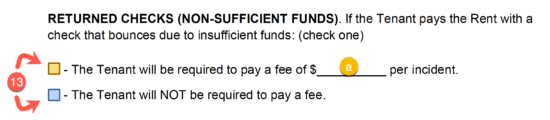

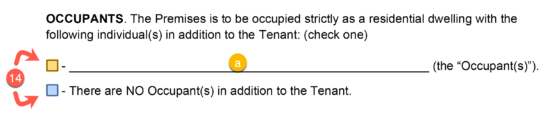

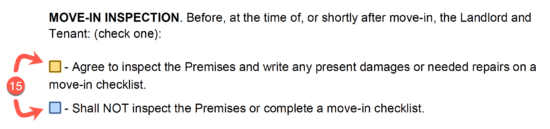

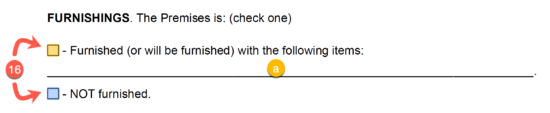

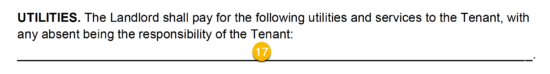

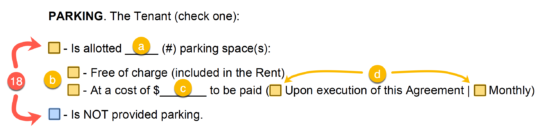

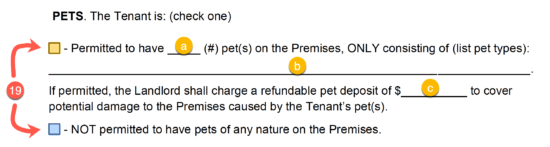

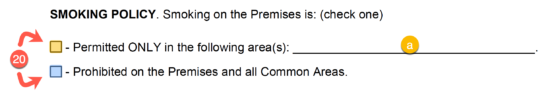

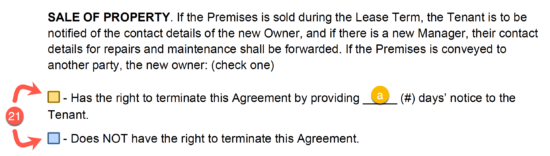

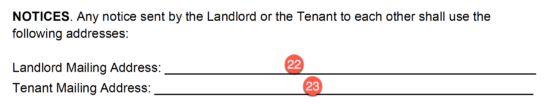

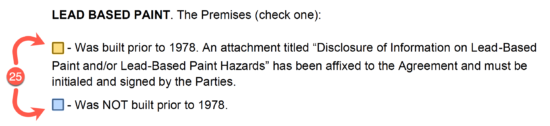

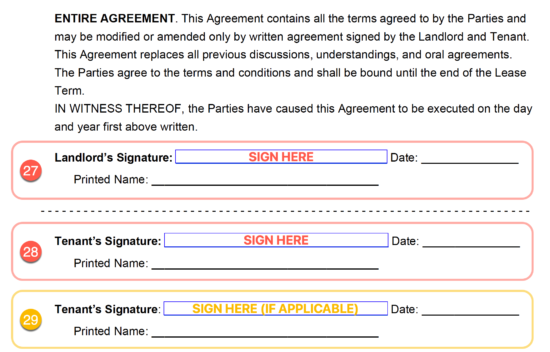

Steps 1-4 (The Parties)This section is used for identifying the landlord (the person that manages or owns the rental) and the tenant(s). The landlord will need to type the following information in this section: 1) – Date. The date the lease is being completed (the current date). Step 5 (Property Address)5) – Property address. The full address of the rental property. This should include the street, unit # (if any), city/town, state, and ZIP code. Example: 123 Rental Ave, Suite 9A, ABC City, Texas 78701. Step 6 (Lease Type & Term)This area is for specifying the length of the lease. The landlord can choose one of two (2) options. The first (and more common) option is “Fixed Lease,” which refers to the agreement being established for a pre-determined length of time (such as 1 year). The second option is a “Month-to-Month Lease,” which is a type of periodic contract that has no end date and renews automatically on a monthly basis until either party wishes to terminate it. 6) – Lease type. Check one (1) of the two options shown. If “Fixed Lease” is selected, complete the fields marked with yellow. Enter the start and end dates, and select whether the lease will continue as a “month-to-month” agreement after the term ends OR if the tenant(s) will be required to move out. If “Month-to-Month Lease” is selected, enter the starting date of the lease followed by the number (#) of days either party has to give in order to terminate the contract. Steps 7 – 9 (Rent)This provision allows the landlord to set the monthly rent ($) the tenant(s) will be required to pay. 7) – Rent amount. Type the total amount ($) of rent the landlord will collect from the tenant(s). Step 10 (Late Fee)A late fee is a monetary penalty that is billed to the tenant(s) if they are late on rent. 10) – Late fee (Y/N). Select whether or not the tenant(s) will be charged a fee if they are late on rent. If the first option is selected, complete steps 10a and 10b by typing the amount ($) of the late fee, followed by the number (#) of days that must pass after the rent due date before a late fee can be issued. Step 11 (Proration Period)A proration period is any time the tenant will be living in the rental that doesn’t fall within one (1) full rent payment period. For example, if the tenant wanted to move into the property a couple of weeks before the official start of the lease, the landlord could require them to pay two (2) weeks’ worth of rent (known as “prorated rent”). 11) – Proration period (Y/N). Place a checkmark in one (1) of the two boxes shown to indicate the proration period. If the first box was selected, enter a) the starting date of the proration period, followed by b) the amount ($) the tenant will be paying. Note: Many states consider rent that is received upfront to be a security deposit. Because many states restrict security deposits to one (1) or two (2) months of rent, the landlord could be breaking rental laws by accepting pre-paid rent on top of a security deposit. Step 12 (Security Deposit)Enter the dollar ($) amount of the security deposit that the tenant(s) is/are required to pay at the start of the lease. Enter the full value of the deposit, not the amount each tenant would be required to pay. Specify the number of days the landlord has to return the deposit (less any deductions) at the end of the lease. 12) – Security deposit (Y/N). Check the appropriate box to indicate whether or not the tenant(s) will be required to pay a security deposit. If the first (top) box is checked, enter a) the amount ($) of the security deposit that will be collected, followed by b) the number (#) of days the landlord will have to return the deposit once the lease term expires. Step 13 (Returned Checks)A “returned check” occurs if a tenant’s check bounces due to insufficient funds in their bank account. To prevent this from occurring, the landlord can charge a fee. 13) – Returned check fee (Y/N). If the landlord will require a fee ($) for bounced checks, place a checkmark in the first box and enter the amount ($) of the fee. If a fee will not be required for bounced checks, select the second (2nd) box and proceed to the next step. Step 14 (Additional Occupants)14) – Occupants (Y/N). If the tenant(s) will have additional person(s) living in the rental, check the first (1st) box and type the name(s) of the other occupants in the provided field. If the tenant will not be living with other occupants, check the second (2nd) box. Step 15 (Move-in Inspection)15) – Move-in inspection (Y/N). If the landlord and tenant(s) will be completing a move-in checklist together, select the first (1st) box. Otherwise, check the second (2nd) box. Note: Conducting a move-in inspection is highly recommended to avoid charging the tenant(s) for the damage they didn’t cause. Step 16 (Furnishings)16) – Furnishings (Y/N). If the rental is furnished, check the first (1st) box and list the furnishings that will be included (e.g., “living room couch, TV set, dining table). If it is not furnished, check the second (2nd) box and head to Step 17. Step 17 (Utilities)17) – Utilities. List any utilities that the landlord will be responsible for (if any). Any fees not included will be the tenant’s responsibility. Step 18 (Parking)18) – Parking provided (Y/N). If the tenant(s) will be provided one (1) or more parking space(s), check the first (1st) box. Then, a) type the number (#) of spots provided, b) check the box corresponding to whether or not a fee is required, c) type the amount ($) of the fee (if any), followed by d) selecting the option that corresponds to how often the fee will need to be paid. If the tenant(s) will not be given parking, the last box (blue) should be checked. Step 19 (Pets)Due to pets being a potential liability for landlords, many choose to restrict (or deny) the number and types of pets tenants can have. 19) – Pets allowed (Y/N). If pets will be allowed on the premises, check the first (1st) box. Then, the landlord will need to a) type the number (#) of pets that the tenant(s) can have, b) list the type(s) of pets that are permitted, followed by c) the deposit the tenant(s) will need to provide to cover any damage caused by their pet. If pets are not allowed on the premises, the second (2nd) box should be checked. Step 20 (Smoking Policy)20) – Smoking (Y/N). If smoking is permitted in certain areas on the premises, check the first (1st) box and specify exactly where tenants can smoke. If smoking is not allowed, check the second (2nd) box. Step 21 (Sale of Property)In the event the owner of the property sells the rental, the landlord can specify whether the new owner would have the power to terminate the rental agreement. 21) – Right to terminate lease (Y/N). Check the first (1st) box if the new owner would have the right to terminate the rental agreement. Then, enter the number (#) of days’ notice the new owner would need to provide the tenant. Check the second (2nd) box if the new owner would not have the right to terminate the lease agreement. Steps 22 & 23 (Notices)22) – Landlord notice address. Type the full address the tenant(s) can use to send the landlord notices and other important information. Step 24 (Governing Law)24) – State name. Enter the name of the state the rental property is located in. Step 25 (Lead-Based Paint)25) – Property built before 1978 (Y/N). If the property was built prior to 1978, check the first (1st) box. The landlord will need to complete (and attach) a Lead-Based Paint Disclosure Form. If the property was built after 1978, check the second (2nd) box and proceed to the next step. Step 26 (Additional Provisions)26) – Additional provisions. If there are any additional sections the landlord wishes to include in the agreement, they can be written in the text box provided. Alternatively, the landlord can attach an addendum if more room is required. Step 27 (Signatures)At a minimum, the landlord and one (1) tenant need to sign the lease. 27) – Landlord name, signature, & date. The landlord will need to sign their name (with eSign or by hand), enter the date (mm/dd/yyyy), and write their full name beneath their signature. |

Sources

-

- www.census.gov/quickfacts/fact/table/US/HSG445222

- Results from the Zillow Consumer Housing Trends Report 2023

- Results from the Zillow Consumer Housing Trends Report 2023

- 2024 Consumer Housing Trends Report – ZillowRentals (Page 14)

- Results from the Zillow Consumer Housing Trends Report 2023

- 2024 Consumer Housing Trends Report – ZillowRentals (Page 20)

- 2024 Consumer Housing Trends Report – ZillowRentals (Page 17)

- 15 U.S. Code § 7001

- 2024 Consumer Housing Trends Report – ZillowRentals (Page 18)