Lease Agreements: By Type (6)

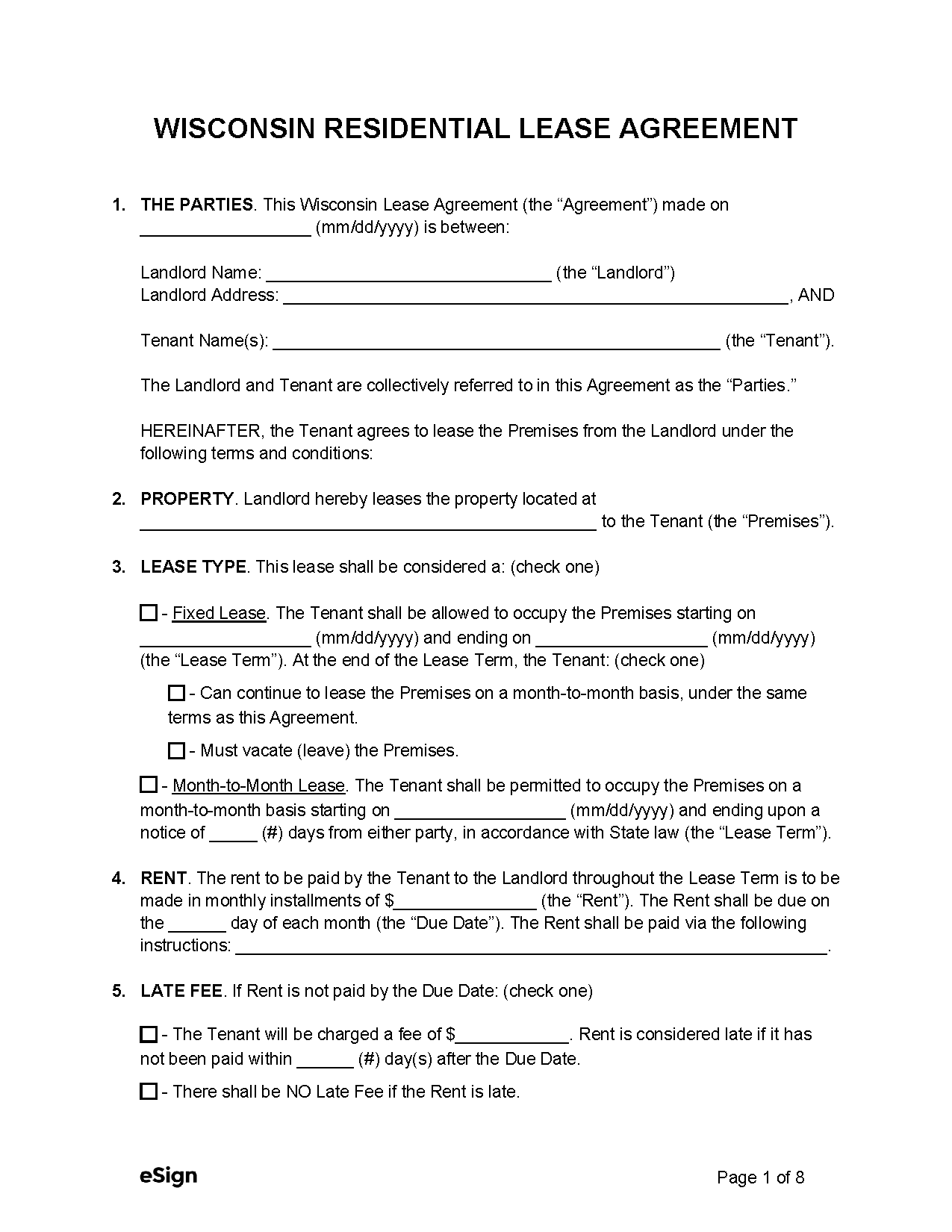

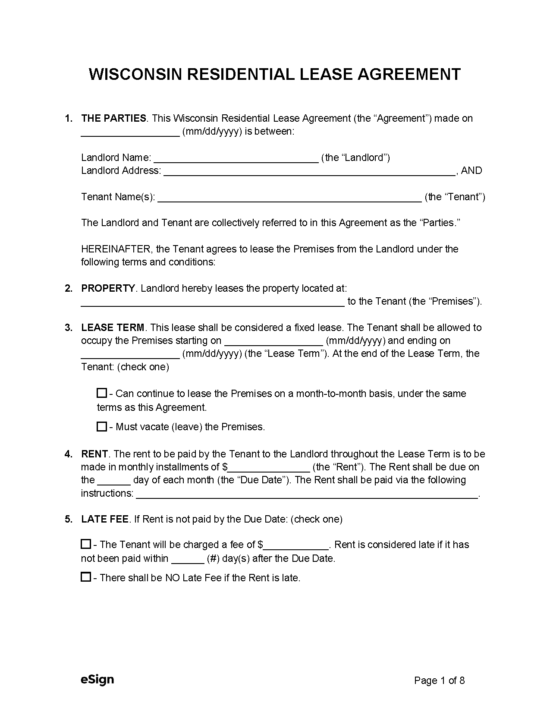

Standard (1-Year) Lease Agreement – Contains the rental conditions of a residential dwelling with a 12-month term. Standard (1-Year) Lease Agreement – Contains the rental conditions of a residential dwelling with a 12-month term.

Download: PDF, Word (.docx), OpenDocument |

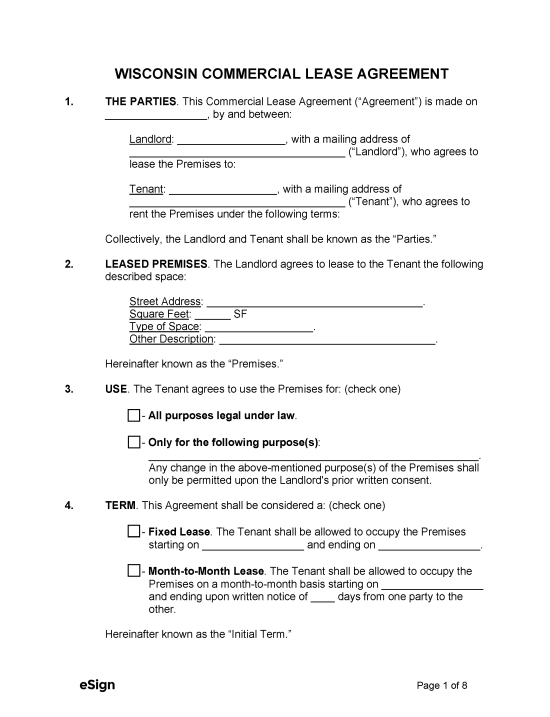

Commercial Lease Agreement – Used by landlords and property owners to lease office, industrial, or retail space to a tenant. Commercial Lease Agreement – Used by landlords and property owners to lease office, industrial, or retail space to a tenant.

Download: PDF, Word (.docx), OpenDocument |

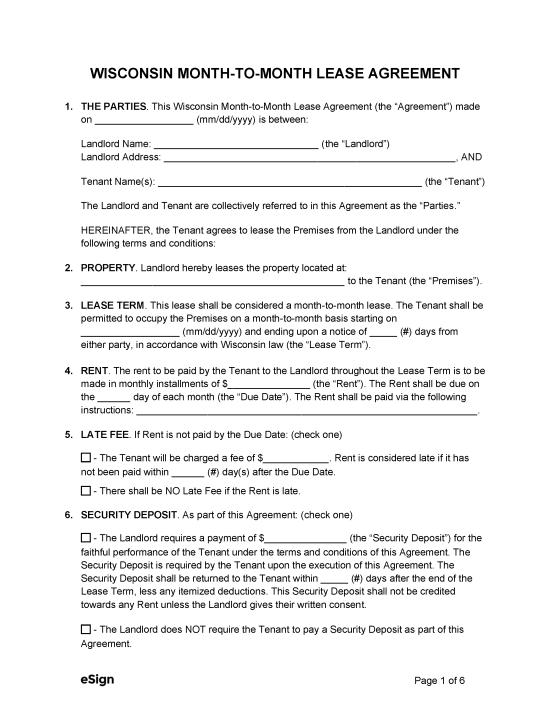

Month-to-Month Lease Agreement – This at-will rental agreement continues on a monthly basis until terminated by either party with 28 days’ notice. Month-to-Month Lease Agreement – This at-will rental agreement continues on a monthly basis until terminated by either party with 28 days’ notice.

Download: PDF, Word (.docx), OpenDocument |

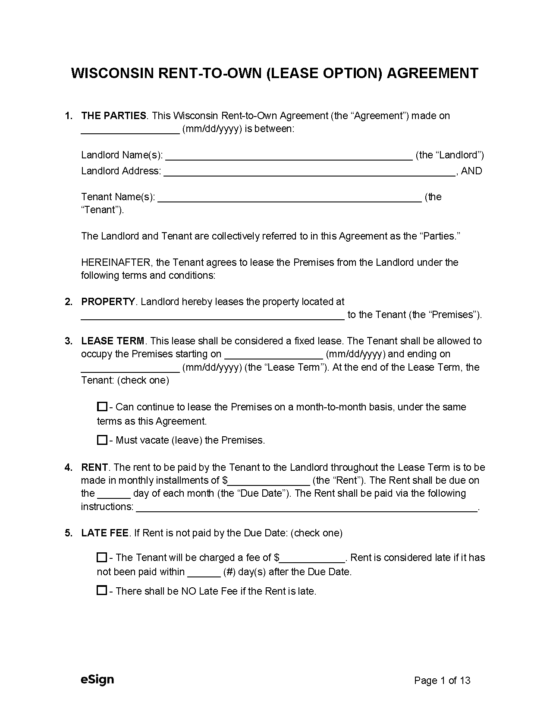

Rent-to-Own (Lease Option) – A tenancy agreement that includes contingencies that enable the tenant to purchase the property at a later date. Rent-to-Own (Lease Option) – A tenancy agreement that includes contingencies that enable the tenant to purchase the property at a later date.

Download: PDF, Word (.docx), OpenDocument |

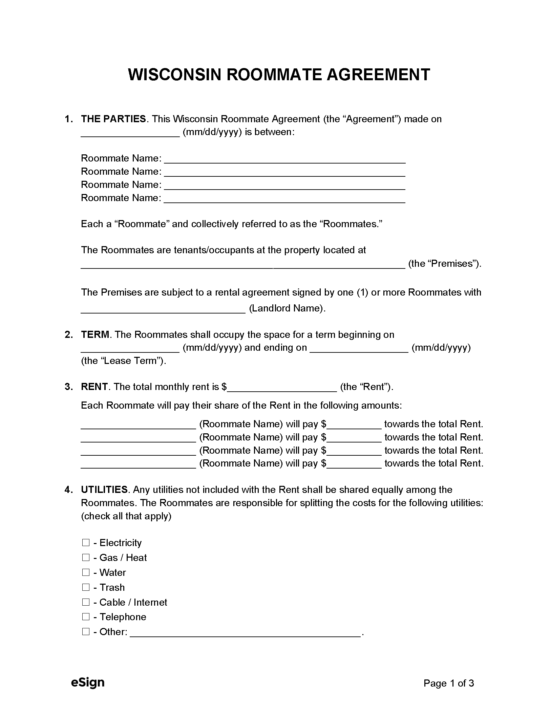

Roommate Agreement – Used by roommates to establish rules and conditions for a shared rental space. Roommate Agreement – Used by roommates to establish rules and conditions for a shared rental space.

Download: PDF, Word (.docx), OpenDocument |

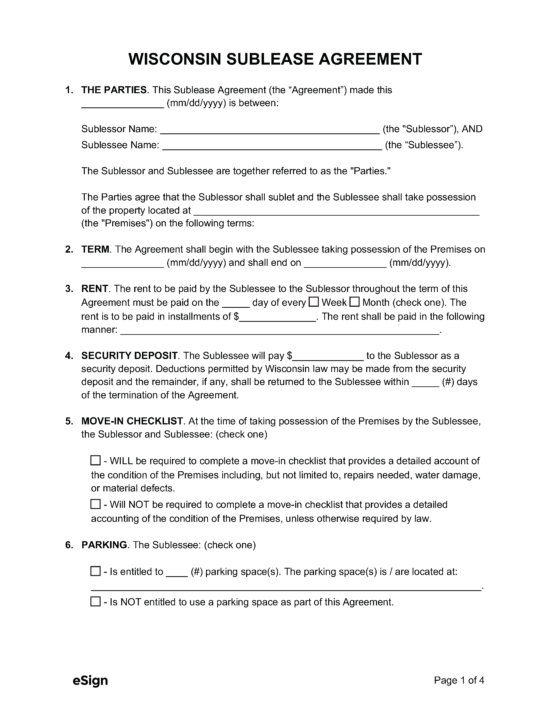

Sublease Agreement – An agreement separate from the original lease that permits a subtenant to rent the property from the tenant. Sublease Agreement – An agreement separate from the original lease that permits a subtenant to rent the property from the tenant.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (5)

- Building Code Violations – Tenants must be informed of any building or housing code violations affecting the habitability of the premises.[1]

- Damage and Defects (PDF) – Before accepting a security deposit, the landlord must inform the tenant that they can inspect the premises and report damages as well as request a list of damages charged to the previous tenant.[2]

- Landlord and Agent Identification – Landlords must disclose to tenants the name and address of the property owner or their representative and any individual authorized to collect rent, manage the premises, or contact the tenant.[3]

- Lead-Based Paint Disclosure (PDF) – Used to disclose the use of lead-based paint on properties that predate 1978.[4]

- Utility Charges – Landlords must disclose whether utility service charges are included in the rent and, if they are not included and the rental units are not separately metered, they must disclose how the charges will be split among all tenants.[5]

Security Deposits

Maximum Amount ($) – State law does not set a maximum amount for security deposits.

Collecting Interest – There are no legal requirements for collecting interest on security deposits in Wisconsin.

Returning to Tenant – Security deposits must be returned to tenants within 21 days of the termination of the rental agreement.[6]

Itemized List Required? – Yes, if any amount of the tenant’s security deposit is withheld for damages, the landlord must send a list of all damages and the amount withheld.[7]

Separate Bank Account? -Nothing in the state statutes requires landlords to keep security deposits in a separate bank account.

Landlord’s Entry

General Access – Landlords are permitted to access the rental property to perform their various duties during reasonable hours and with at least 12 hours’ notice.[8]

Immediate Access – Landlords can enter the premises without notice for emergencies or if the tenant is absent and immediate access is necessary to protect the property from damage.[9]

Rent Payments

Grace Period – There is no rent grace period established in state statutes.

Maximum Late Fee ($) – Landlords may only charge a late fee if it is mentioned in the rental agreement, but state law does not set a maximum amount.[10]

Withholding Rent – Tenants can take certain actions if the landlord fails to maintain the habitability of the premises, but they may not withhold rent.[11]

Breaking a Lease

Non-Payment of Rent – Landlords can use a 5-day notice to pay or quit when a tenant is late paying rent.[12]

Non-Compliance – When a tenant fails to comply with the lease, landlords can serve a 5-day notice to comply or quit.[13]

Lockouts – Landlords may not prevent a tenant from accessing their rental property except through a legal eviction process.[14]

Leaving Before the End Date – If the tenant leaves before the lease has terminated and still owes rent, the landlord can recover rent and damages.[15]

- Duty to Re-rent – Landlords must make a reasonable effort to re-rent the property, i.e., go through the process of finding a new tenant as if the lease term ended as per the agreement.[16]

Lease Termination

Month-to-Month – Monthly tenancies can be terminated by either party as long as 28 days’ notice is provided.[17]

Unclaimed Property – Any of the tenant’s unclaimed property can be assumed by the landlord to be abandoned and may be disposed of as they see fit.[18]