Other Names

- Lease-Option Agreement

- Lease-to-Own Agreement

- Lease-Purchase Agreement

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

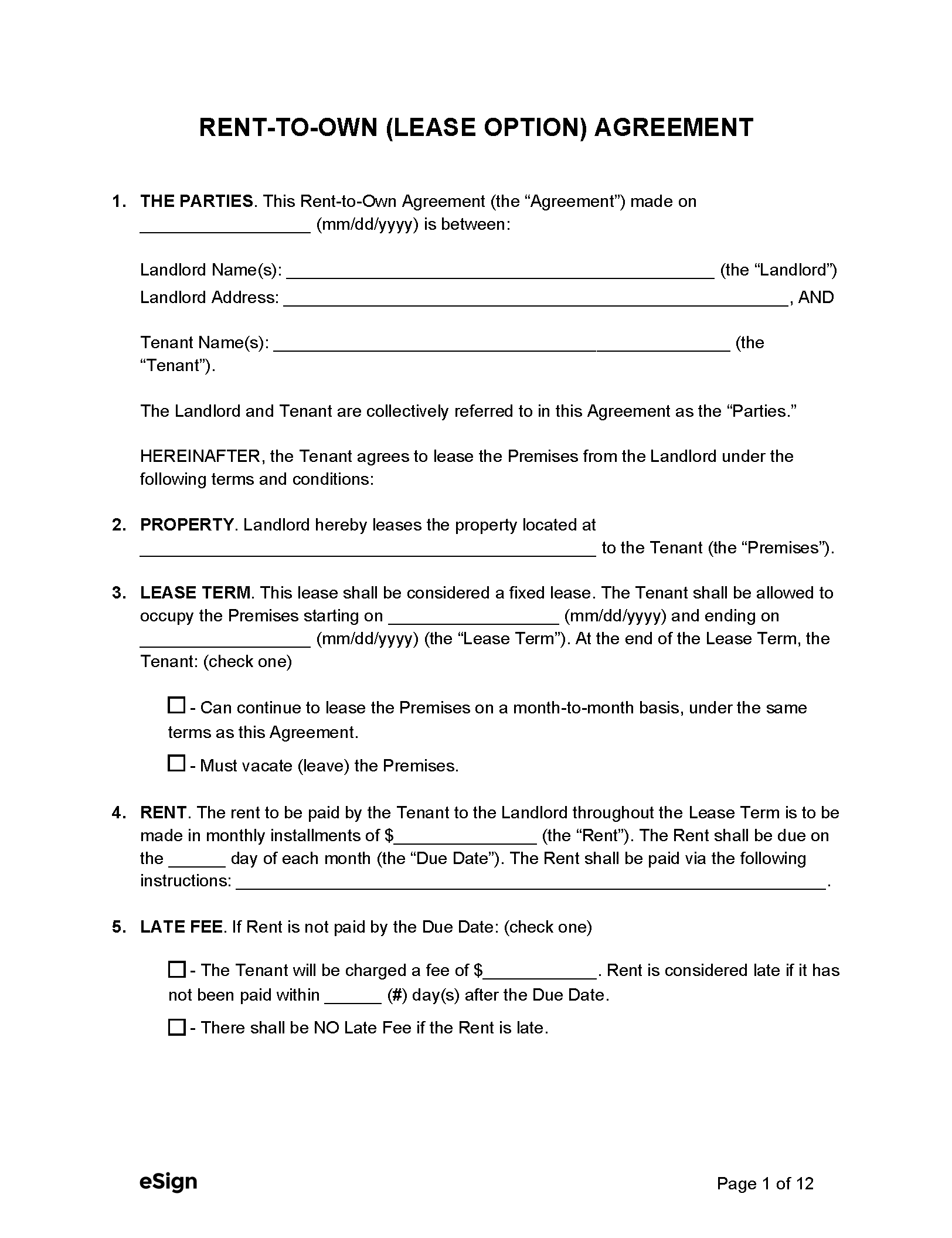

What is a Rent-to-Own Agreement

A rent-to-own agreement is a form that combines leasing and selling real property into one document. The landlord rents their property to a tenant with the intention of selling it to them under negotiated terms. This type of agreement is popular among people who are unable to build credit or get a mortgage.

In some cases, a portion of the rent payment goes towards the purchase price as credit. The tenant must also pay an option fee (or “consideration”) to secure the option to buy. If the buyer decides not to complete the purchase, any money paid to the landlord may be forfeited.

What to Include

- Duration – This is the length of the lease contract, which is typically one to three years.

- Option Term – The amount of time the tenant has to decide whether they want to purchase the property. The option term is typically the length of the lease, although a different timeline can be specified in the contract

- Rent Payments – The monthly payments made by the tenant to lease the property.

- Security Deposit – This payment is typically equivalent to one or two months’ rent.

- Purchase Price – The price of the home if the tenant decides to go through with the purchase.

- Consideration – Money (in the form of rent payments or a specified amount) that goes towards the purchase price. It is forfeited if the buyer doesn’t exercise the purchase option.

Lease-Option vs. Lease-Purchase

A “lease option agreement” and a “lease purchase agreement” are very similar, but the tenant’s obligation to buy changes. With a lease option, the tenant reserves the option to purchase or back out at the end of the term, although they may forfeit the option fee. A lease purchase compels the tenant to make the purchase unless they are unable to secure proper financing.

Seller Pros & Cons

| PROS | CONS |

| Higher rent payments – Because tenants benefit from rent-to-own contracts, sellers often negotiate higher rent payments than if the property were only a rental. | Tenants with poor credit – Lease to own contracts attract individuals who are often in less stable financial positions. |

| Easier to find a buyer – If a property has been sitting on the market for months with no activity, a lease-option agreement can open up the pool of potential buyers. | Property appreciation – With the purchase price locked in, the owner may end up selling the property for less than market value if it appreciates faster than anticipated. |

| Trustworthy renter – Because the tenant intends to eventually purchase the property, they may be more inclined to maintain the premises. | Longer horizon – By leasing the property instead of selling it, the seller will have to wait longer for the bulk of the money they invested into the property. |

| Income – The landlord will benefit from another year of rental payments before receiving the lump sum of the property sale. | Uncertainty – The sale isn’t guaranteed, as the buyer has the option to back out (unless they enter into a lease-purchase agreement). |

Buyer Pros & Cons

| PROS | CONS |

| Secure a price – If the housing market is strong, the buyer may end up acquiring the property below market value since the purchase price is locked in. | Property depreciation – Instead of increasing, the housing market could depreciate, meaning that the buyer may end up purchasing the property above market value. |

| Helps build credit – Renters who can’t qualify for a loan due to poor credit can use a lease-to-own to build their credit until it’s time to purchase. | Nonrefundable payments – If the tenant decides to walk away from purchasing, the owner will keep the option fee and any portion of rent that has gone towards a down payment. |

| Test run – Renting before buying allows the tenant to evaluate the property and its location for suitability. | Utility/repair costs – A tenant may end up paying more to rent a lease-option property because they are often responsible for all maintenance costs. |

| Dependent on owner– If the owner stops making mortgage payments or taxes, the property may be foreclosed, and the rent-to-own agreement will be void. |

How Rent-to-Own Works

Step 1 – List the Property

To get the most exposure for their property, homeowners should consider listing the home on an online platform such as HousingList or Foreclosure.com.

Step 2 – Negotiate

Once an applicant has been found, the parties will need to negotiate the terms of the contract, which are broken down into two parts:

- Lease – The parties will need to agree on the monthly rent, the lease term, the security deposit, utilities and services, parking, and other rental policies.

- Purchase Option – The purchase part of the document includes provisions such as price, consideration (option fee), option term, option deposit, and financing.

Step 3 – Screen the Tenant

The seller should check the applicant’s criminal, credit, and rental history, as well as verify their income to ensure they can make rent payments. The seller should keep an eye out for any of the following red flags:

- Past evictions

- Criminal convictions

- Poor landlord references

- Inadequate income

- Reluctancy to provide information

Step 4 – Sign the Lease

Once negotiations and background checks are complete, the parties can sign the document by hand or with eSign. If the tenant wants to exercise their option to purchase at some point during their lease, they can provide notice to the owner.

Step 5 – Enter Into a Purchase Agreement

If the property owner receives notice from the tenant that they wish to exercise their option to purchase, a purchase agreement can be drawn up. The process of purchasing a home after being in a rent-to-own arrangement will be essentially the same as any property sale except some of the downpayment may already have been made through rent payments.