Lease Agreements: By Type (6)

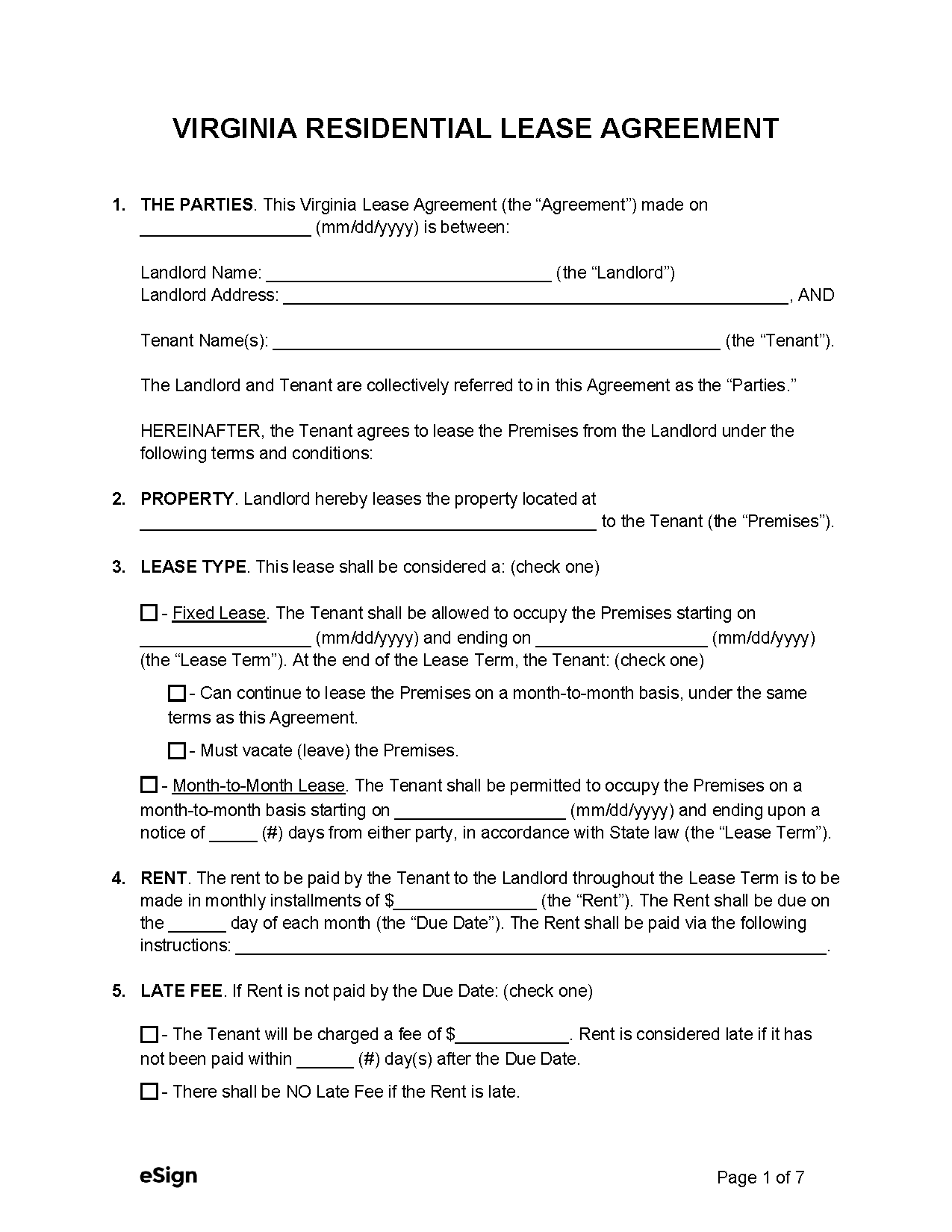

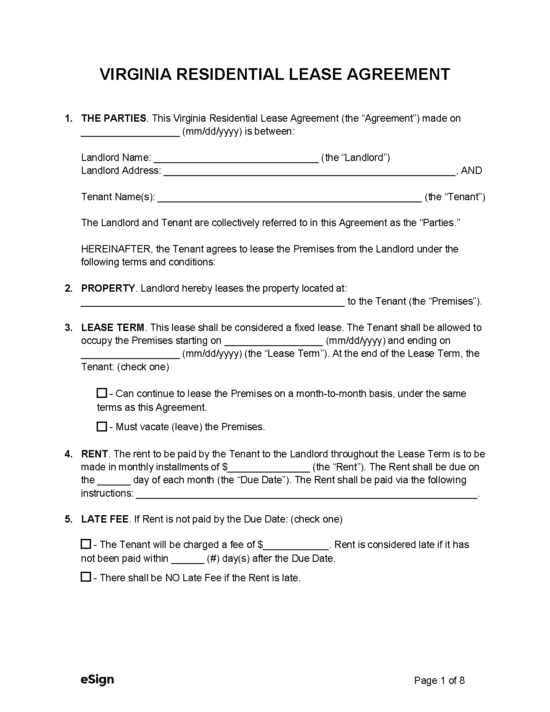

Standard (1-year) Lease Agreement – A rental contract that typically lasts one year. Standard (1-year) Lease Agreement – A rental contract that typically lasts one year.

Download: PDF |

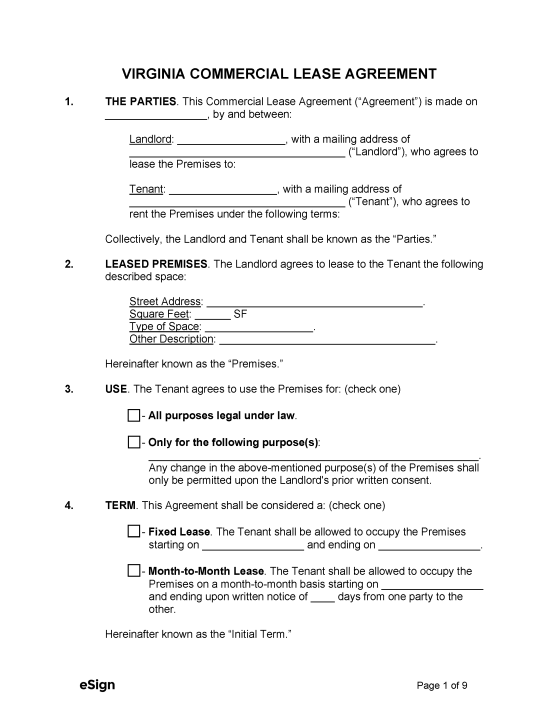

Commercial Lease Agreement – Used to establish the terms for renting commercial real estate. Commercial Lease Agreement – Used to establish the terms for renting commercial real estate.

Download: PDF, Word (.docx), OpenDocument |

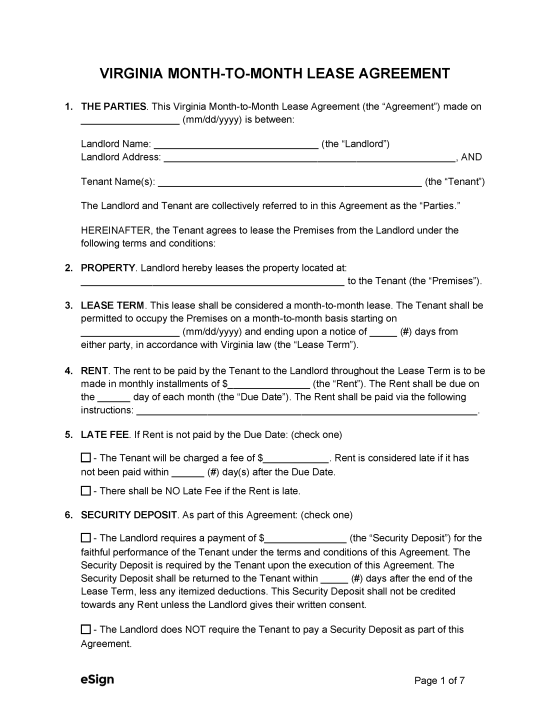

Month-to-Month Lease Agreement – A rental contract that renews on a monthly basis until either the tenant or landlord decides to terminate. – A rental contract that renews on a monthly basis until either the tenant or landlord decides to terminate.

Download: PDF, Word (.docx), OpenDocument |

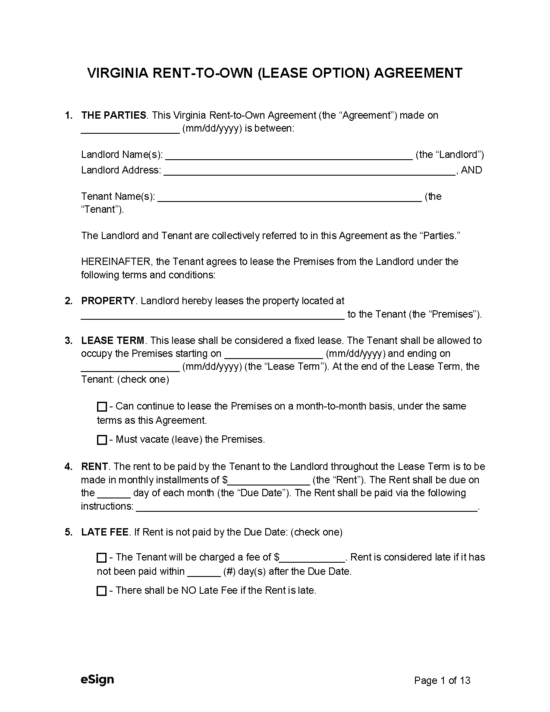

Rent-to-Own Agreement (Lease Option) – A fixed-term residential lease that allows the tenant to buy the property if certain conditions are met. Rent-to-Own Agreement (Lease Option) – A fixed-term residential lease that allows the tenant to buy the property if certain conditions are met.

Download: PDF |

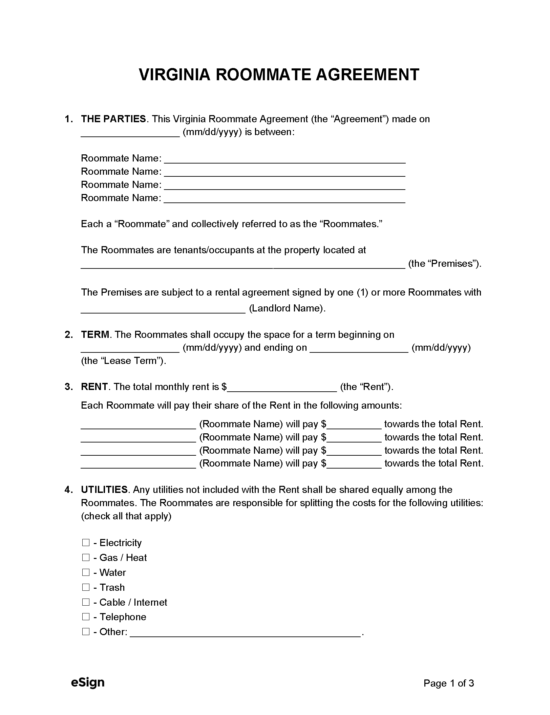

Roommate Agreement – Allows tenants sharing a residential property to outline the rules, rent payments, and other living conditions. Roommate Agreement – Allows tenants sharing a residential property to outline the rules, rent payments, and other living conditions.

Download: PDF, Word (.docx), OpenDocument |

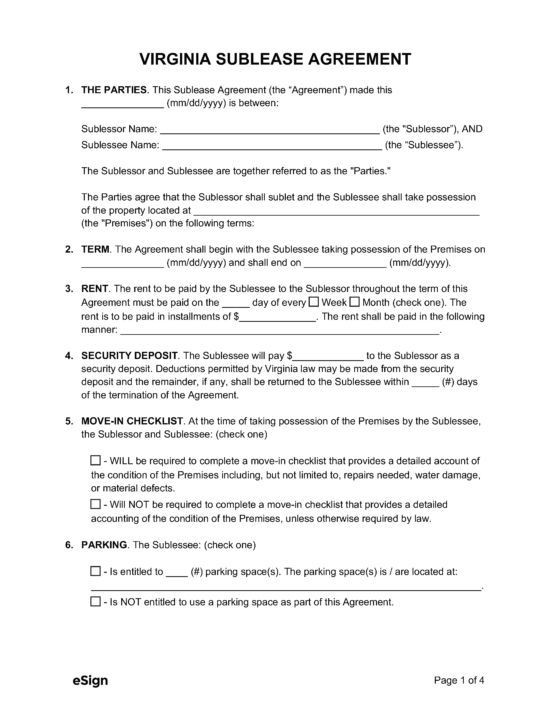

Sublease Agreement – Tenants may use this document to assign rental rights to another individual for a specified period, typically with permission from the landlord. Sublease Agreement – Tenants may use this document to assign rental rights to another individual for a specified period, typically with permission from the landlord.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (11)

- Defective Drywall – If a landlord is aware that a rental unit contains defective drywall, they must provide tenants with a written disclosure stating this information.[1]

- Demolition or Conversion to Condominium – If a property owner has submitted an application to convert a multi-family dwelling into a condominium or cooperative, or if within six months of signing the lease the multi-family dwelling is scheduled to be demolished, converted, or drastically altered forcing the tenants to vacate, the landlord or owner must disclose this information in writing to prospective tenants.[2]

- Lead-Based Paint Disclosure (PDF) – If the property was constructed before 1978, landlords must inform tenants whether lead-based paint was used in its construction.[3]

- Manager and Owner Information – Tenants must receive a written disclosure that states the name and address of the owner and anyone else permitted to act on the owner’s behalf.[4]

- Methamphetamine Disclosure (PDF) – If the property owner has knowledge that the premises were once used to manufacture methamphetamine, and the property has not since been cleaned in accordance with state guidelines, they must disclose this to the tenant.[5]

- Military Air Installation Disclosure (PDF) – A landlord or owner of property located in a military air zone must provide prospective tenants with a disclosure informing them that the dwelling is located in an area that may experience significant noise or be prone to military accidents.[6]

- Mold – A landlord must provide a disclosure in the move-in checklist indicating whether or not mold is visible inside the rental unit.[7]

- Move-In Inspection (PDF) – Within five days after the start of a residential tenancy, the landlord must provide the tenant with an itemized account of any existing damage.[8]

- Sale of Property – If a rental property has been sold, the landlord must notify the tenant of the sale and provide the name, address, and telephone number of the purchaser.[9]

- Statement of Tenant Rights and Responsibilities (PDF) – All tenants must be provided with this rights and responsibilities statement developed by the Department of Housing and Community Development.[10]

- Tourism Activity Zone – Owners of residential property located within a tourism activity zone must inform prospective tenants of such information and provide them with a summary of the possible circumstances that might affect their living conditions (e.g., parades, street closures, outdoor concerts).[11]

Security Deposits

Maximum Amount ($) – Landlords may not demand more than two months’ rent for a security deposit.[12]

Collecting Interest – State law does not make requirements for the collection and distribution of interest on security deposits.

Returning to Tenant – Security deposits must be returned within 45 days.

Itemized List Required? – Yes, after a move-out inspection takes place, the landlord must provide an itemized list of damages to the tenant.[13]

Separate Bank Account? – No, the use of a separate bank account for security deposits is not mentioned in state statutes.

Landlord’s Entry

General Access – 72 hours’ notice must be given for routine maintenance that was not requested by the tenant. If the tenant requests repairs or maintenance, the landlord may enter without giving notice to the tenant.[14]

Immediate Access – Landlords may enter without consent in the case of an emergency.[15]

Rent Payments

Grace Period – Late fees can be applied if the rent is not paid within the first five days of the due date.[16]

Maximum Late Fee ($) – The maximum late fee is 10% of the periodic rent payment or 10% of the remaining amount owed to the landlord, whichever is less.[17]

- Exception: If the landlord did not mention a late fee for rent in the lease agreement, no late fee can be charged.

Bad Check (NSF) Fee – The landlord may be able to charge a tenant $50 plus interest and any fees charged by their bank for a bounced check.[18]

Withholding Rent – If a tenant notifies a landlord of damages or an infestation on the property that is a health or safety risk, the landlord has 14 days to fix the issue. If they fail to remedy the problem, the tenant can hire a third party and deduct the costs from their rent up to $1,500 or one month’s rent, whichever is greater.[19]

Breaking a Lease

Non-Payment of Rent – After the five-day grace period, landlords can serve a 5-day notice to pay or quit if a tenant still hasn’t paid rent.[20]

Non-Compliance – When a tenant fails to comply with the lease agreement, the landlord can deliver a notice to quit for non-compliance stating that the tenant has 21 days to fix the issue or the lease will terminate 30 days from the date of delivery.[21]

- Exception: If the landlord considers the breach incurable, the non-compliance notice does not have to give the tenant the option to fix the issue. Furthermore, if the non-compliance is criminal, the landlord can serve an immediate notice to quit.[22]

Tenant Maintenance – The tenant is required to maintain the cleanliness and safety of the premises, use all services and appliances with care, and avoid damaging, removing, or changing any part of the property without the landlord’s consent.[23]

Lockouts – The landlord cannot intentionally bar the tenant from entering the property.[24]

Leaving Before the End Date – A rental property is considered abandoned by the tenant if they are absent for over seven days and the landlord notifies them that they will terminate the tenancy if they do not reply to the notice within seven days. For this law to apply, landlords have to include in the lease a section stating that the tenant has to give notice every time they plan on being absent for more than seven days.[25]

Lease Termination

Month-to-Month – A landlord or tenant can terminate a monthly lease agreement without cause by delivering a 30-day notice to the other party.[26]

Unclaimed Property – Personal property left on the premises by the tenant can be disposed of by the landlord if they provide one of the following notices[27]:

- Termination Notice – The landlord may dispose of the tenant’s personal property within 24 hours of the tenant’s departure if the landlord has stated their right to do so in a termination notice.

- Abandonment – If the property was abandoned and the landlord sent the appropriate 7-day notice, they may dispose of the tenant’s personal property within 24 hours after the 7-day notice period.

- Separate Notice – If the previous options do not apply, the landlord must provide a written notice stating that the tenant has 10 days to claim their personal property or the landlord can dispose of it within 24 hours after the notice period ends.

Sources

- § 55.1-1218(A)

- § 55.1-1216(C)

- EPA/HUD Fact Sheet

- § 55.1-1216(A)

- § 55.1-1219(A)

- § 55.1-1217(A)

- § 55.1-1215

- § 55.1-1214(A)

- § 55.1-1216(B)

- §§ 55.1-1204(B), 36-139(26)

- § 55.1-707

- § 55.1-1226(A)

- § 55.1-1226(G)

- § 55.1-1229(A)(4)

- § 55.1-1229(A)(4)

- § 55.1-1204(C)(5)

- § 55.1-1204(E)

- § 8.01-27.1(A)

- § 55.1-1244.1(B),(C)

- § 55.1-1245(F)

- § 55.1-1245(A),(B)

- § 55.1-1245(C)

- § 55.1-1227

- § 55.1-1243.1(A)

- § 55.1-1249

- § 55.1-1253(A)

- § 55.1-1254