Lease Agreements: By Type (6)

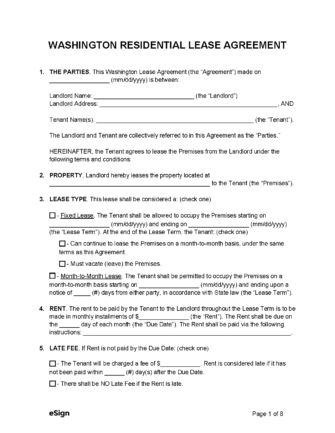

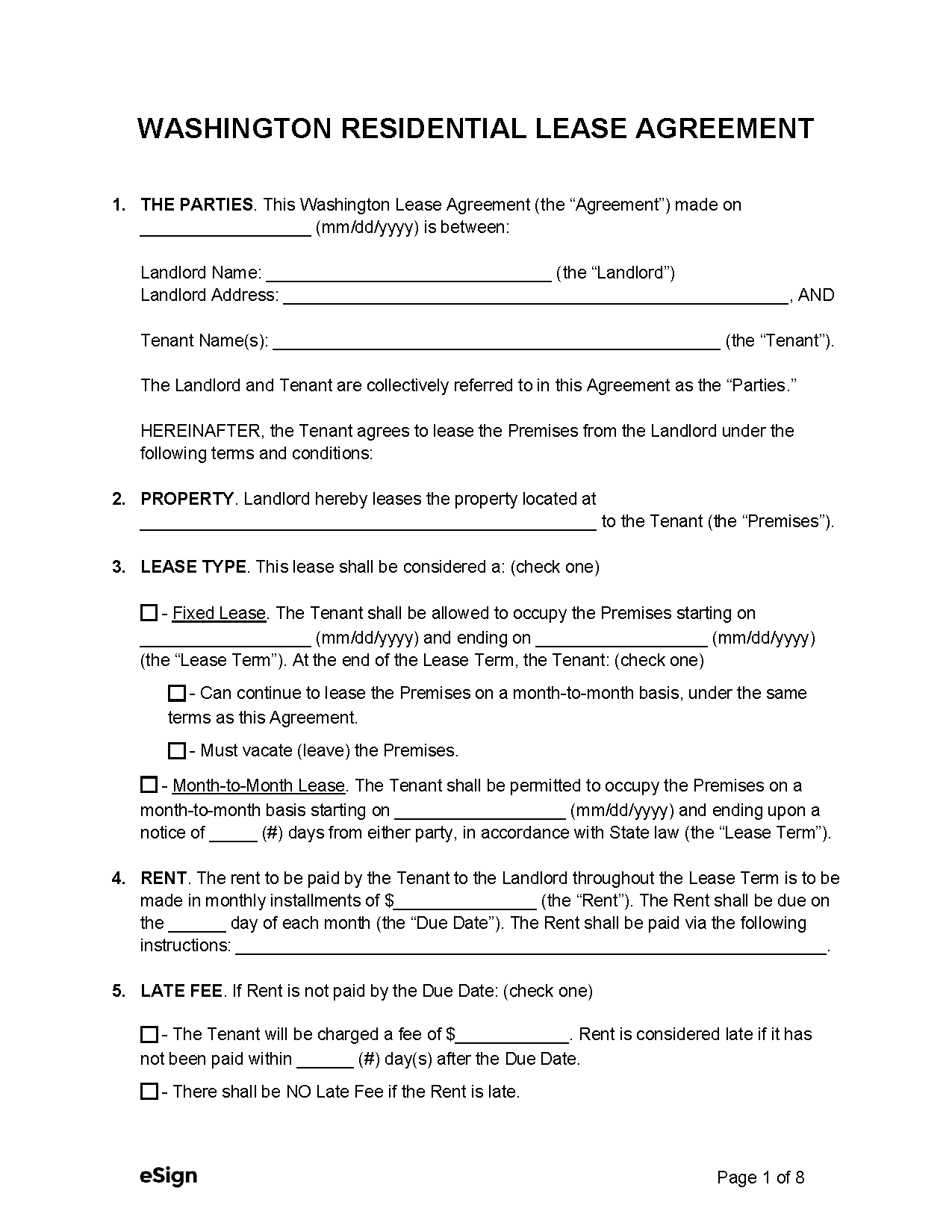

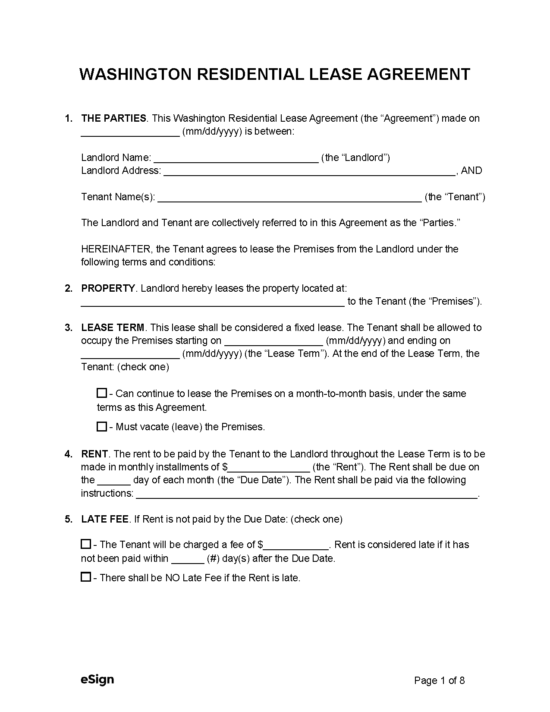

Standard (1-Year) Lease Agreement – A residential lease that establishes the rights and responsibilities of both a landlord and tenant for a fixed-term tenancy. Standard (1-Year) Lease Agreement – A residential lease that establishes the rights and responsibilities of both a landlord and tenant for a fixed-term tenancy.

Download: PDF |

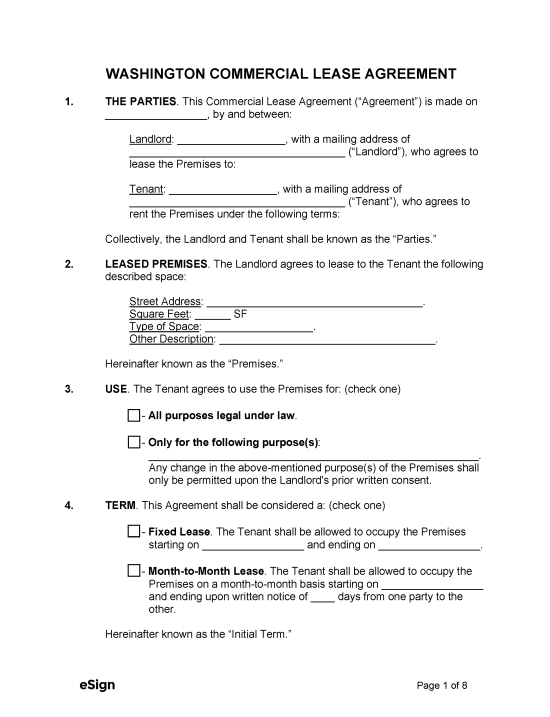

Commercial Lease Agreement – Permits a tenant to occupy a commercial property to run their business. Commercial Lease Agreement – Permits a tenant to occupy a commercial property to run their business.

Download: PDF, Word (.docx), OpenDocument |

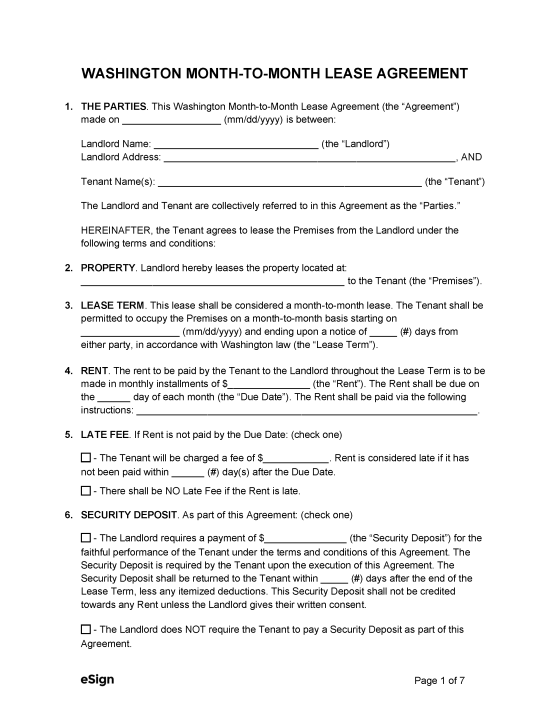

Month-to-Month Lease Agreement – A short-term rental contract that renews at the start of each month unless the parties decide to terminate. – A short-term rental contract that renews at the start of each month unless the parties decide to terminate.

Download: PDF, Word (.docx), OpenDocument |

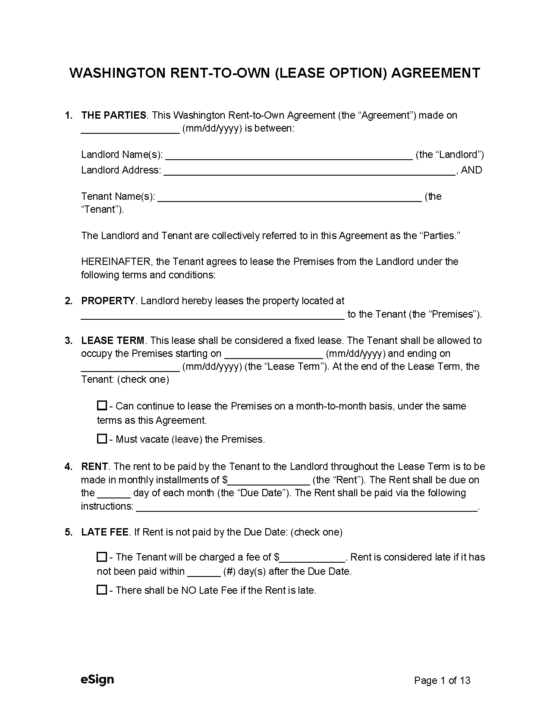

Rent-to-Own Agreement (Lease Option) – Combines a standard lease with a purchase agreement to give the tenant the option to purchase the property if certain contingencies are met. Rent-to-Own Agreement (Lease Option) – Combines a standard lease with a purchase agreement to give the tenant the option to purchase the property if certain contingencies are met.

Download: PDF |

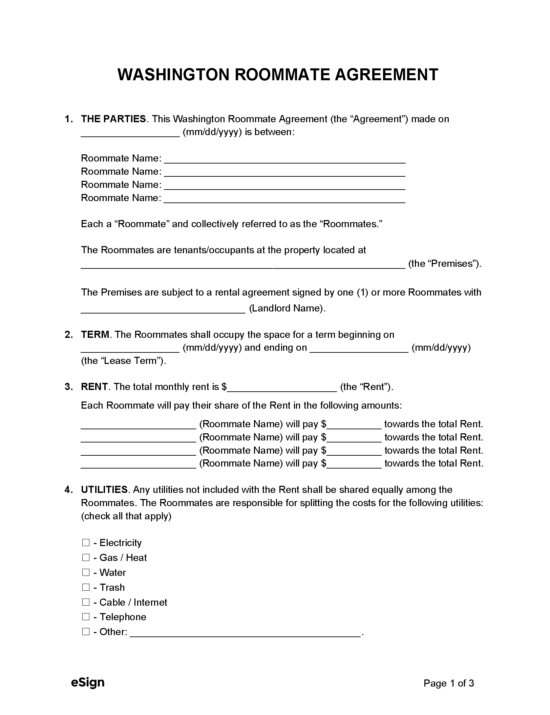

Roommate Agreement – Outlines the rules between individuals renting a shared residential space. Roommate Agreement – Outlines the rules between individuals renting a shared residential space.

Download: PDF, Word (.docx), OpenDocument |

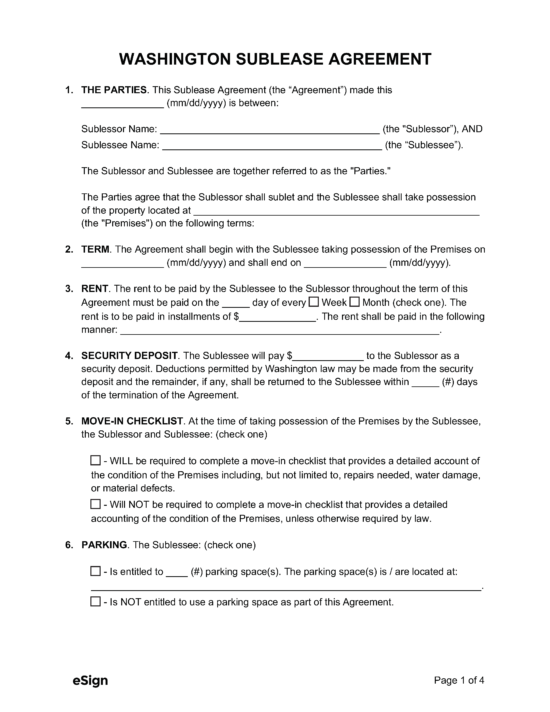

Sublease Agreement – Leaseholders may use this agreement to rent all or a portion of their rental property to another party. Sublease Agreement – Leaseholders may use this agreement to rent all or a portion of their rental property to another party.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (6)

- Fire Safety Information – Landlords must disclose fire safety and protection information to all tenants upon entering into a rental agreement.[1]

- Landlord and Agent Information – Tenants must be given the name and address of the landlord or person authorized to act on their behalf.[2]

- Lead-Based Paint Disclosure Form (PDF) – A form used to disclose the use of lead-based paint on the rental premises (only mandatory if the property was constructed before 1978).[3]

- Mold Information (PDF) – Upon signing a lease, the landlord must provide the tenant with a document that describes the dangers of mold and how it can be controlled.[4]

- Move-In Checklist (PDF) – If a security deposit is collected from a tenant, the landlord must provide a written statement describing the condition of the leased premises.[5]

- Withholding Deposits – When a landlord demands a security deposit at the beginning of a lease, the agreement must outline under what circumstances the deposit may be withheld at the end of the lease term.[6]

Security Deposits

Maximum Amount ($) – State law does not put a restriction on the maximum security deposit amount that landlords can collect from tenant. The city of Seattle limits security deposits (plus any nonrefundable fees) to a maximum of one month’s rent.[7]

Collecting Interest – The landlord is entitled to any interest earned from the deposit unless otherwise agreed upon in writing.[8]

Returning to Tenant – Security deposits must be returned within 30 days after the lease ended or the tenant abandoned the property.[9]

Itemized List Required? – Yes, a statement of the reasons for keeping a portion of the tenant’s security deposit for damages must be provided along with copies of bills, invoices, or receipts for repairs.[10]

Separate Bank Account? – Yes, security deposits must be held in a trust account that is maintained by the landlord for the sole purpose of holding security deposits.[11]

Landlord’s Entry

General Access – The landlord may access a rental property by giving the tenant two days’ written notice.[12]

- Exception: If the landlord is showing the property to prospective tenants or buyers, only one day’s notice is required.

Immediate Access – The landlord may enter without notice in the case of an emergency or abandonment.[13]

Rent Payments

Grace Period – Late fees cannot be charged until five days after rent is late.[14]

Maximum Late Fee ($) – Maximum fees for late rent payments are not mentioned in state statutes.

Bad Check (NSF) Fee – Landlords may charge a tenant a reasonable fee for a bounced rent check. If payment is not made within 15 days, they may charge $40 plus 12% interest on the rent check.[15]

Withholding Rent – If a landlord fails to make repairs after being notified, the tenant’s options are to terminate the lease, file a legal action with the court, or repair the issues and deduct the cost from rent (without exceeding two months’ rent).[16]

Breaking a Lease

Non-Payment of Rent – Landlords must use a 14-day notice to quit if a tenant fails to pay rent on the agreed-upon due date.[17]

Non-Compliance – If a tenant fails to comply with the lease agreement, landlords can deliver a 10-day notice to comply or quit.[18]

Lockouts – Tenants cannot be prohibited from accessing the property without the landlord obtaining a court order.[19]

Leaving Before the End Date – If a tenant abandons the rental property, the landlord can charge them the total rent amount for the remainder of the lease term or the accumulated rent between the date of abandonment and re-renting the property, whichever is less.[20]

- Exception – For monthly leases, the tenant’s liability for abandonment cannot be more than one month’s rent.

Lease Termination

Month-to-Month – To terminate a monthly lease agreement, landlords must provide tenants with a 20-day notice to quit.[21]

Unclaimed Property – If a tenant leaves personal property after abandoning the rental unit, the landlord must store their belongings and notify them that they will be sold unless claimed within 45 days of the notice.[22]

Sources

- § 59.18.060(12)

- § 59.18.060(15)

- EPA/HUD Fact Sheet

- § 59.18.060(13)

- § 59.18.260(2)

- § 59.18.260(1)

- § 7.24.035(A)

- § 59.18.270

- § 59.18.280(1)(a)

- § 59.18.280(1)(a),(b)

- § 59.18.270

- § 59.18.150(6)

- § 59.18.150(5)

- § 59.18.170(2)

- § 62A.3-515

- §§ 59.18.170, 59.18.090, 59.18.100

- § 59.12.030(3)

- § 59.12.030(4)

- § 59.18.290

- § 59.18.310(1)

- § 59.18.200(1)(a)

- § 59.18.310(2)