Processing Time

A landlord commonly takes 48 to 72 hours to accept or reject a new tenant.[1]

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Consumer Report?

The main purpose of a rental application is to run a consumer report which is a profile created from publicly sourced information about an individual.[2]

A consumer report includes:

- Credit Report – Includes an individual’s credit card balances, credit limits, payment history, mortgages, and other loans.

- Credit Inquiries – Which companies and how many occurrences an individual’s credit was requested.

- Public Records – Such as any court matters involving the individual.

How to Screen a Tenant (5 steps)

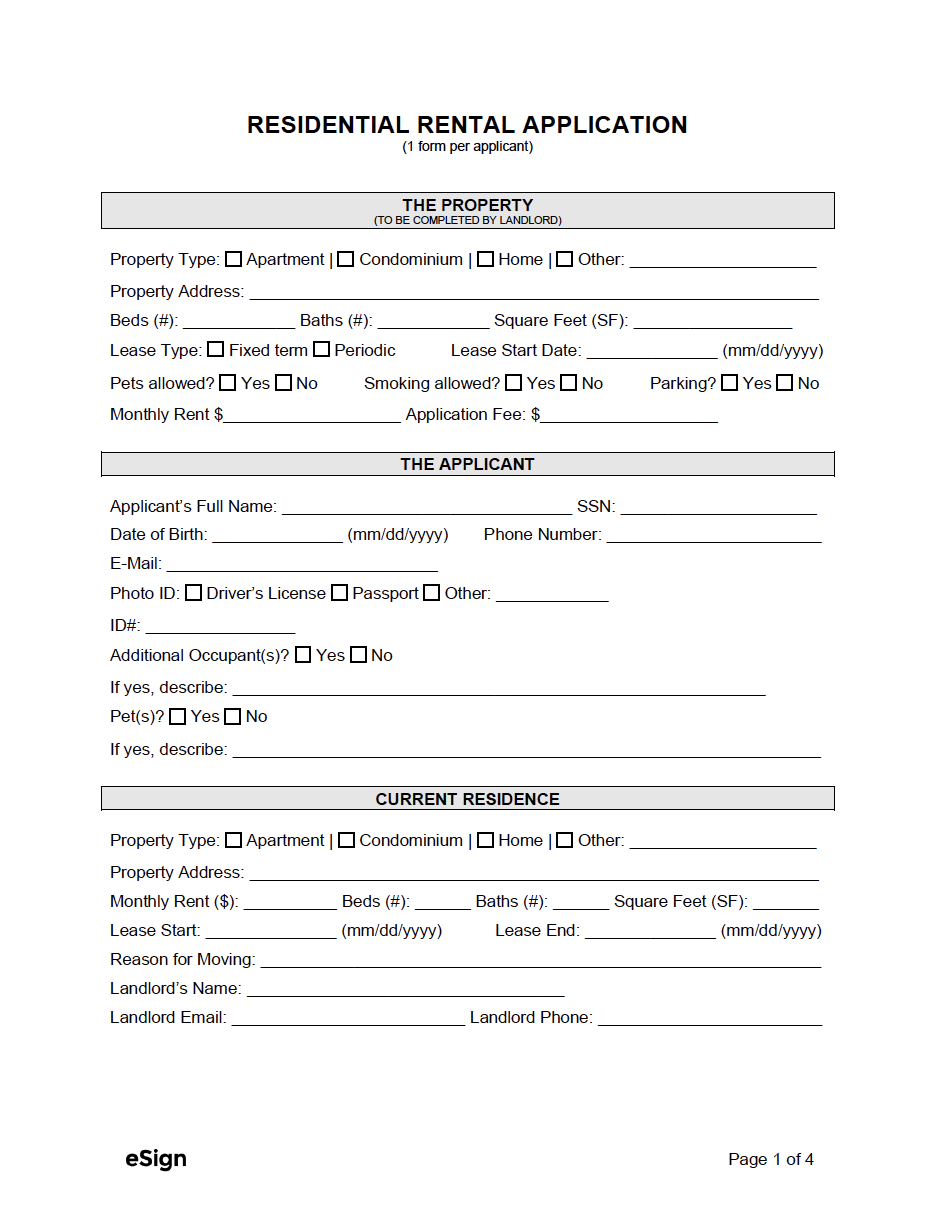

1. Obtain a Completed Rental Application

Download: PDF, Word (.docx), OpenDocument

Required Information[3]

- Full Name

- Current Address

- Previous Addresses (up to last 3 years)

- Date of Birth

- Social Security Number (SSN)

- Consent to Run Report

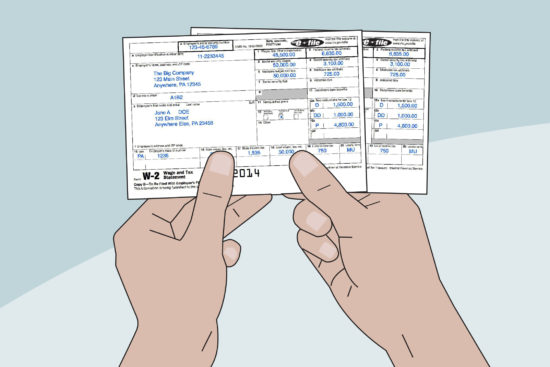

2. Verify the Applicant’s Income

The landlord should verify the applicant’s employment situation and other sources of income. This can be done in 6 ways:[4]

- Employment Verification Letter – Form given to an applicant that is to be completed by a landlord.

- Job Offer Letter – An offer letter signed by the employer verifying the pay of the position.

- Tax Returns – Request the applicant’s W-2. 1099, or 1099-MISC from the last 2 years.

- Recent Paystubs – A copy of an applicant’s last 2 paystubs.

- Bank Statements – The last 2 months’ bank statements from the holder’s account.

- Official Letter – If any of the above cannot be provided, a certified public accountant (CPA) can use a letter that discloses an applicant’s income and assets.

3. Best Tenant Screening Websites

A credit report, background check, nationwide eviction check, and available public information.

| 10 Screening Services (alphabetical) | ||||

| Website | Credit History | Criminal History | Nationwide Eviction | Sex Offender |

|---|---|---|---|---|

| Avail.co | $25 | *$45 | *$45 | *$45 |

| Buildium | **$15 | **$15 | **$15 | **$15 |

| Apartments.com | $24.99 | *$39.99 | *$39.99 | *$39.99 |

| e-Renter | *$29.95 | $19.95 | *$29.95 | *$34.95 |

| Experian | $15 | N/A | N/A | N/A |

| LeaseRunner | $20 | $15 | $12 | $15 |

| MyRental | *$30 | $20 | *$30 | *$30 |

| MySmartMove | $25 | *$40 | *$40 | *$40 |

| RentPrep | *$35 | $18.95 | *$35 | *$35 |

| TenantAlert | *39.95 | *39.95 | *39.95 | *39.95 |

|

||||

4. Verify References

Calling and emailing an applicant’s references validates an applicant’s personality and habits, which standard screening practices can overlook. It is recommended that references be current and previous employers or landlords.

5. Approve or Reject the Applicant

Average Score (2022) – 714[5]

The National Association of Realtors determines that anything above 700 is considered “good” and above 650 is a “fair” credit score.[6]

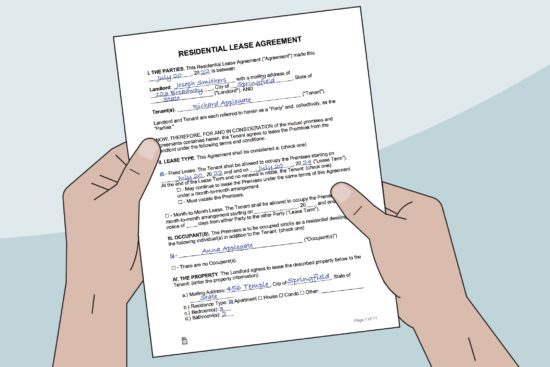

Option A – Tenant is Approved, Write a Lease

If the tenant checks all the boxes for making a great tenant (has a worthy credit score, great references, the necessary income, no recent criminal convictions, and so on), the landlord can approve their application. The next step is to draft a Lease Agreement, which binds the tenant to a specific lease term (typically 1 year).

Once drafted, the landlord should send the lease to the tenant for signing. Once signed by all tenant(s), the landlord will need to collect the first month’s rent, the security deposit, and any other agreed-upon fees.

Option B – Tenant is Rejected, But Can be Approved with a Guarantor

If a tenant doesn’t have sufficient credit or income to justify tenancy, the landlord can require a guarantor to co-sign the lease. Additional screening would be required for the guarantor, and if approved, would be ‘on the hook’ for the lease (in the same manner as the tenant).

The landlord and guarantor would sign and attach the Lease Guarantor Form to a lease.

Option C – Tenant is Rejected, Write an Adverse Action Letter

If the landlord decides to reject the tenant, they will need to deliver the tenant a letter known as an adverse action letter required by the Fair Credit Reporting Act.[7]

Use an Adverse Action Letter that includes the following:

- The applicant can obtain a copy of the report if requested (within 60 days).

- The name, address, and phone number of the reporting agency.

- A general paragraph stating that the tenant was rejected.

- The reason (non-specific) as to why the applicant was rejected.

- A disclosure that the consumer reporting agency did NOT decide to reject the applicant, but the landlord did use the information from the report.

Maximum Application Fees: By State

| State | Maximum Fee | Source |

| California | $54.46 – maximum fees are adjusted yearly based on the CPI. | California Apartment Association |

| Delaware | $50 or the equivalent of 10% of the monthly rent (whichever is greater). | § 5514(d) |

| Maryland | Any fees over $25 must be returned to the tenant. | § 8–213 |

| Massachusetts | Landlords are forbidden from charging an application fee. However, licensed brokers can charge a fee. | § 15B, 254 CMR 7.00 |

| New York | $20 or the background check cost, whichever amount is less. | § 238-A |

| Oregon | Fees cannot be greater than the average actual cost of obtaining information on the applicant. | ORS 90.295 |

| Vermont | Landlords cannot charge an application fee for residential tenancies. | § 4456a |

| Virginia | $50, not including additional costs that result from running background checks. | § 55.1-1203 |

| Washington | Any fee charged to applicants cannot exceed the costs of obtaining screening information. | 59.18.257 |

| Wisconsin | Landlords cannot charge more than $20 for a credit screening report. This does not apply to other screening costs. | § 134.05(4) |

Sample

Download: PDF, MS Word (.docx), OpenDocument

RENTAL APPLICATION

1. THE PROPERTY.

Property Address: [PROPERTY ADDRESS]

Lease Type: ☐ Fixed ☐ Periodic | Start Date: [MM/DD/YYYY]

Monthly Rent $[RENT AMOUNT] | Application Fee: $[FEE AMOUNT]

2. THE APPLICANT.

Applicant’s Full Name: [FULL NAME] | DOB: [MM/DD/YYYY]

Phone Number: [PHONE] | E-Mail: [EMAIL]

License #: [ID NUMBER]

Additional Occupant(s): [OCCUPANT NAMES (IF ANY)].

Pet(s): [DESCRIBE PETS (IF ANY)].

3. CURRENT RESIDENCE.

Property Address: [CURRENT ADDRESS]

Monthly Rent ($): [RENT]

Lease Start: [MM/DD/YYYY] | Lease End: [MM/DD/YYYY]

Reason for Moving: [REASON]

Landlord’s Name: [LANDLORD NAME]

Landlord Email: [LANDLORD EMAIL]

Landlord Phone: [LANDLORD PHONE]

4. CURRENT EMPLOYER.

Company Name: [EMPLOYER NAME]

Employer’s Address: [EMPLOYER ADDRESS]

Title/Occupation: [TITLE / OCCUPATION]

Gross Monthly Income: $[MONTHLY INCOME]

Start Date: [MM/DD/YYYY]

Supervisor Name: [SUPERVISOR NAME]

Supervisor Phone: [SUPERVISOR PHONE]

Supervisor Email: [SUPERVISOR EMAIL]

5. VEHICLE.

Do you own a vehicle? ☐ Yes (describe below) ☐ No

Make: [MAKE] | Model: [MODEL] | Year: [YEAR]

Color: [COLOR] | Plate #: [PLATE #] | State: [STATE]

6. REFERENCES.

Full Name: [REFERENCE NAME] Relationship: [RELATIONSHIP]

E-Mail: [EMAIL ADDRESS] Phone: [PHONE NUMBER]

Full Name: [REFERENCE NAME] Relationship: [RELATIONSHIP]

E-Mail: [EMAIL ADDRESS] Phone: [PHONE NUMBER]

7. BACKGROUND INFORMATION.

Have you ever been evicted or a defendant in an eviction action? ☐ Yes ☐ No

If yes, describe: [DESCRIBE (IF APPLICABLE)].

Have you ever filed, or are you in the process of filing for bankruptcy? ☐ Yes ☐ No

If yes, describe: [DESCRIBE (IF APPLICABLE)].

Do you have any outstanding balances with past landlords? ☐ Yes ☐ No

If yes, describe: [DESCRIBE (IF APPLICABLE)].

Have you ever been asked to move for a lease violation of any kind? ☐ Yes ☐ No

If yes, describe: [DESCRIBE (IF APPLICABLE)].

Have you ever been convicted of a crime? ☐ Yes ☐ No

If yes, describe: [DESCRIBE (IF APPLICABLE)].

8. CONSENT & ACKNOWLEDGMENT.

I hereby certify that I am at least 18 years of age and that all information given on this application is true and correct. I authorize the Landlord and its agents to obtain an investigative consumer credit report including but not limited to credit history, OFAC search, landlord/tenant court record search, criminal record search, and registered sex offender search. I authorize the release of information from previous or current landlords, employers, bank representatives, and personal references. I agree to furnish additional credit and/or personal references upon request. I understand incomplete or incorrect information provided in this application may cause a delay in processing which may result in denial of tenancy. This investigation is for resident screening purposes only and is strictly confidential. I hereby hold the Landlord and its agents free and harmless from any liability for any damages arising out of any improper use of this information.

Important information about your rights under the Fair Credit Reporting Act:

• You have a right to request disclosure of the nature and scope of the investigation.

• You must be told if information in your file has been used against you.

• You have a right to know what is in your file, and this disclosure may be free.

• You have the right to ask for a credit score (there may be a fee for this service).

• You have the right to dispute incomplete or inaccurate information. Consumer reporting agencies must correct inaccurate, incomplete, or unverifiable information.

Consumer Response Center, Room 130-A, Federal Trade Commission, 600 Pennsylvania Avenue N.W., Washington D.C. 20580.

In connection with my application for housing, I understand that the property owner/agent may obtain one or more consumer reports, which may contain public information, for the purposes of evaluating my application. These consumer reports will be obtained from one or more of the following consumer reporting agencies:

• Equifax, E.C.I.F., P.O. Box 740241, Atlanta, GA, 30374-0241, (800) 685-1111

• Trans Union, Regional Disclosure Center, 1561 Orangethorpe Ave., Fullerton, CA, 92631, (714) 738-3800

• Experian (TRW), Consumer Assistance, P.O. Box 949, Allen, TX, 75002, (888) 397-3742

These consumer reports are defined as investigative consumer reports. These reports may contain information on my character, general reputation, personal characteristics, and mode of living. In connection with my application for housing, I authorize the owner/agent to obtain a consumer report from the consumer reporting agencies listed above.

Applicant’s Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [APPLICANT PRINTED NAME]

Sources

- www.apartments.com/rental-manager/resources/screening/how-long-does-it-take-process-rental-applications

- 15 U.S. Code § 1681a(d)

- 15 U.S. Code § 1681b

- www.realtor.com/advice/rent/show-proof-income-beyond-pay-stub/

- www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/

- www.realtor.com/advice/rent/credit-score-you-need-to-rent-an-apartment/

- 15 U.S. Code § 1681m