Common Uses (6)

- Background check. As part of a consumer report being generated.

- Borrowing money. When applying for a mortgage or personal loan.

- Past employment. To verify a former employment position.

- Immigration. When applying for a green card, visa, or residency status.

- Leasing property. When requested by a landlord.

- Social benefits. To qualify for government benefits.

Sample

Download: PDF, MS Word (.docx), ODT

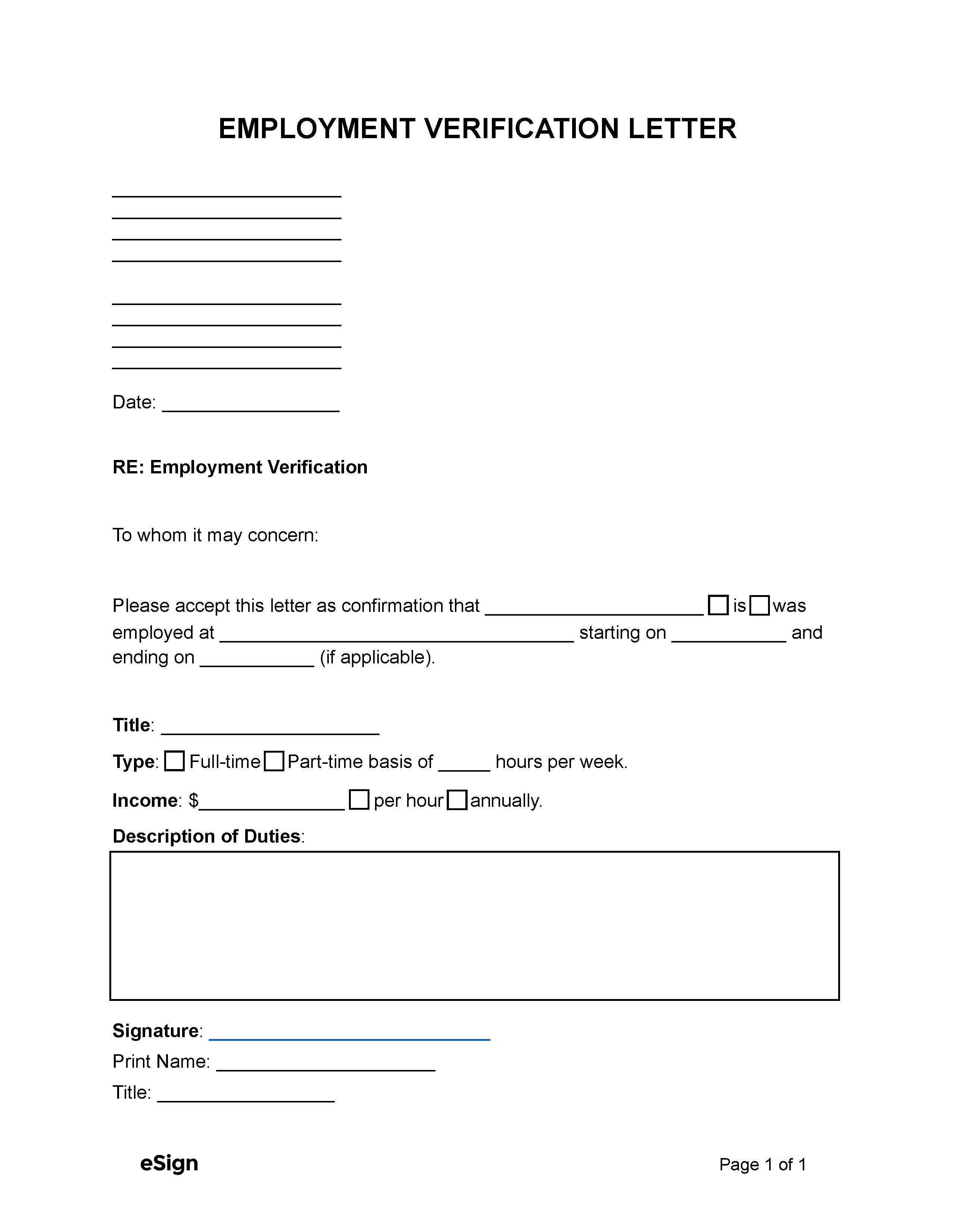

EMPLOYMENT VERIFICATION FORM

[RECIPIENT NAME]

[RECIPIENT STREET ADDRESS]

[RECIPIENT CITY, STATE, ZIP]

[RECIPIENT PHONE]

[SENDER NAME]

[SENDER STREET ADDRESS]

[SENDER CITY, STATE, ZIP]

[SENDER PHONE]

Date: [MM/DD/YYYY]

To whom it may concern:

Please accept this letter as confirmation that [NAME] ☐ is ☐ was employed at [COMPANY NAME] starting on [MM/DD/YYYY] and ending on [MM/DD/YYYY] (if applicable).

Title: [EMPLOYEE POSITION]

Type: ☐ Full-time ☐ Part-time basis of [#] hours per week.

Income: $[AMOUNT] ☐ per hour ☐ annually.

Description of Duties: [LIST EMPLOYEE DUTIES]

Signature ________________________

Print Name: [NAME]

Title: [TITLE]

Additional Documents

- Pay stub

- Past tax returns (IRS Form 1040)

- Wage and Tax Statement (IRS Form W-2)

- Bank statements

- Social Security proof of income letter

- Workers compensation or unemployment benefits statements

- Court-ordered payments (settlement agreements, alimony/child support payments, etc.)