By Type (9)

Sample

Download: PDF, Word (.docx), OpenDocument

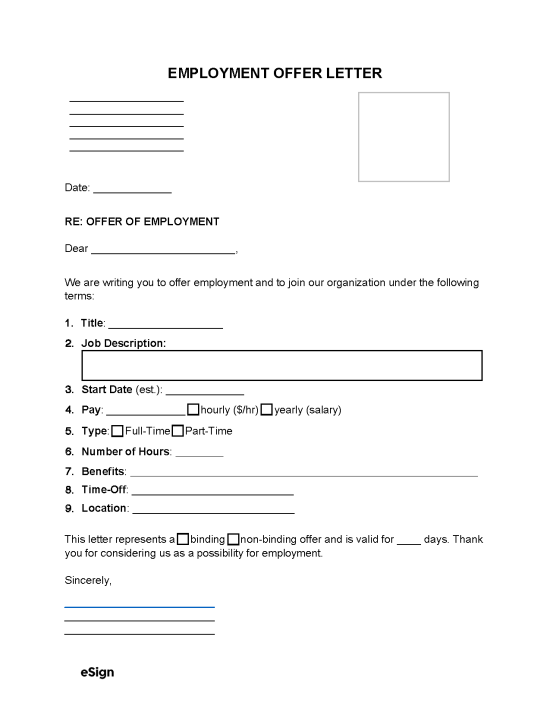

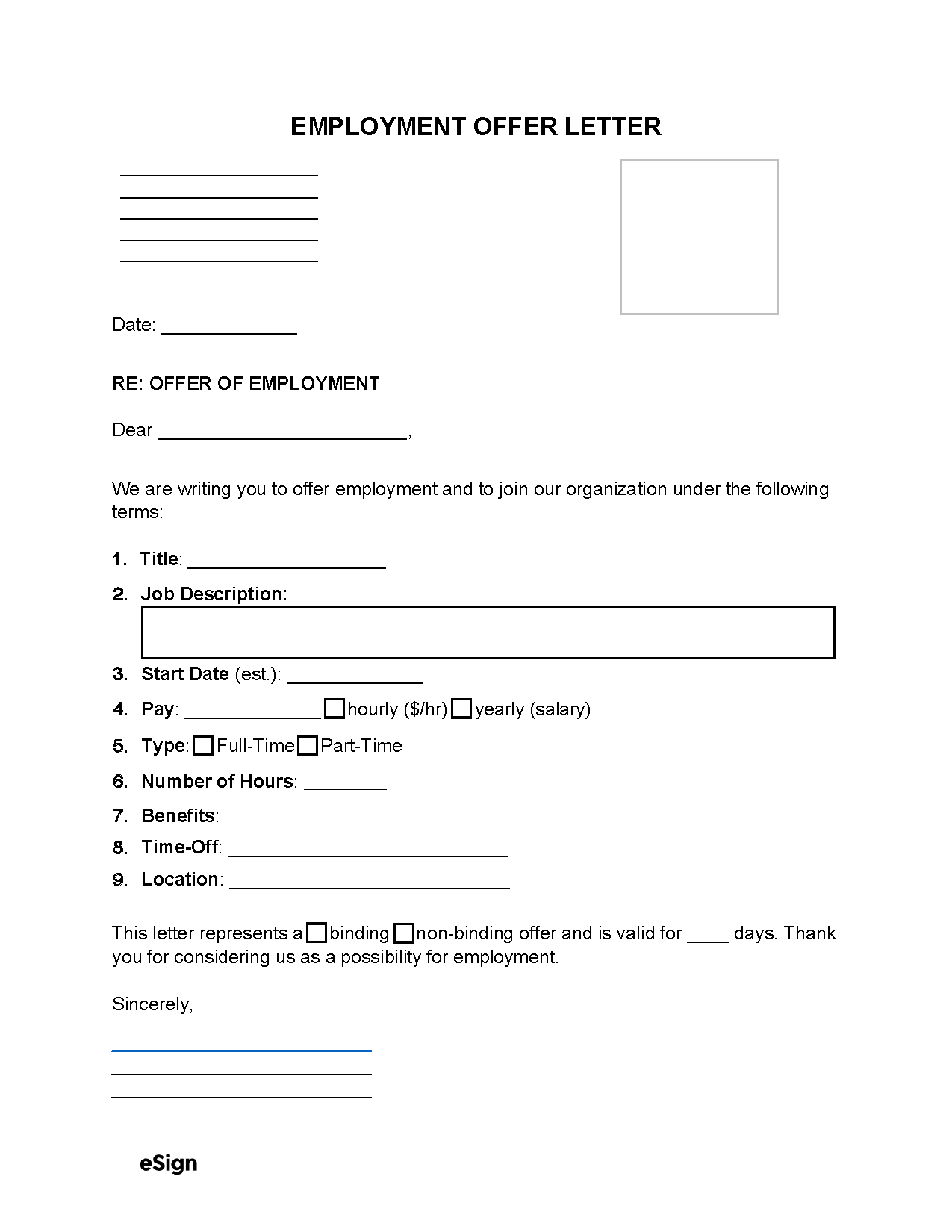

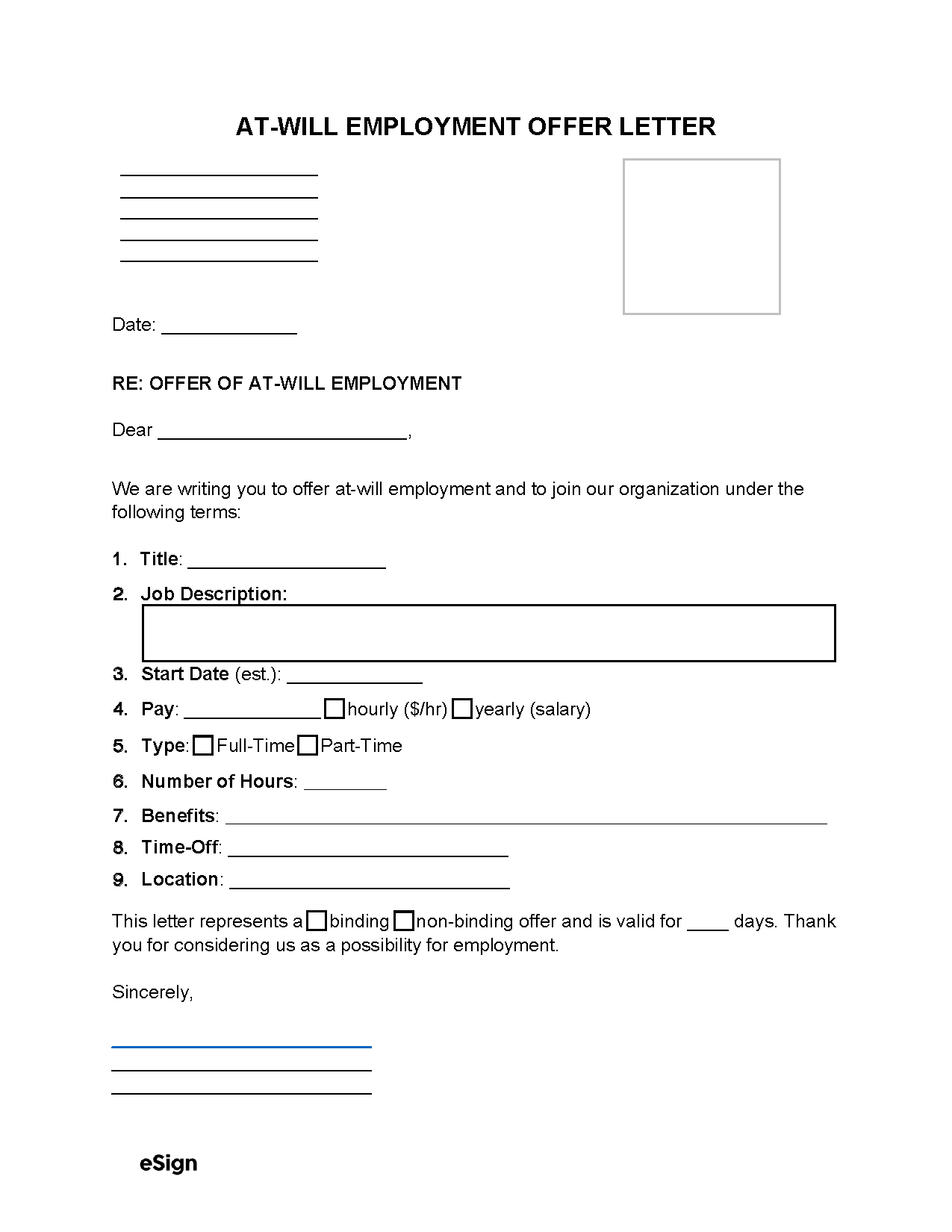

EMPLOYMENT OFFER LETTER

Date: [DATE]

RE: OFFER OF EMPLOYMENT

Dear [CANDIDATE NAME],

We are writing you to offer employment and to join our organization under the following terms:

- Title: [POSITION]

The job description is: [JOB DESCRIPTION] - Start Date (est.): [START DATE]

- Pay: $[AMOUNT] ☐ hourly ($/hr) ☐ yearly (salary)

- Type: ☐ Full-Time ☐ Part-Time (If part-time, how many hours? [HOURS])

- Benefits: [ADD BENEFITS]

- Time-Off: [ADD VACATION/PERSONAL DAYS]

- Location: [ADDRESS]

This letter represents a ☐ binding ☐ non-binding offer and is valid for [#] days. Thank you for considering us as a possibility for employment.

Sincerely,

_________________________

[SENDER NAME]

[SENDER TITLE]

What Happens AFTER an Employee Accepts

After a candidate accepts a position there are a few steps that must be completed before they can be legally hired:

- Employment Eligibility Verification (USCIS Form I-9) – The employer should provide Form I-9 to employees to verify that they’re eligible to work in the U.S.

- Background Check – The employer should perform a background check to properly vet new employees.

- Employment Contract – The employer will want to draft and sign an employment contract to bind the employee to a working relationship.

- IRS W-4 Form – The employee must complete this form so that the employer can withhold the proper amount for taxes from the employee’s pay.

- Onboarding Checklist – An onboarding checklist can be provided to employees to acquaint them with the new position.

- Employee Handbook – A handbook that includes the policies regarding time off, “at-will” employment, overtime pay, and benefits should be provided.

- Withholding Taxes – Employers may sign up employees to a payroll service for withholding income taxes.