Contents |

Versions (3)

Download: PDF, Word (.docx), OpenDocument

Download: PDF

Download: PDF

Sample

Download: PDF, Word (.docx), OpenDocument

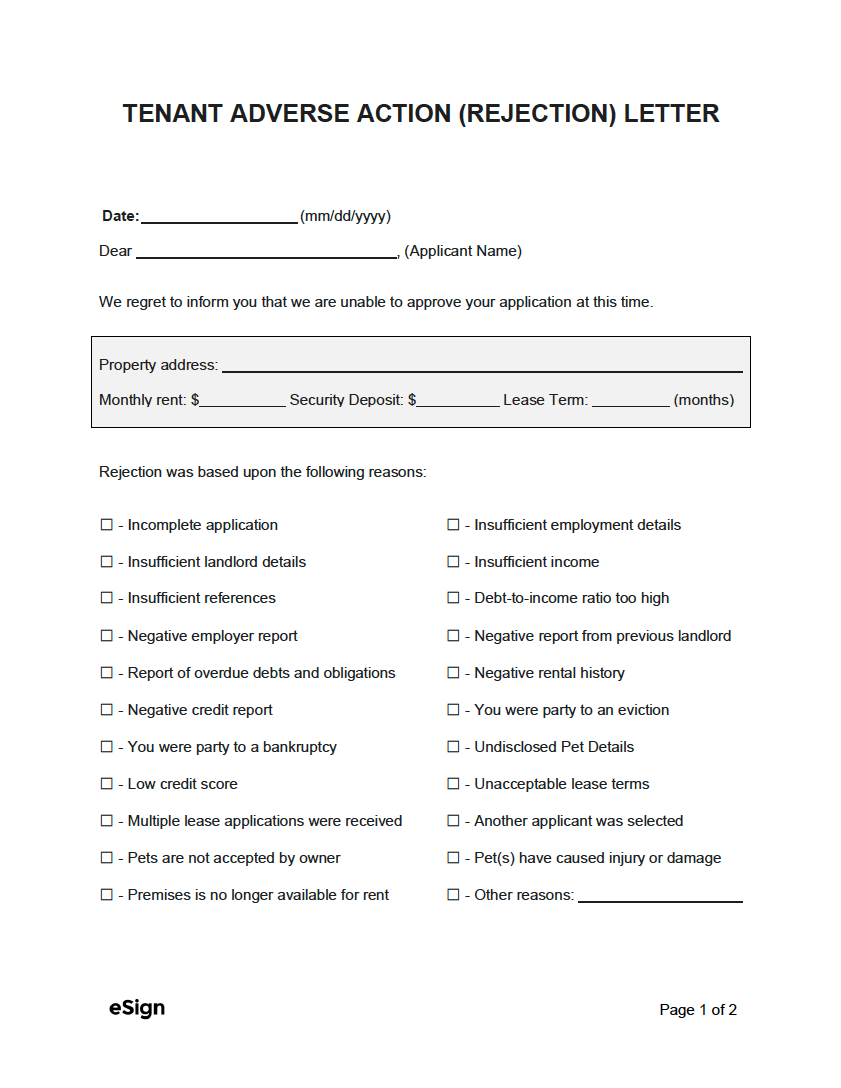

TENANT ADVERSE ACTION (REJECTION) LETTER

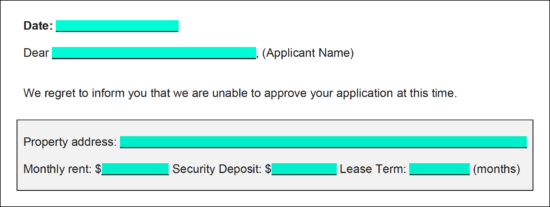

Date: [MM/DD/YYYY]

Dear [APPLICANT NAME],

We regret to inform you that we are unable to approve your application at this time.

Property Address: [ADDRESS OF THE RENTAL]

Monthly Rent: $[AMOUNT]

Security Deposit: $[AMOUNT]

Lease Term: [#] (months)

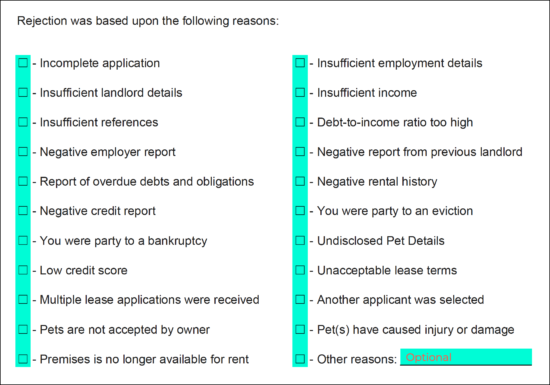

Rejection was based upon the following reasons:

☐ – Incomplete application

☐ – Insufficient employment details

☐ – Insufficient landlord details

☐ – Insufficient income

☐ – Insufficient references

☐ – Debt-to-income ratio too high

☐ – Negative employer report

☐ – Negative report from a previous landlord

☐ – Report of overdue debts and obligations

☐ – Negative rental history

☐ – Negative credit report

☐ – You were party to an eviction

☐ – You were party to a bankruptcy

☐ – Undisclosed Pet Details

☐ – Low credit score

☐ – Unacceptable lease terms

☐ – Multiple lease applications were received

☐ – Another applicant was selected

☐ – The owner does not accept pets

☐ – Pet(s) have caused injury or damage

☐ – Premises is no longer available for rent

☐ – Other reasons: [OTHER].

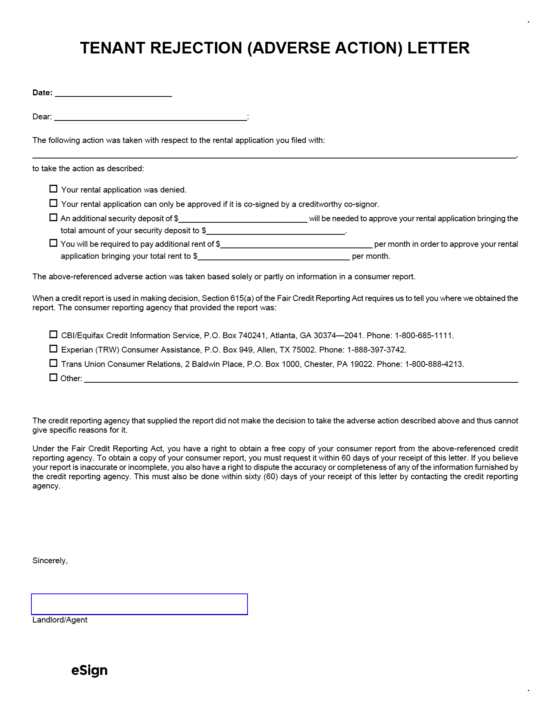

Your application may have been denied on the basis of a report given by a consumer reporting Agency and/or on the basis of the information obtained from other sources.

If your application has been denied on the basis of information obtained from other sources, then you have a right under the Fair Credit Reporting Act to make a written request within 60 days from the receipt of this notice regarding the nature of this information. As per federal law, we are prohibited from disclosing the source of this information.

If your application has been denied on the basis of information obtained from a consumer reporting Agency/Agencies, then you have the right under the Fair Credit Reporting Act to make a written request within 60 days from the receipt of this notice, to obtain a free report from any of the following Agencies:

| Equifax Information Services PO Box 105873 Atlanta, GA 30348-5873 (800) 685-1111 |

Experian (TRW) PO Box 2104 Allen, TX 75013-2014 (888) 397-3742 |

Trans Union PO Box 1000 Chester, PA 19022 (800) 888-4213 |

You also have the right to dispute your credit report on the basis of its inaccuracy or incompleteness. You may have other rights under Consumer Protection Law or credit reporting, for which you may contact your state Attorney General’s office or your local Consumer Protection Agency.

Important Note: The Fair Housing Act is a federal statute that prohibits discrimination in the sale or rental of housing, as well as in residential real estate-related transactions such as advertising, mortgage lending, homeowner’s insurance, and zoning. The law makes it unlawful to discriminate on the basis of race, color, religion, sex, national origin, disability, and familial status.

Sincerely, _________________________________

Landlord/Agent

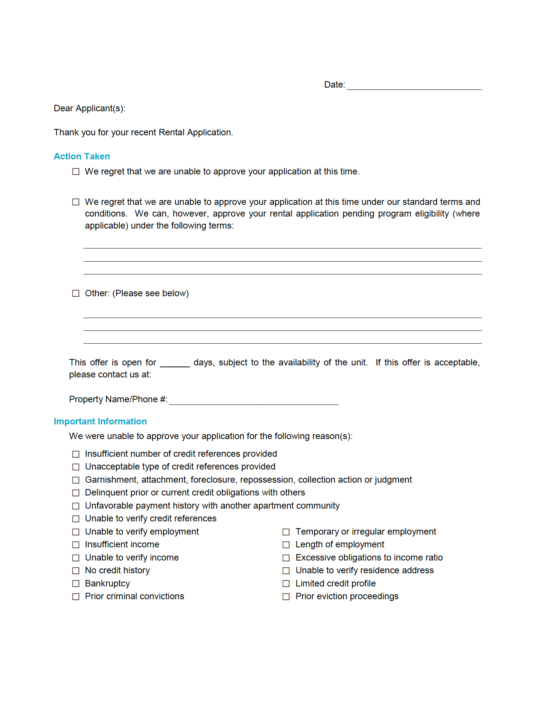

What is a Tenant Rejection Letter?

A tenant rejection letter is a relatively simple form that provides tenants with official documentation after being denied the right to lease residential property. Landlords are required by law to provide tenants with the form if they ordered a consumer report anytime during the application process. A consumer report is an official record that a landlord can request on a tenant and includes background information regarding criminal, rental, employment, and/or credit history. The law that requires landlords to use tenant rejection letters is the Fair Credit Reporting Act (FCRA) and is enforced by the Federal Trade Commission (FTC).

As stated by the FTC’s article on adverse action, the form must be used even if information from the report wasn’t the main reason for the tenant’s rejection.

What Must It Include?

In order to be deemed sufficient by the FTC, the letter must include the following information:

- The contact information of the reporting company used (for the background check). This needs to include the reporting company’s name, address, and phone number.

- A formal statement saying the company that ran the report for the landlord was not involved in the decision to deny the tenant and that they can’t provide any reasoning to the tenant.

- Information that states the applicant has the legal right to dispute the accuracy or completeness of the report (or any other information provided by the reporting agency regarding the applicant) and that they can acquire a free report from the company as long as they request it within sixty (60) days.

The letter can be customized to meet the landlord’s or property manager’s preferences as long as the information above is included.

Valid Reasons for Rejecting a Tenant

Prior to listing what a tenant can be rejected for, it’s equally important to know what factors they cannot be denied for. As stated by the Fair Housing Act (FHA), a landlord cannot deny an applicant based on the following determinants:

- Race

- National Origin

- Color

- Disability

- Religion

- Sex

- Familial Status

- Disability

The following are examples of what a landlord can lawfully reject a tenant for:

- Smoking

- Poor references

- Low credit score

- Failure to complete the rental application in full

- Lying on the application

- No rental history

- Low income

- Income can’t be verified

- History of not paying rent

- History of damaging rental properties

- Criminal record

- Previous evictions

Landlords can aid in protecting themselves from liability by screening each applicant in the same manner. A rental application template is the most common way of doing this. By using the same template for each person, they can easily compare applicants based on attributes that don’t discriminate on any of the eight (8) factors listed above.

Instructions (How to Write)

Step 1 – Lease + Tenant Information

The landlord should start by providing the date of rejection, and they should attempt to deliver the letter as close to the rejection date as possible. On the next line, enter the first and last name of the applicant. The landlord can establish the details of what the applicant was applying for by entering the following information into the appropriate fields:

- Address of the property

- Monthly rent ($)

- Security deposit ($)

- Lease term (in months)

Step 2 – Reason for Rejection

Providing information on why the tenant was rejected is a common courtesy, and it lets them understand what they can improve upon prior to applying for other rentals. Place a checkmark next to each corresponding box to indicate the reason(s) for rejection.

Step 3 – Sign the Letter

Signing the letter adds to its legitimacy and validity. The signature can be handwritten or signed electronically using eSign. Once completed, the letter can be delivered, mailed, or emailed to the applicant.