Agreements: By Type (6)

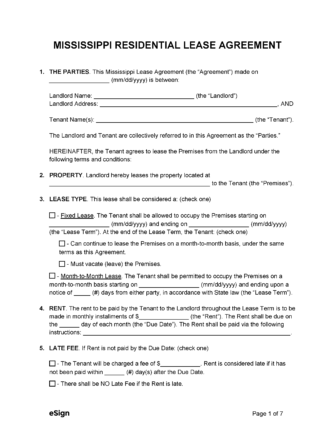

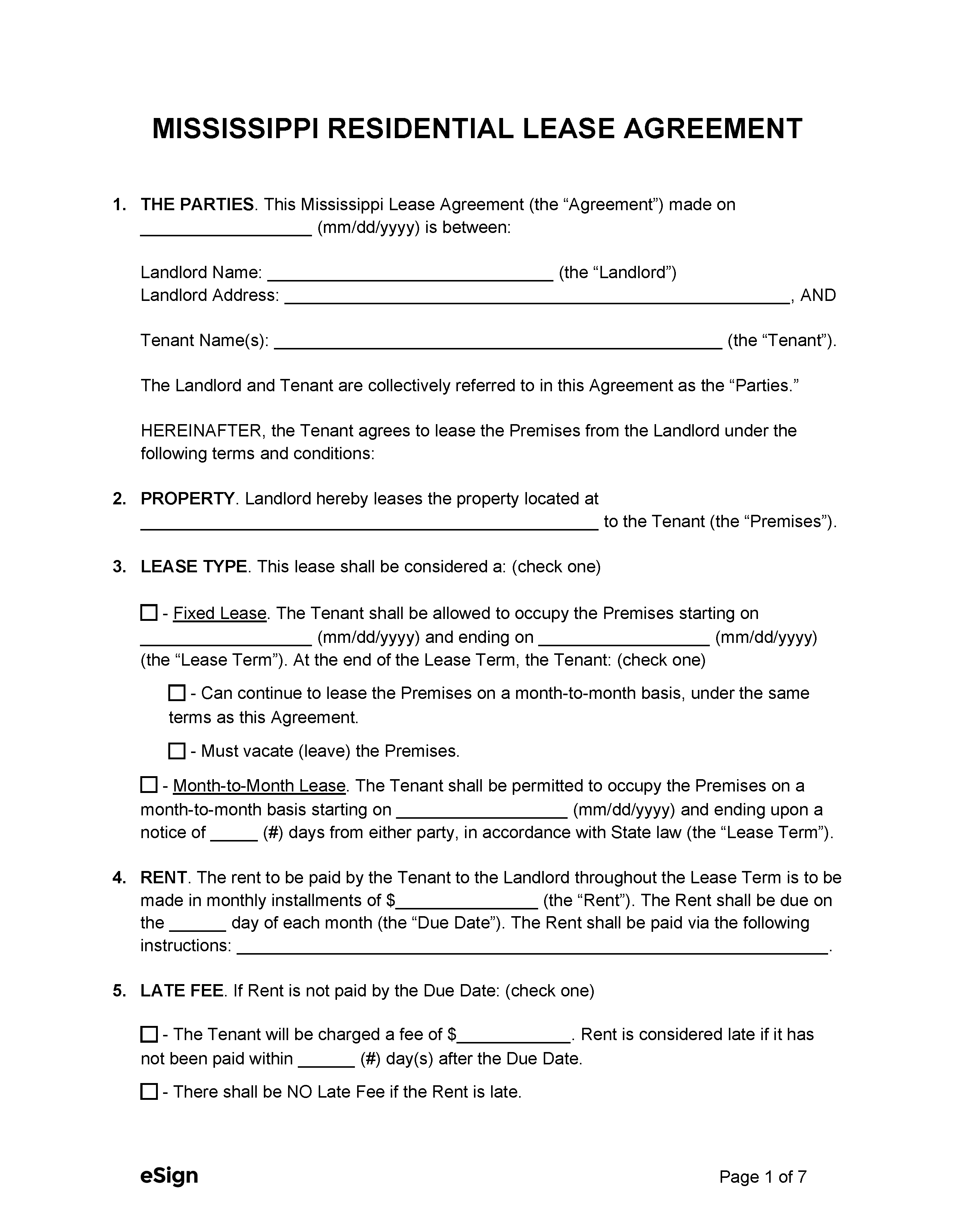

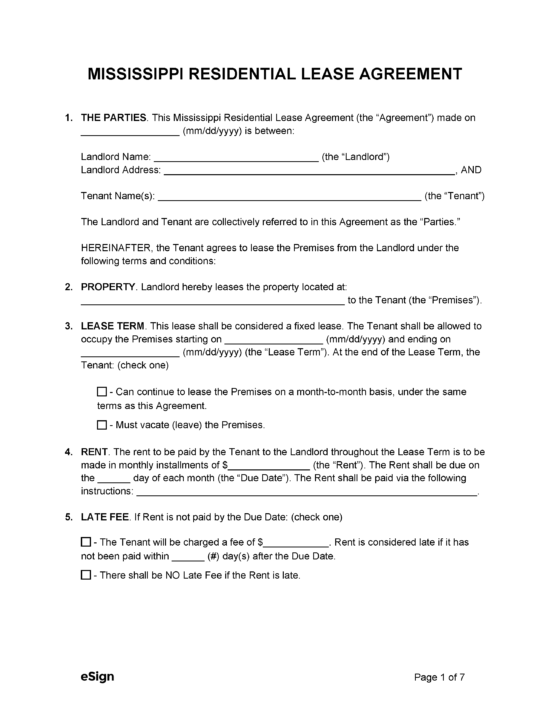

Standard (1-year) Lease Agreement – This agreement has a one-year term and relays the standard information required in a rental contract. Standard (1-year) Lease Agreement – This agreement has a one-year term and relays the standard information required in a rental contract.

Download: PDF, Word (.docx), OpenDocument |

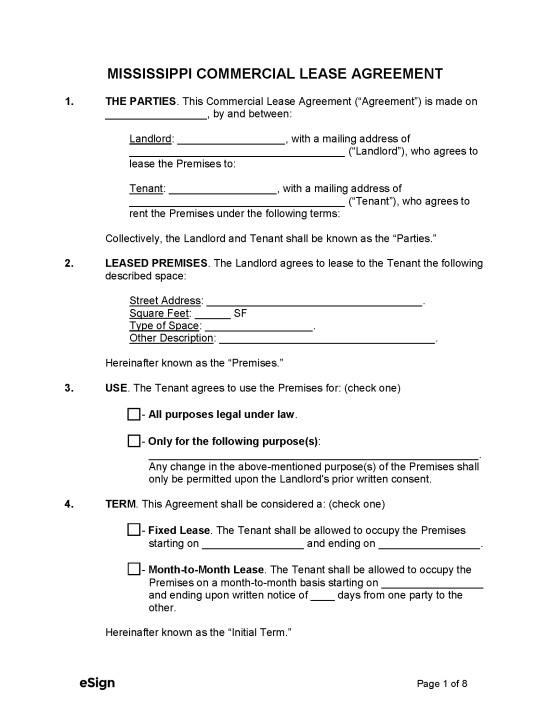

Commercial Lease Agreement – This agreement is used to rent out commercial real estate such as warehouses, retail outlets, restaurants, or office space. Commercial Lease Agreement – This agreement is used to rent out commercial real estate such as warehouses, retail outlets, restaurants, or office space.

Download: PDF, Word (.docx), OpenDocument |

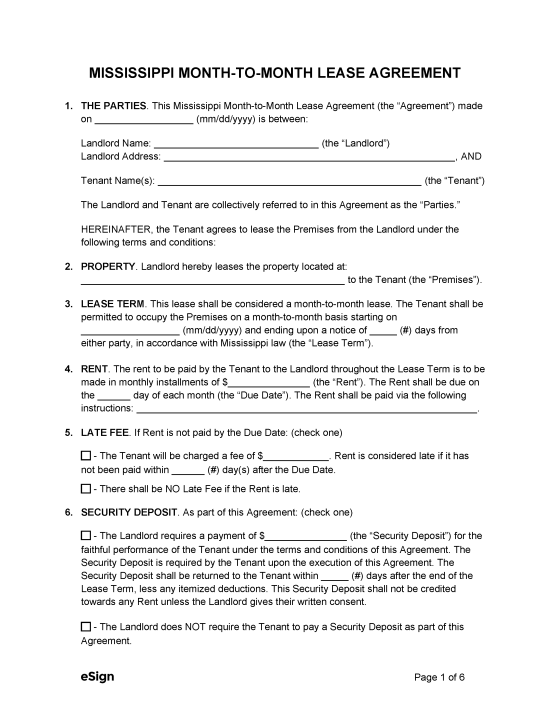

Month-to-Month Lease Agreement – A lease that allows the tenant to renew it with each monthly rent payment and can be terminated at any time with sufficient notice. Month-to-Month Lease Agreement – A lease that allows the tenant to renew it with each monthly rent payment and can be terminated at any time with sufficient notice.

Download: PDF, Word (.docx), OpenDocument |

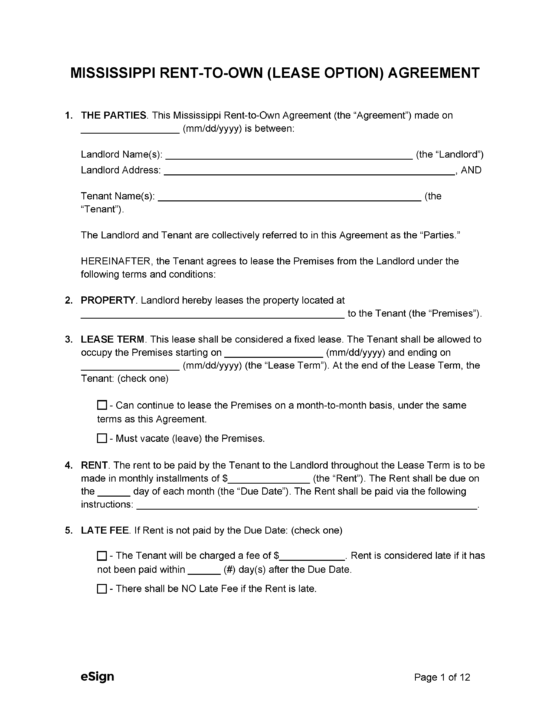

Rent-to-Own Agreement (Lease Option) – Enables a tenant to buy the rental property after a specific period if they have met certain financial obligations. Rent-to-Own Agreement (Lease Option) – Enables a tenant to buy the rental property after a specific period if they have met certain financial obligations.

Download: PDF, Word (.docx), OpenDocument |

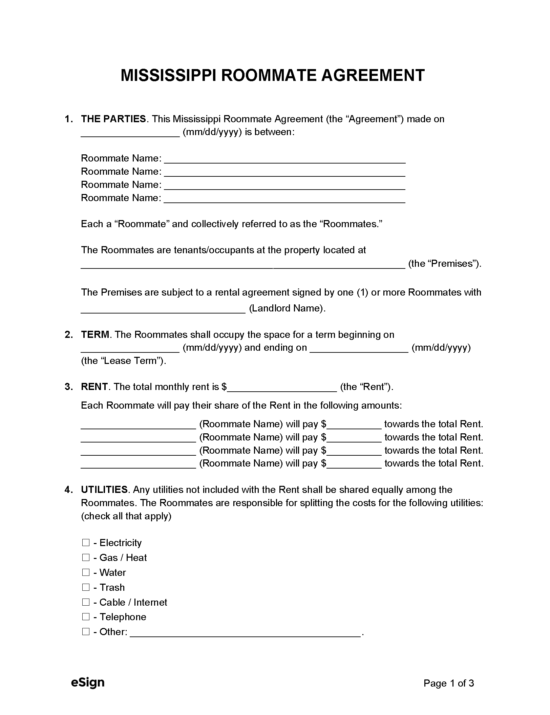

Roommate Agreement – An agreement that allows individuals sharing a rented space to determine the division of utilities, rent, and other responsibilities. Roommate Agreement – An agreement that allows individuals sharing a rented space to determine the division of utilities, rent, and other responsibilities.

Download: PDF, Word (.docx), OpenDocument |

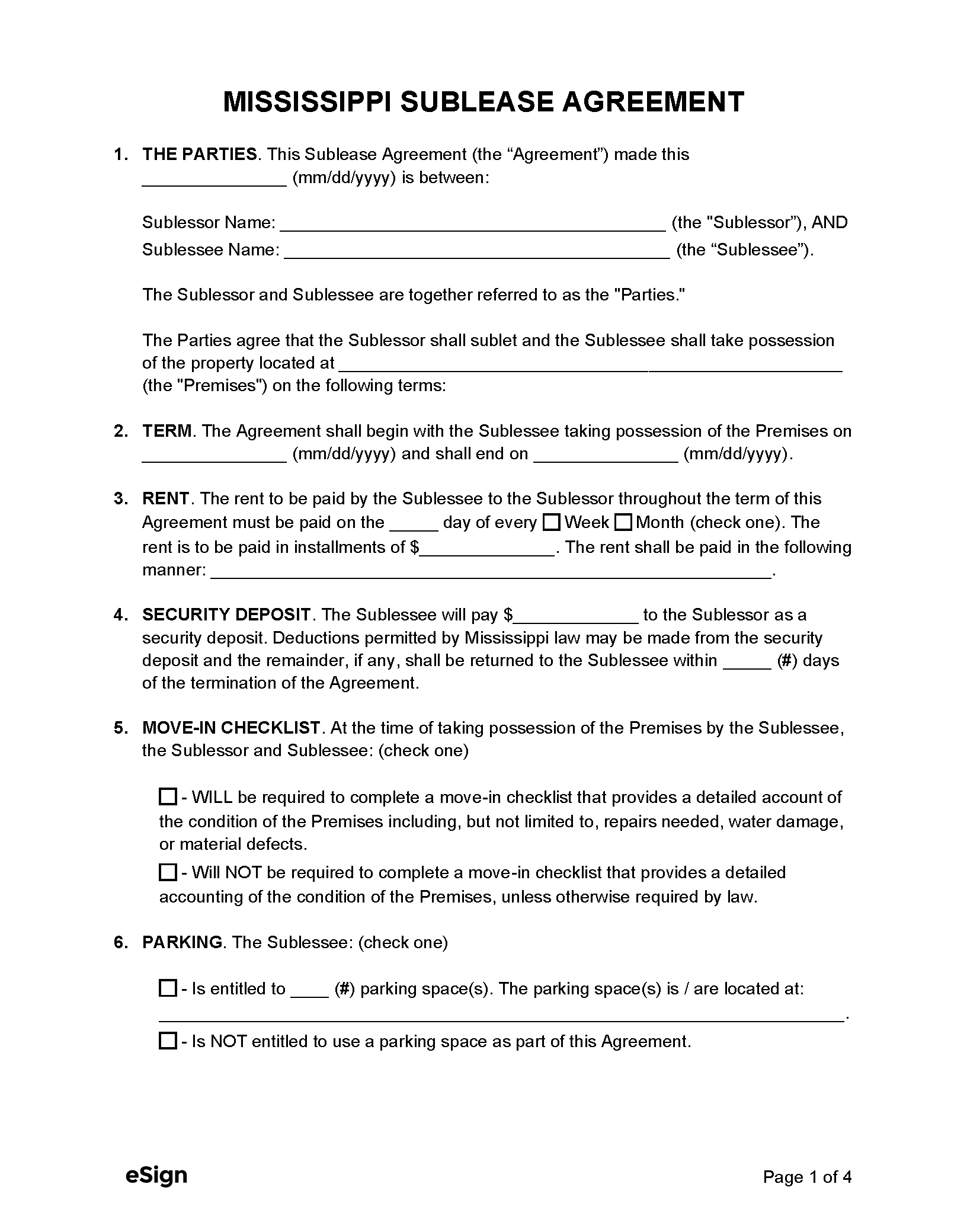

Sublease Agreement – A sublease enables a tenant to rent out all or part of their rental unit to a sublessee. Sublease Agreement – A sublease enables a tenant to rent out all or part of their rental unit to a sublessee.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (1)

- Lead-Based Paint Disclosure (PDF) – This federally-required disclosure form must be presented to all tenants of property built before 1978 to warn them about toxic paint.[1]

Security Deposits

Maximum Amount ($) – There are no state laws that limit the amount landlords can charge.

Collecting Interest – Interest doesn’t need to be collected on security deposits.

Returning to Tenant – The security deposit must be returned to the tenant within 45 days of the lease termination.[2]

Itemized List Required? – Yes, the landlord must deliver a statement to the tenant explaining any deduction to their deposit.[3]

Separate Bank Account? – No, security deposits aren’t required to be kept in separate bank accounts.

Landlord’s Access

General Access – Landlords aren’t legally required to give tenants a notice to enter their rental unit.

Immediate Access – The landlord or property manager can enter without notice in emergencies.

Rent Payments

Grace Period – Tenants aren’t provided a grace period to pay rent under state law.

Maximum Late Fees ($) – There’s no statutory limit on the amount landlords can charge for late rent fees in Mississippi.

Withholding Rent – If the landlord doesn’t repair damages within 30 days of receiving notice from the tenant, the tenant can make the repairs and deduct the cost from their rent. However, the amount deducted cannot exceed one month’s rent.[4]

Breaking a Lease

Non-Payment of Rent – A 3-day notice to pay or quit can be given to tenants who don’t pay their rent on time.[5]

Non-Compliance – If a tenant breaches their lease, the landlord can give them a 14-day notice to fix the problem or leave the property.[6]

Lockouts – The landlord cannot perform a “self-help” eviction by changing the tenant’s locks.

Leaving Before the End Date – If a tenant owing rent deserts their rental unit, the landlord can request a county constable to inspect the premises and put up a notice demanding the tenant pay within 5 to 15 days. If the tenant doesn’t pay the rent and fees owed, and any property left behind doesn’t cover the full amount, the landlord will be given possession within 48 hours.[7]

Lease Termination

Month-to-Month Tenancy – Either party can terminate the lease with 30 days’ notice.[8]

Unclaimed Property – Any property that a tenant fails to claim within 72 hours of a court-ordered move-out date, the landlord can possess or dispose of without notice to the tenant.[9]