Lease Agreements: By Type (6)

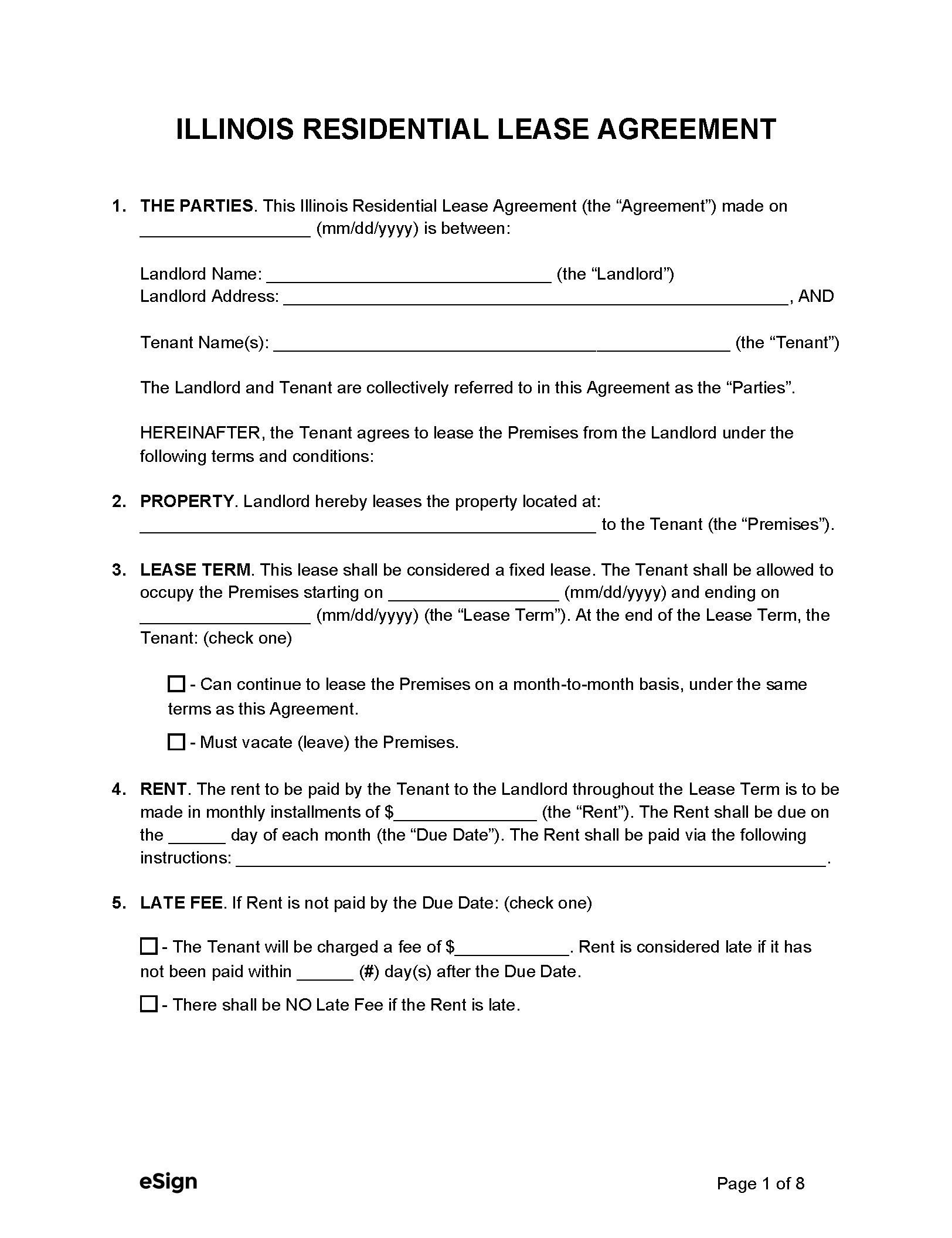

Standard (1-year) Lease Agreement – Creates a residential rental arrangement between a landlord and tenant for a fixed term. Standard (1-year) Lease Agreement – Creates a residential rental arrangement between a landlord and tenant for a fixed term.

Download: PDF |

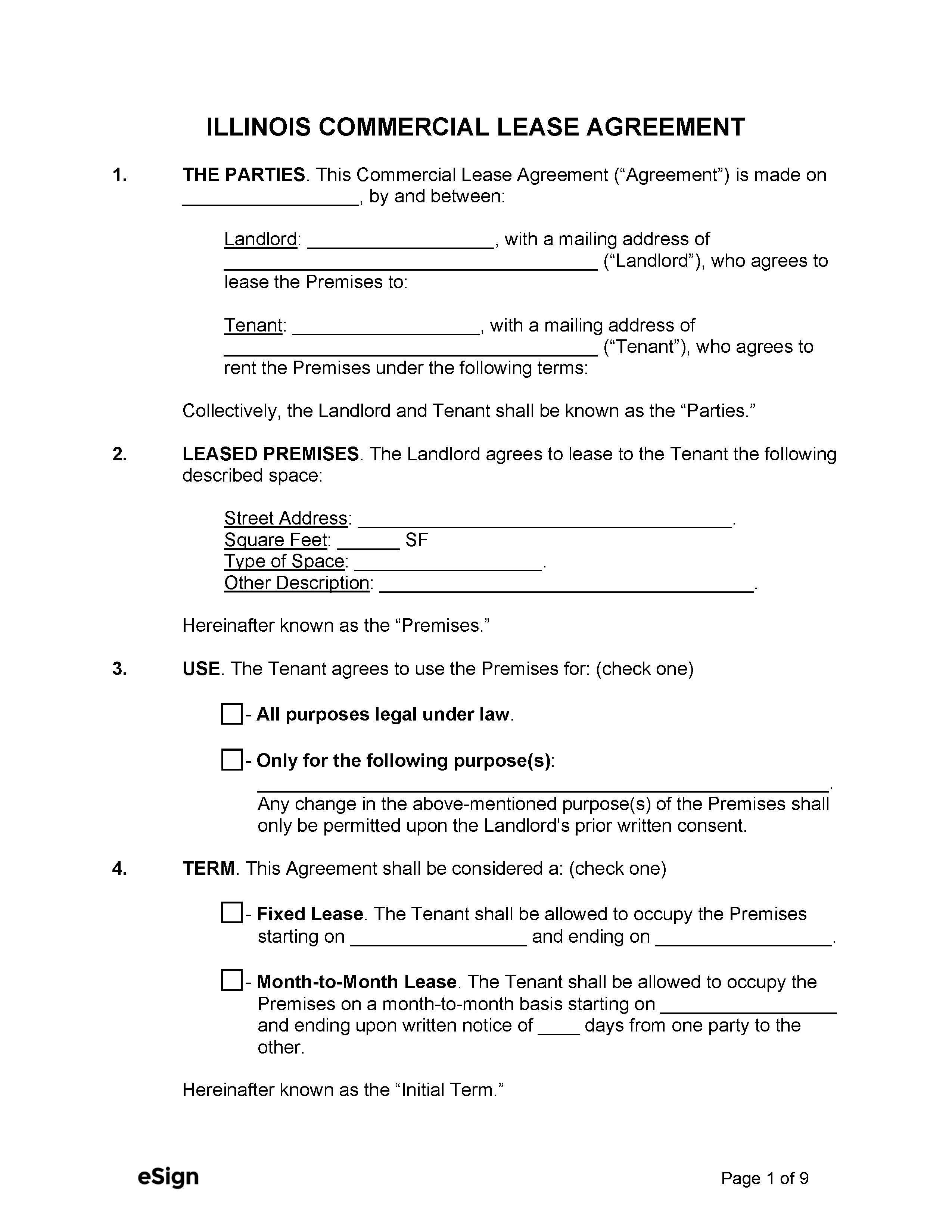

Commercial Lease Agreement – Used to rent office space, industrial properties, and retail stores to individuals or business entities. Commercial Lease Agreement – Used to rent office space, industrial properties, and retail stores to individuals or business entities.

Download: PDF, Word (.docx), OpenDocument |

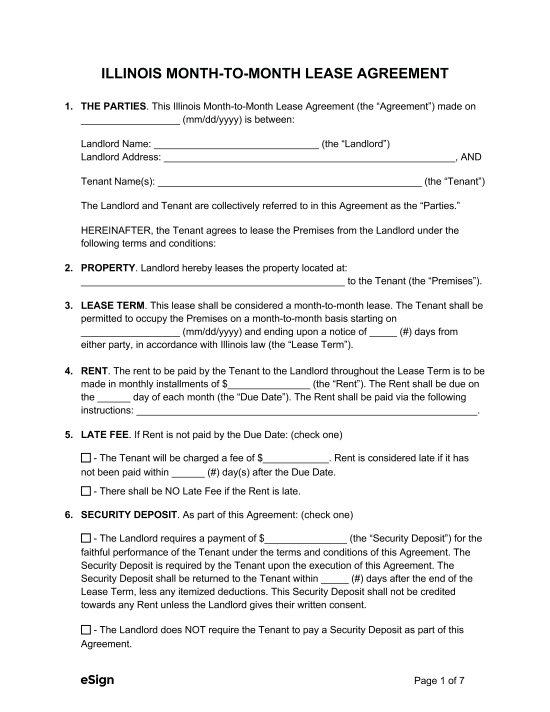

Month-to-Month Lease Agreement – Establishes an at-will rental arrangement wherein the tenant pays monthly rent, and either party may terminate the arrangement with notice. Month-to-Month Lease Agreement – Establishes an at-will rental arrangement wherein the tenant pays monthly rent, and either party may terminate the arrangement with notice.

Download: PDF, Word (.docx), OpenDocument |

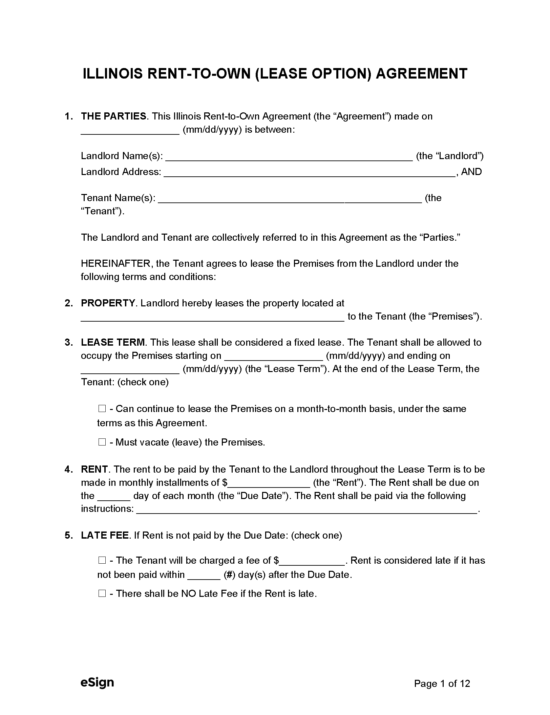

Rent-to-Own Agreement (Lease Option) – Created for landlords who wish to lease out a piece of property for a certain period of time and give the tenant the option to buy it. Rent-to-Own Agreement (Lease Option) – Created for landlords who wish to lease out a piece of property for a certain period of time and give the tenant the option to buy it.

Download: PDF |

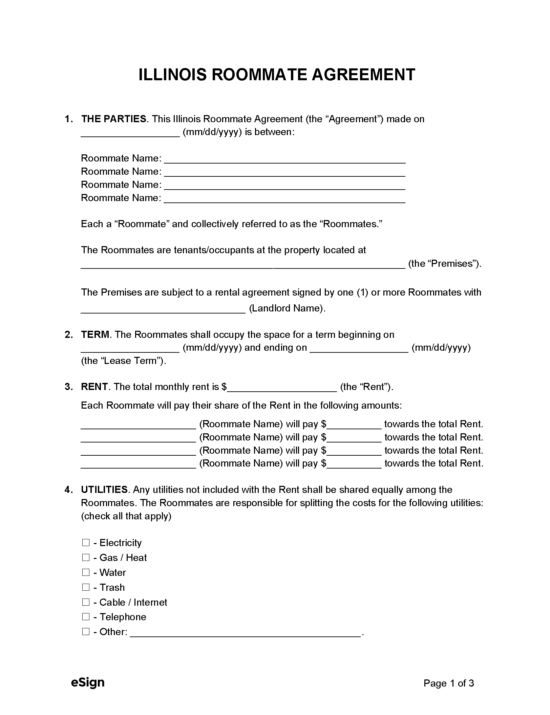

Roommate Agreement – Used to establish rent amount, deposits, utilities, termination options, etc. between individuals who are living together. Roommate Agreement – Used to establish rent amount, deposits, utilities, termination options, etc. between individuals who are living together.

Download: PDF, Word (.docx), OpenDocument |

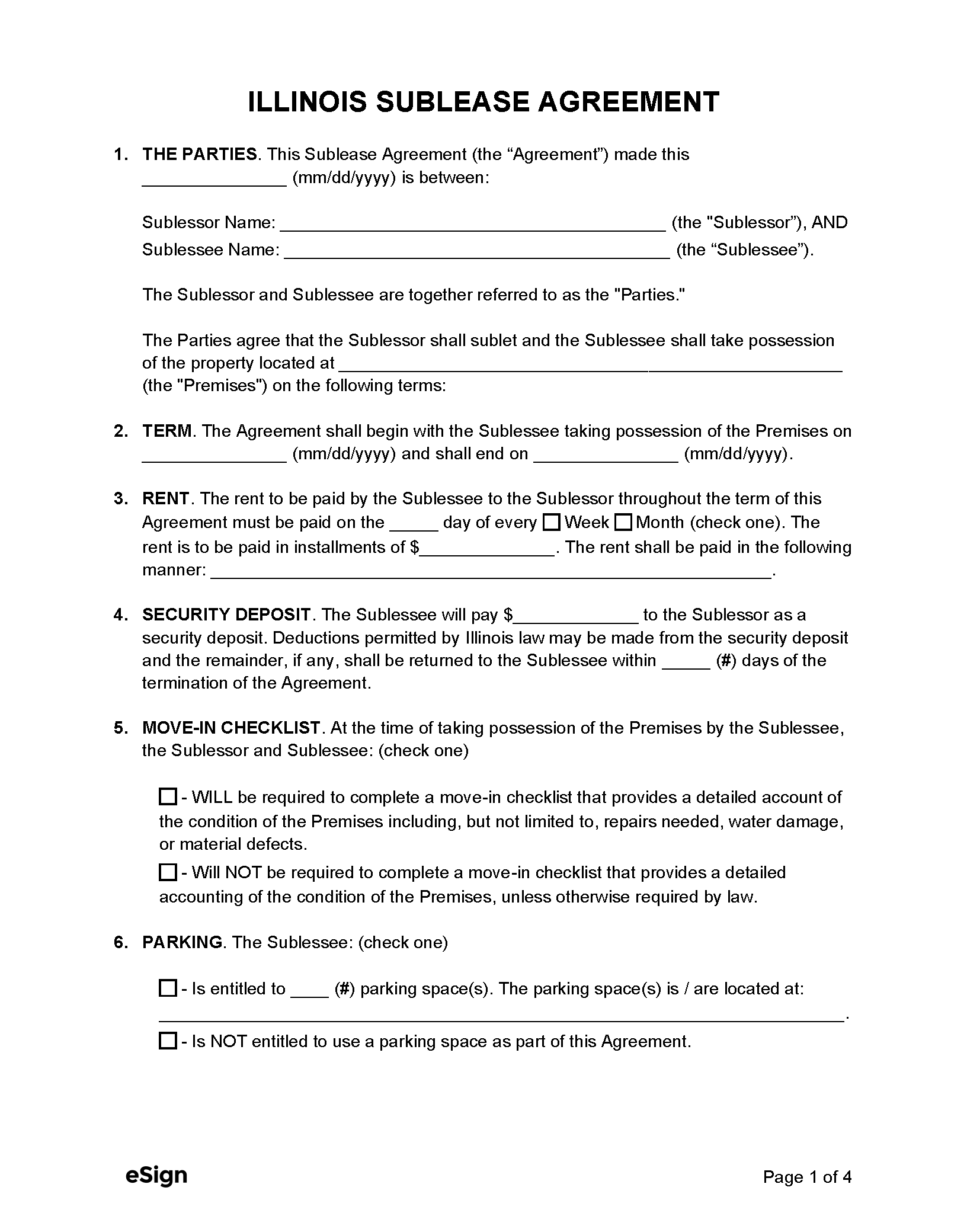

Sublease Agreement – Used by tenants who have been given permission by their landlord to rent all or part of their space to another individual (subtenant). Sublease Agreement – Used by tenants who have been given permission by their landlord to rent all or part of their space to another individual (subtenant).

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (5)

- Carbon Monoxide and Smoke Detector Disclosures – Tenants must be given information about carbon monoxide alarm and smoke detector testing and maintenance.[1]

- Lead-Based Paint Disclosure (PDF) – This disclosure must be given to any tenants of renal properties built prior to 1978.[2]

- Radon Disclosure (PDF) – Upon request by the tenant, landlords must provide a Radon Guide, a disclosure form describing their knowledge of radon on the premises, and any records or reports regarding hazardous radon concentrations.[3]

- Rent Concession Act – Any concession for the tenant’s rent must be written in the lease agreement.[4]

- Utility Payments – Landlords must notify tenants if they are on a shared utility meter and disclose how they will split the charges.[5]

Security Deposits

Maximum Amount ($) – State law doesn’t set a limit on security deposits.

Collecting Interest – Interest only needs to be collected and paid by landlords who own 25 or more units in cases where the deposit is held for 6 months or longer.[6]

Returning to Tenant – Landlords must return the security deposit within 45 days of the move-out date.[7]

Itemized List Required? – Within 30 days of the tenant vacating the rental, the landlord must provide an itemized list of any deductions to their security deposit. This rule doesn’t apply if the property includes less than five units.[8]

Separate Bank Account? – If the landlord owns 25 or more units, they must keep security deposits in a separate interest-bearing account for any tenancies that last over six months.[9]

Landlord’s Access

General Access – Landlords aren’t required to give notice prior to entry except in Chicago, where two days’ notice must be given.[10]

Immediate Access – Notice isn’t required to enter a rental unit for emergency purposes.

Rent Payments

Grace Period – Landlords don’t have to give tenants a grace period to pay rent unless it’s stated in the lease.

- Exception: Tenants in trailer parks must be given a five-day grace period after the rent due date.[11]

Maximum Late Fees ($) – There is no statutory limit on late fees.

- Mobile Home Lots: Late fees can’t exceed $20 or 20% of the rent.[12]

- Within Chicago: Late fees are limited to $10 for the first $500 of monthly rent plus 5% of any amount beyond the $500.[13]

Bad Check (NSF) Fee – Landlords can charge a bounced check fee of up to $25.[14]

Withholding Rent – Tenants are entitled to withhold up to $500 or half their monthly rent, whichever is lesser, for necessary repairs not made by the landlord within 14 days of being notified.[15]

Breaking a Lease

Non-Payment of Rent – If tenants don’t pay rent on time, they can be given a 5-Day Notice to Quit for Non-Payment.[16]

Non-Compliance – A 10-Day Notice to Quit can be given to tenants who break the terms of their lease.[17]

Lockouts – Landlords are prohibited from locking out a tenant without a court order.[18]

Leaving Before the End Date: In Chicago, tenants who quit a rental without completing their lease term will be liable for the rent due for the lease period. If the unit is re-rented, the tenant must pay the difference between the rent owed for the remainder of the lease period and that collected from the new tenant.[19]

Lease Termination

Month-to-Month Tenancy – At least 30 days’ notice must be given when terminating a month-to-month tenancy.[20]

Unclaimed Property:

- Outside Chicago: No Statute

- Within Chicago: The landlord must store any abandoned personal property for at least seven days.[21]

Sources

- 430 ILCS 135/1, 425 ILCS § 60/3(d)

- EPA/HUD Fact Sheet

- 420 ILCS 46/26

- 765 ILCS 730

- 765 ILCS 740/5

- 765 ILCS 715/1, 2

- 765 ILCS 710/1(a)

- 765 ILCS 710/1(a), (b)

- 765 ILCS § 715/1

- § 5-12-050

- 770 ILCS 95.7.10(a)

- 770 ILCS 95.7.10(c)

- § 5-12-140(h)

- 810 ILCS 5/3-806

- 765 ILCS 742/5

- 735 ILCS 5/9-209

- 735 ILCS 5/9-210

- § 5-12-160

- § 5-12-130(e)

- 735 ILCS 5/9-207(b)

- § 5-12-130(f)