Lease Agreements: By Type (6)

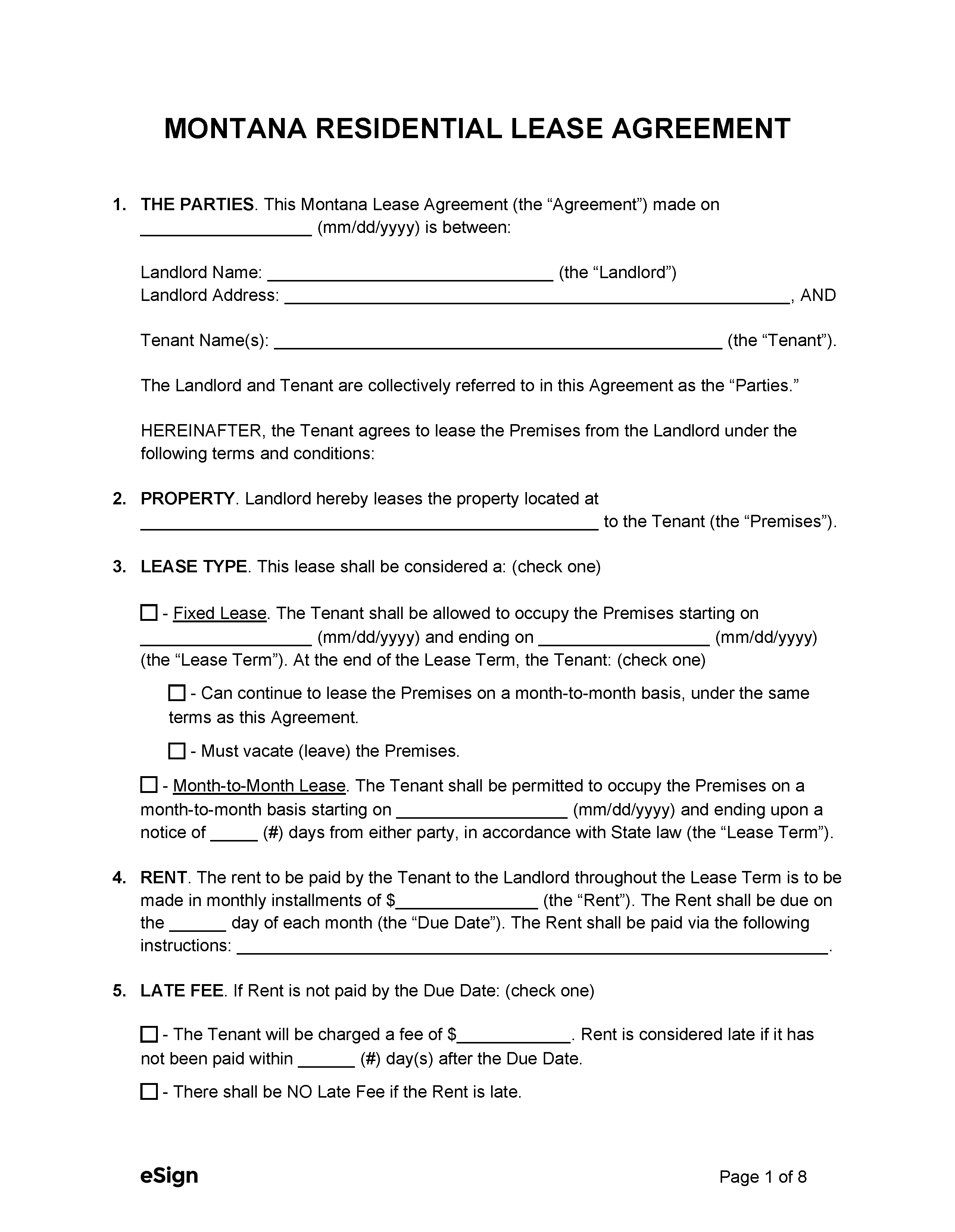

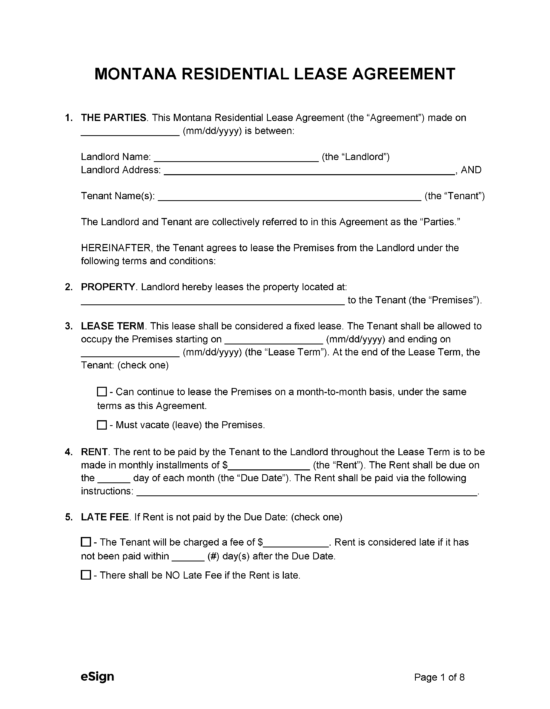

Standard (1-Year) Lease Agreement – This residential lease establishes a fixed-term tenancy, guaranteeing tenants the right to occupancy if the lease terms are upheld. Standard (1-Year) Lease Agreement – This residential lease establishes a fixed-term tenancy, guaranteeing tenants the right to occupancy if the lease terms are upheld.

Download: PDF |

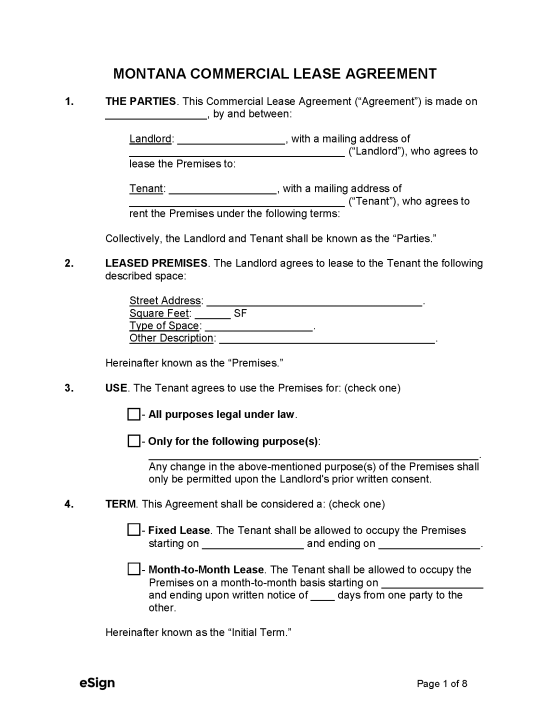

Commercial Lease Agreement – Unlike a residential lease, this agreement can only be used to rent out commercial property like an office space or warehouse. Commercial Lease Agreement – Unlike a residential lease, this agreement can only be used to rent out commercial property like an office space or warehouse.

Download: PDF, Word (.docx), OpenDocument |

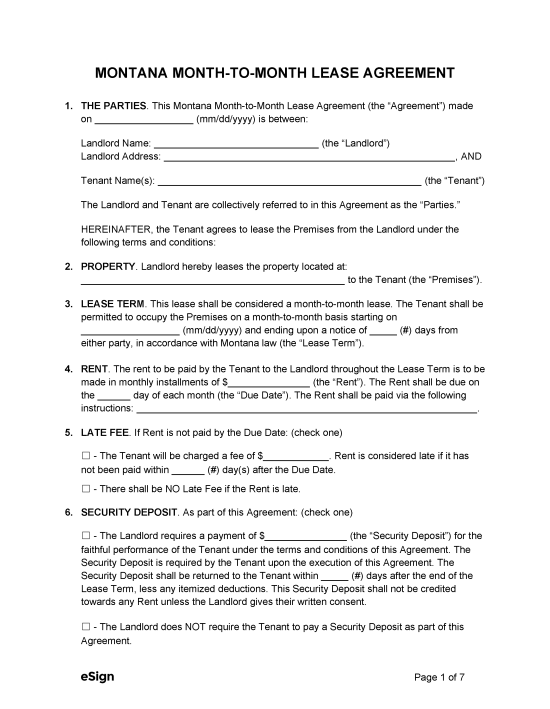

Month-to-Month Lease Agreement – This lease creates a flexible rental arrangement where either party can terminate the tenancy at any time by providing 30 days’ notice. Month-to-Month Lease Agreement – This lease creates a flexible rental arrangement where either party can terminate the tenancy at any time by providing 30 days’ notice.

Download: PDF, Word (.docx), OpenDocument |

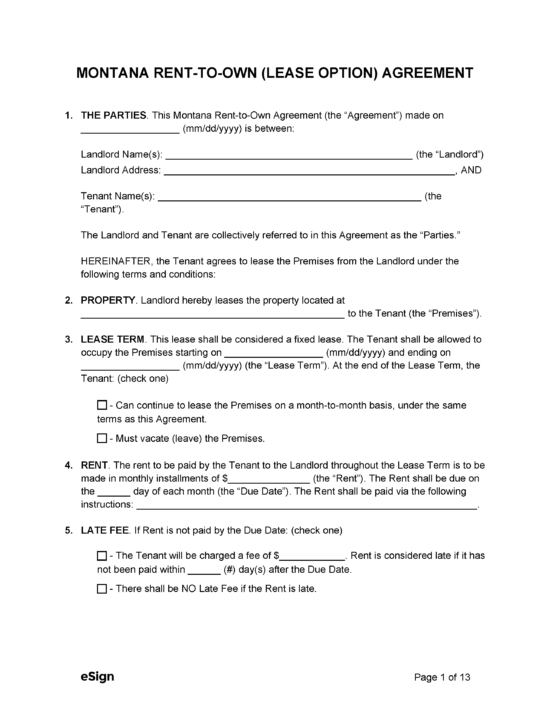

Rent-to-Own Agreement (Lease Option) – A rent-to-own agreement enables the tenant to lease the landlord’s property for a fixed period and potentially purchase it under certain conditions. Rent-to-Own Agreement (Lease Option) – A rent-to-own agreement enables the tenant to lease the landlord’s property for a fixed period and potentially purchase it under certain conditions.

Download: PDF |

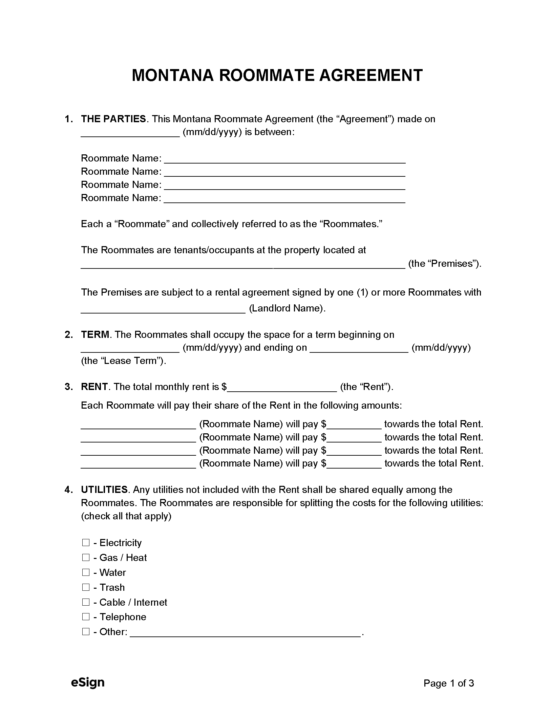

Roommate Agreement – An agreement between roommates that defines household rules, the division of costs, cleaning responsibilities, and other conditions of a shared living space. Roommate Agreement – An agreement between roommates that defines household rules, the division of costs, cleaning responsibilities, and other conditions of a shared living space.

Download: PDF, Word (.docx), OpenDocument |

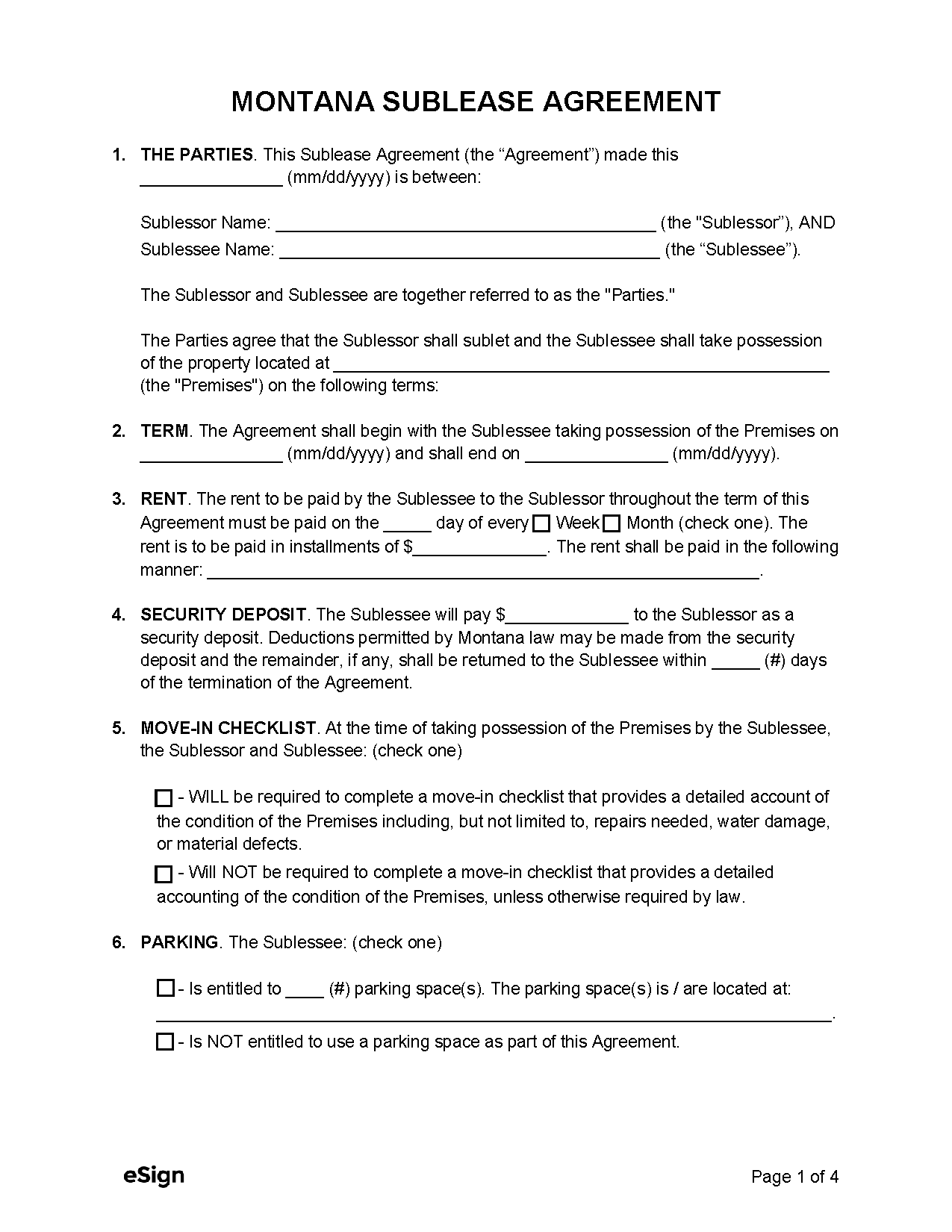

Sublease Agreement – Tenants can use a sublease agreement to rent their living space to a sublessee for a pre-determined period. Subleasing is only allowed with the landlord’s approval. Sublease Agreement – Tenants can use a sublease agreement to rent their living space to a sublessee for a pre-determined period. Subleasing is only allowed with the landlord’s approval.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (5)

- Lead-Based Paint Disclosure (PDF) – If the property was built pre-1978, the landlord is required to provide new tenants with a disclosure about lead paint in the rental unit.[1]

- Methamphetamine Disclosure (PDF) – Prospective tenants must be notified in writing if the property has been used to produce methamphetamine and has not been remediated to the standards relayed in state law.[2]

- Mold Disclosure (PDF) – Landlords must disclose whether they know of any mold on the premises and provide tenants with information about the risks of mold exposure.[3]

- Names and Addresses – Before or at the start of a lease, tenants must be provided with the name and address of the property manager and owner or any representative of the owner with the authority to receive notices and demands.[4]

- Statement of Condition (PDF) – If the landlord receives a security deposit, they must give each tenant a statement describing the condition of the rental property.[5]

Security Deposits

Maximum Amount ($) – Montana has no statutory limits on security deposits; landlords can charge what they feel is reasonable.

Collecting Interest – Nothing in Montana law requires landlords to accumulate interest on security deposits.

Returning to Tenant – If deductions were made to the deposit, the balance must be refunded within 30 days after the lease terminates or the tenant vacates. If there were no deductions, the tenant must receive their full deposit within 10 days of the landlord’s final inspection.[6]

Itemized List Required? – Yes, if the deposit is used to cover unpaid rent, cleaning fees, or damages, the landlord must provide a list of deductions within 30 days after the tenancy terminates or the tenant moves out.[7]

Separate Bank Account? – No, a separate bank account is not required to hold security deposits.

- Exception for Property Managers – Licensed property managers must maintain a trust account for storing security deposits.[8]

Landlord’s Entry

General Access – A landlord cannot legally enter the rental property without first providing 24 hours’ notice.[9]

Immediate Access – In the case of an emergency, a landlord may access the premises at any point without the tenant’s consent.[10]

Rent Payments

Grace Period – Landlords are not obligated to offer a grace period before charging late fees. Unless stated differently in the lease, rent is due at the start of the rental term.[11]

Maximum Late Fee ($) – Montana has no statutory limit on late fees.

Bad Check (NSF) Fee – Landlords can charge a maximum fee of $30 when a tenant’s check is rejected due to insufficient funds.[12]

Withholding Rent – If the landlord’s actions result in health and safety issues that they don’t fix within a reasonable time after being notified, tenants can repair the issues themselves and deduct up to one month’s rent to cover the expenses.[13]

- Emergency Repairs – Only a qualified person can perform the repairs required in the event of an emergency.

Breaking a Lease

Non-Payment of Rent – A 3-day notice to pay or quit can be issued to the tenant immediately after their rent is due and unpaid.[14]

Non-Compliance – Landlords can give tenants a 14-day notice to quit, instructing them to either fix the non-compliance or vacate within 14 days.[15]

Tenant Maintenance – If the tenant neglects to maintain their rental unit and doesn’t fix the problem within 14 days after being notified (or sooner in an emergency), the landlord can carry out the repairs and bill the tenant.[16]

Lockouts – Unless the landlord is granted a writ of possession (eviction order) from the court, they cannot exclude or remove the tenant from the rental property.[17]

Leaving Before the End Date – When tenants break their lease by vacating early, they’re generally obligated to pay rent for the rest of the lease term.

- Duty to Find Another Tenant – Landlords must take reasonable steps to re-rent the property. If a new tenant is found before the lease expires, the old tenant will no longer be responsible for paying rent.[18]

Lease Termination

Month-to-Month Tenancy – The landlord must provide 30 days’ notice to terminate a month-to-month tenancy.[19]

Unclaimed Property – Landlords must wait 48 hours before removing, documenting, and storing items left behind by the tenant. Additionally, they must notify the tenant and local law enforcement. If the property stays unclaimed for 15 days after notice is provided, all valuable possessions must be sold at auction, while low-value items can be thrown away.[20]

- Exception for Evictions – The 48-hour waiting period mentioned above is not required if the tenant is evicted.

Sources

- EPA/HUD Fact Sheet

- § 75-10-1305

- § 70-16-703

- § 70-24-301

- § 70-25-206

- § 70-25-202(a), (b)

- § 70-25-202(a)

- ARM § 24.210.805(1)

- § 70-24-312(3)

- § 70-24-312(2)

- § 70-24-201(2)(c)

- § 27-1-717(2)

- § 70-24-406(1)(b)

- § 70-24-422(2)

- § 70-24-422(1)(d)

- §§ 70-24-321, 70-24-425

- §§ 70-24-411, 70-24-427(4)

- § 70-24-426(3)

- § 70-24-441(2)

- § 70-33-430