By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

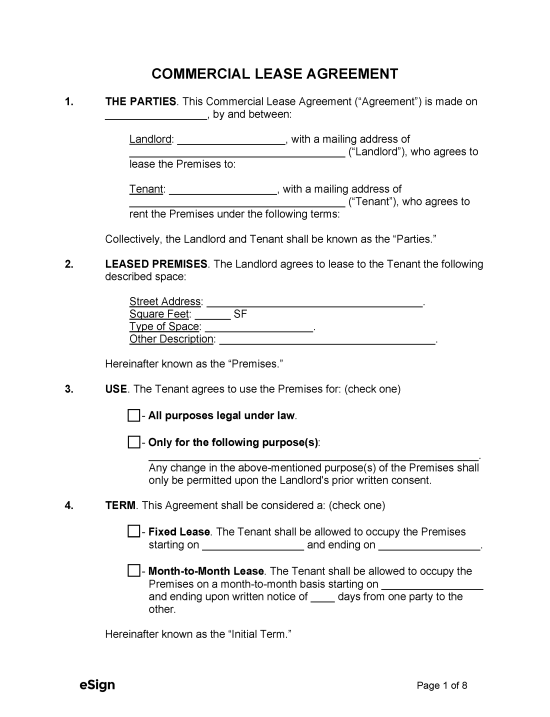

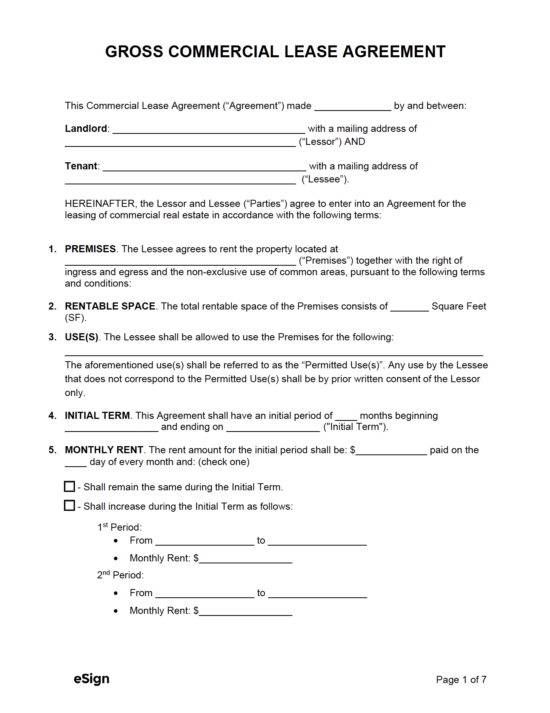

By Type (5)

Gross Lease – The tenant must pay the monthly rent only and is not obligated to pay property expenses. Gross Lease – The tenant must pay the monthly rent only and is not obligated to pay property expenses.

Download: PDF, Word (.docx), OpenDocument |

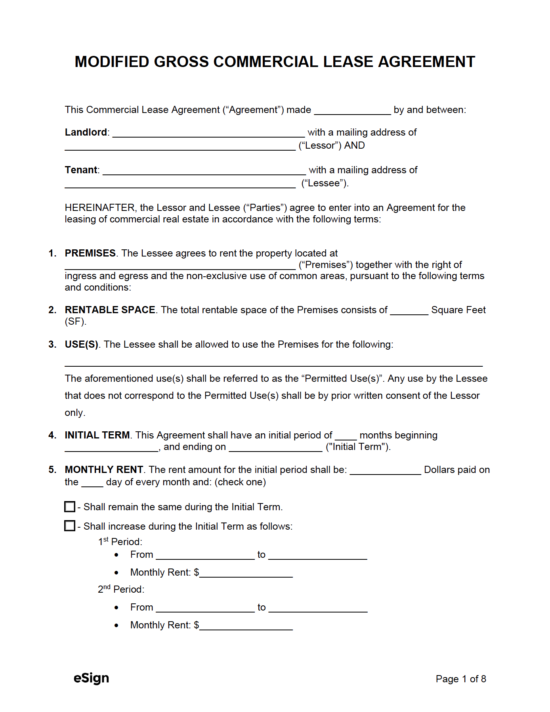

Modified Gross Lease – The tenant must pay the monthly rent with obligations to pay some property expenses. Modified Gross Lease – The tenant must pay the monthly rent with obligations to pay some property expenses.

Download: PDF, Word (.docx), OpenDocument |

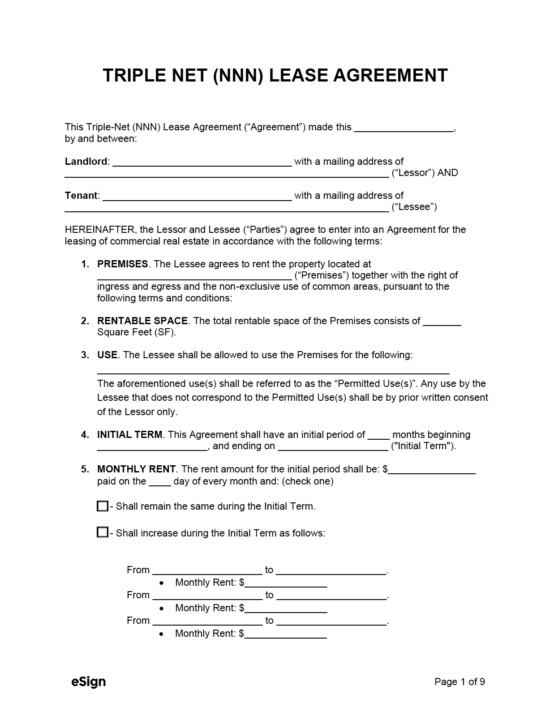

Triple-Net (NNN) Lease – The tenant must pay the monthly rent and is obligated to pay all of their portion of the property expenses. Triple-Net (NNN) Lease – The tenant must pay the monthly rent and is obligated to pay all of their portion of the property expenses.

Download: PDF, Word (.docx), OpenDocument |

Office – For any office-related use. Commonly used by professionals such as accountants, lawyers, or IT workers. Office – For any office-related use. Commonly used by professionals such as accountants, lawyers, or IT workers.

Download: PDF, Word (.docx), OpenDocument |

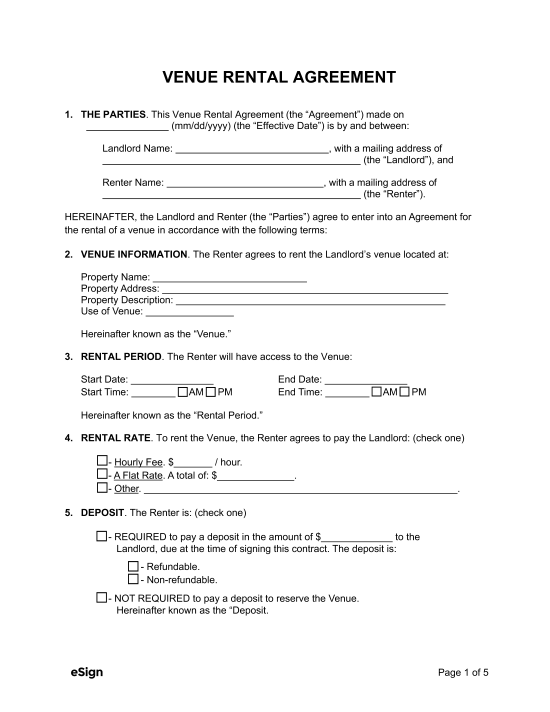

Venue (Event) – To rent a venue space for weddings, holiday parties, corporate gatherings, or other events. Venue (Event) – To rent a venue space for weddings, holiday parties, corporate gatherings, or other events.

Download: PDF, Word (.docx), OpenDocument |

How to Lease Commercial Property

1. Listing for Lease

A landlord has 2 options when placing their property for lease:

- Hiring a Broker – A broker will show what the property is worth to the landlord, list for lease, and handle initial negotiations with a willing tenant. For this service, the broker will charge a commission based on a percentage of the initial term (typically 3% to 8%).

- For Lease by Owner – If the landlord prefers to lease themselves, it is recommended to upload photos and enter the property details into online marketplaces such as LoopNet and Crexi.

2. Handle Inquiries

Immediately after listing the property, the landlord will most likely be busy providing information to prospective tenants. If a potential tenant shows interest, they may request a property showing.

3. Screening the Tenant

Landlord Requests from the Tenant: (5 items)

- Commercial Lease Application (completed)

- Driver’s license (photocopy)

- EIN Number (for business entities)

- Last two (2) years of business taxes (either IRS Form 8879-S or IRS Form 1120S)

- Last two (2) years of personal income taxes (IRS Form 1040)

Tenant Screening Services:

- MySmartMove (TransUnion) – For Individuals

- Dun & Bradstreet – For Businesses

4. Negotiating the Rent

The rent is commonly priced per square foot ($/sf). The best way to determine the “market rent” is to know what other tenants are paying in the area.

- Property Expenses ($) – It is common for the tenant to pay for a portion (or all) of the common area maintenance expenses, including real estate taxes, insurance, and maintenance.

- Landlord’s Improvements – The landlord’s responsibilities regarding setting up the space to suit the tenant’s specific needs.

5. Agree to Terms

When the terms are agreed between the parties, a commercial letter of intent is commonly written which is a non-binding contract that outlines the main terms of an agreement.

Download: PDF, MS Word, OpenDocument

6. Writing a Commercial Lease

A landlord, broker, or attorney (recommended) can write a commercial lease. It should include the responsibilities, obligations, and liabilities of both the landlord and tenant while adhering to federal, state, and local laws.