Lease Agreements: By Type (6)

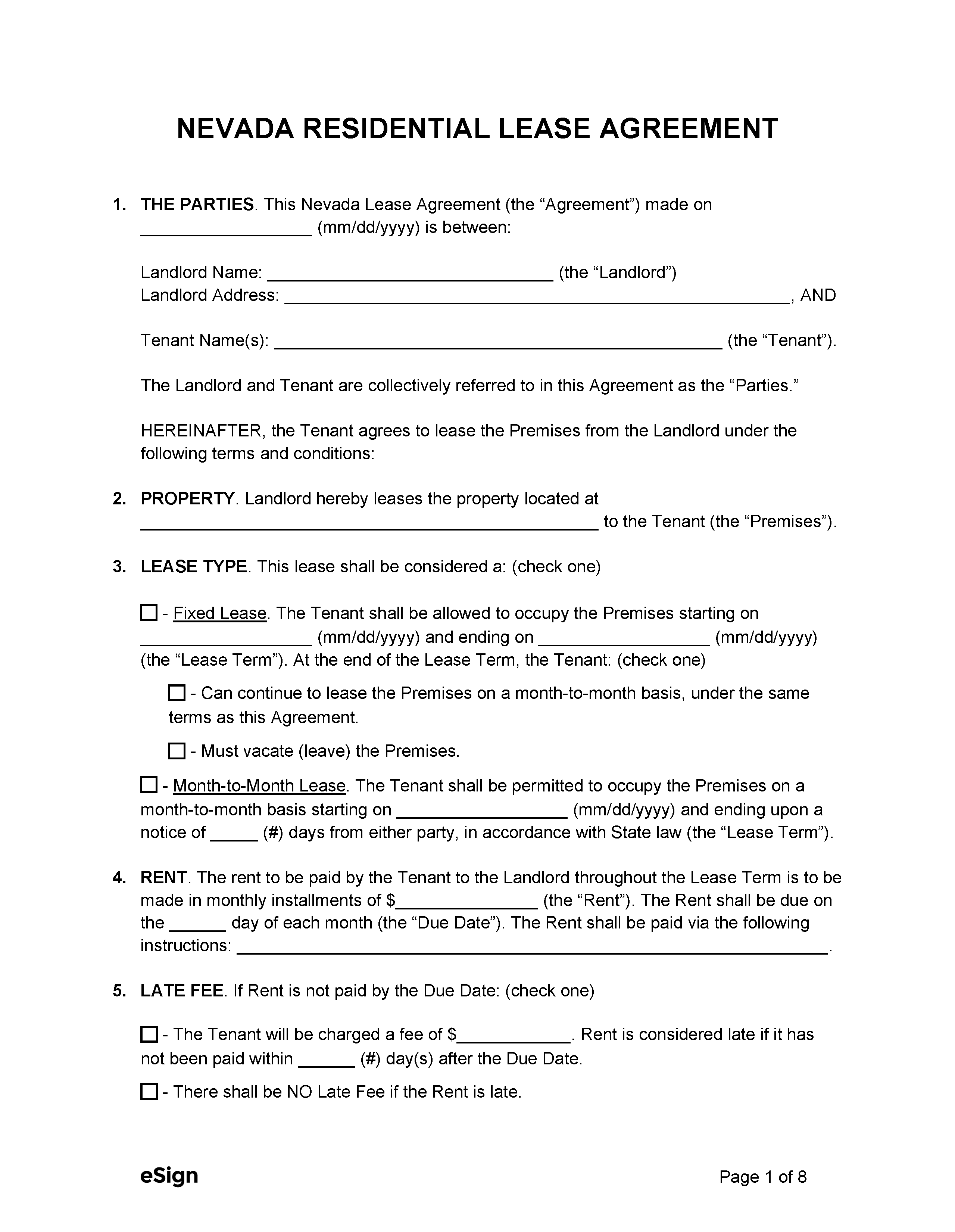

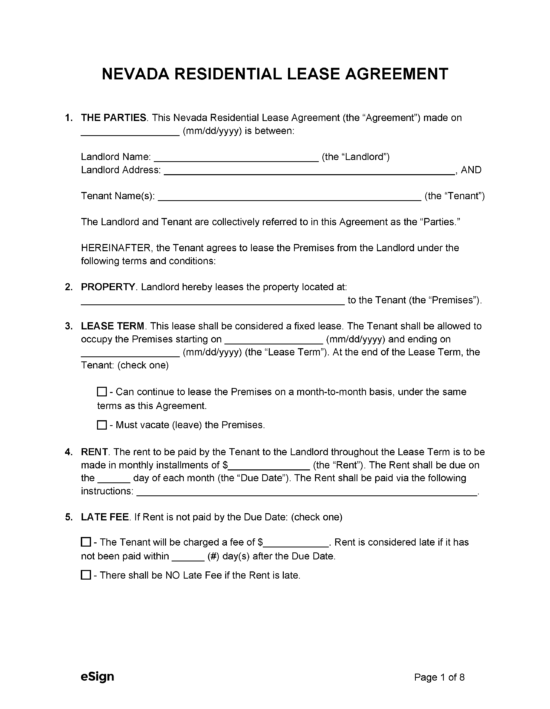

Standard (1-year) Residential Lease – A residential lease for a one-year term. Standard (1-year) Residential Lease – A residential lease for a one-year term.

Download: PDF, Word (.docx), OpenDocument |

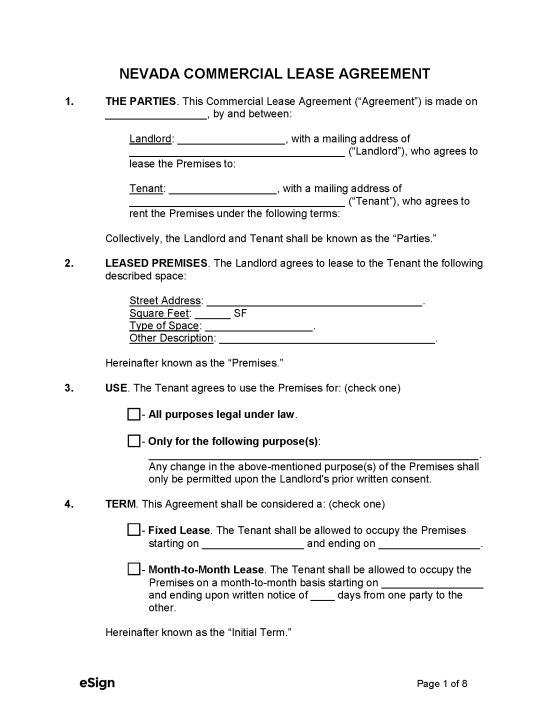

Commercial Lease Agreement – A rental contract used to rent commercial, industrial, and office space to an individual or business entity. Commercial Lease Agreement – A rental contract used to rent commercial, industrial, and office space to an individual or business entity.

Download: PDF, Word (.docx), OpenDocument |

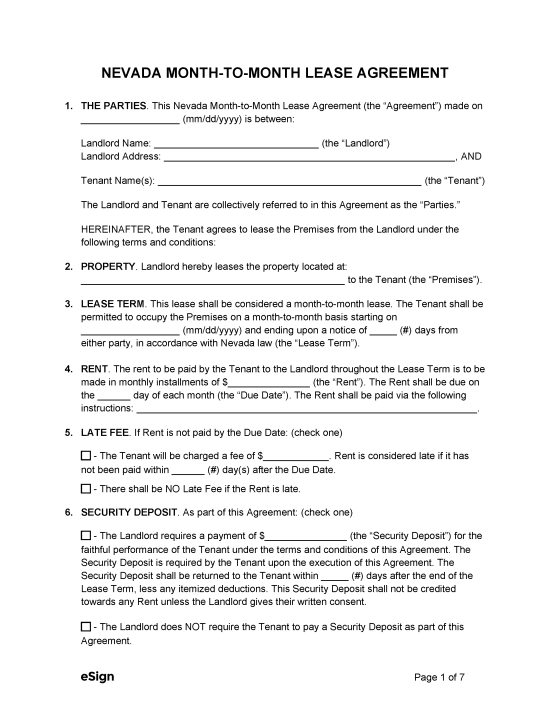

Month-to-Month Lease Agreement – A rental agreement that renews and is paid monthly. Month-to-Month Lease Agreement – A rental agreement that renews and is paid monthly.

Download: PDF, Word (.docx), OpenDocument |

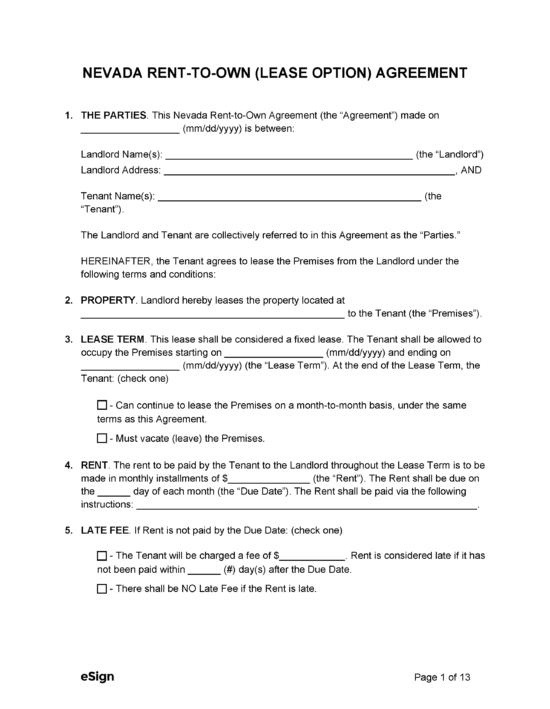

Rent-to-Own Agreement (Lease Option) – Allows a tenant to rent a property with the option to purchase it. Rent-to-Own Agreement (Lease Option) – Allows a tenant to rent a property with the option to purchase it.

Download: PDF, Word (.docx), OpenDocument |

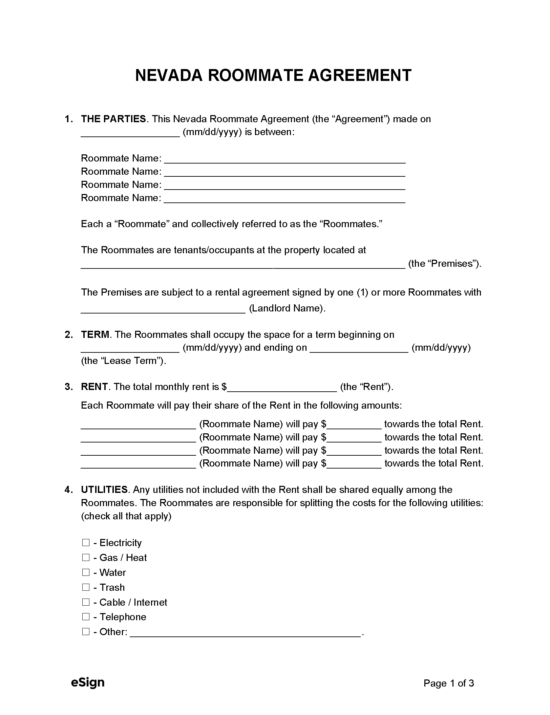

Roommate Agreement – Used by roommates to formalize the rules and responsibilities of living in the rental unit. Roommate Agreement – Used by roommates to formalize the rules and responsibilities of living in the rental unit.

Download: PDF, Word (.docx), OpenDocument |

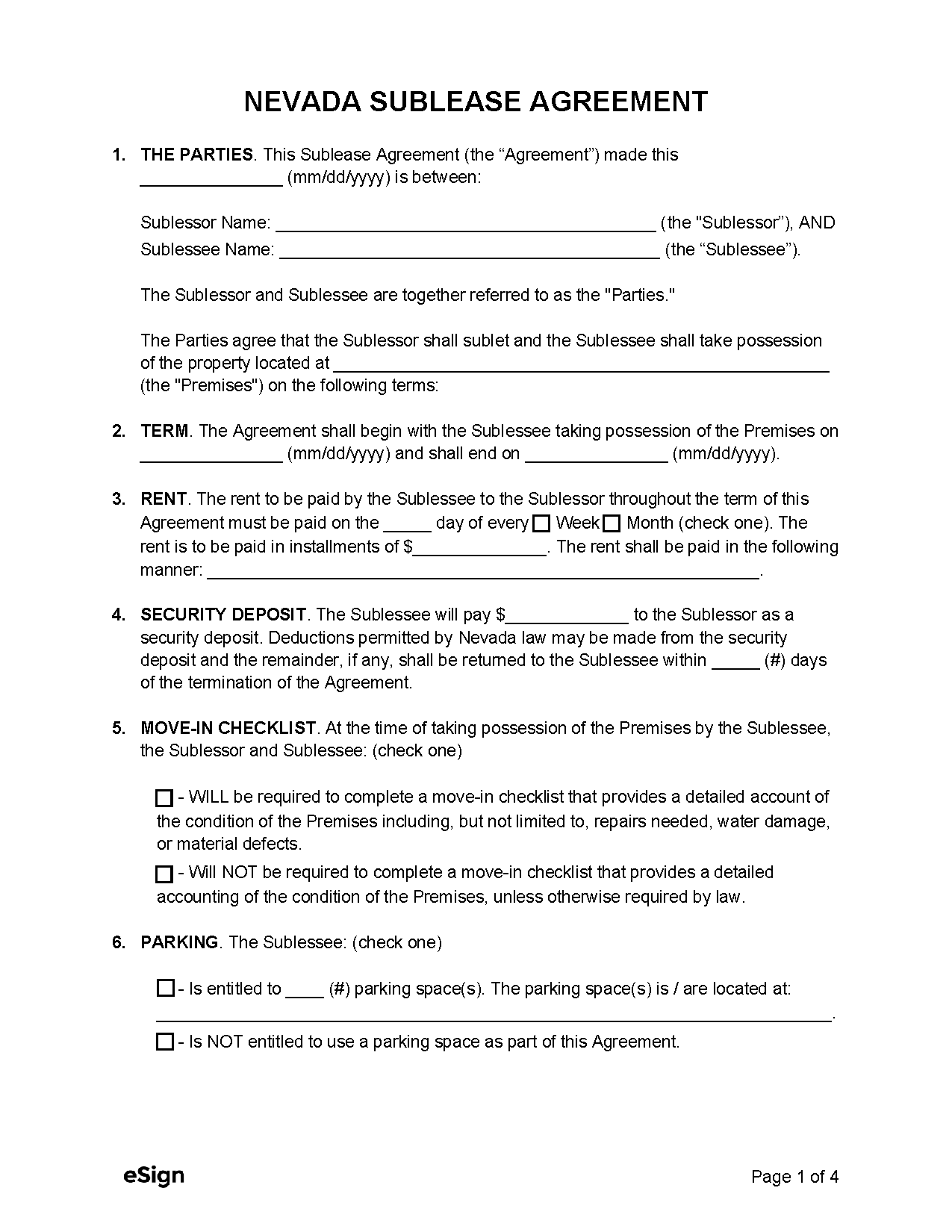

Sublease Agreement – Used by a tenant to rent their space to another individual. Sublease Agreement – Used by a tenant to rent their space to another individual.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (3)

- Foreclosure – Landlords are required to inform prospective tenants of any impending forclosures.[1]

- Inventory and Condition of Premises – The landlord must provide a signed list detailing the condition and inventory of the property.[2]

- Lead-Based Paint Disclosure (PDF) – Landlords must deliver a lead-based paint disclosure form to tenants before renting a property built before 1978.[3]

Security Deposits

Maximum Amount ($) – Security deposits cannot be more than three months’ rent.[4]

Collecting Interest – There is no state law that requires landlords to collect interest on a security deposit on behalf of their tenants.

Returning to Tenant – Security deposits must be returned to the tenant within 30 days of the lease termination.[5]

Itemized List Required? – Yes, any deductions to a security deposit must be listed in writing and provided to the tenant.

Separate Bank Account? – No, there are no statutes that state that a security deposit should be kept in a separate account.

Landlord’s Entry

General Access – Landlords must give tenants at least 24 hours’ notice before entering the property.[6]

Emergency Access – Landlords do not need permission to enter the premises in an emergency.[7]

Rent Payments

Grace Period – Late fees may not be imposed until three days after the rent due date.[8]

Maximum Late Fee ($) – The late fee may not exceed 5% of the rent amount.[9]

Withholding Rent – If a landlord is legally required to provide heat, hot water, or some other essential service and fails to do so, the tenant can withhold rent after giving 48 hours written notice.[10]

Rent Increase Notice – Landlords must give 60 days’ notice before increasing the rent.[11] For tenancies of less than a month, only 30 days’ notice is required.

Breaking a Lease

Non-Payment of Rent – A 7-day notice to quit is used on tenants who have not paid their rent, communicating that they must pay the balance or move out.[12]

Non-Compliance – A 5-day notice to quit can break the lease with a tenant who breaches a condition of their rental agreement. It gives the tenant five days to remedy the violation or move out.[13]

Tenant Maintenance – If the tenant fails to remedy basic maintenance or repair issues within 14 days of notice, the landlord may fix the issue and charge the tenant for the work performed.[14]

Lockouts – Landlords may not change a residence’s locks without involving the sheriff or receiving a court order.[15]

Leaving Before the End Date – A tenant that abandons the premises before the end of their lease term is liable for the rental payments for the remaining months.[16] However, the landlord must make a reasonable effort to re-rent the unit to another tenant in the meantime.

Lease Termination

Month-to-Month Tenancy – A 30-day notice to quit is used to end a month-to-month tenancy.[17]

Unclaimed Property – Landlords must store abandoned personal property for 30 days and may only dispose of it after 14 days of notifying the tenant.[18] The tenant is liable for any expenses incurred during the storage.