Lease Agreements: By Type (6)

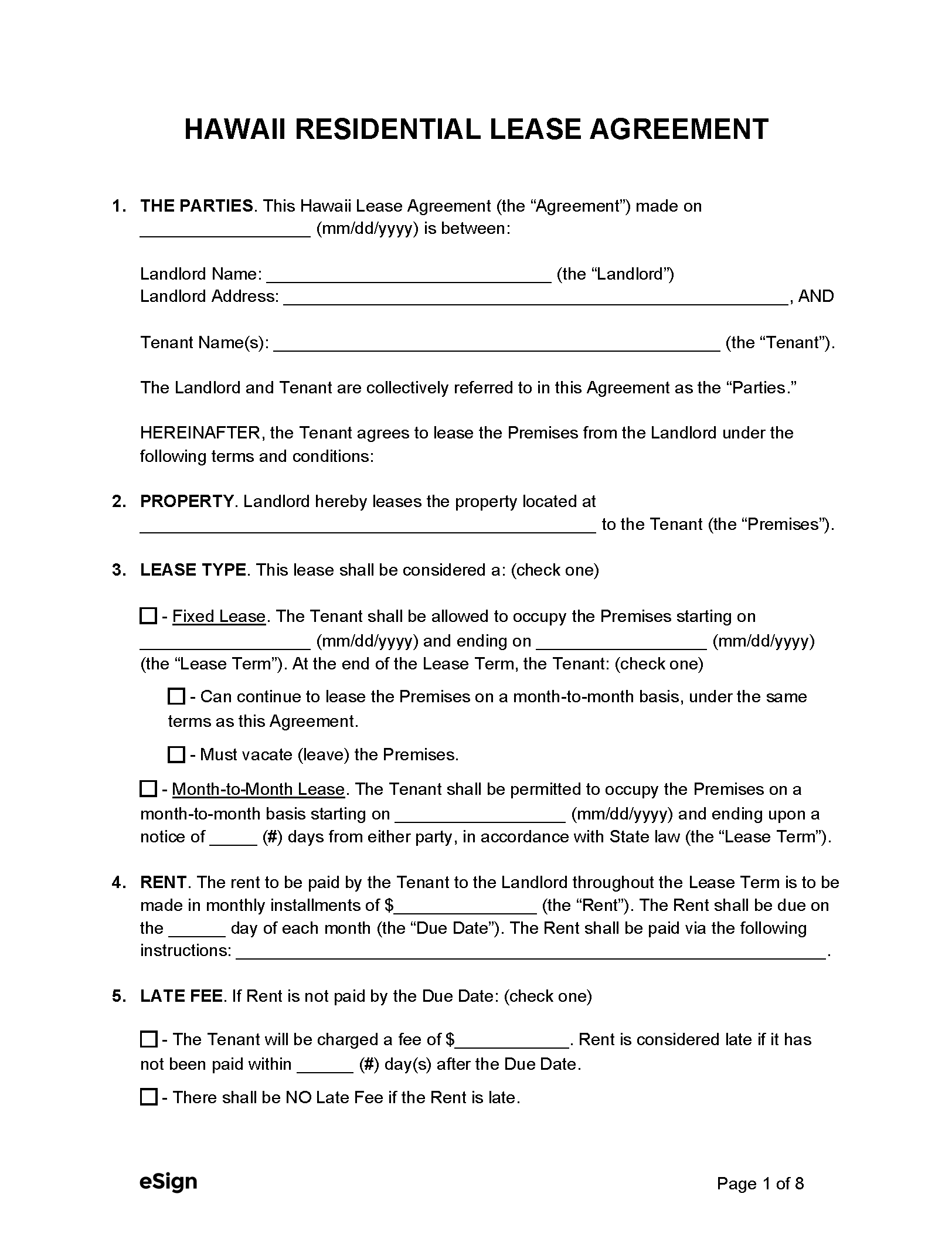

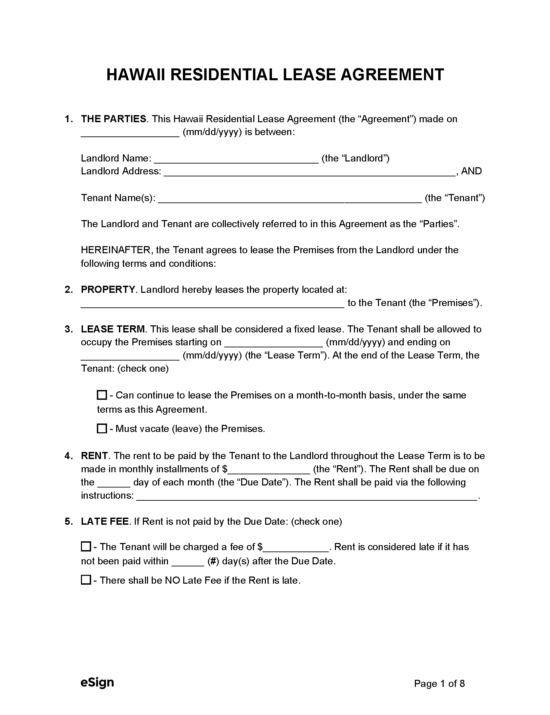

Standard (1-year) Lease Agreement – A standard lease agreement establishes a rental arrangement that lasts for one year and cannot be terminated, except under special circumstances. Standard (1-year) Lease Agreement – A standard lease agreement establishes a rental arrangement that lasts for one year and cannot be terminated, except under special circumstances.

Download: PDF, Word (.docx), OpenDocument |

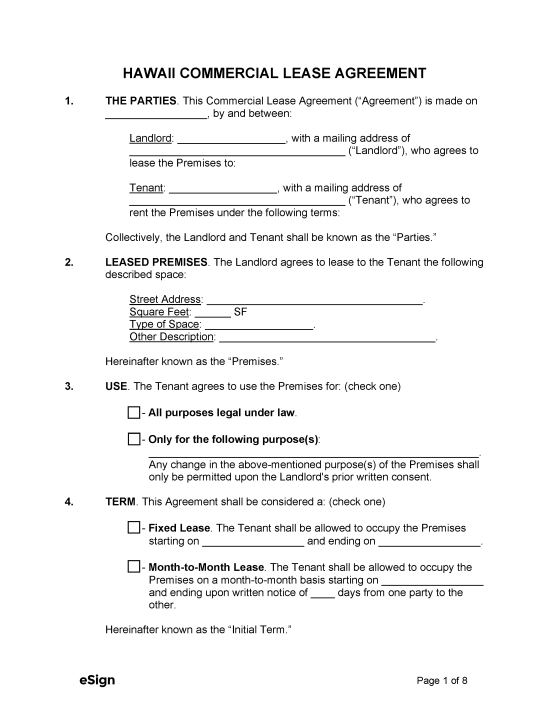

Commercial Lease Agreement – A contract used by landlords who are renting out property for business use, such as office space, industrial property, or retail stores. – A contract used by landlords who are renting out property for business use, such as office space, industrial property, or retail stores.

Download: PDF, Word (.docx), OpenDocument |

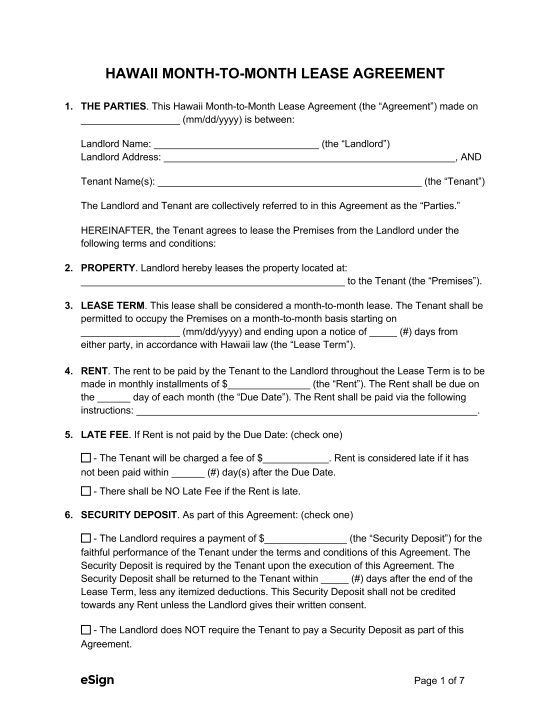

Month-to-Month Lease Agreement – A contract used to rent property to a tenant on a monthly basis with the option to terminate the agreement at any time with appropriate notice given to the other party. Month-to-Month Lease Agreement – A contract used to rent property to a tenant on a monthly basis with the option to terminate the agreement at any time with appropriate notice given to the other party.

Download: PDF, Word (.docx), OpenDocument |

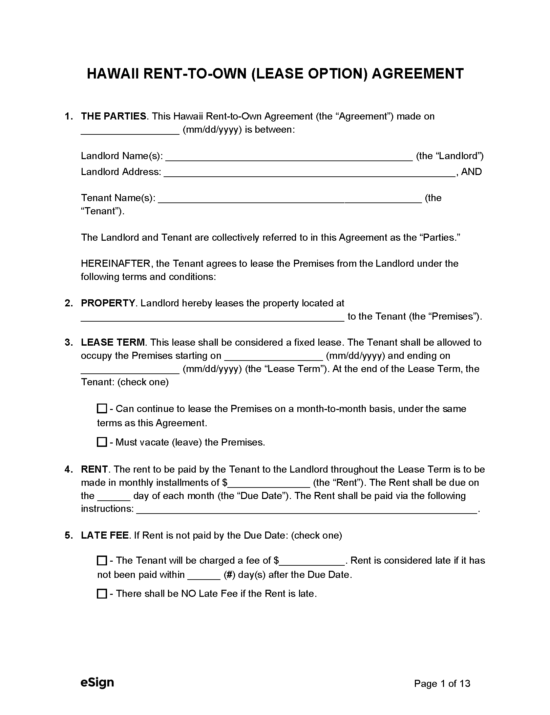

Rent-to-Own Agreement (Lease Option) – A rental form used by landlords and tenants who have an understanding that the tenant may purchase the property during a designated option period (other conditions will apply). – A rental form used by landlords and tenants who have an understanding that the tenant may purchase the property during a designated option period (other conditions will apply).

Download: PDF, Word (.docx), OpenDocument |

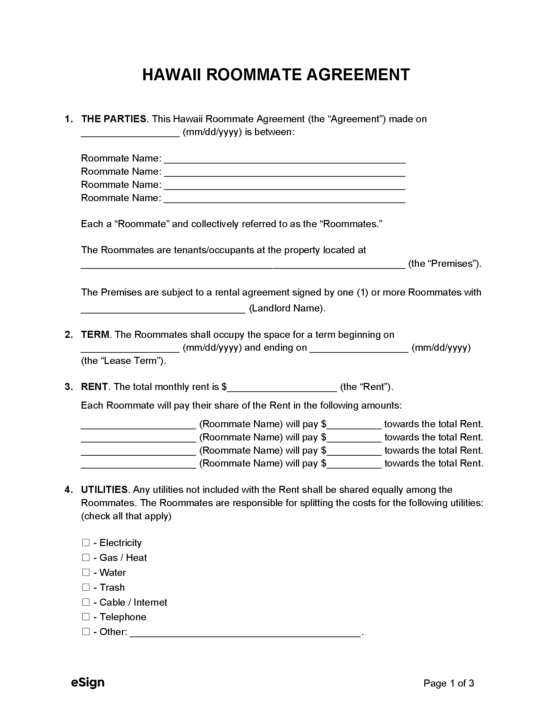

Roommate Agreement – An agreement separate from the original lease that defines living conditions for roommates. Roommate Agreement – An agreement separate from the original lease that defines living conditions for roommates.

Download: PDF, Word (.docx), OpenDocument |

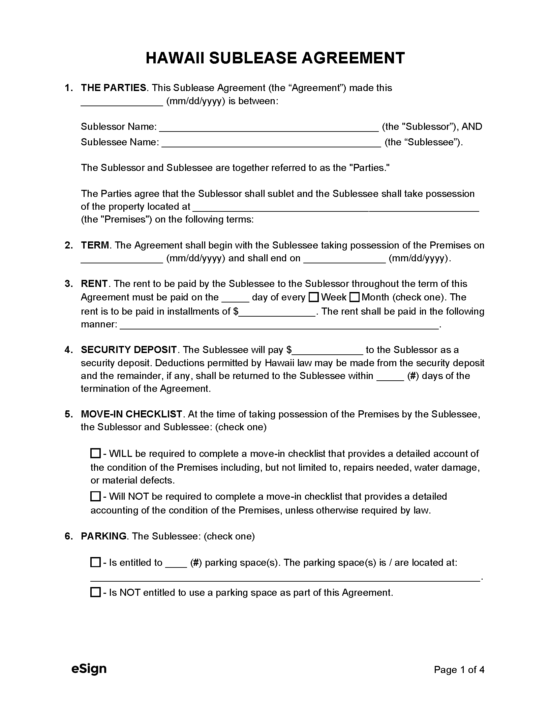

Sublease Agreement – A rental contract used by a tenant to rent out the property they are currently leasing from a landlord to a subtenant. Landlord permission is almost always required. Sublease Agreement – A rental contract used by a tenant to rent out the property they are currently leasing from a landlord to a subtenant. Landlord permission is almost always required.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (3)

- Identification – The landlord must disclose to the tenant the names and addresses of all owners of the residential property as well as all persons authorized to manage the premises and accept service of process, notices, and demands. The landlord’s excise tax number must also be provided.[1]

- Lead-Based Paint Disclosure (PDF) – Landlords are required to notify tenants regarding the presence of lead-based paint in their rental unit if it was built before 1978.[2]

- Property Condition Disclosure – Before signing a lease, the landlord must record the condition of the premises, including any provided furnishings or appliances, in a document signed by both parties.[3]

Security Deposits

Maximum Amount ($) – Maximum security deposit amount shall not exceed one month’s rent.[4]

Collecting Interest – Interest doesn’t need to be collected on security deposits.

Returning to Tenant – The security deposit must be returned to the tenant within 14 days of the lease termination date.[5]

Itemized List Required? – Yes, within 14 days of the rental agreement’s termination, the landlord must give a list of damages and reasons for withholding any part of the security deposit. Otherwise, they must return the whole amount to the tenant.

Separate Bank Account? – Landlords aren’t required to keep security deposits in a separate bank account.

Landlord’s Access

General Access – The landlord must provide two days’ notice to a tenant before entering the premises.[6]

Immediate Access – The landlord may enter anytime for emergencies.

Rent Payments

Grace Period – Tenants aren’t required to be given a grace period to pay rent unless specified in their lease.

Maximum Late Fees ($) – Late fees may be charged as stated in a lease agreement but shall not exceed 8% of the total monthly rent.[7]

Bad Check (NSF) Fee – Landlords are entitled to charge a $30 fee for bounced checks.[8]

Withholding Rent – If a landlord doesn’t begin repairs for damage that threatens the health and safety of the tenant within five days of being notified by a state or county agency, the tenant may arrange for repairs and withhold up to $500 of their rent. Receipts for services and repairs must be given to the landlord.[9]

Breaking a Lease

Non-Payment of Rent – Tenants who fail to pay rent on time can be evicted if they fail to pay after receiving a 5-days’ notice.[10]

Non-Compliance – A tenant can be given a 10-day notice to quit for general non-compliance with their lease. Serious lease violations that endanger the health and safety of other tenants may allow for immediate notice to quit.[11]

Lockouts – The landlord cannot lock out the tenant unless a court order authorizes them.[12]

Leaving Before the End Date – Tenants who quit their rental before their lease expiration must pay the landlord all rent due for the remainder of their term or the rent needed to cover the time it takes to re-rent the property, whichever is less.[13]

Lease Termination

Month-to-Month Tenancy – Month-to-month tenants must be given 45 days’ notice to terminate their lease.[14]

Unclaimed Property – Any of the tenant’s property left behind after abandoning the premises or the termination of their lease can be sold by the landlord after giving notice to the tenant and publishing an advertisement of the sale for at least three consecutive days. Proceeds from the sale must be held in a trust for 30 days before being claimed by the landlord.[15]