By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What is Durable Power of Attorney?

Durable power of attorney is the financial representation of someone else, incapacitated or not, for an indefinite period. Under such designation, an agent will have the power to handle assets and real estate, and make business decisions on behalf of the principal. To get durable power of attorney, a principal must obtain the statutory form provided by their state and sign it in accordance with state law. Afterward, the agent may use a copy of the document to legally represent the principal for the financial powers listed in the form.

“Durable” Definition

“Durable,” with respect to a power of attorney, means not terminated by the principal’s incapacity.

Glossary

An “Agent” (also referred to as an “attorney-in-fact” or “surrogate”) is the person authorized to act on behalf of the principal.

An “alternate agent” (“successor agent” or “2nd agent”) is a person authorized to act on behalf of the principal ONLY IF the main agent is not available.

“Conservatorship” (also known as “legal guardianship”) is when a court appoints a conservator to handle someone else’s finances if they cannot do so for themselves. Often filed when a person becomes incapacitated and they don’t have a power of attorney document.

“Durable” refers to the period of effectiveness of a power of attorney document; i.e., the powers contained therein will continue even if the principal can no longer make decisions for themselves.

“Incapacity” refers to the principal’s inability to make evaluated decisions in a clear manner due to impairment or another type of hindrance, be it physical, mental, or situational.

A “Principal” is the person authorizing someone else to act on their behalf.

“Signing” refers to the signing requirements in the State of the principal.

How to Get Durable Power of Attorney

Obtaining durable power of attorney means a principal grants someone else (the agent) the power to make financial decisions on their behalf. The agent must agree to the terms and conditions and sign the form in accordance with state requirements. After the form has been signed, the designation begins immediately with the agent able to perform tasks and sign other documents on the principal’s behalf.

- Step 1 – Choose an Agent

- Step 2 – Deciding Powers

- Step 3 – Granting Specific Authority

- Step 4 – Signing the Form

- Step 5 – Acting as an Agent

Step 1 – Choose an Agent

It’s recommended that an agent (attorney-in-fact) be the principal’s spouse, a family member, or a close friend (in that order). An agent will have the ultimate authority to act in the principal’s place regarding financial matters. In addition to the main agent, the principal should select up to two (2) alternate agents, who only serve as the principal’s main agent should the primary attorney-in-fact be a poor fit for the role, pass away, or be unavailable/unwilling to perform their duties.

Step 2 – Deciding Powers

A typical statutory durable power of attorney allows a principal to select any of the following powers:

- Real Property

- Tangible Personal Property

- Stocks and Bonds

- Commodities and Options

- Banks and Other Financial Institutions

- Operation of Entity or Business

- Insurance and Annuities

- Estates, Trusts, and Other Beneficial Interests

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Governmental Programs or Civil or Military Service

- Retirement Plans

- Taxes

Step 3 – Granting Specific Authority

In a special section of a durable power of attorney, the form will ask if the agent will have additional authority, such as the ability to:

- Create, amend, revoke, or terminate an inter vivos trust

- Make gifts

- Create or change rights of survivorship

- Create or change a beneficiary designation

- Authorize another person to be an agent

Depending on the state, there may be additional financial powers offered.

Step 4 – Signing the Form

When it comes time to sign the document, the signing requirements established in the principal’s state of residence must be followed. This involves the principal and agent(s) signing in the presence of witnesses and/or a notary public.

Find a Notary (3 options)

- Online Notary – Use the online notary process on the eSign homepage where the principal, agent(s), and any witnesses may appear in front of a camera with government identification.

- Bank or Credit Union – Go to a financial institution as most employees at banks are licensed notaries public.

- Find a Notary – Hire a notary to meet with the principal and agent in person. Use an online directory such as 123Notary.com.

Step 5 – Acting as an Agent

After a durable power of attorney has been completed and signed, the agent may begin acting on the principal’s behalf. The agent will be required to have a duplicate copy with them at all times and, when signing forms for the principal, sign in the following manner: “[Principal’s Name] by [Agent’s Name] acting as Agent”.

Signing Requirements: By State

Below are the signing requirements for durable power of attorney forms for all fifty (50) states. It’s important to note that in most states a witness cannot be a family member, medical staff, a beneficiary in the principal’s last will and testament, or an individual under eighteen (18) years of age.

| STATE | SIGNING REQUIREMENTS | STATUTE |

| Alabama | Notarized | § 26-1A-105 |

| Alaska | Notarized | § 13.26.600 |

| Arizona | Notarized & 1 Witness | § 14-5501 |

| Arkansas | Notarized | § 28-68-105 |

| California | Notarized OR 2 Witnesses | § 4121(c) |

| Colorado | Notarized | § 15-14-705 |

| Connecticut | Notarized & 2 Witnesses | § 1-350d |

| Delaware | Notarized & 1 Witness | § 49A-105(a) |

| Florida | Notarized & 2 Witnesses | § 709.2105(2) |

| Georgia | Notarized & 1 Witness | § 10-6B-5(a) |

| Hawaii | Notarized | § 551E-3(b) |

| Idaho | Notarized | § 15-12-105 |

| Illinois | Notarized & 1 Witness | § 755 ILCS 45/3-3(b) |

| Indiana | Notarized OR 2 Witnesses | § 30-5-4-1(4) |

| Iowa | Notarized | § 633B.105 |

| Kansas | Notarized & 2 Witnesses | § 58-652(a)(3) |

| Kentucky | Notarized | § 457.050 |

| Louisiana | N/A | No statute |

| Maine | Notarized | § 5-905(1) |

| Maryland | Notarized & 2 Witnesses | § 17-110 |

| Massachusetts | N/A | No statute |

| Michigan | Notarized & 2 Witnesses | § 700.5501(2) |

| Minnesota | Notarized | § 523.01 |

| Mississippi | N/A | No statute |

| Missouri | N/A | No statute |

| Montana | Notarized | § 72-31-305 |

| Nebraska | Notarized | § 30-4041 |

| Nevada | Notarized | § 162A.220 |

| New Hampshire | N/A | No statute |

| New Jersey | Notarized & 1 Witness | § 46:2B-8.9 |

| New Mexico | Notarized | § 45-5B-105 |

| New York | Notarized & 2 Witnesses | § 5-1501B(b) |

| North Carolina | Notarized | § 32C-1-105 |

| North Dakota | N/A | No statute |

| Ohio | Notarized | § 1337.06 |

| Oklahoma | Notarized | § 15-1003 |

| Oregon | N/A | No statute |

| Pennsylvania | Notarized & 2 Witnesses | § 5601(b)(3) |

| Rhode Island | Notarized | § 18-16-2 |

| South Carolina | Notarized & 2 Witnesses | § 62-8-105 |

| South Dakota | N/A | No statute |

| Tennessee | N/A | No statute |

| Texas | Notarized | § 752.051 |

| Utah | Notarized | § 75-9-105 |

| Vermont | Notarized & 1 Witness | § 3503 |

| Virginia | Notarized | § 64.2-1603 |

| Washington | Notarized OR 2 Witnesses | § 11.125.050 |

| West Virginia | Notarized | § 39B-1-105 |

| Wisconsin | Notarized | § 244.05 |

| Wyoming | Notarized | § 3-9-105 |

Power of Attorney Definitions: By State

The state-by-state statutes for important power of attorney terms have been provided below:

| STATE | DEFINITIONS (STATUTE) |

| Alabama | § 26-1A-102 |

| Alaska | § 13.26.695 |

| Arizona | § 14-5101 |

| Arkansas | § 28-68-102 |

| California | § 4022 |

| Colorado | § 15-14-702 |

| Connecticut | § 1-350a |

| Delaware | § 49A-102 |

| Florida | § 709.2102 |

| Georgia | § 10-6B-2 |

| Hawaii | § 551E-1 |

| Idaho | § 15-12-102 |

| Illinois | § 755 ILCS 45/2-3 |

| Indiana | IC 30-5-2 |

| Iowa | § 633B.102 |

| Kansas | § 58-651 |

| Kentucky | § 457.020 |

| Louisiana | No definitions |

| Maine | § 5-902 |

| Maryland | § 17-101 |

| Massachusetts | No definitions |

| Michigan | § 700.5501 |

| Minnesota | § 523.03 |

| Mississippi | § 87-3-105 |

| Missouri | § 404.703 |

| Montana | § 72-31-302 |

| Nebraska | § 30-4002 |

| Nevada | § 162A.010 |

| New Hampshire | § 564-E:102 |

| New Jersey | § 46:2B-10 |

| New Mexico | § 45-5b-102 |

| New York | § 5-1501 |

| North Carolina | § 32C-1-102 |

| North Dakota | § 30.1-30-01 |

| Ohio | § 1337.22 |

| Oklahoma | 58 O.S. § 3002 |

| Oregon | § 127.002 |

| Pennsylvania | § 5601(f) and § 5604(a) |

| Rhode Island | No definitions |

| South Carolina | § 62-8-102 |

| South Dakota | § 59-12-1 |

| Tennessee | § 34-6-102 |

| Texas | § 751.002 |

| Utah | § 75-9-102 |

| Vermont | § 3501 |

| Virginia | § 64.2-1600 |

| Washington | § 11.125.020 |

| West Virginia | § 39B-1-102 |

| Wisconsin | § 244.02 |

| Wyoming | § 3-9-102 |

Sample

Download: PDF, Word (.docx), OpenDocument

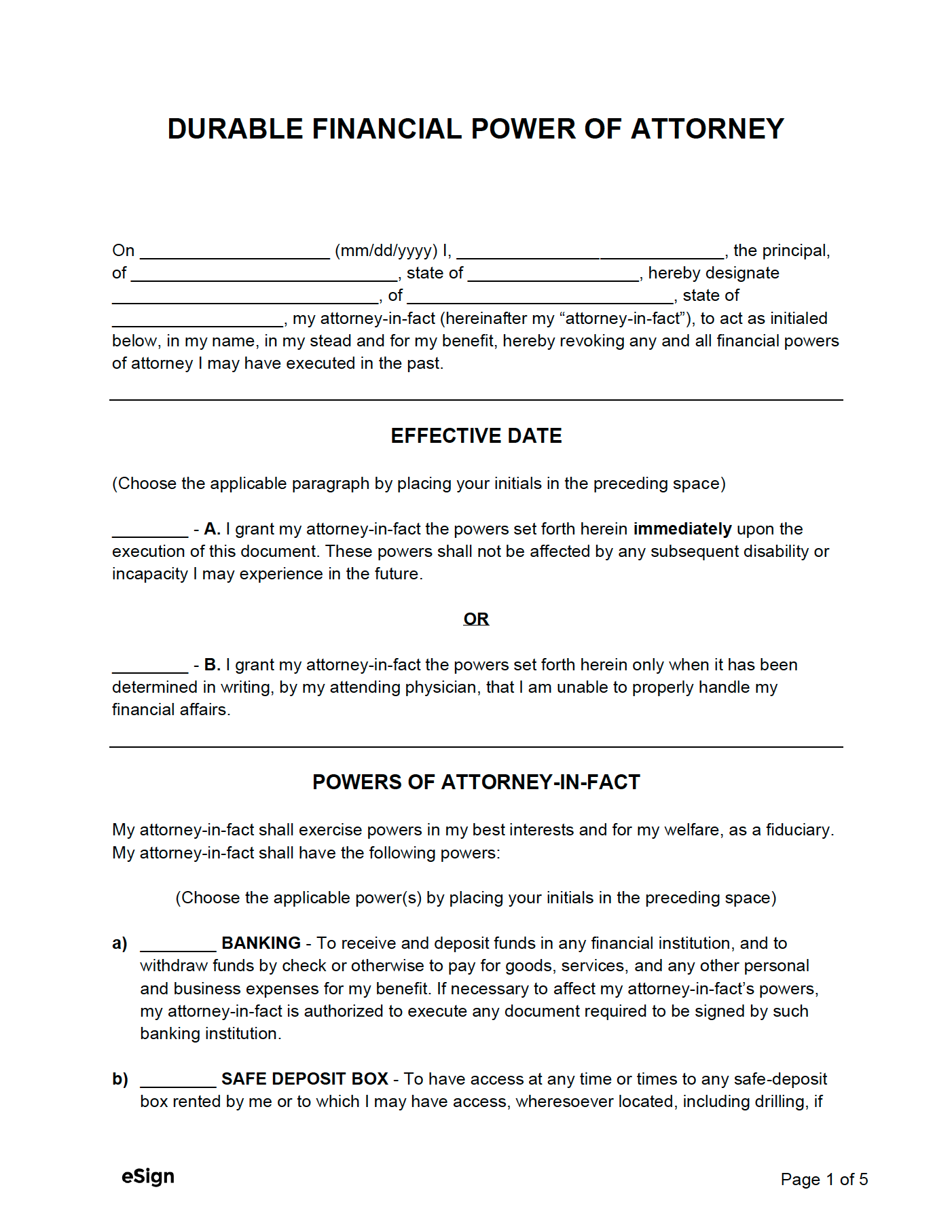

How to Write

Download: PDF, Word (.docx), OpenDocument

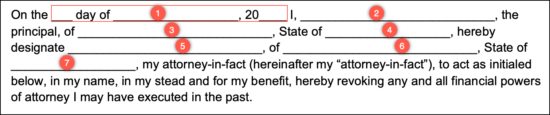

Step 1 – Party Information

The first paragraph of the form provides contact information for the principal (assigning powers) and the agent (receiving powers). The following information will need to be entered:

- The date the principal is completing the POA (day, month, and year).

- The principal’s full name.

- The principal’s street address.

- The principal’s state of residence.

- The agent’s full name.

- The agent’s street address.

- The agent’s state of residence.

Important note: By completing the form, the principal acknowledges that they will be revoking any financial POAs that were previously created.

Step 2 – When the POA Becomes Effective

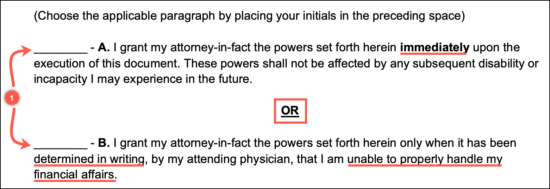

The principal has two (2) options to choose from in regard to the effective date of the power of attorney document. The must inscribe their initials next to only one (1) of the following options:

- Option A (Immediate) – By initialing this option, the POA will go into effect the moment the POA is signed. In other words, the agent will have the right to exercise every power that was granted to them immediately upon execution.

- Option B (Springing) – This option makes the POA only go into effect once the principal is deemed medically incapacitated by their physician, i.e., unable to communicate/make decisions.

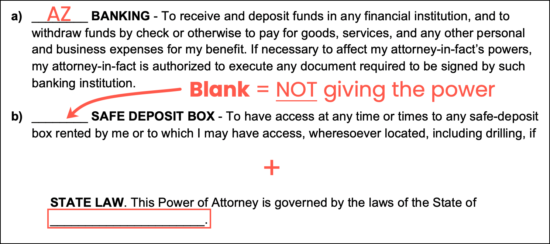

Step 3 – Powers

The principal can choose to grant their agent any of the twelve (12) powers listed in this section of the form. Furthermore, they can add any powers not already listed in the special instructions subsection. To select a power, the principal must place their initials next to each power they wish to grant. The agent will not be able to complete actions and make decisions regarding any powers that are not initialed.

After this, the principal will need to enter the name of the state in which the power of attorney will be used (not necessarily the state in which the principal resides).

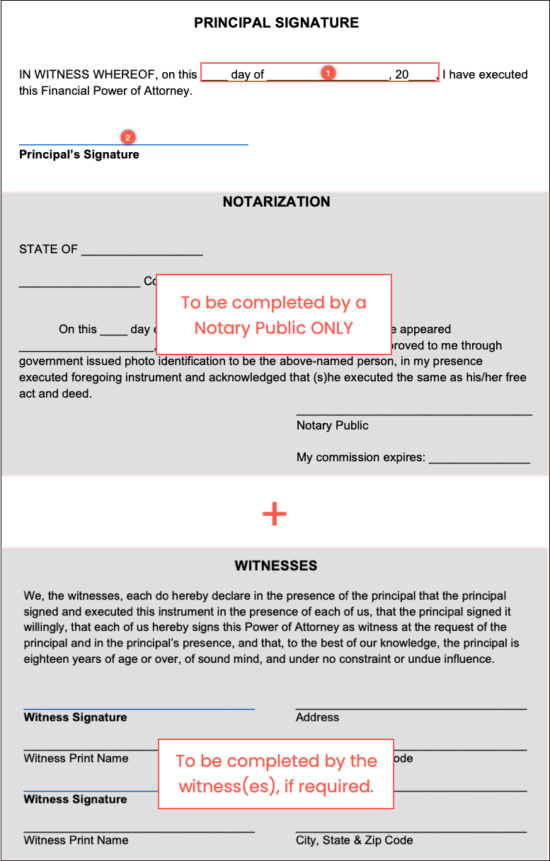

Step 4 – Principal’s Signature

The document should be signed in accordance with the requirements in the state where the agent will be using the POA. For example, if the principal lives in Montana, but they’ll be signing a POA to have their agent perform tasks in Florida, the form should be signed as required by Florida law (i.e., notarization and two (2) witnesses).

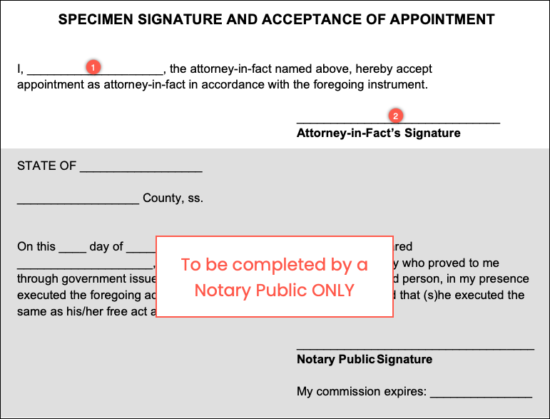

Step 5 – Agent Acceptance of Appointment

On the last page (5) of the document, the agent will need to 1) print their name on the line provided and 2) sign their name. If the agent wishes to have their signature notarized, there is an acknowledgment section provided at the bottom of the page.

Related Forms

General ($) Power of Attorney – This POA if also used to grant certain financial powers, but does not remain effective if the principal becomes incapacitated.

Limited Power of Attorney – A non-durable POA that appoints an agent to handle specific tasks for the principal for a predetermined period of time (or until the ask is complete).

Advance Directive – An advance directive outlines a principal’s end-of-life wishes and nominates an agent to communicate those wishes with medical staff.

Medical Power of Attorney – This POA form appoints a health care representative to make decisions for the principal when they are unable to do so (due to some sort of incapacitation) and ensure medical professionals act in accordance with their living will and/or advance directive.