By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What is a General Power of Attorney?

A general power of attorney is a legal document allowing a person (“principal”) to select someone else to make any type of financial decisions on their behalf. It can grant the same powers to the agent as a durable power of attorney and is the same in every respect except that it is non-durable.

Non-Durable

A general power of attorney is non-durable, meaning it will terminate immediately after a principal becomes incapacitated or can no longer think for themselves.

How to Get a General Power of Attorney

- Step 1 – Select an Agent

- Step 2 – Choose Powers

- Step 3 – Complete the Form

- Step 4 – Sign the Power of Attorney

Granting power of attorney using a general POA form involves selecting someone to be your “agent,” completing the form, and signing in accordance with state law. In theory it is a simple process, but giving someone power of attorney means they will have the authority to make a number of important financial decisions, so the principal should be very mindful while completing each step.

Step 1 – Select an Agent

The most important step is to choose an agent that will represent the principal’s financial interests. This type of power of attorney is common amongst business partners or anyone that would like representation for financial matters.

- Alternate Agent – An alternate or “secondary” agent can be selected if the primary agent is not available.

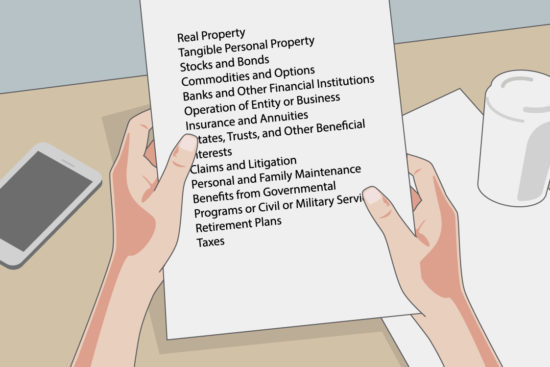

Step 2 – Choose Powers

The principal can select any type of financial power including, but not limited to, those listed in the Uniform Power of Attorney Act (UPOAA):

- Real Property

- Tangible Personal Property

- Stocks and Bonds

- Commodities and Options

- Banks and Other Financial Institutions

- Operation of Entity or Business

- Insurance and Annuities

- Estates, Trusts, and Other Beneficial Interests

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Governmental Programs or Civil or Military Service

- Retirement Plans

- Taxes

In addition, the principal may include special powers to run a business, manage or sell property, and any other financial act permissible by state and federal law.

Step 3 – Complete the Form

The principal and agent should complete the power of attorney together. If there is anything the principal doesn’t understand they should seek legal counsel.

Step 4 – Sign the Power of Attorney

A general power of attorney must be signed in the same manner as a durable power of attorney; the state signing requirements can be referenced when completing this step (notarization and two (2) witnesses is commonplace).

How to Write

Download: PDF, Word (.docx), OpenDocument

Prior to filling out the form, the principal should prepare by identifying someone they believe would make a great fit as their agent. They should then speak with their preferred agent to ask if they’d be willing to act in the role, are comfortable performing all of the actions required, and would sign the document when requested. If the agent is on board with acting as the attorney-in-fact, the principal can begin completing the document.

- Step 1 – Principal & Agent

- Step 2 – Initialing Powers

- Step 3 – Interpretation and Governing Law

- Step 4 – Beginning & End Dates

- Step 5 – Principal’s Signature

- Step 6 – Agent’s Acceptance of Appointment

- Step 7 – Witness Signatures (if required)

- Step 8 – Notarization (if required)

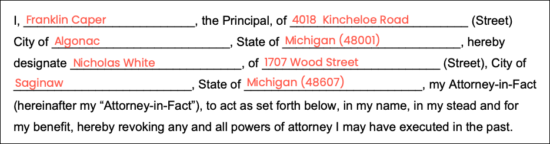

Step 1 – Principal + Agent

At the top of the first (1st) page, the principal will need to provide both their name and address, and the name and address of the agent they selected. The principal can include the ZIP code in parentheses next to the state if they feel it necessary.

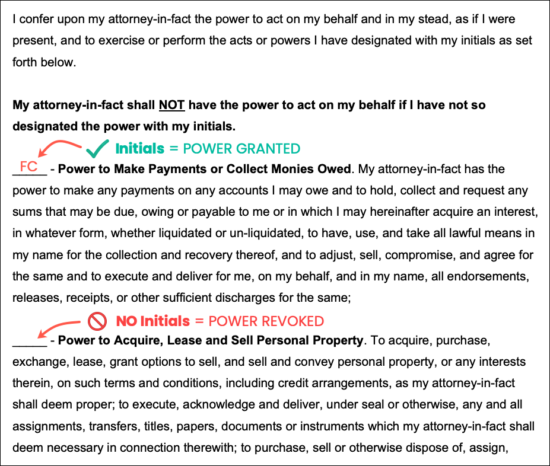

Step 2 – Initialing Powers

The principal will need to inscribe their initials next to each power they wish to grant to the agent. If initials are not placed next to a power, the agent will NOT have the authority to perform these actions. If there are any miscellaneous powers the principal would like to grant to the agent, they can do so by providing their initials next to “Other” and entering the powers in detail on the three (3) lines provided.

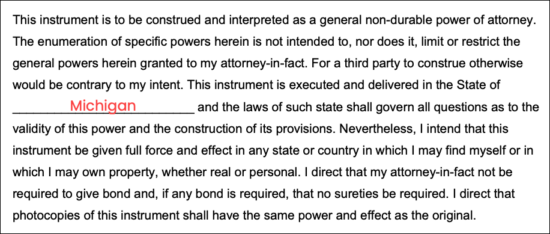

Step 3 – Interpretation and Governing Law

Provide the name of the state in which the principal resides on the single line provided. If the POA will be used primarily in another state, enter the name of the state in which the agent will be exercising their power.

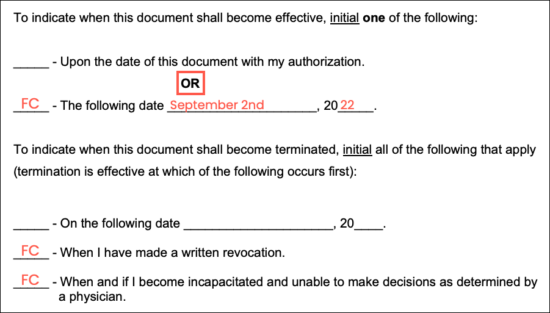

Step 4 – Beginning & End Dates

The effective date is the date on which the agent will be able to start performing their assigned duties for the principal. For the effective date, the principal can initial only one (1) of the two options provided.

- Initial the first line for the POA to go into effect immediately after the principal’s signature is recorded; OR

- Initial the second line and enter the day, month, and year on which the POA should begin.

If the principal wants the form to go into effect upon their incapacitation, a durable (financial) form should be used instead.

For the termination date, the principal can select any/all of the three (3) following options:

- Initial the first line to specify an exact date for the POA to terminate. Include the date (day, month, and year) on which the agent’s powers will be revoked.

- Initial the second line if the principal has the option to revoke the POA manually at any time. Even if this option is not selected, the principal can most likely still revoke the form through the use of an official POA revocation form.

- Initial the third (last) line to have the POA terminate in the event the principal is unable to communicate/make decisions. Note: because this is a non-durable form, even if this line is not initialed, the POA will still revoke should the principal become incapacitated.

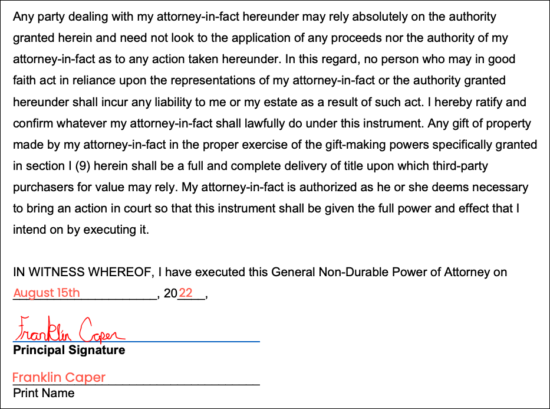

Step 5 – Principal’s Signature

The principal will need to inscribe their signature onto the document in order for it to be legally binding. See the state signing requirements to ensure the form is signed properly. If the principal will be signing in the presence of a Notary Public or witnesses, they will need to wait to sign until these parties can observe the signature. At the time of signing, the principal will need to provide the following:

- The day, month, and year they are signing;

- Their signature (use eSign or sign by hand); and

- Their full printed name.

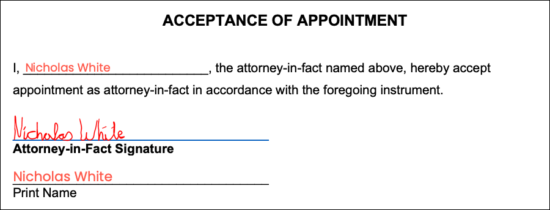

Step 6 – Agent’s Acceptance of Appointment

While not always a state requirement, the agent should sign the form to show they understand their role as the attorney-in-fact, and that they agree to uphold all responsibilities that come with this position. The agent will need to enter the following information:

- Their full name (first and third line)

- Signature (using eSign or by hand)

The agent does not need to have their signature witnessed or notarized.

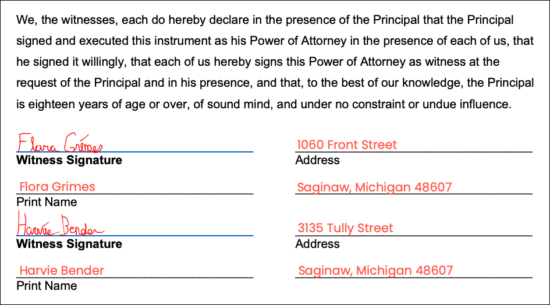

Step 7 – Witness Signatures (if required)

This section is to be completed by the witness(es) ONLY. Many states require the principal to have their signature witnessed by one (1) or more people. The witnesses should be over the age of eighteen (18+) and cannot be an agent of the principal. The notary cannot serve as a witness. Each witness will need to complete the following steps:

- Sign their name (if using eSign, the witness must be in the same room as the principal);

- Write their full printed name; and

- Write their mailing address on the lines provided.

Step 8 – Notarization (if required)

This section is to be completed by a Notary Public ONLY. No instruction is necessary.

Related Forms

Durable ($) Power of Attorney – Can be used to grant the same powers as a general POA but remains effective in the event the principal becomes incapacitated.

Limited Power of Attorney – A customizable form used by a principal to nominate an agent to handle specific duties, often for a shorter period of time.

Tax Power of Attorney – A form that appoints an agent to handle tax matters for the principal. Most states have their own official document, whereas other states use the federally mandated IRS Form 2848.

Vehicle Power of Attorney – Used to grant an attorney-in-fact the power to perform tasks on behalf of the principal such as registering a vehicle, applying for a title, selling and buying vehicles, and recording liens.