By Type (8)

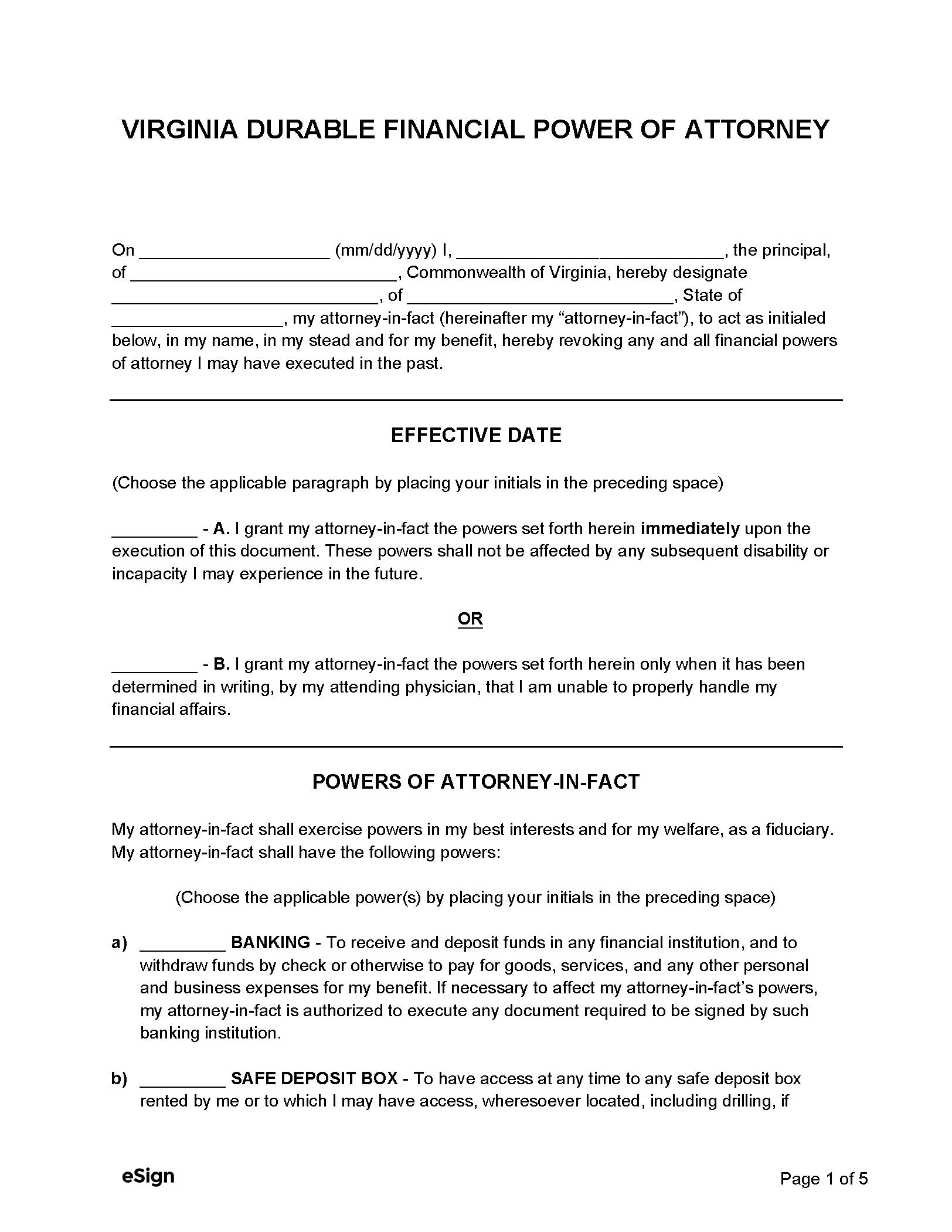

Advance Directive – Informs health care providers of treatment preferences and assigns power to a medical representative. Advance Directive – Informs health care providers of treatment preferences and assigns power to a medical representative.

Download: PDF |

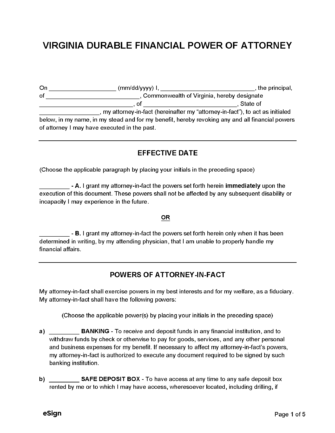

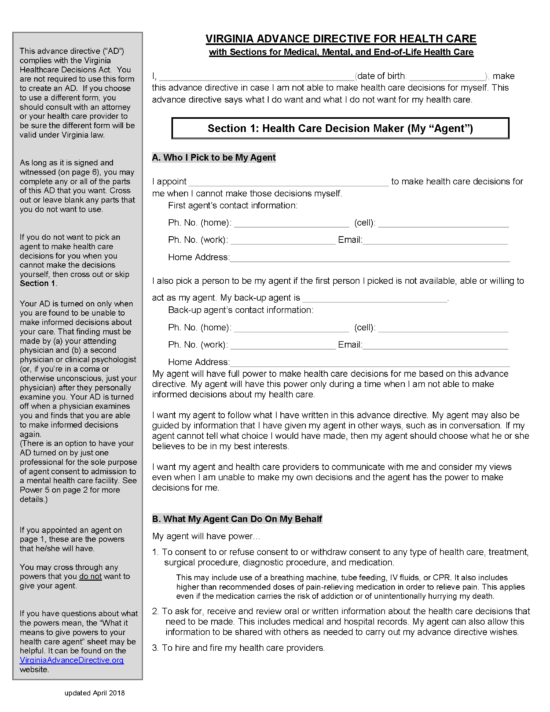

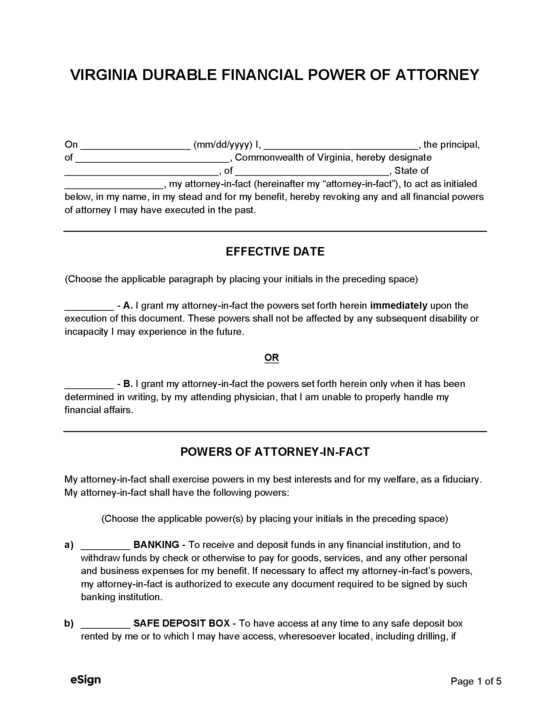

Durable Power of Attorney – Gives an agent financial powers that extend beyond the principal’s mental and physical incapacitation. Durable Power of Attorney – Gives an agent financial powers that extend beyond the principal’s mental and physical incapacitation.

Download: PDF, Word (.docx), OpenDocument |

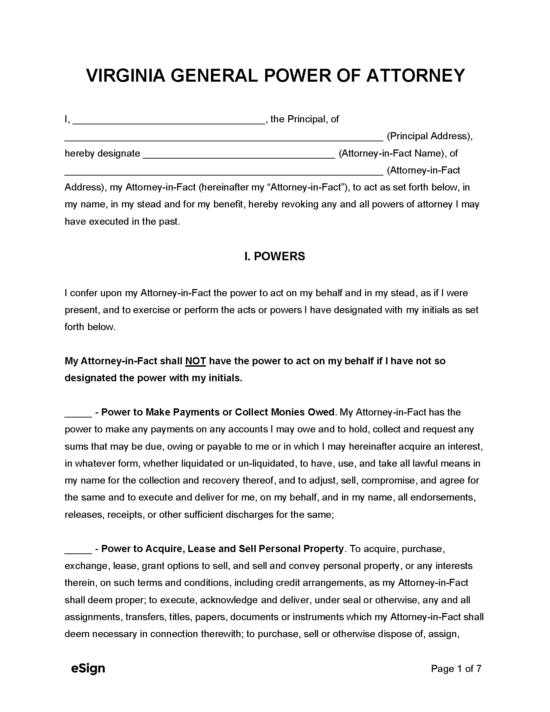

General (non-durable) Power of Attorney – Provides broad powers over the principal’s finances but terminates upon their incapacitation. General (non-durable) Power of Attorney – Provides broad powers over the principal’s finances but terminates upon their incapacitation.

Download: PDF, Word (.docx), OpenDocument |

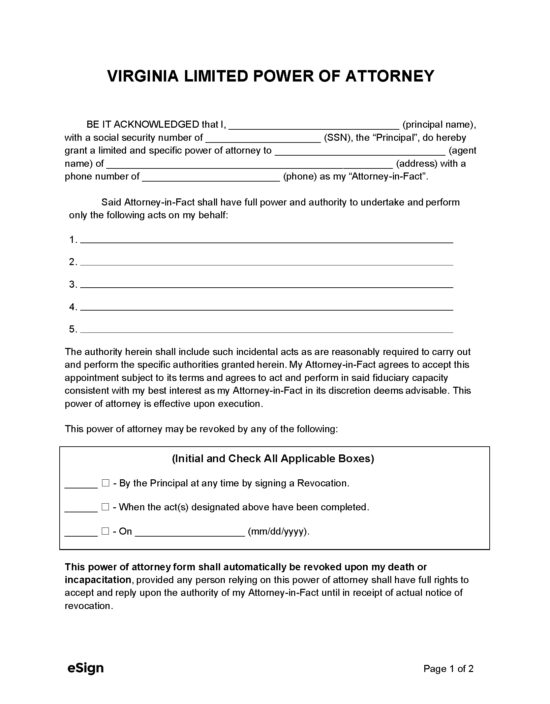

Limited Power of Attorney – Gives an agent permission to handle specific financial transactions only, often for a limited period. Limited Power of Attorney – Gives an agent permission to handle specific financial transactions only, often for a limited period.

Download: PDF, Word (.docx), OpenDocument |

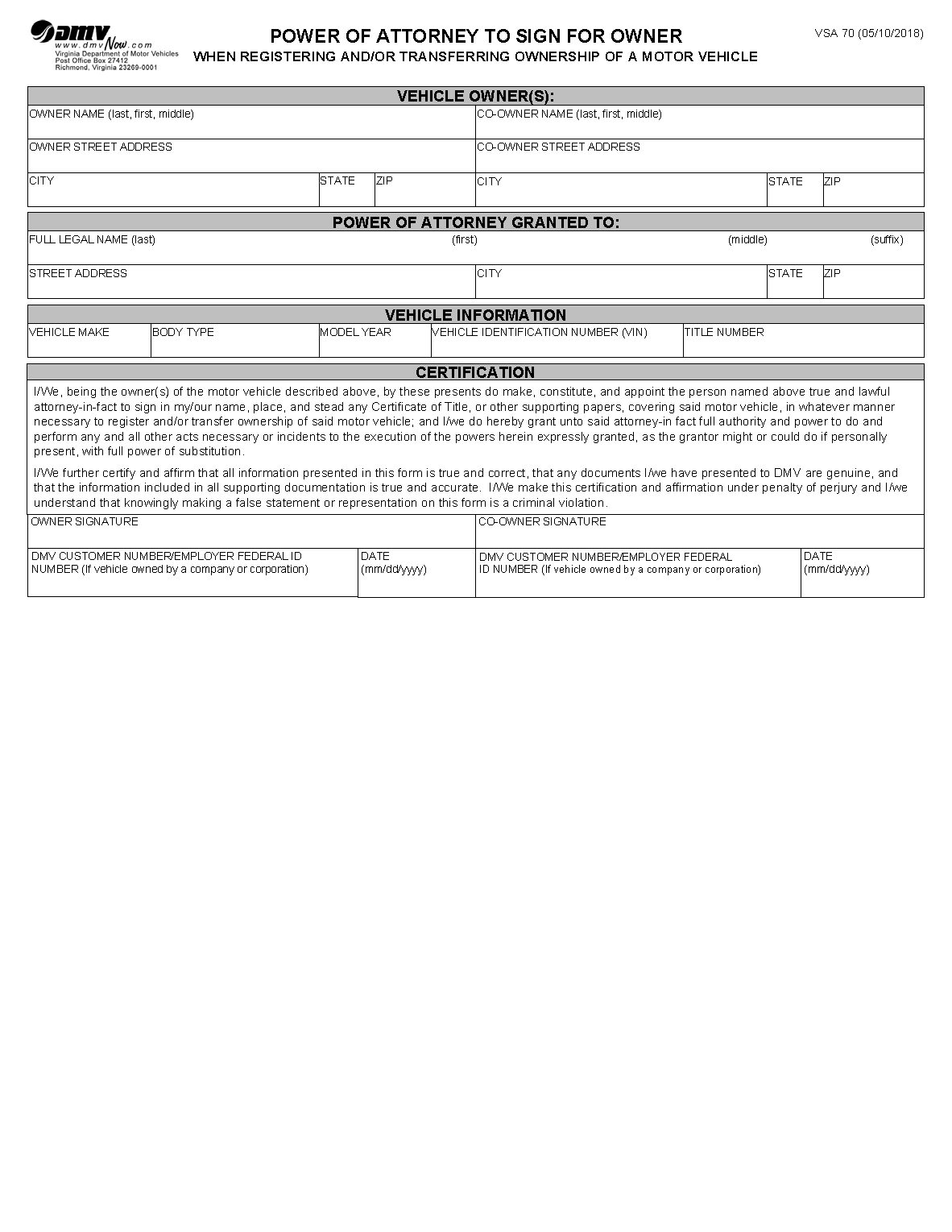

Motor Vehicle (Form VSA-70) Power of Attorney – For when a third party is needed to register or transfer ownership of a motor vehicle. Motor Vehicle (Form VSA-70) Power of Attorney – For when a third party is needed to register or transfer ownership of a motor vehicle.

Download: PDF |

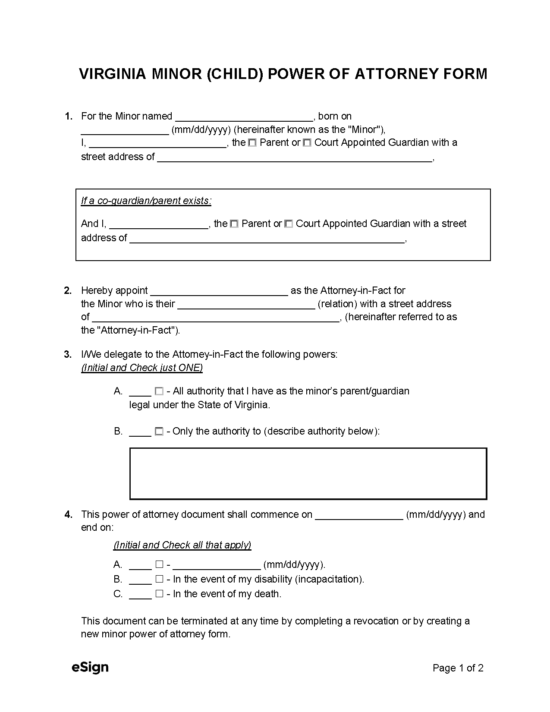

Minor (Child) Power of Attorney – Allows a parent to give a trusted individual the authority to act as their child’s temporary caregiver. Minor (Child) Power of Attorney – Allows a parent to give a trusted individual the authority to act as their child’s temporary caregiver.

Download: PDF, Word (.docx), OpenDocument |

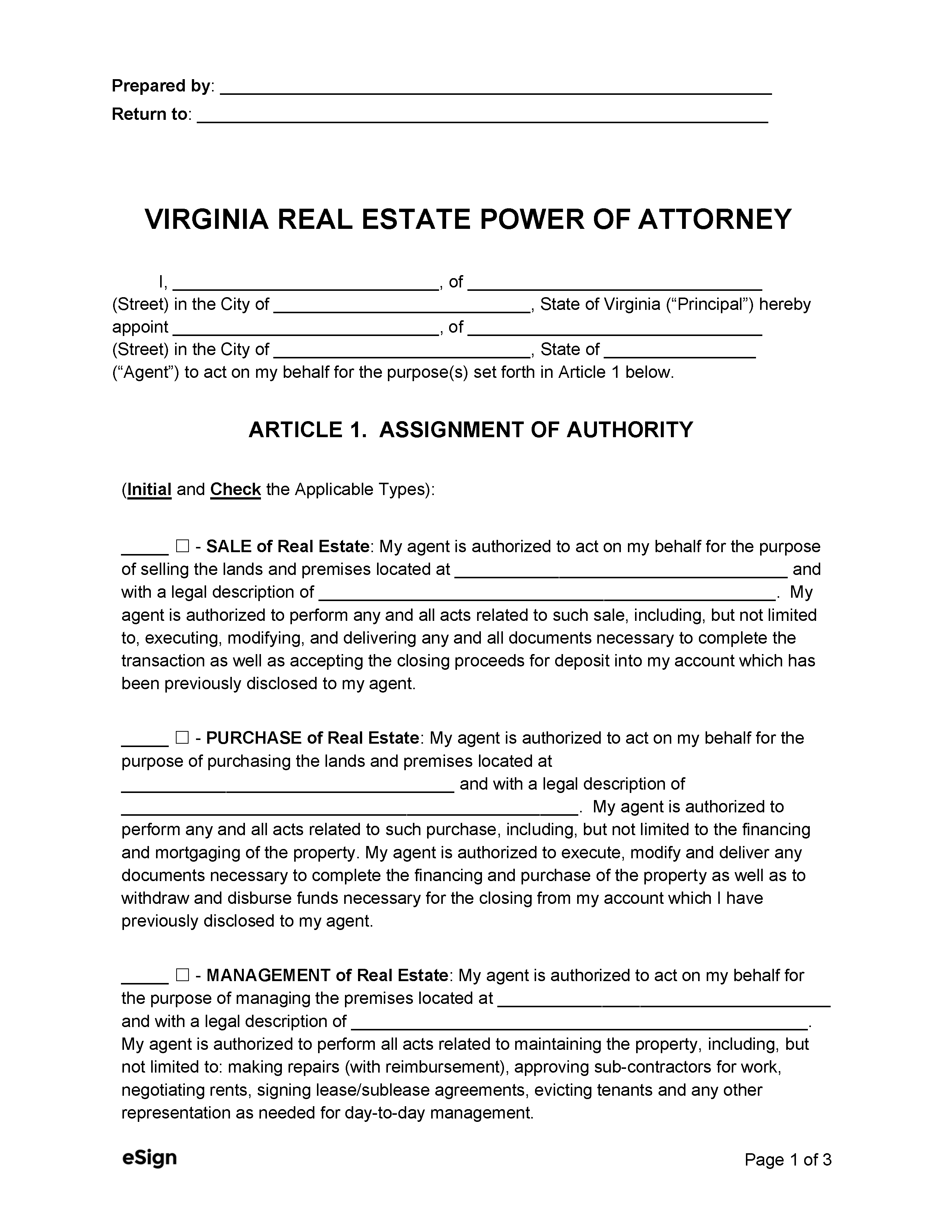

Real Estate Power of Attorney – Used when a representative is needed to act on the principal’s behalf in real estate transactions. Real Estate Power of Attorney – Used when a representative is needed to act on the principal’s behalf in real estate transactions.

Download: PDF, Word (.docx), OpenDocument |

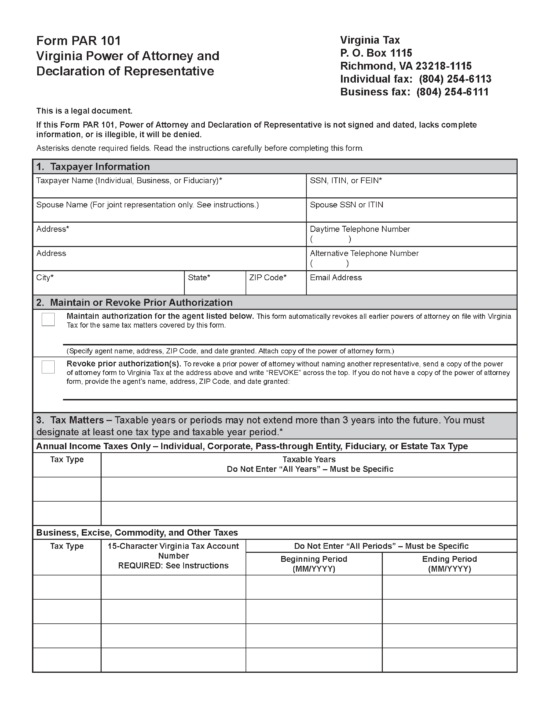

Tax (Form PAR 101) Power of Attorney – Permits a representative to file the principal’s taxes and handle related matters with the Department of Taxation. Tax (Form PAR 101) Power of Attorney – Permits a representative to file the principal’s taxes and handle related matters with the Department of Taxation.

Download: PDF |