By Type (8)

Advance Directive – A combined living will and medical power of attorney used to provide health care guidance. Advance Directive – A combined living will and medical power of attorney used to provide health care guidance.

Download: PDF |

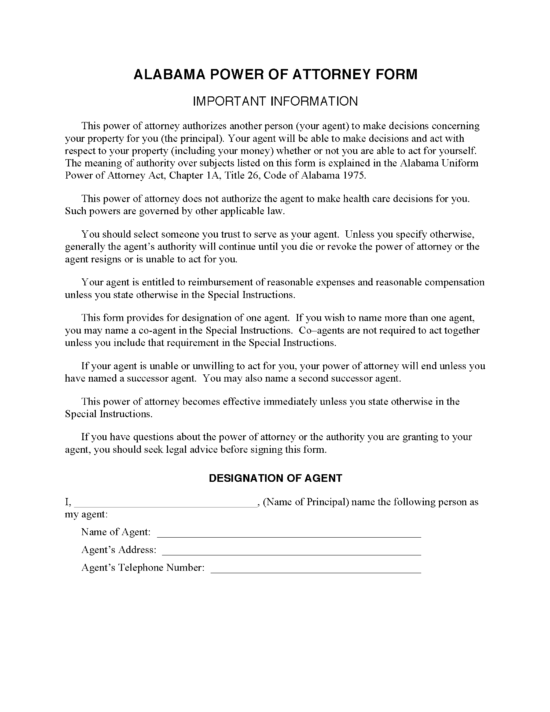

Durable Power of Attorney – A financial power of attorney that doesn’t end once the principal becomes incapacitated. Durable Power of Attorney – A financial power of attorney that doesn’t end once the principal becomes incapacitated.

Download: PDF |

General (non-durable) Power of Attorney – Used to appoint an agent to manage finances whose powers terminate upon the principal’s incapacitation. General (non-durable) Power of Attorney – Used to appoint an agent to manage finances whose powers terminate upon the principal’s incapacitation.

Download: PDF |

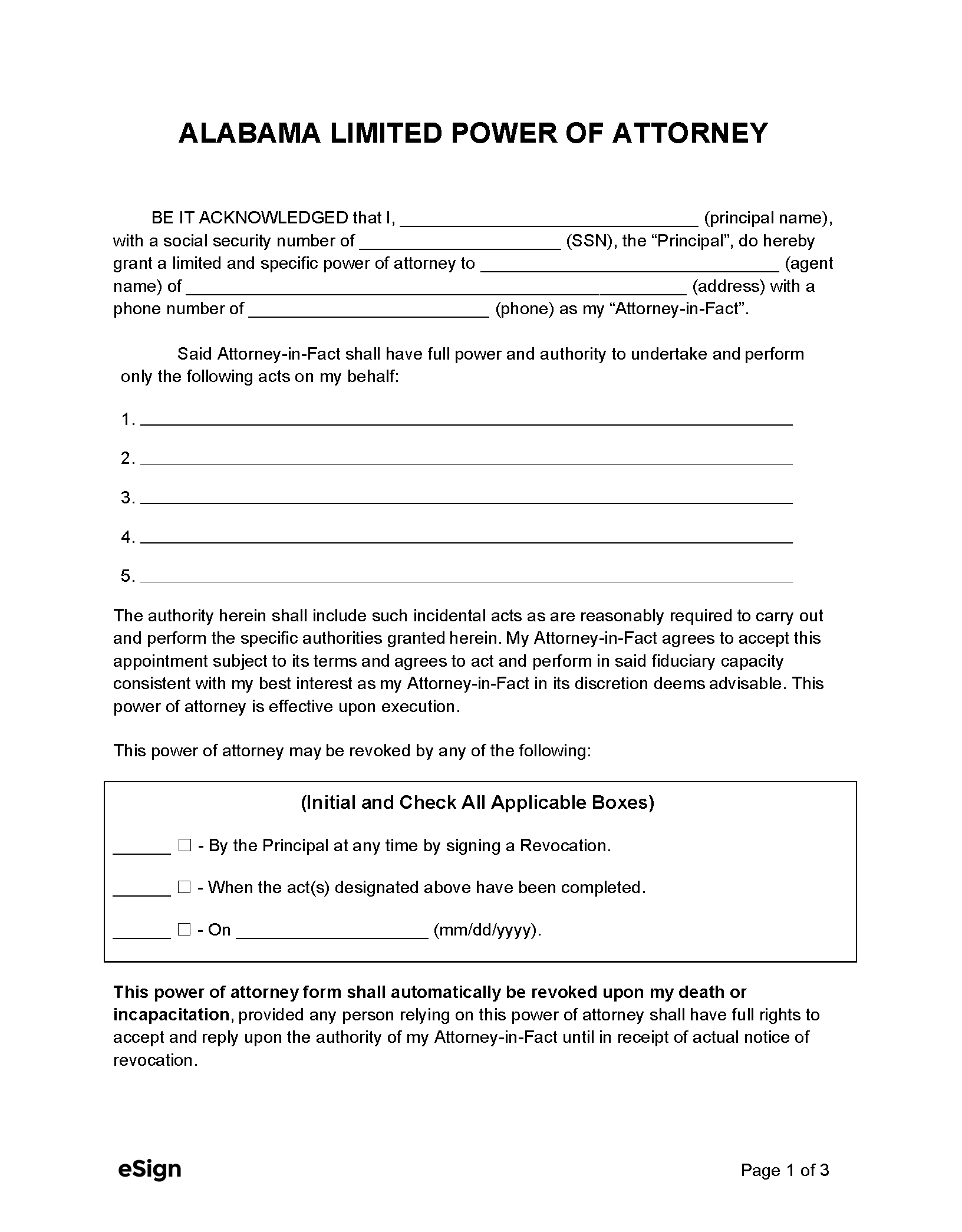

Limited Power of Attorney – Assigns an agent power over a specific task or area of the principal’s affairs. Limited Power of Attorney – Assigns an agent power over a specific task or area of the principal’s affairs.

Download: PDF, Word (.docx), OpenDocument |

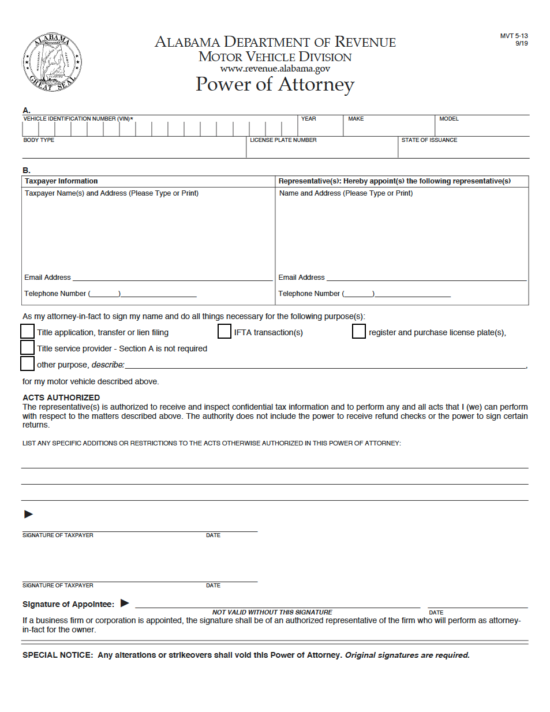

Motor Vehicle (Form MVT 5-13) Power of Attorney – Enables someone else to handle the registration, buying, and selling of a vehicle. Motor Vehicle (Form MVT 5-13) Power of Attorney – Enables someone else to handle the registration, buying, and selling of a vehicle.

Download: PDF |

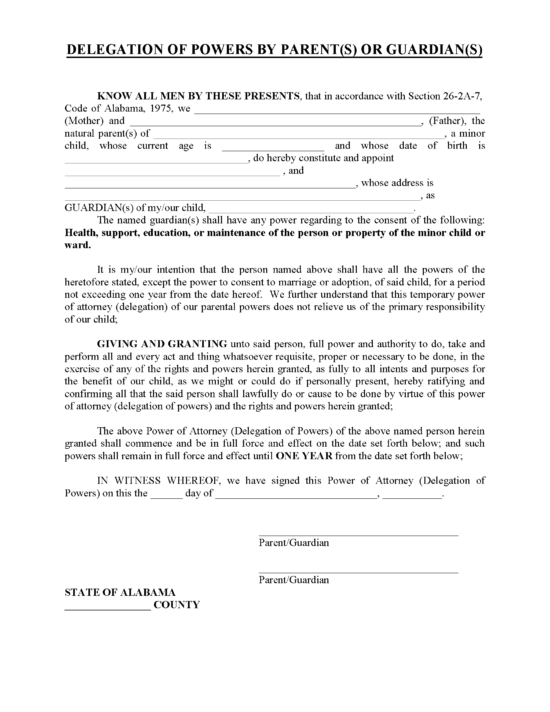

Minor (Child) Power of Attorney – Grants a trusted representative with parental powers for a limited period. Minor (Child) Power of Attorney – Grants a trusted representative with parental powers for a limited period.

Download: PDF |

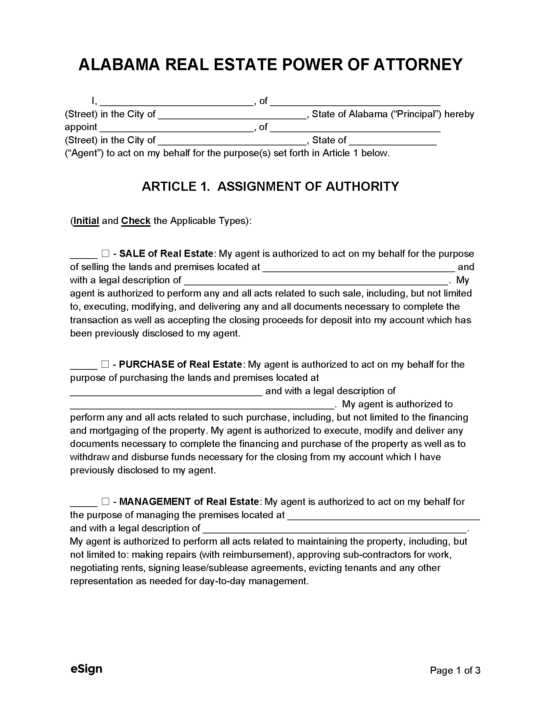

Real Estate Power of Attorney – Enables a buyer or owner of real estate to assign a representative to carry out a transaction on their behalf. Real Estate Power of Attorney – Enables a buyer or owner of real estate to assign a representative to carry out a transaction on their behalf.

Download: PDF, Word (.docx), OpenDocument |

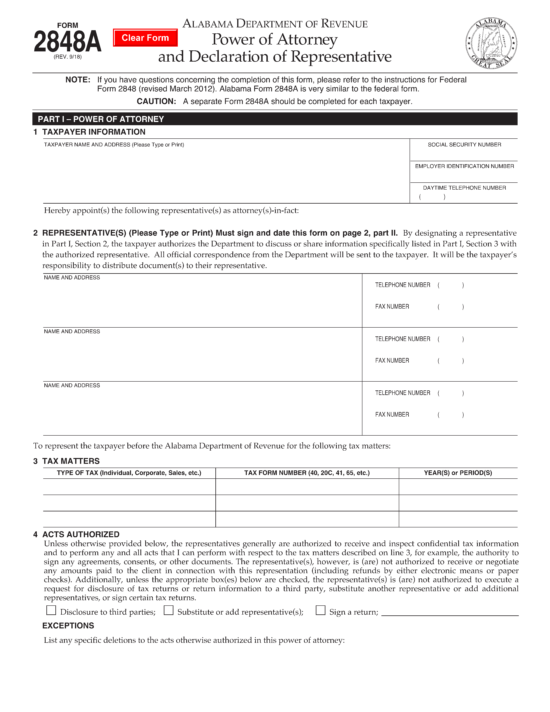

Tax (Form 2848A) Power of Attorney – Allows a tax professional to handle filing with the Alabama Dept. of Revenue. Tax (Form 2848A) Power of Attorney – Allows a tax professional to handle filing with the Alabama Dept. of Revenue.

Download: PDF |