When to Use a Small Claims Demand Letter

A small claims demand letter is used when a person or company claims another party owes them money. It’s usually sent after the initial attempts to recover payment were unsuccessful but before filing a lawsuit in small claims court.

Most states have rules on what claims can and cannot be brought before the small claims court. In general, the small claims court handles disputes over:

- Unpaid personal loans.

- Broken verbal or written agreements.

- Medical expenses from personal injury.

- Property damage.

- Security deposit refunds.

Maximum Small Claim Amounts

Each state limits the dollar amount that can be sued for in small claims court. In some states, claims exceeding this limit may still be filed, but the claimant can only recover up to the maximum amount and forfeits the right to pursue additional damages in future lawsuits.

The link below contains a state-by-state list of the maximum recoverable amounts as of this writing. Certain exceptions may apply; individuals should check with their local court to see if the claim is valid.

State Small Claim Limits |

||

| STATE | MAXIMUM AMOUNT | LAW |

| Alabama | $6,000 | § 12-12-31(a) |

| Alaska | $10,000 | § 22.15.040(a) |

| Arizona | $3,500 | § 22-503(A) |

| Arkansas | $5,000 | Guide to Small Claims Court |

| California | $12,500 for individuals, $6,250 for entities | §§ 116.220(a)(1), 116.221 |

| Colorado | $7,500 | § 13-6-403(1)(a) |

| Connecticut | $5,000 for money damages, $15,000 for home improvements contracts | § 51-15(d) |

| Delaware | $25,000 | §§ 9301(1), (2) |

| Florida | $8,000 | Rule 7.010(b) |

| Georgia | $15,000 | § 15-10-2(a)(5) |

| Hawaii | $5,000 | § 633-27(a) |

| Idaho | $5,000 | § 1-2208(1)(a) |

| Illinois | $10,000 | Rule 281 |

| Indiana | $10,000 for individuals, $6,000 for businesses and trusts | Small Claims Manual, pp. 11 & 17 |

| Iowa | $6,500 | § 631.1(1)(b) |

| Kansas | $10,000 | § 61-2703(a) |

| Kentucky | $2,500 | § 24A.230(1) |

| Louisiana | $5,000 | § 5202(A) |

| Maine | $6,000 | § 7482 |

| Maryland | $5,000 | § 4-405 |

| Massachusetts | $7,000 | Ch. 218 § 21 |

| Michigan | $7,000 | § 600.8401 |

| Minnesota | $20,000, or $4,000 if the claim involves a consumer credit transaction | § 491A.01(Subd. 3a)(a) |

| Mississippi | $3,500 | § 9-11-9 |

| Missouri | $5,000 | Missouri Small Claims Court Handbook, p.1 |

| Montana | $7,000 | § 25-35-502(1) |

| Nebraska | $6,000 | § 25-2802(4) |

| Nevada | $10,000 | § 73.010(1) |

| New Hampshire | $10,000 | § 503:1(I) |

| New Jersey | $5,000 | New Jersey Judiciary Small Claims, p. 1 |

| New Mexico | $10,000 | § 34-8a-3(A)(2) |

| New York | $5,000 in City Courts, $3,000 in Town and Village Courts, $10,000 in New York City, and $5,000 in Nassau and Suffolk Counties | NY Courts – Small Claims |

| North Carolina | $10,000 | § 7A-210 |

| North Dakota | $15,000 | § 27-08.1-01(1) |

| Ohio | $6,000 | § 1925.02(A)(1) |

| Oklahoma | $10,000 | § 12-1751(A) |

| Oregon | $10,000 | § 55.011(3) |

| Pennsylvania | $12,000 | Bringing Suit Before a Magisterial District Judge |

| Rhode Island | $5,000 | § 10-16-1 |

| South Carolina | $7,500 | § 22-3-10 |

| South Dakota | $12,000 | § 15-39-45.1 |

| Tennessee | $25,000 (no maximum for evictions or claims to recover personal property) | § 16-15-501(d) |

| Texas | $20,000 | § 26.042(a) |

| Utah | $20,000 | § 78A-8-102(1)(a)(i) |

| Vermont | $10,000, or $5,000 if the claim involves a consumer credit transaction or medical debt | A Guide to Small Claims Proceedings in Vermont, p. 4 |

| Virginia | $5,000 | § 16.1-122.2 |

| Washington | $10,000 for individuals, $5,000 for all other matters | § 12.40.010 |

| West Virginia | $10,000 | § 50-2-1 |

| Wisconsin | $10,000 for money claims, $5,000 for personal injury, $25,000 for consumer credit property claims, and $5,000 for non-consumer credit property claims | § 799.01(1)(d), Wisconsin Court System – Small Claims |

| Wyoming | $6,000 | § 1-21-201 |

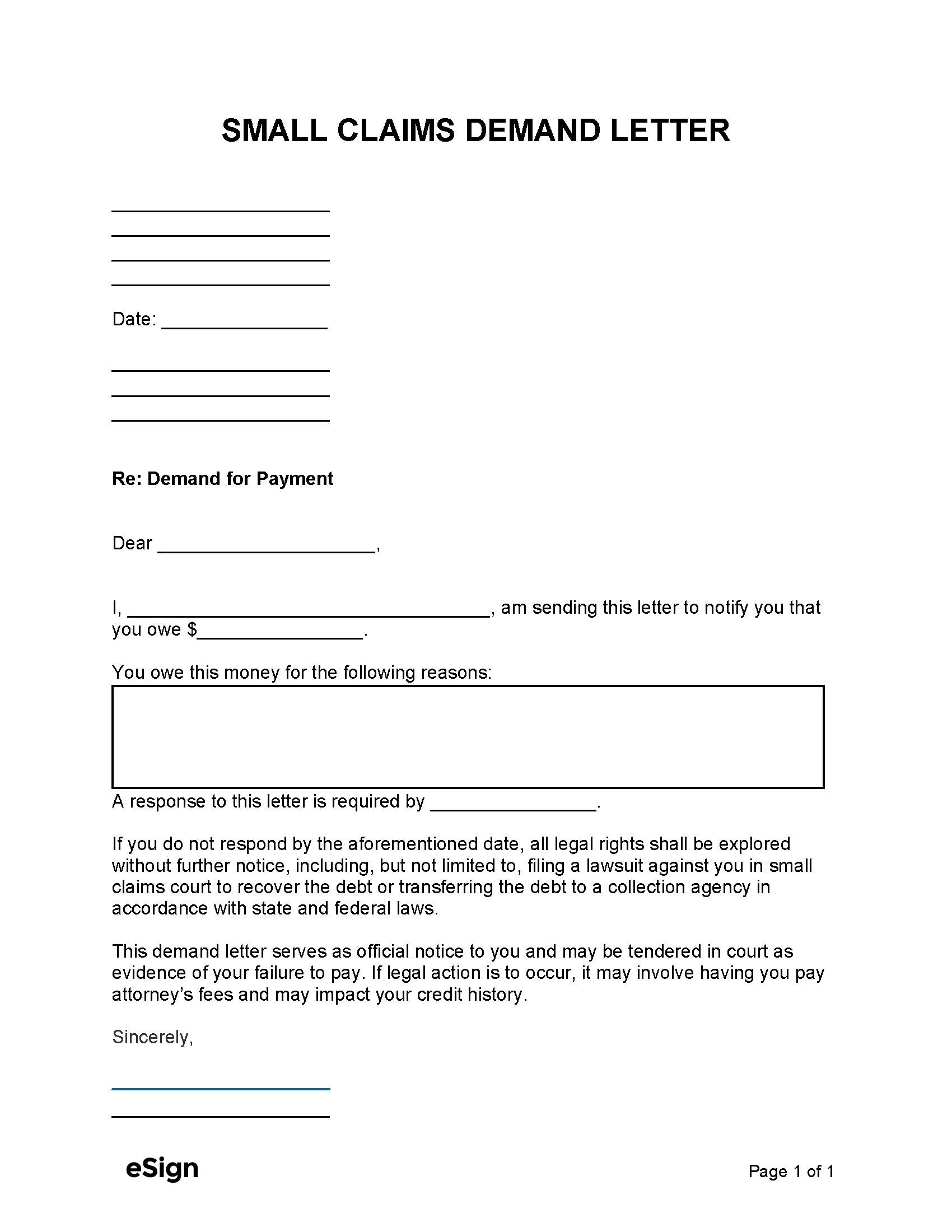

Sample

Download: PDF, Word (.docx), OpenDocument

[SENDER NAME]

[SENDER ADDRESS]

[SENDER CONTACT INFO]

Date: [DATE]

[RECIPIENT NAME (AND TITLE, IF APPLICABLE)]

[RECIPIENT BUSINESS NAME (IF APPLICABLE)]

[RECIPIENT ADDRESS]

Re: Demand for Payment

Dear [RECIPIENT NAME],

I, [NAME OF PERSON SENDING LETTER], am sending this letter to notify you that you owe $[DOLLAR AMOUNT].

You owe this money for the following reasons: [DESCRIBE REASON FOR MONEY OWED].

A response to this letter is required by [DATE].

If you do not respond by the aforementioned date, all legal rights shall be explored without further notice, including, but not limited to, filing a lawsuit against you in small claims court to recover the debt or transferring the debt to a collection agency in accordance with state and federal laws.

This demand letter serves as official notice to you and may be tendered in court as evidence of your failure to pay. If legal action is to occur, it may involve having you pay attorney’s fees and may impact your credit history.

Sincerely,

________________________

[SENDER’S NAME (AND TITLE, IF APPLICABLE)]