The Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from unfair, abusive, and deceptive practices from collection agencies.

Under § 809(b) of the FDCPA, a consumer who receives a notice of debt from a debt collection agency has 30 days to dispute the debt and request information regarding it. To do so, the consumer must send a debt validation letter challenging the debt and/or demanding validation.

The debt validation letter can ask for documents and information such as:

- The original creditor’s name and address

- A copy of any Judgment related to the debt

- The debt amount and the date it became delinquent

During the time that the disputed debt is being validated, the agency must stop all collection activities and communications with the consumer. If they don’t respond to the letter, the debt can be considered invalid.

How to Write

A debt validation letter should include the following:

- Sender Information – The consumer’s name and address.

- Date – The date the letter is being drafted.

- Collection Agency Information – Collection agency’s name and address.

- Debt Account Number – If known.

- Notice of Debt – The collection agency contact date and method.

- Statement of Dispute – A statement that the consumer is disputing the debt.

- Demand for Validation – A list of documentation requested by the consumer.

- Signature – The consumer’s signature.

Once complete, the letter should be sent by certified mail to the collection agency.

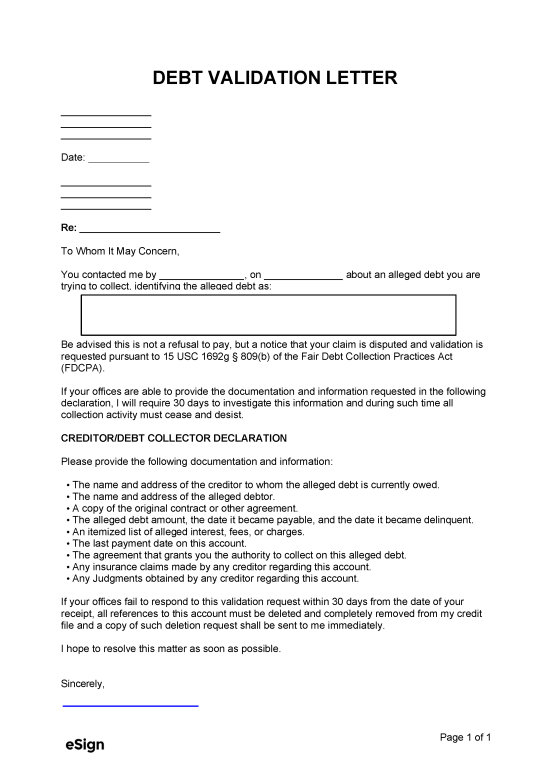

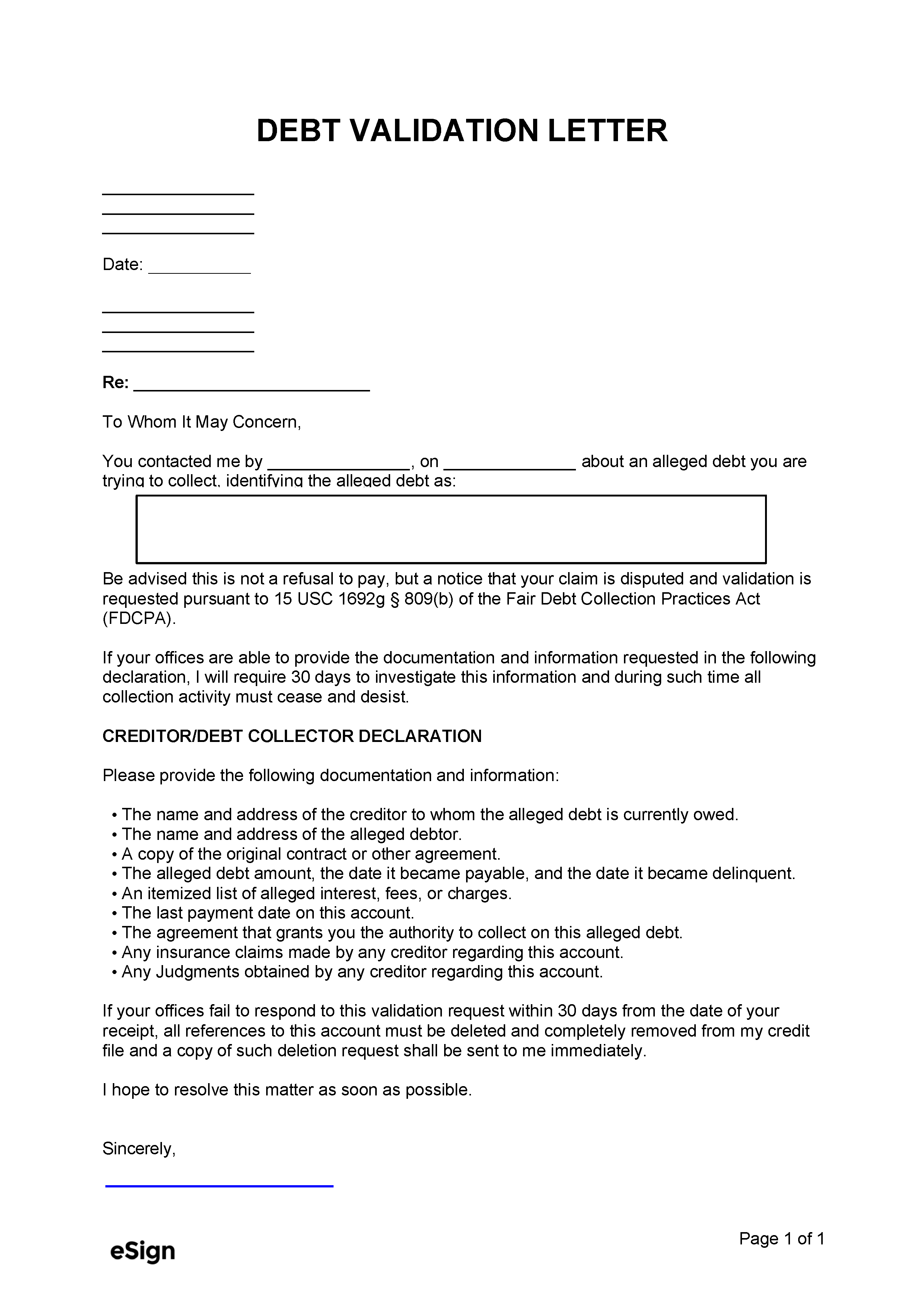

Sample

Download: PDF, Word (.docx), OpenDocument

[SENDER NAME]

[SENDER ADDRESS]

[SENDER CONTACT INFO]

Date: [DATE]

[COLLECTION AGENCY NAME]

[COLLECTION AGENCY ADDRESS]

Re: [DEBT ACCOUNT #]

To Whom It May Concern,

You contacted me by [CONTACT METHOD], on [DATE] about an alleged debt you are trying to collect, identifying the alleged debt as [DESCRIBE ALLEGED DEBT].

Be advised this is not a refusal to pay but a notice that your claim is disputed, and validation is requested pursuant to 15 USC 1692g § 809(b) of the Fair Debt Collection Practices Act (FDCPA).

If your offices are able to provide the documentation and information requested in the following declaration, I will require 30 days to investigate this information and during such time all collection activity must cease and desist.

CREDITOR/DEBT COLLECTOR DECLARATION

Please provide the following documentation and information:

- The name and address of the creditor to whom the alleged debt is currently owed.

- The name and address of the alleged debtor.

- A copy of the original contract or other agreement.

- The alleged debt amount, the date it became payable, and the date it became delinquent.

- An itemized list of alleged interest, fees, or charges.

- The last payment date on this account.

- The agreement that grants you the authority to collect on this alleged debt.

- Any insurance claims made by any creditor regarding this account.

- Any Judgments obtained by any creditor regarding this account.

If your offices fail to respond to this validation request within 30 days from the date of your receipt, all references to this account must be deleted and completely removed from my credit file and a copy of such deletion request shall be sent to me immediately.

I hope to resolve this matter as soon as possible.

Sincerely,

______________________

[SENDER’S NAME]