Is an Operating Agreement Required in Alaska?

No – Operating agreements are not required in Alaska, but drafting one is strongly recommended for LLCs of all sizes.

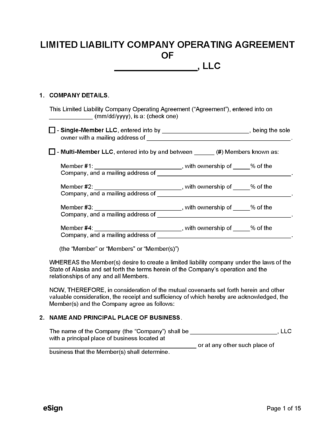

Types (2)

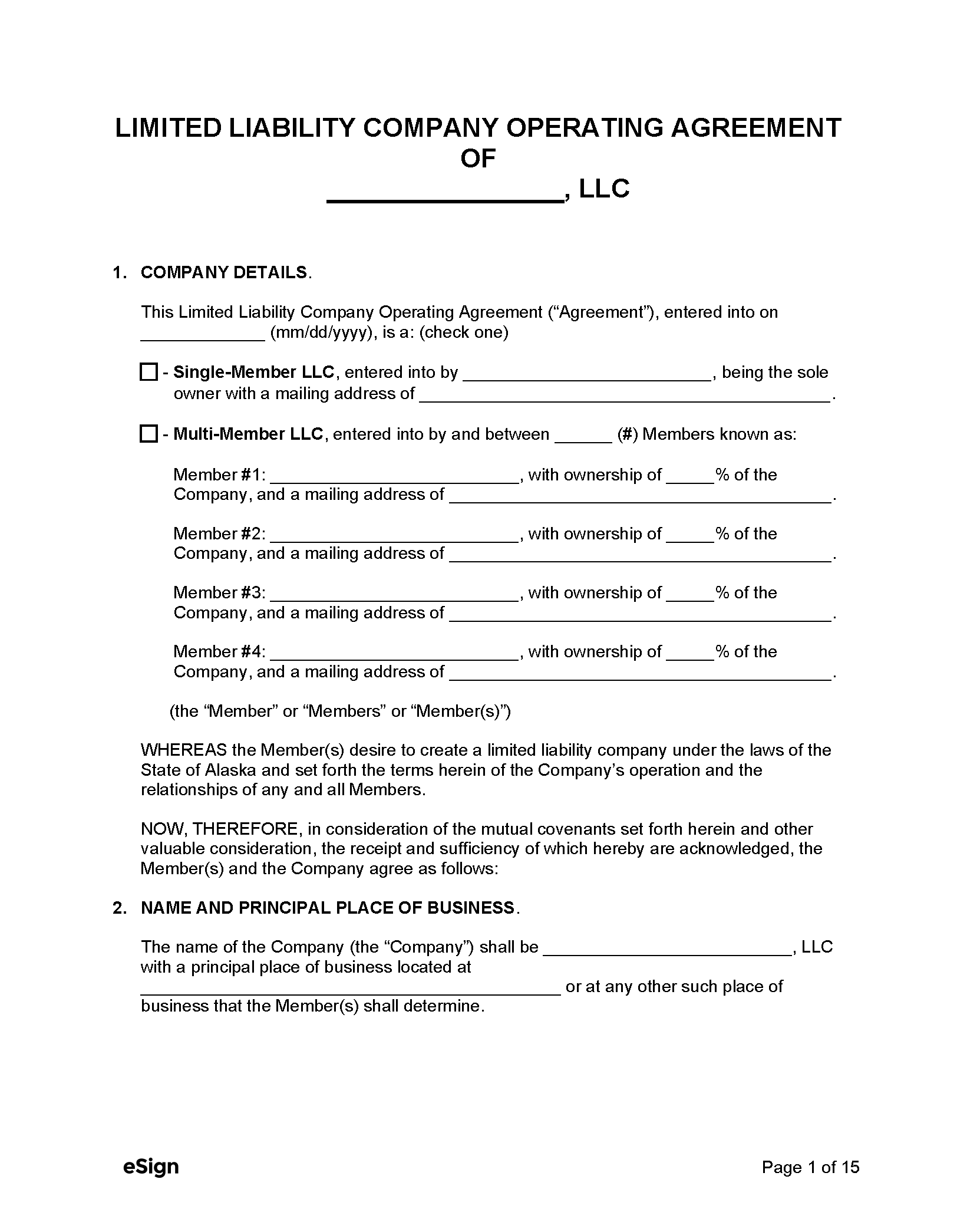

Single-Member LLC Operating Agreement – Designed for entities that have one sole owner. Single-Member LLC Operating Agreement – Designed for entities that have one sole owner.

|

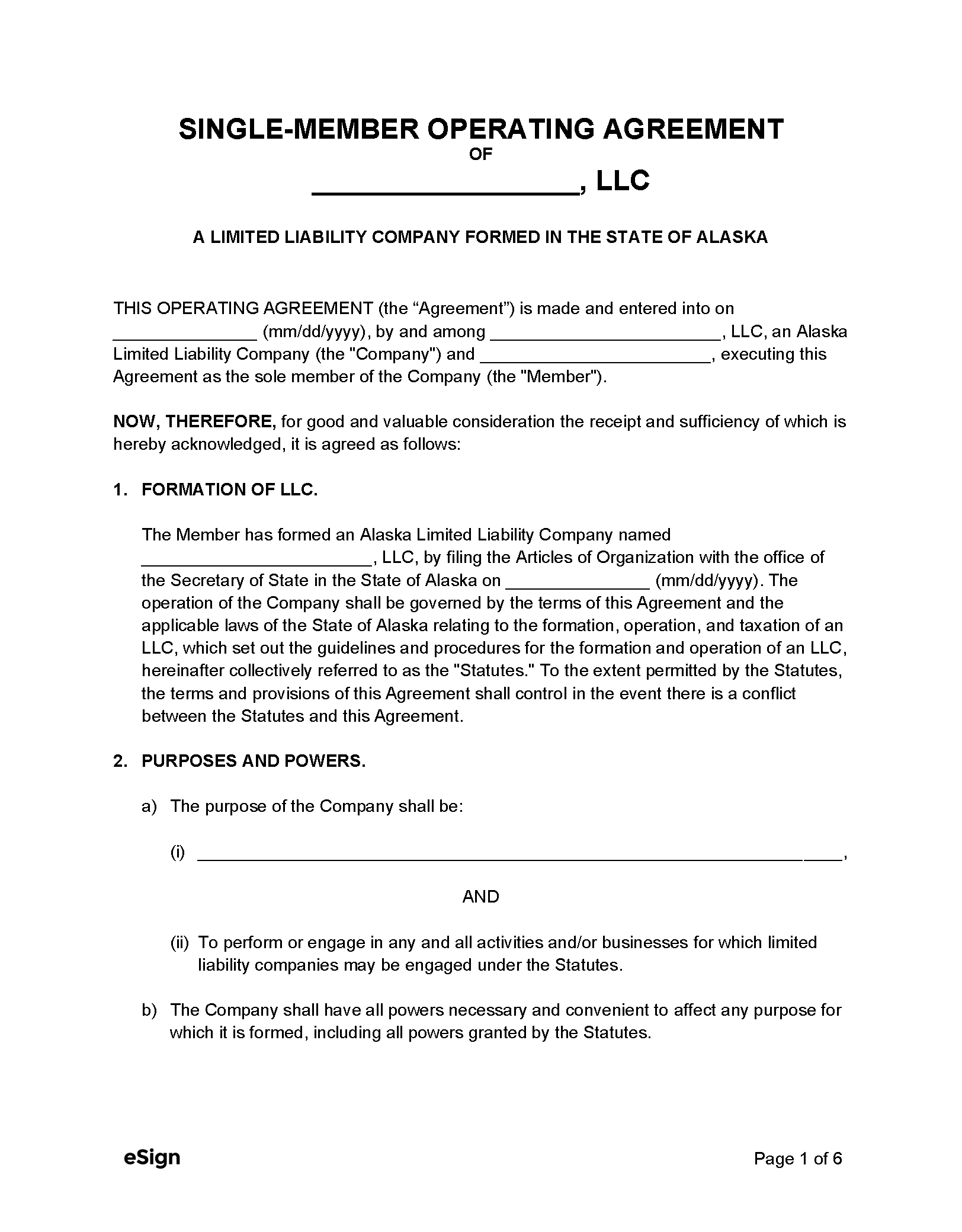

Multi-Member LLC Operating Agreement – For companies that split ownership among two or more people/entities. Multi-Member LLC Operating Agreement – For companies that split ownership among two or more people/entities.

|