The form should be delivered by mail within 7-10 days of denial, although the FCRA (Fair Credit Reporting Act) permits recipients to be informed orally or digitally as well.

Contents |

Sample

Download: PDF, Word (.docx), OpenDocument

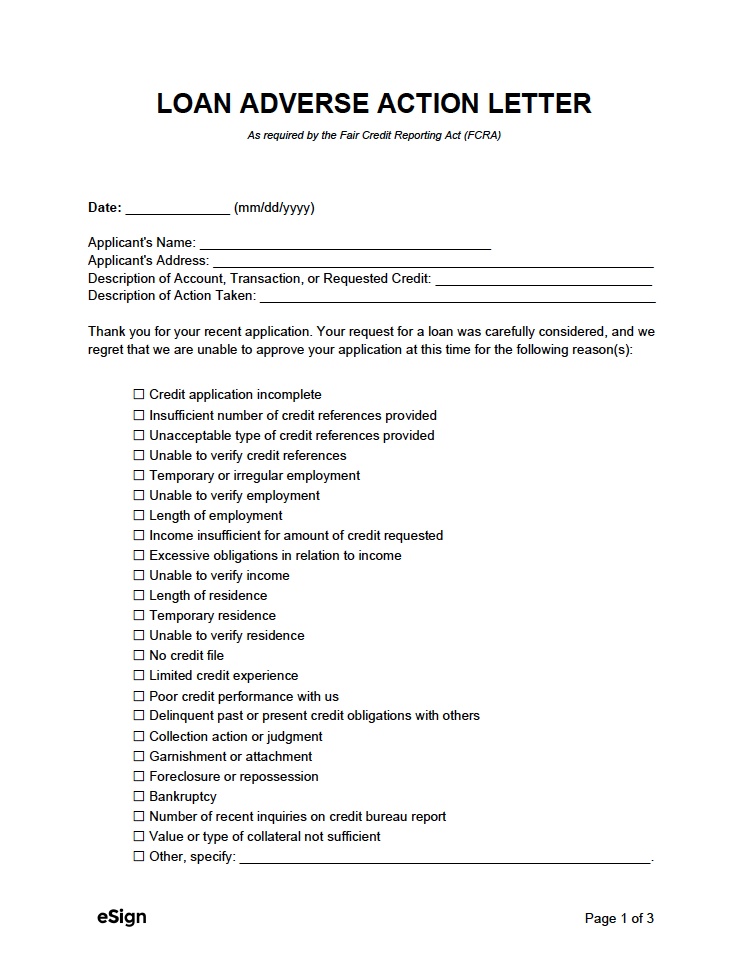

LOAN ADVERSE ACTION LETTER

As required by the Fair Credit Reporting Act (FCRA)

Date: [MM/DD/YYYY]

Applicant’s Name: [APPLICANT NAME]

Applicant’s Address: [APPLICANT ADDRESS]

Description of Account, Transaction, or Requested Credit: [ACTION TAKEN]

Description of Action Taken: [ACTION DESCRIPTION]

Thank you for your recent application. Your request for a loan was carefully considered, and we regret that we are unable to approve your application at this time for the following reason(s):

☐ Credit application incomplete

☐ Insufficient number of credit references provided

☐ Unacceptable type of credit references provided

☐ Unable to verify credit references

☐ Temporary or irregular employment

☐ Unable to verify employment

☐ Length of employment

☐ Income insufficient for the amount of credit requested

☐ Excessive obligations in relation to income

☐ Unable to verify income

☐ Length of residence

☐ Temporary residence

☐ Unable to verify residence

☐ No credit file

☐ Limited credit experience

☐ Poor credit performance with us

☐ Delinquent past or present credit obligations with others

☐ Collection action or judgment

☐ Garnishment or attachment

☐ Foreclosure or repossession

☐ Bankruptcy

☐ Number of recent inquiries on credit bureau report

☐ Value or type of collateral not sufficient

☐ Other, specify: [OTHER REASON].

☐ (Check if applicable). Our credit decision was based in whole or in part on information obtained in a report from the consumer reporting agency listed below. You have a right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency.

The reporting agency played no part in our decision and is unable to supply specific reasons why we have denied credit to you. You also have a right to a free copy of your report from the reporting agency if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

Reporting Agency Name: [REPORTING AGENCY NAME]

Reporting Agency Address: [REPORTING AGENCY ADDRESS]

Reporting Agency Telephone number (Toll-Free): [REPORTING AGENCY PHONE]

We also obtained your credit score from this consumer reporting agency and used it in making our credit decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change depending on how the information in your consumer report changes.

Your credit score: [APPLICANT CREDIT SCORE]

Date: [MM/DD/YYYY]

Scores range from a low of [#] to a high of [#].

Key factors that adversely affected your credit score:

- [FACTOR 1]

- [FACTOR 2]

- [FACTOR 3]

- [FACTOR 4]

- Number of recent inquiries on a consumer report, as a key factor.

If you have any questions regarding your credit score, you should contact the entity that provided the credit score at:

Address: [ENTITY ADDRESS]

Telephone number (Toll-Free): [PHONE NUMBER]

| (Check if applicable)

☐ Our credit decision was based in whole or in part on information obtained from an affiliate or from an outside source other than a consumer reporting agency. Under the Fair Credit Reporting Act, you have the right to make a written request, no later than 60 days after you receive this notice, for disclosure of the nature of this information. Creditor’s name: [CREDITOR NAME] |

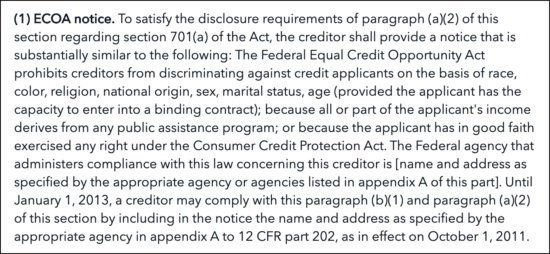

ECRA Notice: The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The Federal agency that administers compliance with this law concerning this creditor is (name and address as specified by the appropriate agency listed in appendix A).

Notice Requirements (2)

If an individual’s credit score is one of the reasons for their rejection, specific additions must be made to the adverse action letter. Two (2) laws mandate notices sent by creditors: the FCRA (Fair Credit Reporting Act) and the Equal Credit Opportunity Act (ECOA). Each act has specific requirements for sending notices, which are noted below.

FCRA Requirements

FCRA notice information must be provided if the following applies:

- Adverse action was taken as a result of information revealed in a consumer report (regardless if it was the only reason or one of many reasons);

- The applicant’s credit is denied (or another unfavorable action) based on information that was acquired from third parties (not including consumer reporting agencies) relating to the consumer’s creditworthiness, standing, credit capacity, personal character, reputation, and/or mode of living; OR

- Adverse action was taken based upon information provided by a corporate affiliate of the person taking the action.

Laws: FCRA (15 U.S.C § 1681)

Required information:

- A notice that adverse action was taken as a result of information acquired from a consumer reporting agency.

- The consumer’s right to receive a free copy of the consumer report from the reporting agency, as long as it is requested within 60 days.

- The consumer’s right to dispute the accuracy or completeness of any information found in the consumer report.

- The name, address, and phone number of the consumer reporting agency that provided the report.

- A clear statement that the reporting agency did not make the credit decision and is unable to provide to the consumer the specific reasons why adverse action was taken against them.

- If the consumer was denied credit based on information obtained from third (3rd) parties other than consumer reporting agencies, it must include a statement explaining that the consumer has the right to request the information that was relied on in taking adverse action within sixty (60) days of receipt of the notice.

- If the consumer was denied credit based upon info obtained from an affiliate, the notice needs to contain a disclosure that states the consumer has the right to obtain information on the report by sending a written request within sixty (60) days after receiving the notice. The consumer needs to receive the information within thirty (30) days after receiving their written request.

ECOA Requirements

ECOA notice information must be provided if:

- Adverse action was taken on a completed credit application;

- Adverse action was taken on an incomplete credit application;

- Adverse action was taken on an existing credit account; or

- The creditor made a counteroffer to an application for credit and the applicant does not accept the counteroffer.

Laws: 15 USC Ch. 41, Sub Ch. IV

Required information:

- The name and address of the creditor.

- An ECOA antidiscrimination notice (should be very similar to the one that can be found in 12 C.F.R. §1002.9(b)(1))*.

- The name and address of the creditor’s primary regulator.

- A statement of the action taken by the creditor (if they denied, are offering different terms, etc.).

- A statement listing the specific reason(s) for the action taken OR a disclosure that informs the applicant of their right to the specific reasons for their rejection and the name, address, and phone number of the person or office from which said information can be obtained.