Contents |

What is a Personal Loan Agreement?

A personal loan agreement is a form that creates a legal obligation for one person to repay another person/entity money that was lent to them. There are two (2) general types of personal loans: secured and unsecured. A secured loan requires the borrower to use the value of an asset as collateral. This means that if the borrower defaults on their payments, the lender can auction or sell the asset (property, vehicle, stock, bond, etc.) to make back their money. An unsecured loan does not involve any collateral.

What can personal loans be used for?

Individuals can obtain a personal loan for many reasons, including, but not limited to, the following:

- Consolidating debt

- Repairing / renovating a home

- Medical bills

- Financing a vehicle

- Helping out family or friends

- Paying for a funeral

- Divorce costs

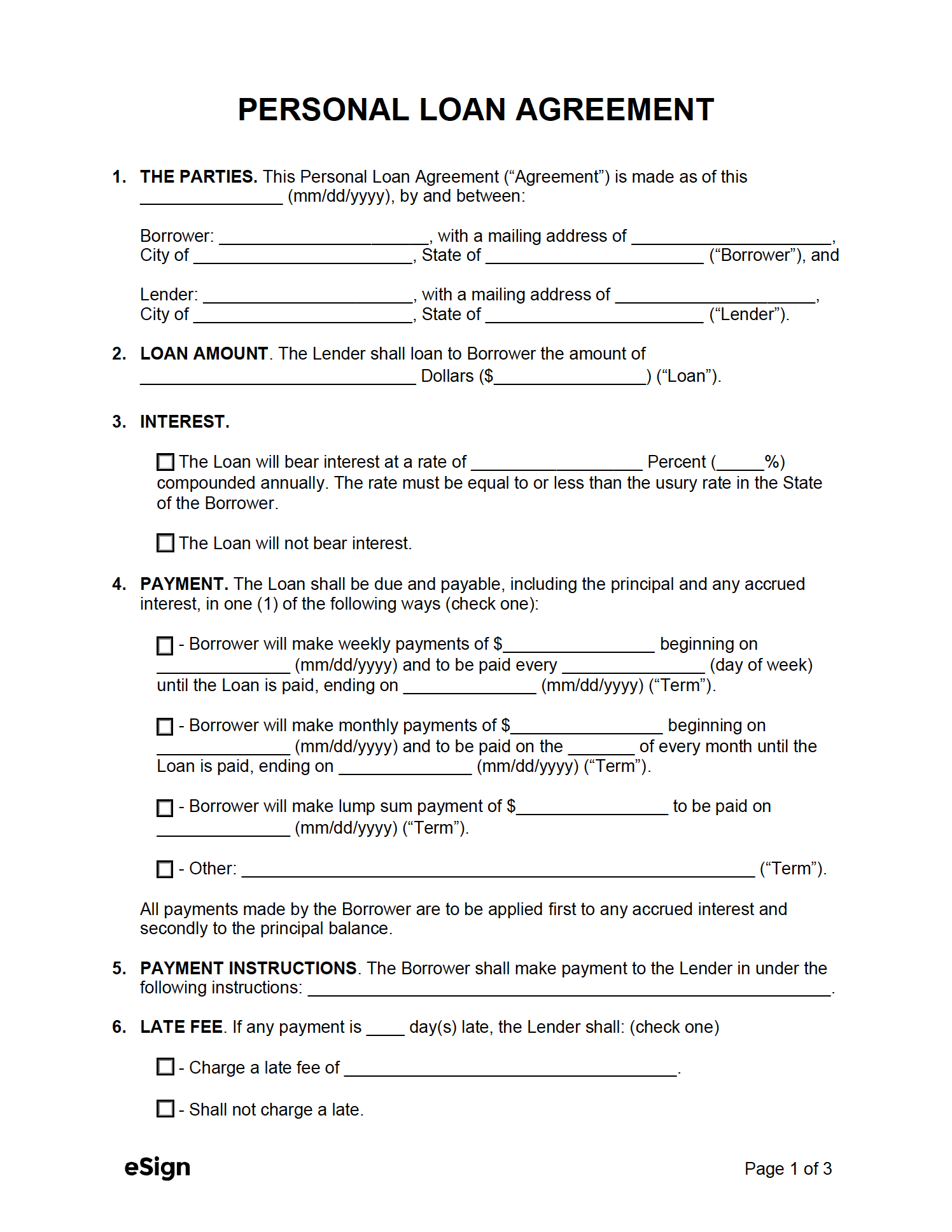

Sample

Download: PDF, Word (.docx), OpenDocument

PERSONAL LOAN AGREEMENT

1. THE PARTIES. This Personal Loan Agreement (the “Agreement”) is made as of this [MM/DD/YYYY], by and between [BORROWER NAME], with a mailing address of [BORROWER ADDRESS] (the “Borrower”), and [LENDER NAME], with a mailing address of [LENDER ADDRESS] (the “Lender”).

2. LOAN AMOUNT. The Lender shall loan the Borrower the amount of [AMOUNT] (the “Loan”).

3. INTEREST. The Loan will bear interest at a rate of [RATE] Percent compounded annually. The rate must be equal to or less than the usury rate in the State of the Borrower.

4. PAYMENT. The Loan shall be due and payable, including the principal and any accrued interest, in one (1) of the following ways (check one):

☐ – Borrower will make weekly payments of $[AMOUNT] beginning on [MM/DD/YYYY] and to be paid every [FREQUENCY] (day of the week) until the Loan is paid, ending on [MM/DD/YYYY] (the “Term”).

☐ – Borrower will make monthly payments of $[AMOUNT] beginning on [MM/DD/YYYY] and to be paid on the [#] of every month until the Loan is paid, ending on [MM/DD/YYYY] (the “Term”).

☐ – Borrower will make a lump sum payment of $[AMOUNT] to be paid on [MM/DD/YYYY] (the “Term”).

☐ – Other: [OTHER PAYMENT TERM] (the “Term”).

All payments made by the Borrower are to be applied first to any accrued interest and secondly to the principal balance.

5. PAYMENT INSTRUCTIONS. The Borrower shall pay the Lender under the following instructions: [PAYMENT INSTRUCTIONS].

6. LATE FEE. If any payment is [#] day(s) late, the Lender shall: (check one)

☐ – Charge a late fee of [DESCRIBE LATE FEE].

☐ – Shall not charge a late.

7. SECURITY. The Loan Amount under this Agreement shall be: (check one)

☐ – Secured. There shall be property described as [DESCRIBE HOW THE PROPERTY IS SECURED] (the “Security”) that shall transfer to the possession and ownership of the Lender immediately pursuant to Section 9(a) of this Agreement.

☐ – Unsecured. There shall be NO SECURITY provided in this Agreement.

The Security may not be sold or transferred without the Lender’s consent until the Due Date. If the Borrower breaches this provision, the Lender may declare all sums due under this Agreement immediately due and payable, unless prohibited by applicable law. The Lender shall have the sole option to accept the Security as full payment for the Loan without further liabilities or obligations. If the market value of the Security does not exceed the balance of the Loan, the Borrower shall remain liable for the remaining balance while accruing interest at the maximum rate allowed by law.

8. PREPAYMENT. The Borrower has the right to pay back the Loan in full or make additional payments at any time without penalty.

9. REMEDIES. No delay or omission on the part of the holder of this Agreement in exercising any right hereunder shall operate as a waiver of any such right or of any other right of such holder, nor shall any delay, omission, or waiver on any one occasion be deemed a bar to or waiver of the same or any other right on any future occasion. The rights and remedies shall be cumulative and may be pursued singly, successively, or together, at the sole discretion of the Lender.

10. ATTORNEYS FEES. In the event any payment under this Agreement is not paid when due, the Borrower agrees to pay, in addition to the principal and interest hereunder, reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate in the State of [STATE NAME] of the then outstanding balance owing on the Loan, plus all other reasonable expenses incurred by the Lender in exercising any of its rights and remedies upon default.

11. EVENTS OF ACCELERATION. The occurrence of any of the following shall constitute an “Event of Acceleration” by the Lender under this Agreement:

a) Borrower’s failure to pay any part of the principal or interest as and when due under this Agreement; or

b) Borrower’s becoming insolvent or not paying its debts as they become due.

12. ACCELERATION. Upon the occurrence of an Event of Acceleration under this Agreement, and in addition to any other rights and remedies that the Lender may have, the Lender shall have the right, at its sole and exclusive option, to declare the balance of the Loan AND the Security described in section 7 immediately due and payable.

13. WAIVERS BY BORROWER. No waiver of any provision of this Agreement shall be effective unless made in writing and signed by the waiving party. The failure of any party to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

14. SUCCESSORS. This Agreement shall be binding upon and inure to the benefit of the respective successors and permitted assigns of each of the parties to this Agreement.

15. GOVERNING LAW. This Agreement shall be governed by, and construed in accordance with, the laws in the State of [STATE NAME].

16. ADDITIONAL TERMS & CONDITIONS.

[ENTER ANY ADDITIONAL TERMS AND CONDITIONS].

IN WITNESS WHEREOF, the Borrower has executed this Agreement as of the day and year first above written.

Borrower Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [BORROWER NAME]

Lender Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [LENDER NAME]

Witness Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

Witness Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]