Is an Operating Agreement Required?

No – While state law doesn’t mandate the execution of operating agreements, it is considered common practice.

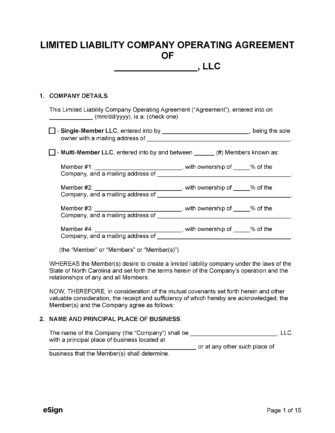

Types (2)

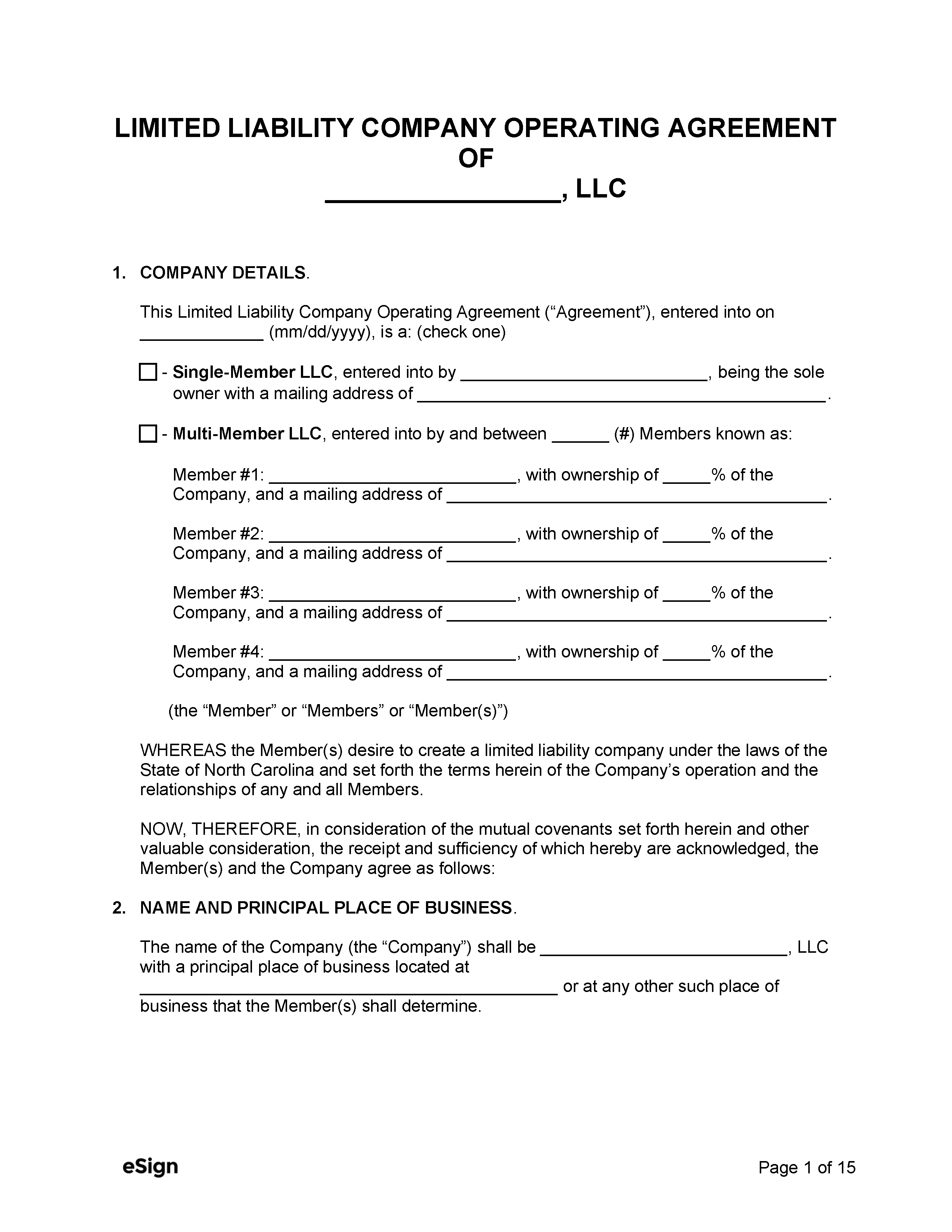

Single-Member LLC Operating Agreement – A simplified contract to be used by companies with one member. Single-Member LLC Operating Agreement – A simplified contract to be used by companies with one member.

|

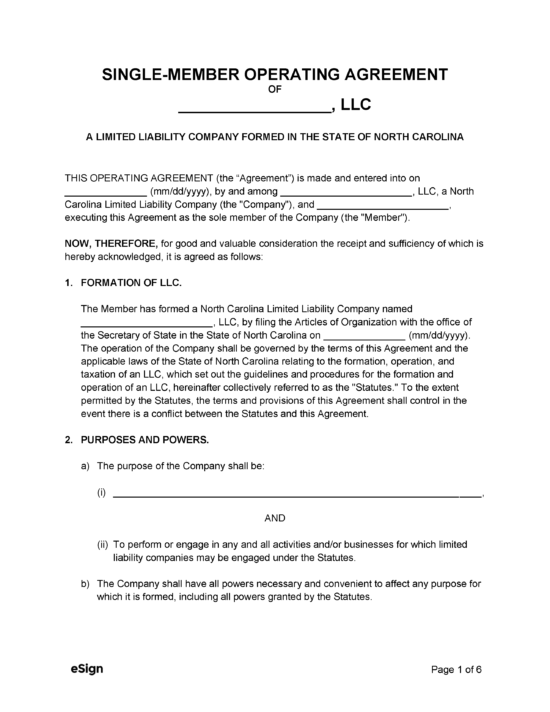

Multi-Member LLC Operating Agreement – An operating agreement for use by LLCs with two or more members. Multi-Member LLC Operating Agreement – An operating agreement for use by LLCs with two or more members.

|