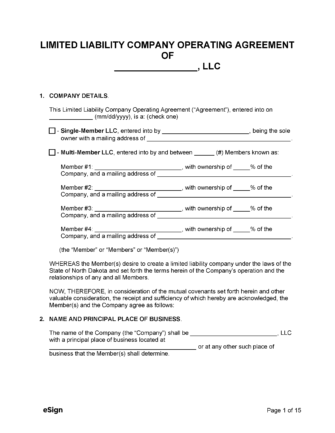

Is an Operating Agreement Required?

No – Although state law doesn’t require companies to create operating agreements, they can help protect the members from liability and disagreements.

Types (2)

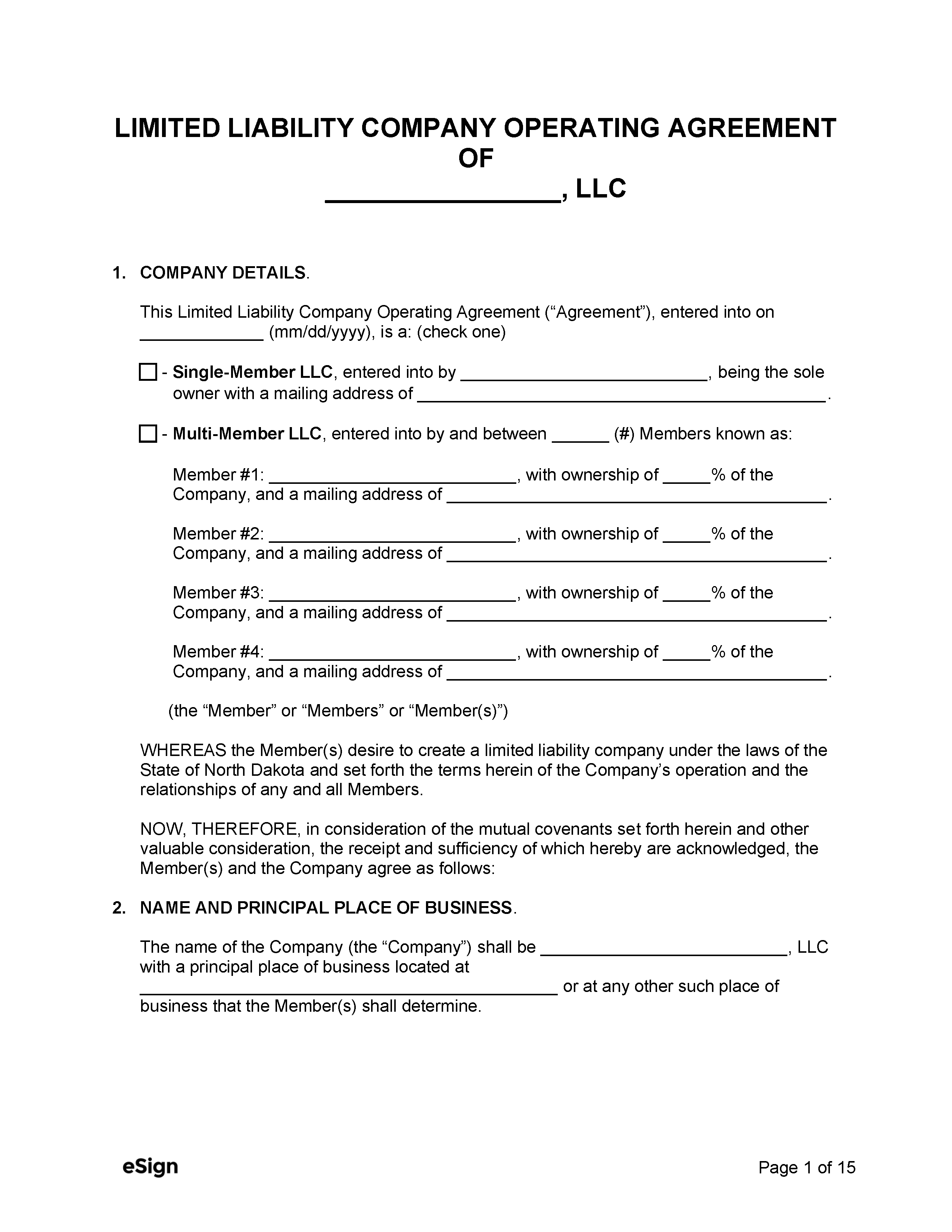

Single-Member LLC Operating Agreement – Establishes the rules and regulations for an LLC that has one sole owner. Single-Member LLC Operating Agreement – Establishes the rules and regulations for an LLC that has one sole owner.

|

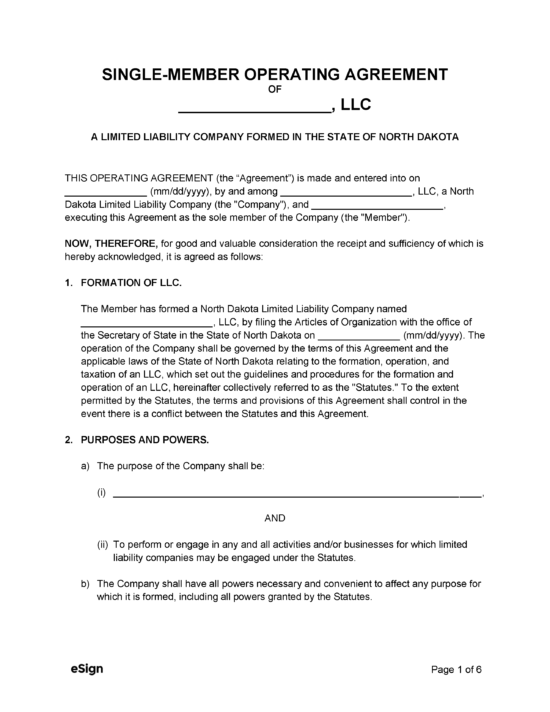

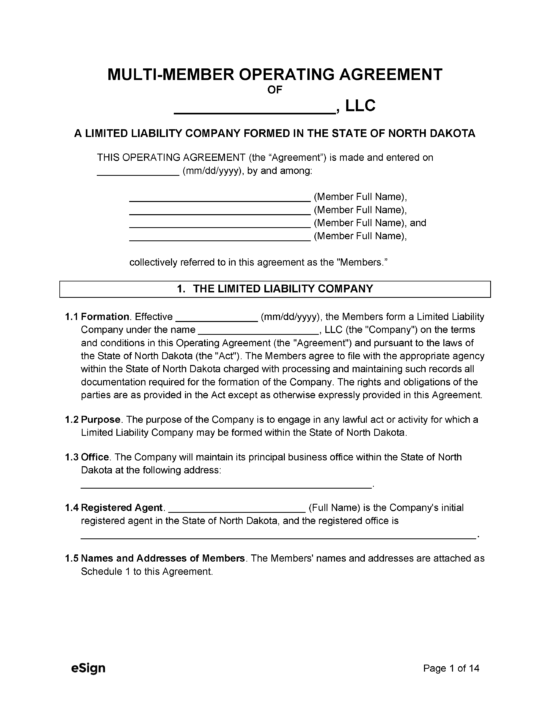

Multi-Member LLC Operating Agreement – An operating agreement for an LLC that has more than one member. Multi-Member LLC Operating Agreement – An operating agreement for an LLC that has more than one member.

|