Laws

- Maximum Estate Value: $40,000[1]

- Mandatory Waiting Period: 30 days after filing[2]

- Where to File: Probate Court

How to File (4 Steps)

Step 1 – Conditions

Connecticut’s settlement process for small estates is available only if all of the following conditions apply:

- The total value of the decedent’s property is $40,000 or less

- The decedent did not own real estate solely in their name

- The filer is the decedent’s surviving spouse, next of kin, or another person or entity with an interest in the estate

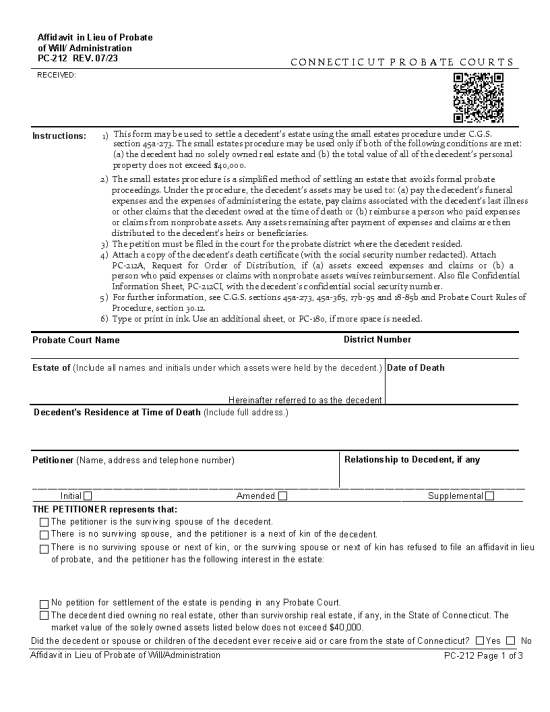

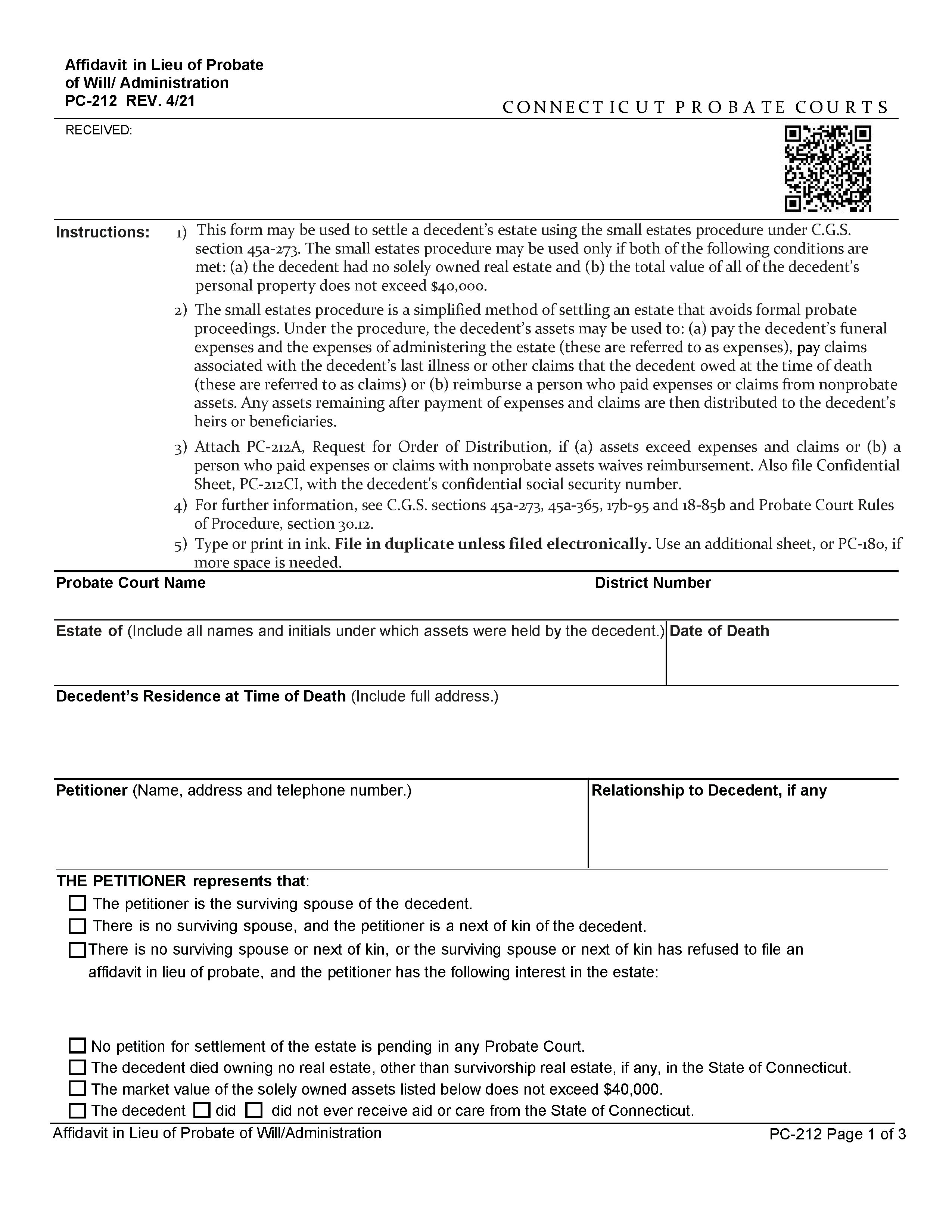

Step 2 – Required Forms

The person initiating the small estate process (“petitioner”) must fill out the Affidavit in Lieu of Probate of Will (Form PC-212), the Confidential Information Sheet (Form PC-212CI), and attach a copy of the death certificate.

A Request for Order of Distribution (Form PC-212A) is also needed if either of the following applies:

- The value of all assets exceeds the estate’s total expenses and claims

- The person who paid the expenses and claims waives reimbursement

Step 3 – Court Filing

The petitioner’s paperwork may be submitted either in person at the probate court or online using the state’s eFiling service. After filing, a 30-day waiting period must elapse before the court issues its decision.

Step 4 – Asset Distribution

If the court approves the Affidavit, it will issue an Order for Distribution that sets the priority for paying debts and specifies how any remaining assets should be distributed to heirs and beneficiaries.