Laws

- Maximum Estate Value: $75,000[1]

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: No filing required.

How to Use (3 Steps)

Step 1 – Small Estate Conditions

To qualify as a small estate in Kansas, all of the following must be true:

- The value of the decedent’s property does not exceed $75,000

- All debts, claims, and taxes due on the decedent’s account have been paid

- The affiant is entitled to the estate under the decedent’s will or Kansas succession laws

- There is no pending or granted petition for the appointment of an executor or administrator of the decedent’s estate

Step 2 – Required Documents

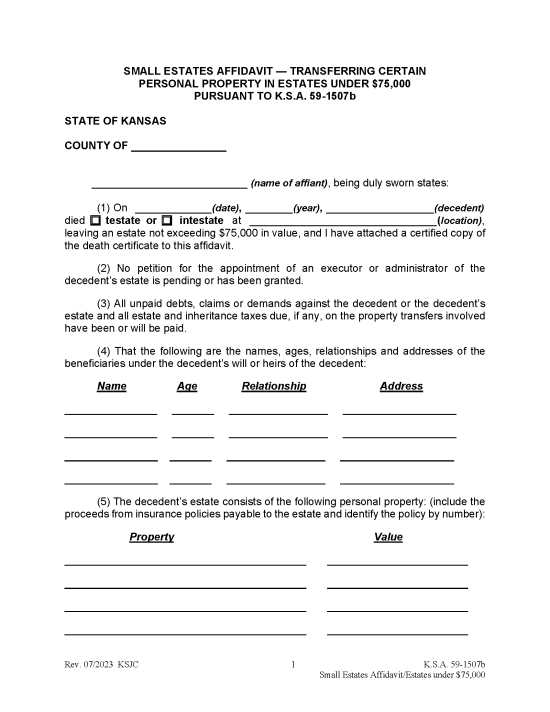

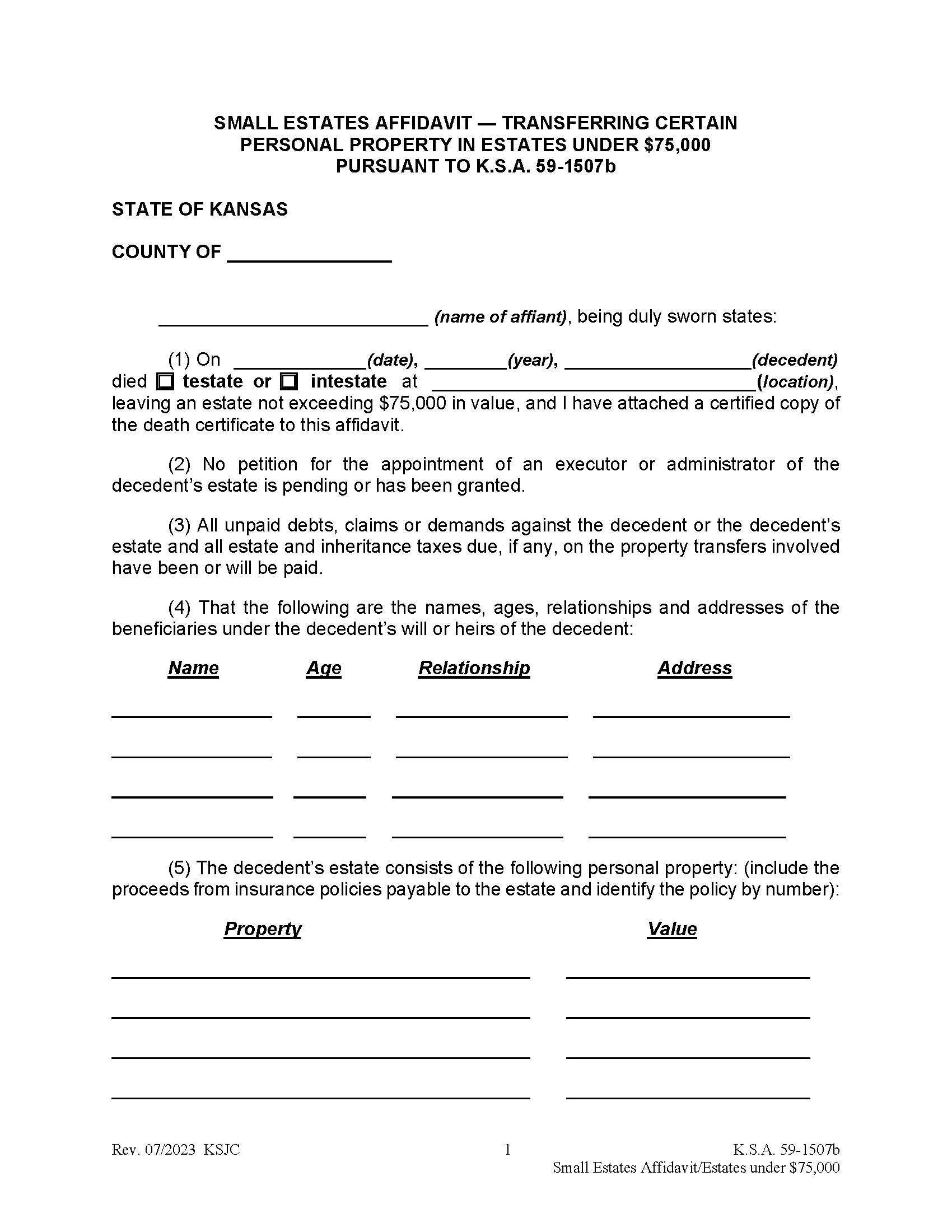

An individual entitled to the decedent’s property must complete the Small Estates Affidavit and attach the decedent’s will (if applicable) and a copy of the death certificate. The Affidavit must then be sworn before a notary public, who will apply their official seal.

Note: To claim any vehicles that are included in the estate, the affiant must also complete the Claim of Heir and/or Beneficiary Affidavit.

Step 3 – Property Distribution

The notarized Affidavit can be used to claim and collect the decedent’s assets by presenting the document to the individual, bank, company, or agency holding the property and/or records. Assets will need to be distributed to the decedent’s heirs in accordance with their will or state law.