Laws

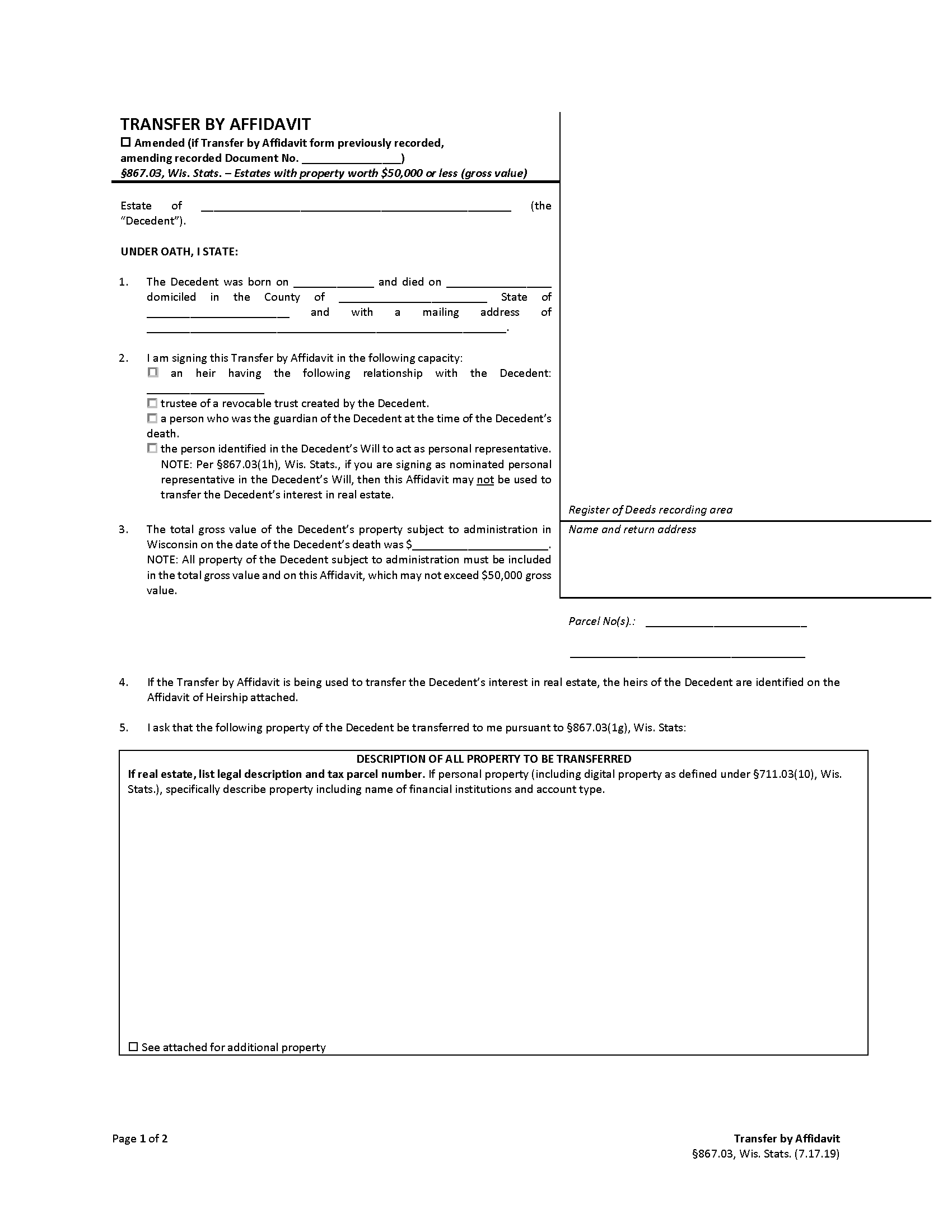

- Statute: § 867.03

- Maximum Estate Value (§ 867.03(1g)): $50,000

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Register of Deeds

How to File (4 Steps)

- Step 1 – Requirements

- Step 2 – Complete Affidavit and Other Required Forms

- Step 3 – File Application

- Step 4 – Summary Distribution

Step 1 – Requirements

The individual completing the Transfer by Affidavit is called the affiant. This person may be an heir, a trustee, or a decedent’s guardian. If no real property is being transferred, then the affiant may also be a personal representative named in the decedent’s will.

The following must be included with or in the affidavit:

- The description and value of the property being transferred, including the names of any financial institutions and account types.

- The dollar amount of the total gross value of the property.

- The Affidavit of Heirship and Affidavit of Service or Waiver of Notice if real property is being transferred.

- Whether the decedent or their spouse received these government medical services:

- Medicaid/Medical Assistance;

- A Managed Care Organization provided Family Care and/or Partnership benefits;

- Community Options Program;

- Wisconsin Chronic Disease Program; or

- Patient/inmate of a state or county institution or hospital.

Step 2 – Complete Affidavit and Other Required Forms

When all the requirements in the previous step have been met, the affiant may complete the Transfer by Affidavit. When complete, the affiant will need to distribute the notarized form with all additional documents to the necessary parties.

If the deceased or their spouse received the medical services as described in the previous step, a copy of the Transfer of Affidavit must be sent via certified mail to the Estate Recovery Program at the following address:

Wisconsin Department of Health Services

Estate Recovery Program

P.O. Box 309

Madison, WI

53701-0309

If the decedent’s estate included real estate, the affiant must provide all of the decedent’s heirs with a copy of the following documents:

- Transfer by Affidavit

- Affidavit of Heirship

- Affidavit of Service or Waiver of Notice

- Notice stating the affiant will record the Transfer of Affidavit with the Register of Deeds.

These documents are to be sent to all heirs via certified mail or personal service at least thirty (30) days before submitting the Transfer of Affidavit to the Register of Deeds.

Step 3 – File Application

Once all required forms have been executed, notarized, and sent to the appropriate parties, the affiant will need to file the forms with the Register of Deeds. A copy of the affidavit(s) must be filed in every county where real property being transferred is located.

Step 4 – Summary Distribution

Once the Transfer of Affidavit has been recorded, the affiant may distribute the property as designated in the will or by intestate succession laws, once all decedent’s debts have been paid. If the affiant is a person named in the will as a personal representative, property may not be transferred until thirty (30) days after the day the Transfer of Affidavit was recorded unless the individual is an heir, trustee, or guardian.