Laws

- Maximum Estate Value[1]:

- Primary Residence: $750,000

- Personal & Other Real Property (Combined): $208,850 (exclusions apply)[2]

- Real Property Only (Non-Primary Residence): $69,625

- Mandatory Waiting Period: 6 months for real property other than primary residence, 40 days for all other property[3]

- Where to File: Superior Court where real property is located (filing not required for personal property)

How to File (4 Steps)

Step 1 – Determine Eligibility

The estate must meet the following requirements to be eligible for distribution outside of probate:

- The value of the decedent’s property does not exceed the state maximum

- 40 days have passed since the decedent’s death, or 6 months if collecting real property other than the primary residence

- No probate administration has been or will be opened, unless the appointed personal representative provides written consent

- No other person has a greater claim to the property being collected

- If collecting real property other than the primary residence, last illness expenses, funeral expenses, and unsecured debts must have been paid

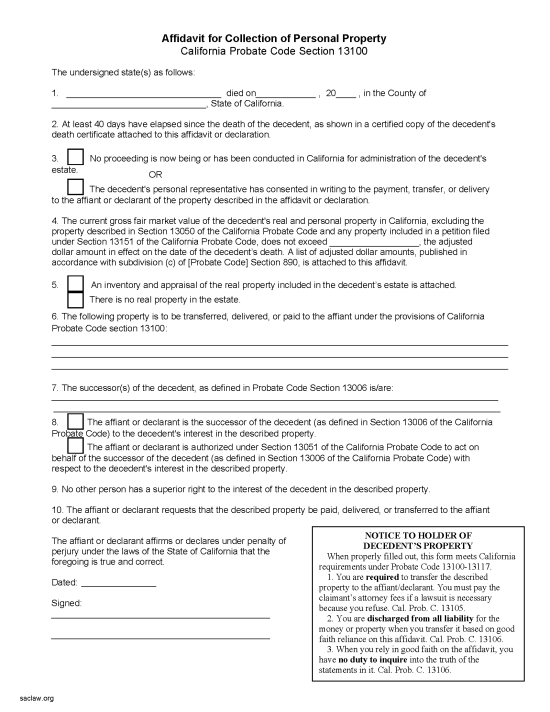

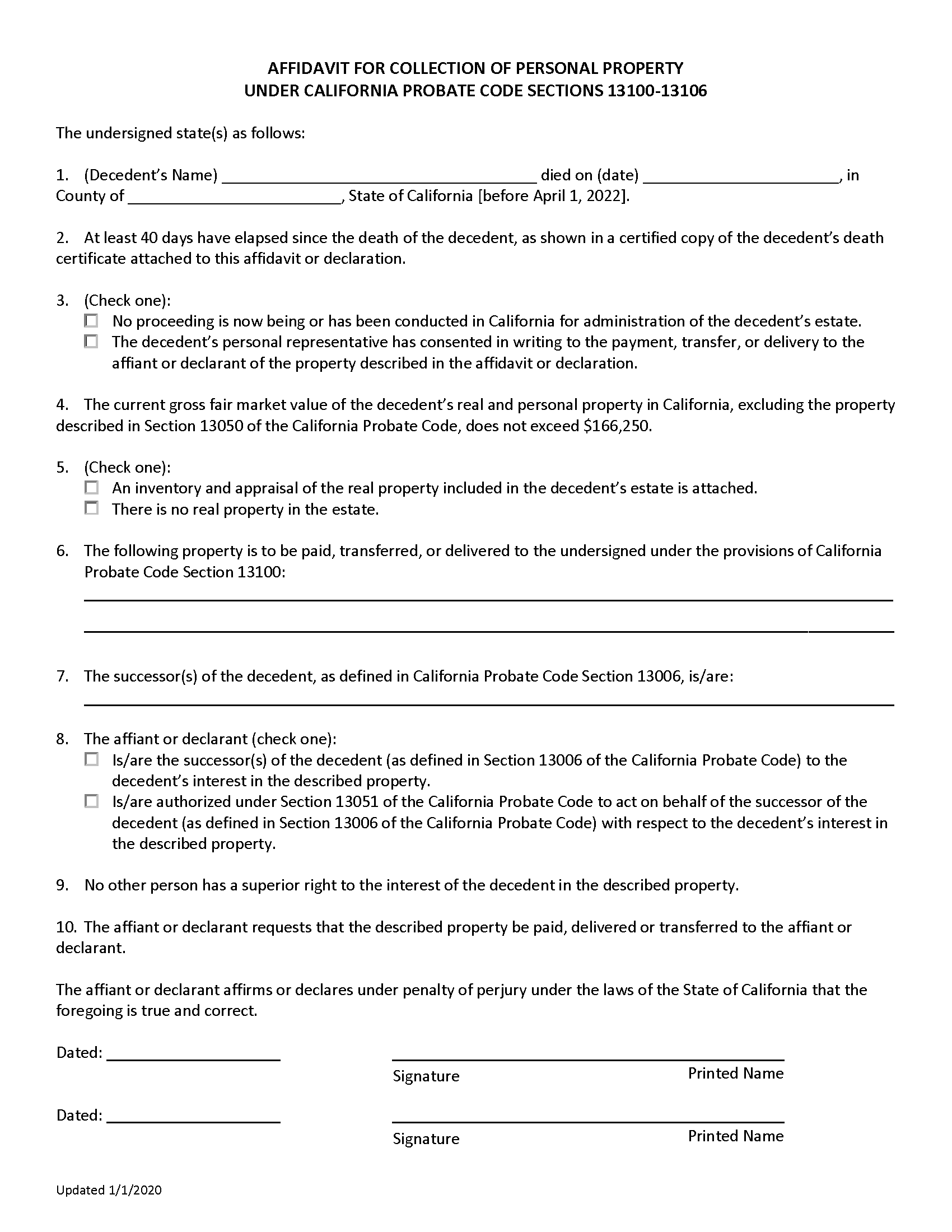

Step 2 – Complete the Forms

The successor must complete the form that corresponds to the type of property being collected:

- Personal Property: Affidavit for Collection of Personal Property

- Primary Residence: Petition to Determine Succession to Primary Residence (Form DE-310)

- Other Real Property: Affidavit Re Real Property of Small Value (Form DE-305)

Each form mentioned above must include the following attachments:

- Certified copy of the death certificate

- Copy of the will (if any)

- Written consent from the personal representative (if the court has appointed one)

- Inventory and Appraisal (Form DE-160) – Required only if the decedent owned real property

Step 3 – File With the Court (if applicable)

If the successor is claiming real property, the completed documents must be filed with the superior court in the county where the property is located. A filing fee will apply.

A hearing will be set for claims involving the decedent’s primary residence. In that case, the successor must:

- Send notice of the claim to all successors named in the Petition within 5 business days of filing.[4]

- Deliver a Notice of Hearing (Form DE-120) to all successors named in the Petition at least 15 days before the hearing.[5]

If the judge approves the Petition at the court hearing, they will provide the successor an Order Determining Succession to Primary Residence (Form DE-315).

Step 4 – Collect Property

The successor may claim the property by presenting the completed forms and proof of identity to the individual or entity holding the assets.