Laws

- Statute: Chapter 81: Small Estates

- Maximum Estate Value (§ 1901(a)): $45,000

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Probate Court

How to Record (3 Steps)

- Step 1 – Qualifications

- Step 2 – Complete Affidavit and Other Required Forms

- Step 3 – File Affidavit

- Step 4 – Distribute Assets and Submit Final Report

Step 1 – Qualifications

In order to file the Petition to Open Small Estate, the petitioner must ensure that the estate’s value does not exceed $45,000 and only includes personal property. The qualifying property may include a time-share estate, but no other type of real estate can be transferred through this petition. Any property that automatically transfers to a spouse or beneficiary through survivorship is not included in the value of the estate.

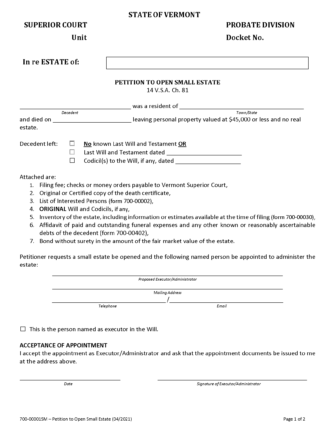

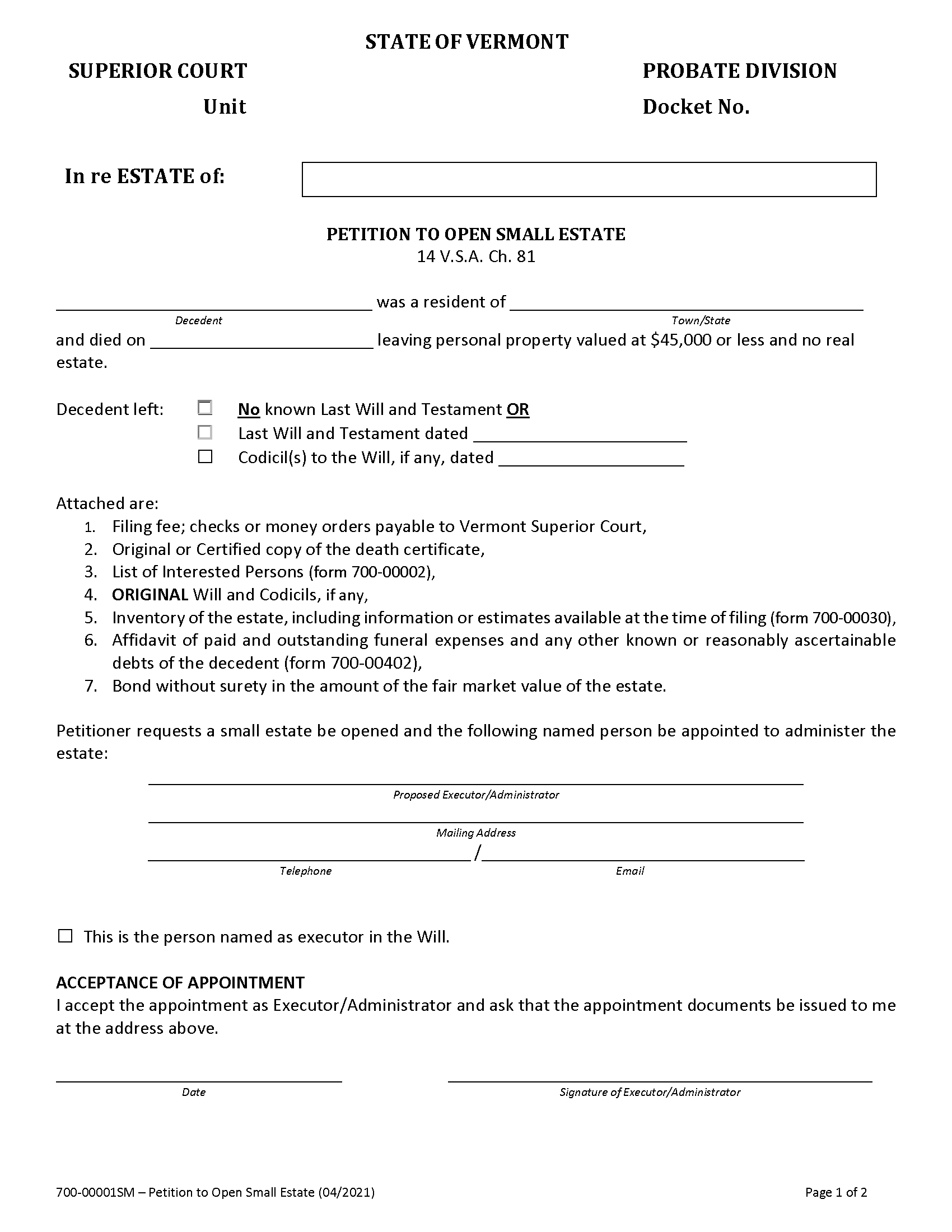

Step 2 – Complete Affidavit and Other Required Forms

If the above qualifications are met, the petitioner may complete the Petition to Open Small Estate in order to select an individual to administer the estate. They must also complete other documents, including:

- List of Interested Persons (Form 700-00002E)

- Inventory of Estate (Form 700-00030)

- Affidavit of Paid & Outstanding Funeral Expenses and Debts for Small Estate (Form 700-00402)

- Estate Administration Bond (Form 700-00020) (without surety in the estate’s fair market value)

- Waiver of Surety on Estate Administration Bond (Form 700-00004) (in lieu of the Estate Administration Bond)

- Original or certified copy of death certificate

- Original will and codicils (if any)

Step 3 – File Affidavit

Once completed, the documents detailed in the previous step may be filed with the local probate court. A filing fee will be charged amounting to $50 for estates valued at $10,000 or less, and $110 for estates valued at $10,000 – $45,000.

A copy of the petition must be provided to interested parties that did not sign the petition. A Certificate of Service (Form 100-00264) must then be provided to the court, proving that the parties were provided a copy of the document. Any interested party who wishes to contest this petition must provide an objection with the court within fourteen (14) days of receiving this notice.

Step 4 – Distribute Assets and Submit Final Report

If there are no objections, the court will appoint the person named in the petition as the estate’s fiduciary. The fiduciary will then be issued letters of administration, which they will be able to use to obtain the property and distribute it to the appropriate parties. The fiduciary should use Receipt (Form 700-00153) to keep track of all distributions.

A Report of Fiduciary of Small Estate (Form 700-00055) must be submitted by the fiduciary to the court when all expenses and debts have been paid, and all receipts have been provided.