Laws

- Statute: § 700.3983

- Maximum Estate Value (§ 700.3983(1)(a) & § 700.1210): $15,000, less liens and encumbrances, and adjusted annually according to the cost-of-living factor set by the Department of Treasury (see most-current adjustment). For deaths occurring in 2021, the maximum is $24,000.

- Mandatory Waiting Period (§ 700.3983(1)(b)): Twenty-eight (28) days

- Where to File: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Small Estate Qualifications

Certain statutory requirements must be met in order for an estate to qualify for distribution by affidavit. The conditions are as follows:

- The value of the estate cannot exceed the statutory limit, the amount of which is adjusted annually. For deaths occurring in 2021, the maximum is $24,000, excluding liens and encumbrances.

- At least twenty-eight (28) days must pass after the decedent’s death.

- No application or petition for the appointment of a personal representative has been made.

- The affiant must be entitled to the assets being claimed.

- The estate cannot include real property.

Note: If the decedent owned real property, a simplified probate process is available in which a petitioner files a Petition and Order for Assignment with the Probate Court.

Step 2 – Draft Affidavit

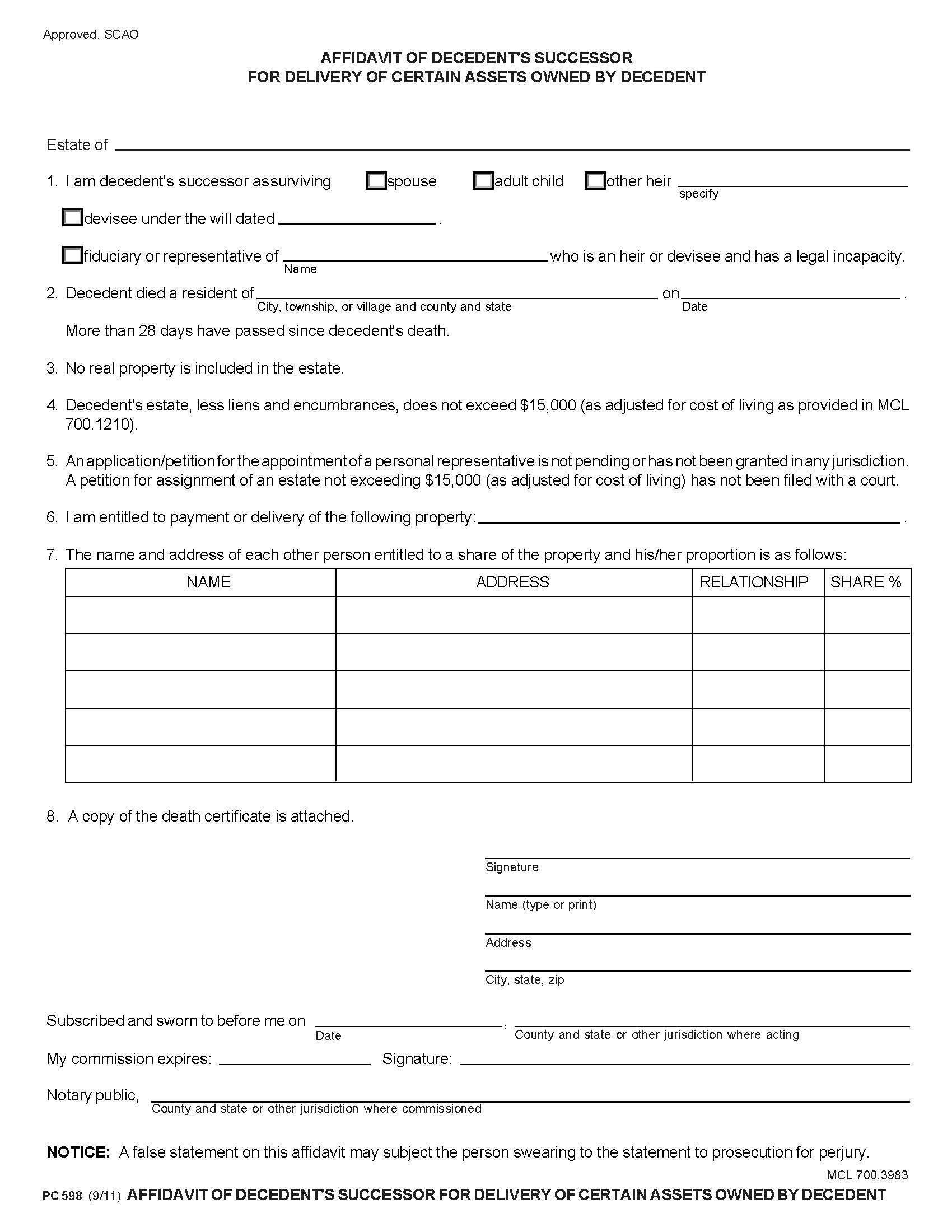

An affiant who claims assets must fill out the Affidavit of Decedent’s Successor for Delivery of Certain Assets Owned by Decedent (PC 598). The affidavit must be signed in the presence of a notary public, and a copy of the death certificate must be attached.

Step 3 – Collect Assets

Michigan statute § 700.3983(1) states that any person possessing the decedent’s assets must relinquish the property upon being presented with a valid affidavit and death certificate. Therefore, all that’s needed to obtain the assets in a small estate are those two (2) documents. However, if the decedent left a motor vehicle, the affiant must take additional action in order to transfer the vehicle’s title to their name; more information on the topic can be found on the Secretary of State webpage.