Laws

- Statute: Title XXXI, Ch. 473 §§ 473.097 – 473.107

- Maximum Estate Value (§ 473.097(1)(1)): $40,000, less liens, debt, and encumbrances

- Mandatory Waiting Period (§ 473.097(1)(2)): Thirty (30) days

- Where to File: Probate Court

How to File (5 Steps)

- Step 1 – Small Estate Criteria

- Step 2 – Estate Bond

- Step 3 – File Affidavit

- Step 4 – Publish Notice

- Step 5 – Collect Assets

Step 1 – Small Estate Criteria

A small estate affidavit can be used to obtain property without awaiting administration from the probate court. The person who files the affidavit, called the “affiant,” must verify that the estate satisfies the following conditions, as required by § 473.097(1):

- At least (30) days have passed from the date of death.

- The value of the decedent’s property does not exceed $40,000, less liens, debt, and encumbrances.

- If the decedent left a will, the will has been presented to the court within the time restrictions specified in § 473.050.

Step 2 – Estate Bond

For most small estates, the affiant will need to obtain a bond in the amount of the decedent’s personal property (real estate excluded). The bond serves to protect the estate assets in the event the affiant becomes incompetent or fails to fulfill their obligations as executor. However, if all heirs agree to waive the bond requirement, they may submit to the court a motion to waive the bond (more on this below).

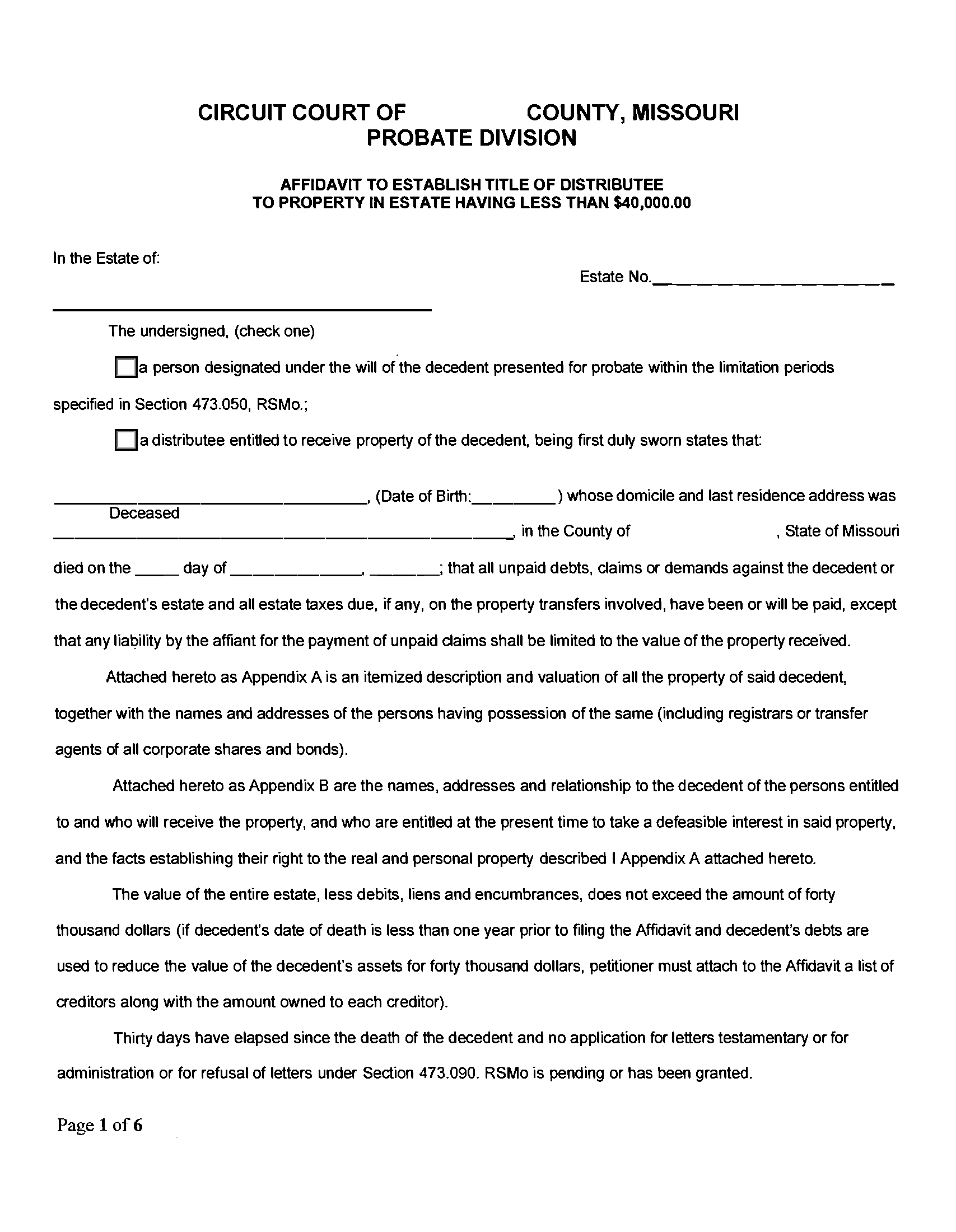

Step 3 – File Affidavit

The affiant must fill out the Affidavit to Establish Title of Distributee and provide their signature in the presence of a notary public. The following must be attached to the affidavit:

- Death certificate;

- Confidential Case Filing Information Sheet;

- Funeral bill with proof of payment; and

- Verification of property owned by the decedent (e.g., titles, certificates).

The above documents must be submitted to a clerk of the Probate Court. Once approved, the clerk will attach a certificate stating specific facts about the estate. The clerk will then provide the affiant with copies of the affidavit and certificate.

Note: If all heirs agree to waive the bond requirement, each heir must sign a separate motion requesting that the bond be waived. (This motion is included in the Affidavit to Establish Title of Distributee.)

Step 4 – Publish Notice

If the value of all property in the estate exceeds $15,000, the probate clerk must publish a notice to inform creditors of their right to claim any unpaid debt. This publication shall be made in a local newspaper once per week for two (2) consecutive weeks. After completion of publication, a proof of publication document must be filed with the court within ten (10) days.

Step 5 – Collect Assets

After the affidavit has been approved, the affiant will be permitted to collect the decedent’s property and transfer it to the heirs. Personal property can be obtained from the custodian of said property, who must release the asset upon receipt of the affidavit. To transfer real estate ownership, the heirs must file a copy of both the affidavit and the clerk’s certificate with the recorder of deeds.

If the decedent owned a vehicle but didn’t name a Transfer on Death (TOD) beneficiary, the heir will need to file a title application (Motor Vehicle – Watercraft) with the Department of Revenue. They will also need to file the existing certificate of title, a copy of the small estate affidavit, and the applicable filing fee (see FAQ for more info).