Laws

- Statute: § 2113.03

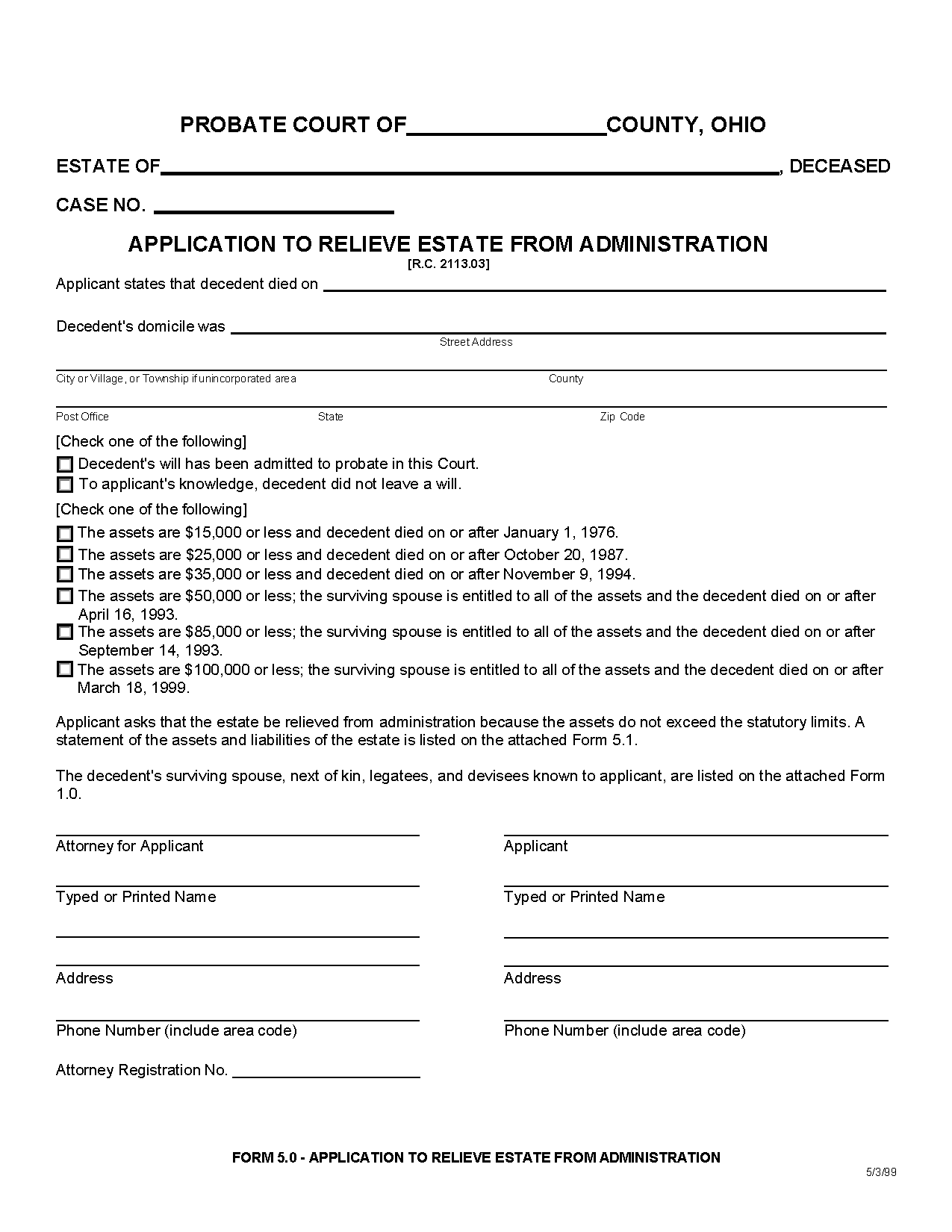

- Maximum estate value (§ 2113.03(A)(1) & (2)): $35,000, or $100,000 if the surviving spouse is the sole beneficiary in the decedent’s will or if they are entitled to all of the decedent’s estate under § 2105.06 or § 2106.13(B)(1) & (2).

- Mandatory waiting period: Not mentioned in state statutes.

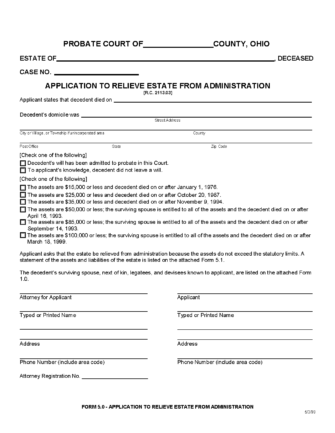

- Where to file: Probate Court

How to Record (4 Steps)

- Step 1 – Qualify as a Small Estate

- Step 2 – Complete Attachments

- Step 3 – Submit Application and Send Notices

- Step 4 – Distribute Estate

Step 1 – Qualify as a Small Estate

The total value of the decedent’s assets must be under $35,000 to qualify as a small estate. The limit is raised to $100,000 for surviving spouses if one of the following applies:

- The decedent left a will entitling the spouse to all of the decedent’s assets (§ 2113.03(A)(2)(a)).

- The decedent died intestate, and there are surviving children (or lineal descendants) who are children of the spouse (§ 2105.06(B)).

- The decedent died intestate, and there are no children (or lineal descendants) (§ 2105.06(E)).

Step 2 – Complete Attachments

The applicant must complete a written inventory of the estate’s property and assets using the Assets and Liabilities of Estate to be Relieved from Administration (Form 5.1). The inventory may be taken with an appraiser, who will need to sign the document.

The applicant must also identify all parties entitled to the decedent’s assets using the Surviving Spouse, Children, Next of Kin, Legatees and Devisees (Form 1.0). Once completed, both forms will be attached to the application in the following step.

Step 3 – Submit Application and Send Notices

The applicant must submit the completed application, supplementary forms, and will (if any) to the probate court. The court will give a length of time for notices to be sent to the parties indicated in Form 1.0 (unless the notices are waived in the application) and, if deemed necessary, for a notice to be published in a newspaper in circulation in the county (§ 2113.03(B)).

Step 4 – Distribute Estate

On a date following the expiration of the notice and publication period, the court will hold a hearing at the date and time indicated on the Application to Release Estate from Administration. If the hearing is successful, the court will relieve the estate from administration, and the applicant may collect and distribute the property to the rightful inheritors.