Laws

- Statute: § 33-24-1

- Maximum Estate Value (§ 33-24-1(a)): $15,000, not including tangible personal property

- Mandatory Waiting Period (§ 33-24-1(a)): Thirty (30) days

- Where to File: Probate Court

How to File (4 Steps)

- Step 1 – Petition Requirements

- Step 2 – File Petition

- Step 3 – Collect Assets

- Step 4 – Settle Estate

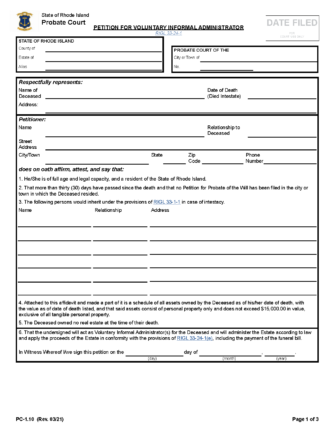

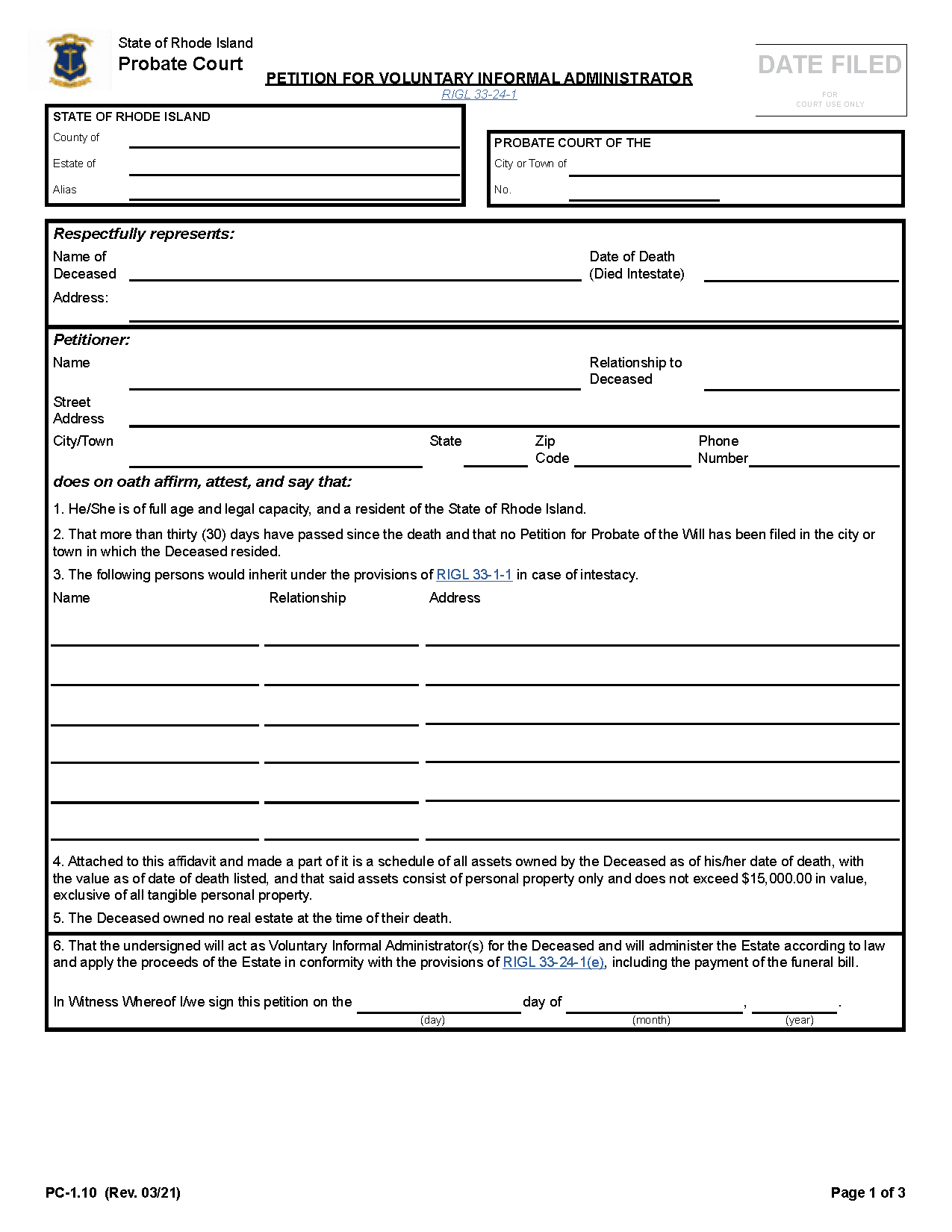

Step 1 – Petition Requirements

A Petition for Voluntary Informal Administrator (Form PC-1.10) can only be used under specific circumstances. The following conditions must be met:

- The decedent has been deceased for thirty (30) days.

- The decedent did not own real estate.

- The total estate value, excluding tangible personal property, is $15,000 or less.

- The affiant is a Rhode Island resident.

- There is no Petition for Probate of the Will, petition for letters testamentary, or letters of administration filed in the probate court of the city or town where the decedent resided.

Step 2 – File Petition

The petition must be completed and filed with the decedent’s death certificate in the Probate Court of the city or town where the decedent resided. The filing fee is $30.

Once the probate judge assesses the petition and certificate, the clerk will issue a certification of appointment of voluntary administrator. The granting of the certification does not usually require a court hearing; however, the judge may request one before appointing the affiant the informal administrator (or executor). The certification will require a $5 fee.

An affiant named executor in the decedent’s will should instead complete and file the Petition for Voluntary Informal Executor (Form PC-1.9) in the same manner as the Petition for Voluntary Informal Administrator. If the petition is successful, the affiant will be issued a certification of appointment of executor (§ 33-24-2).

Note: Tangible property must be stated on the petition, but is not included in the estate’s total value.

Step 3 – Collect Assets

The voluntary administrator or executor can present a copy of the certification of appointment to collect the assets listed in the petition schedule. Both tangible and intangible property (defined in § 33-21.1-1(10)), such as money, accounts, stocks, and bonds may be collected in the same manner.

Step 4 – Settle Estate

The voluntary administrator or executor will need to settle the estate in the following order:

- Settle funeral, medical, administration, and other expenses (§ 33-24-1(e)).

- Resolve the decedent’s debts in the order specified in § 33-12-11.

- Distribute the remainder of the estate to the surviving spouse, or if there is no surviving spouse, to the persons in the order shown in § 33-1-10.