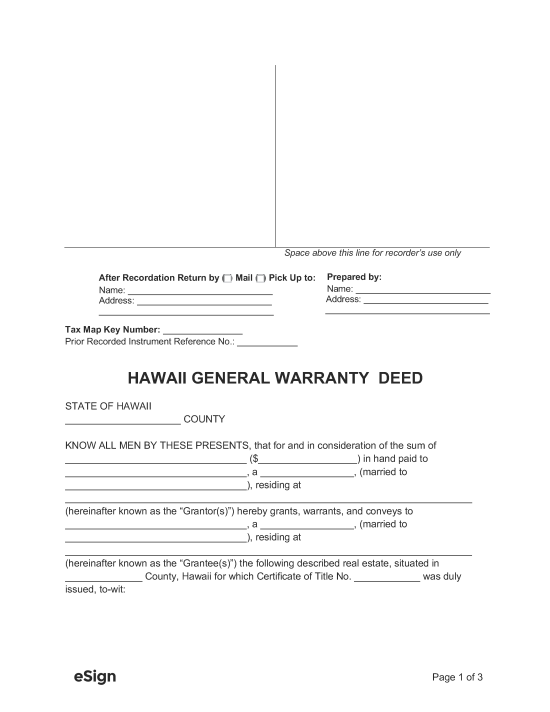

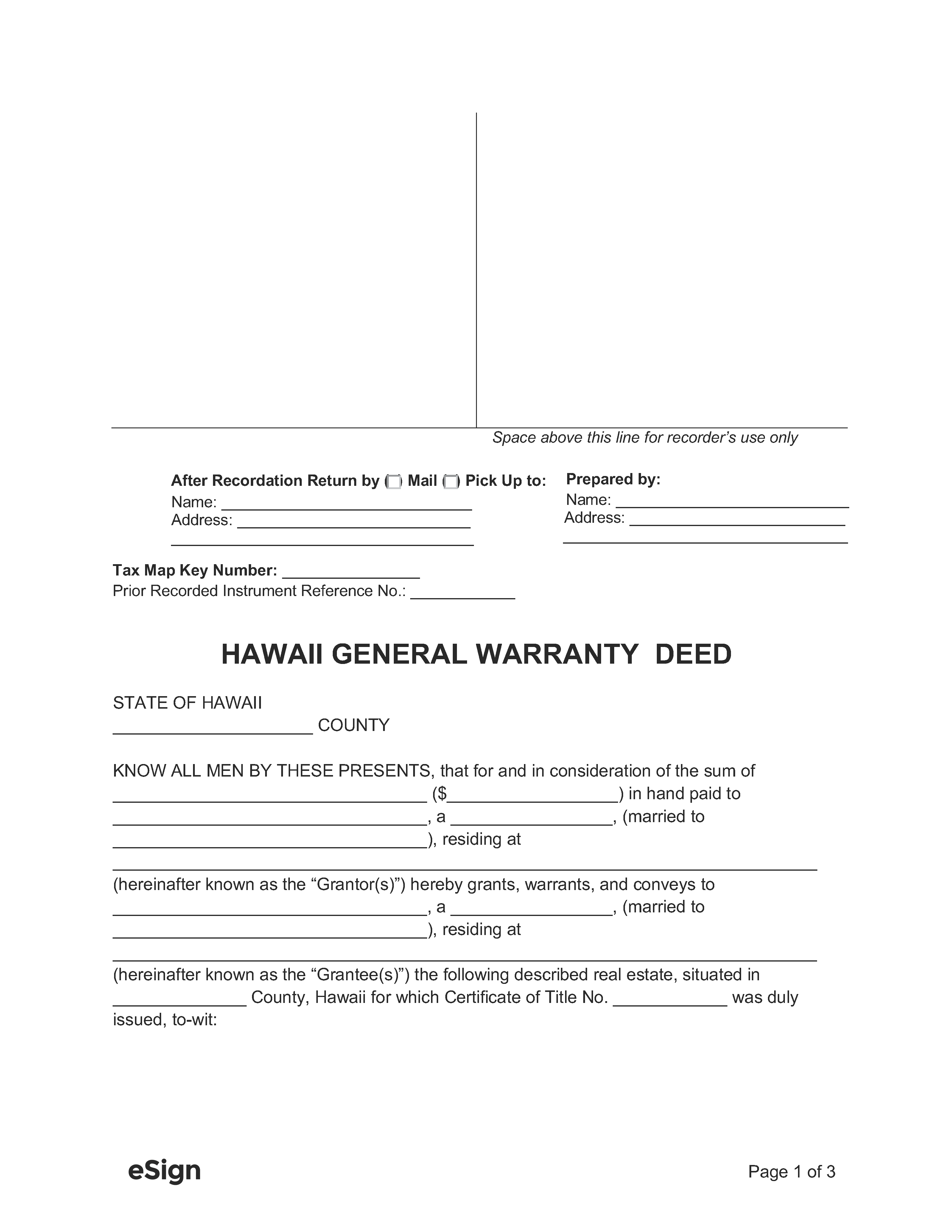

How to Format

Layout

- The paper must be no greater than 8.5 by 11 inches.

- The first page must include a top margin of 3.5 inches for recording information. In the inch below the top margin, the return address should be included starting at 1.5 inches from the left margin.[1]

Signatures

Before recording a deed, the grantor must acknowledge their signature before a notary public.[2]

Recording

Deeds are filed at the Hawaii Bureau of Conveyances.[3] The filing fee (for up to 50 pages) is $36 with the Land Court and $41 with the Regular System.[4]

Conveyance Tax Certificate (Form P-64A) – Must accompany deeds when filing unless the property is exempt from conveyance tax.[5] If exempt, Form P-64B must be filed with the deed instead.