Contents |

Sample

Download: PDF, Word (.docx), OpenDocument

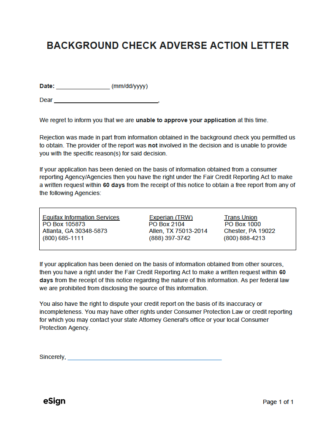

BACKGROUND CHECK ADVERSE ACTION LETTER

Date: [MM/DD/YYYY]

Dear [RECIPIENT NAME],

We regret to inform you that we are unable to approve your application at this time.

Rejection was made in part from information obtained in the background check you permitted us to obtain. The provider of the report was not involved in the decision and is unable to provide you with the specific reason(s) for said decision.

If your application has been denied on the basis of information obtained from a consumer reporting Agency/Agencies, then you have the right under the Fair Credit Reporting Act to make a written request within 60 days from the receipt of this notice to obtain a free report from any of the following Agencies:

| Equifax Information Services PO Box 105873 Atlanta, GA 30348-5873 (800) 685-1111 |

Experian (TRW) PO Box 2104 Allen, TX 75013-2014 (888) 397-3742 |

Trans Union PO Box 1000 Chester, PA 19022 (800) 888-4213 |

If your application has been denied on the basis of information obtained from other sources, then you have a right under the Fair Credit Reporting Act to make a written request within 60 days from the receipt of this notice regarding the nature of this information. As per federal law, we are prohibited from disclosing the source of this information.

You also have the right to dispute your credit report on the basis of its inaccuracy or incompleteness. You may have other rights under Consumer Protection Law or credit reporting, for which you may contact your state Attorney General’s office or your local Consumer Protection Agency.

Sincerely, ___________________________

What is “Adverse Action?”

An adverse action is a decision that results in the denial of a person based in part or wholly because of information derived from a background check. This can be for employment, credit, housing, and more.

When is it Required?

An organization is legally required to deliver a post-adverse action letter whenever they use information obtained from a background check to reject/deny the person the report was acquired for. Such actions include not hiring, promoting, lending, renting, or accepting the individual.

Instructions (How to Write)

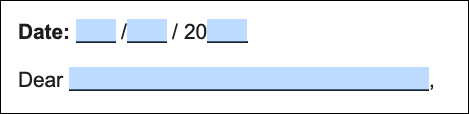

Step 1 – Date + Recipient Name

Enter the date (mm/dd/yyyy) the letter was delivered to the recipient, followed by their full name.

Step 2 – Signature of Rejecting Person/Entity

To make the form official, the individual responsible for denying the candidate based on information contained in the report should sign their name. The document can be signed and sent to the recipient by using eSign.