A mortgage adverse action letter is a notice sent from a financial institution to a home loan applicant to inform them that their application was denied. Issuing the letter provides transparency to consumers about why their application was rejected and informs them of their right to dispute or request a copy of the report. The structure and issuance of adverse action letters fall under two (2) federal acts: the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA).

Contents |

Sample

Download: PDF, Word (.docx), OpenDocument

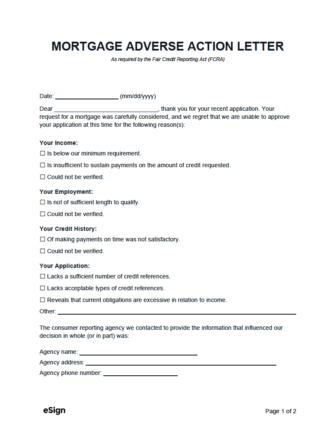

MORTGAGE ADVERSE ACTION LETTER

As required by the Fair Credit Reporting Act (FCRA)

Date: [MM/DD/YYYY]

Dear [APPLICANT NAME], thank you for your recent application. Your request for a mortgage was carefully considered, and we regret that we are unable to approve your application at this time for the following reason(s):

Your Income:

☐ Is below our minimum requirement.

☐ Is insufficient to sustain payments on the amount of credit requested.

☐ Could not be verified.

Your Employment:

☐ Is not of sufficient length to qualify.

☐ Could not be verified.

Your Credit History:

☐ Of making payments on time was not satisfactory.

☐ Could not be verified.

Your Application:

☐ Lacks a sufficient number of credit references.

☐ Lacks acceptable types of credit references.

☐ Reveals that current obligations are excessive in relation to income.

Other: [OTHER REASON]

The consumer reporting agency we contacted to provide the information that influenced our decision in whole (or in part) was:

Agency name: [AGENCY NAME]

Agency address: [AGENCY ADDRESS]

Agency phone number: [AGENCY PHONE]

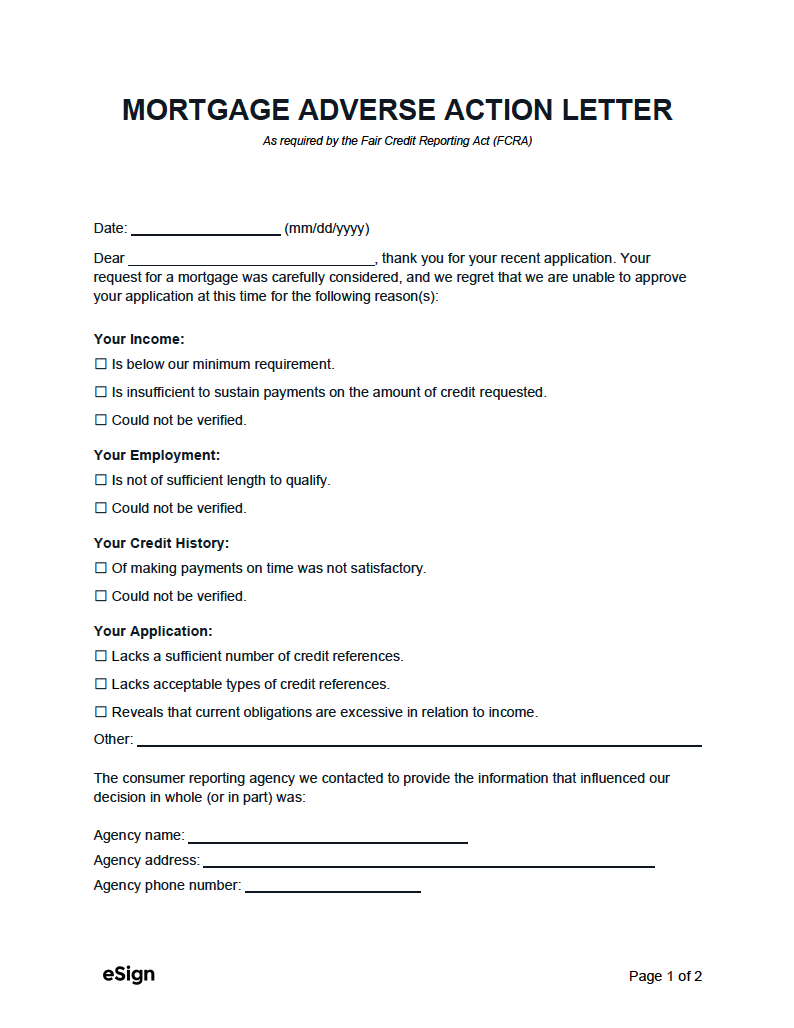

It’s important to know that the reporting agency played no part in our decision and is unable to supply specific reasons why we have denied credit to you. You have a right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency. You also have a right to a free copy of your report from the reporting agency if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency. Any questions regarding such information should be directed to [REPORTING AGENCY NAME] (consumer reporting agency). If you have any questions regarding this letter, you should contact us at:

Creditor name: [CREDITOR NAME]

Creditor address: [CREDITOR ADDRESS]

Creditor phone number: [CREDITOR PHONE]

☐ (Check if applicable) We also obtained your credit score from the consumer reporting agency and used it in making our credit decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change depending on how the information in your consumer report changes.

Your credit score: [SCORE]

Date: [MM/DD/YYYY]

Scores range from a low of [#] to a high of [#].

Key factors that adversely affected your credit score:

- [FACTOR 1]

- [FACTOR 2]

- [FACTOR 3]

- [FACTOR 4]

- ☐ Number of recent inquiries on consumer report, as a key factor (check if applicable).

If you have any questions regarding your credit score, you should contact the entity that provided the credit score at:

Address: [CONTACT ADDRESS]

Phone number (toll-free): [CONTACT PHONE]

ECRA Notice: The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The Federal agency that administers compliance with this law concerning this creditor is (name and address as specified by the appropriate agency listed in appendix A).

Who is it For?

The letter is a necessity for any institution that offers mortgage lending and uses consumer reports to pre-screen applicants, which includes the following entities:

- Banks

- Credit Unions

- Mortgage Lenders

When to Send

The letter must be sent whenever an entity takes adverse action on an applicant because of information in a credit report. Although businesses don’t fall under the FCRA’s requirements for reporting, they still fall under Regulation B of the ECOA. Using a general letter template that includes disclosures for both laws simplifies the process and ensures all government requirements are met.

Regulation B requires the notice to be sent within thirty (30 days) of receiving the consumer’s credit application. If the creditor makes a counteroffer to the applicant, they have ninety (90) days to inform the applicant of adverse action if the applicant does not accept the counteroffer.