Sending the notice ahead of a formal decision allows the applicant to dispute information contained in the report; it is a requirement per the Fair Credit Reporting Act (FCRA).

Sample

Download: PDF, Word (.docx), OpenDocument

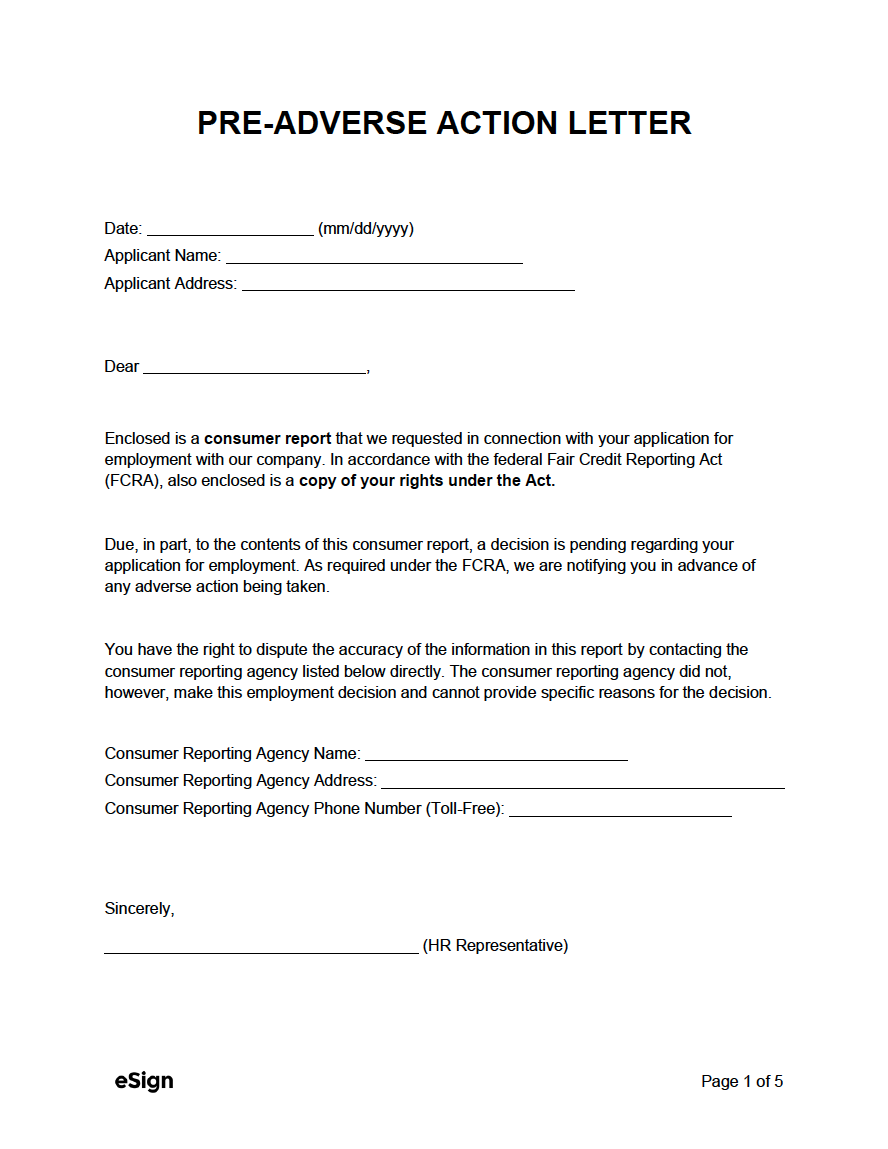

PRE-ADVERSE ACTION LETTER

Date: [MM/DD/YYYY]

Applicant Name: [APPLICANT NAME]

Applicant Address: [APPLICANT ADDRESS]

Dear [APPLICANT FIRST NAME],

Enclosed is a consumer report that we requested in connection with your application for employment with our company. In accordance with the federal Fair Credit Reporting Act (FCRA), enclosed is a copy of your rights under the Act.

Due, in part, to the contents of this consumer report, a decision is pending regarding your application for employment. As required under the FCRA, we are notifying you in advance of any adverse action being taken.

You have the right to dispute the accuracy of the information in this report by contacting the consumer reporting agency listed below directly. However, the consumer reporting agency did not make this employment decision and cannot provide specific reasons for the decision.

Consumer Reporting Agency Name: [AGENCY NAME]

Consumer Reporting Agency Address: [AGENCY ADDRESS]

Consumer Reporting Agency Phone Number (Toll-Free): [AGENCY PHONE]

Sincerely,

______________________________

[HR REPRESENTATIVE NAME]

What’s Included

The notice is relatively simple; it includes the applicant’s contact information, the credit reporting agency that supplied the report, and a summary of the applicant’s rights under the FCRA.

In addition to the notice and rights summary, the issuer must attach the applicant’s full report.

How to Use

The pre-adverse action letter needs to be sent prior to making a decision on the consumer’s application. This gives them ample time to review the report to ensure it contains accurate, up-to-date information. The letter is recommended to be sent via mail, although the FCRA also permits consumers to be informed electronically and verbally. Should the recipient find an issue with the report, they can file a claim with the credit reporting agency. If the agency finds the consumer’s claim of wrongful information is false, the claim may be denied.

To formally deny the consumer, they need to be sent an official adverse action notice.