Affidavit of Domicile: Explained

Financial institutions require an affidavit of domicile before transferring stocks, bonds, or options of a deceased individual to the new owner. Knowing which state the decedent died in is important for determining which tax and probate laws apply.

The affidavit is completed under oath, meaning the signing party is swearing under penalty of perjury that the statements within the document are accurate. A notary public must acknowledge the person’s identity and signature and certify the form with their own signature and notary seal.

Sample

Download: PDF, Word (.docx), OpenDocument

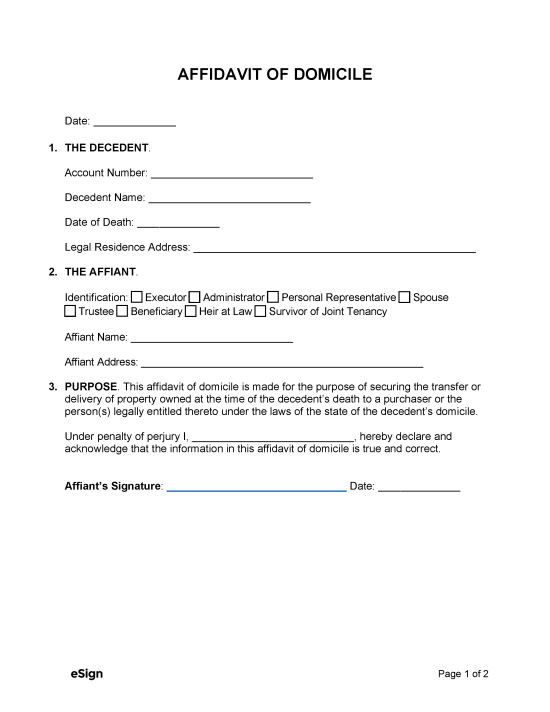

AFFIDAVIT OF DOMICILE

Date: [MM/DD/YYYY]

1. THE DECEDENT.

Account Number: [ACCOUNT NUMBER]

Decedent Name: [DECEDENT NAME]

Date of Death: [MM/DD/YYYY]

Legal Residence Address: [DECEDENT ADDRESS OF RESIDENCE]

2. THE DECEDENT.

Identification: ☐ Executor ☐ Administrator ☐ Personal Representative ☐ Spouse ☐ Trustee ☐ Beneficiary ☐ Heir at Law ☐ Survivor of Joint Tenancy

Affiant Name: [AFFIANT NAME]

Affiant Address: [AFFIANT ADDRESS]

3. PURPOSE. This affidavit of domicile is made for the purpose of securing the transfer or delivery of property owned at the time of the decedent’s death to a purchaser or the person(s) legally entitled thereto under the laws of the state of the decedent’s domicile.

Under penalty of perjury I, [AFFIANT NAME], hereby declare and acknowledge that the information in this affidavit of domicile is true and correct.

Affiant Signature: ______________________________ Date: _______________

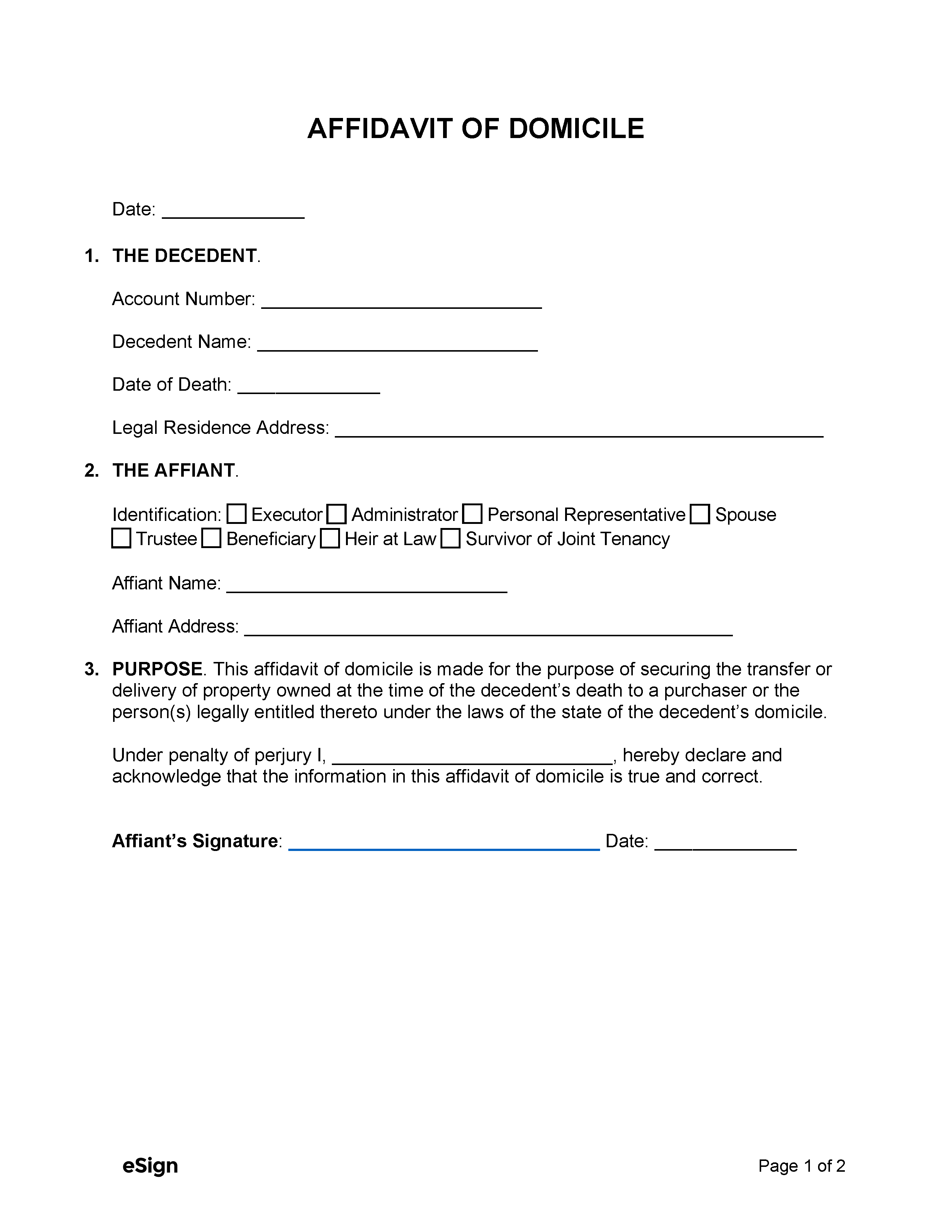

State of [STATE]

County of [COUNTY]

Subscribed band sworn to (or affirmed) before me on this [DAY] of [MONTH], [YEAR], by [AFFIANT NAME], proved to me on the basis of satisfactory evidence to be the person who appeared before me.

WITNESS my hand and official seal.

Signature: ________________________

My Commission Expires: _______________

(Seal)