Formatting Requirements

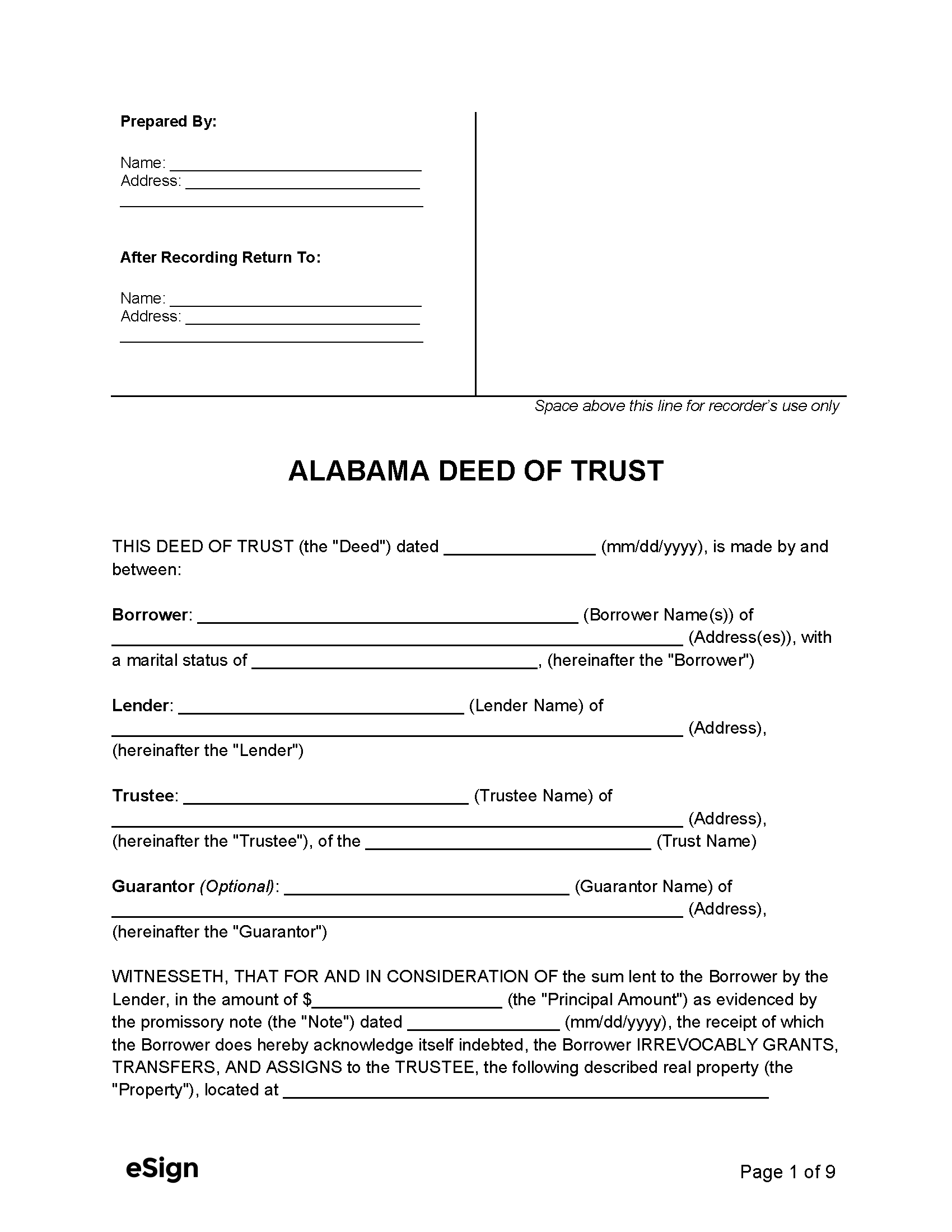

The grantor must acknowledge their signature before a notary or witness.[1] The document must be recorded with the Judge of Probate’s office.[2]

While there are no statewide formatting requirements, filers should ensure their form complies with local standards.