By Type (6)

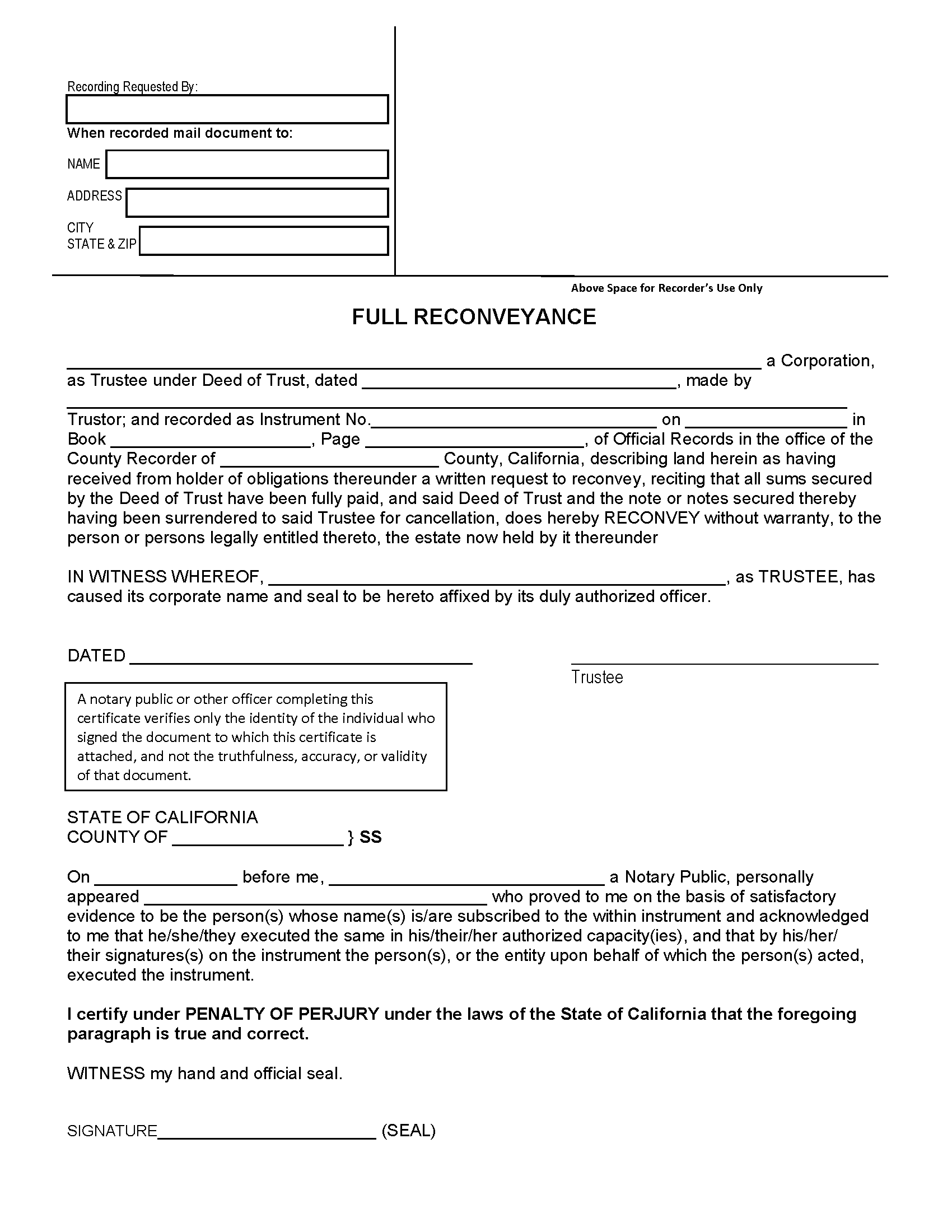

Deed of Reconveyance – Returns the property title to the borrower under a deed of trust when they have repaid their debt. Deed of Reconveyance – Returns the property title to the borrower under a deed of trust when they have repaid their debt.

Download: PDF |

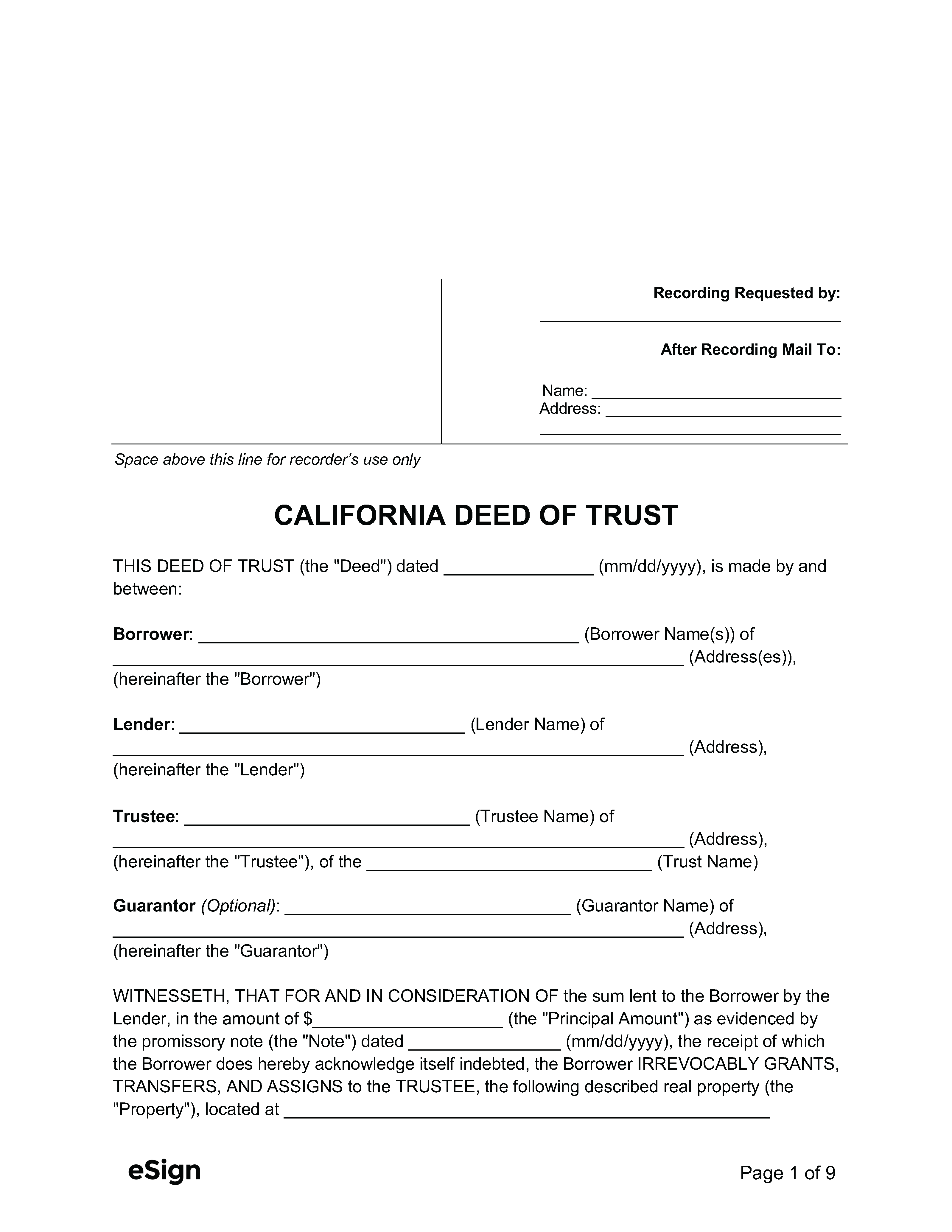

Deed of Trust – Transfers the property’s title to a trustee until the property’s financing is repaid by the borrower. Deed of Trust – Transfers the property’s title to a trustee until the property’s financing is repaid by the borrower.

|

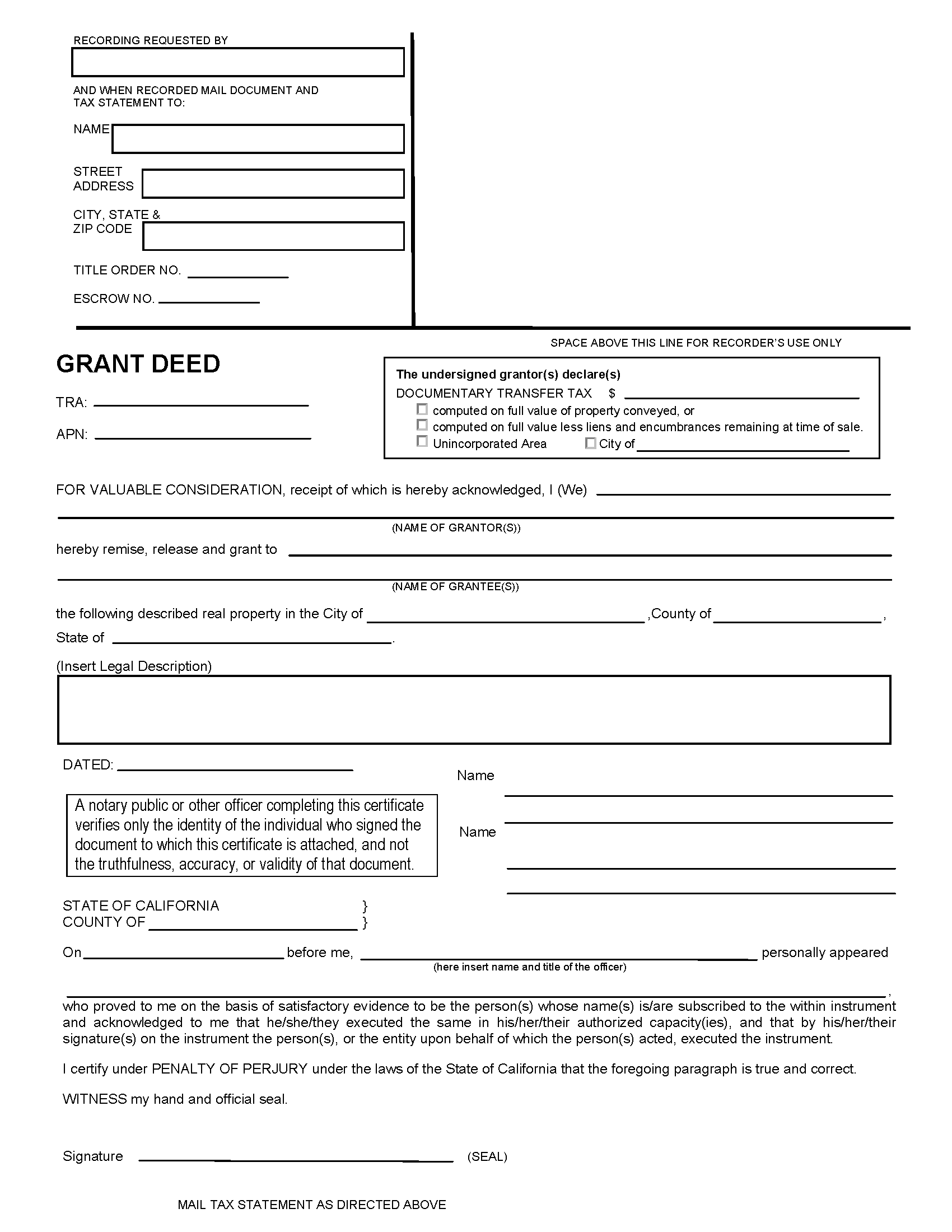

Grant Deed – Gives the grantee guarantees that the conveyed property was not encumbered by the seller. Grant Deed – Gives the grantee guarantees that the conveyed property was not encumbered by the seller.

Download: PDF |

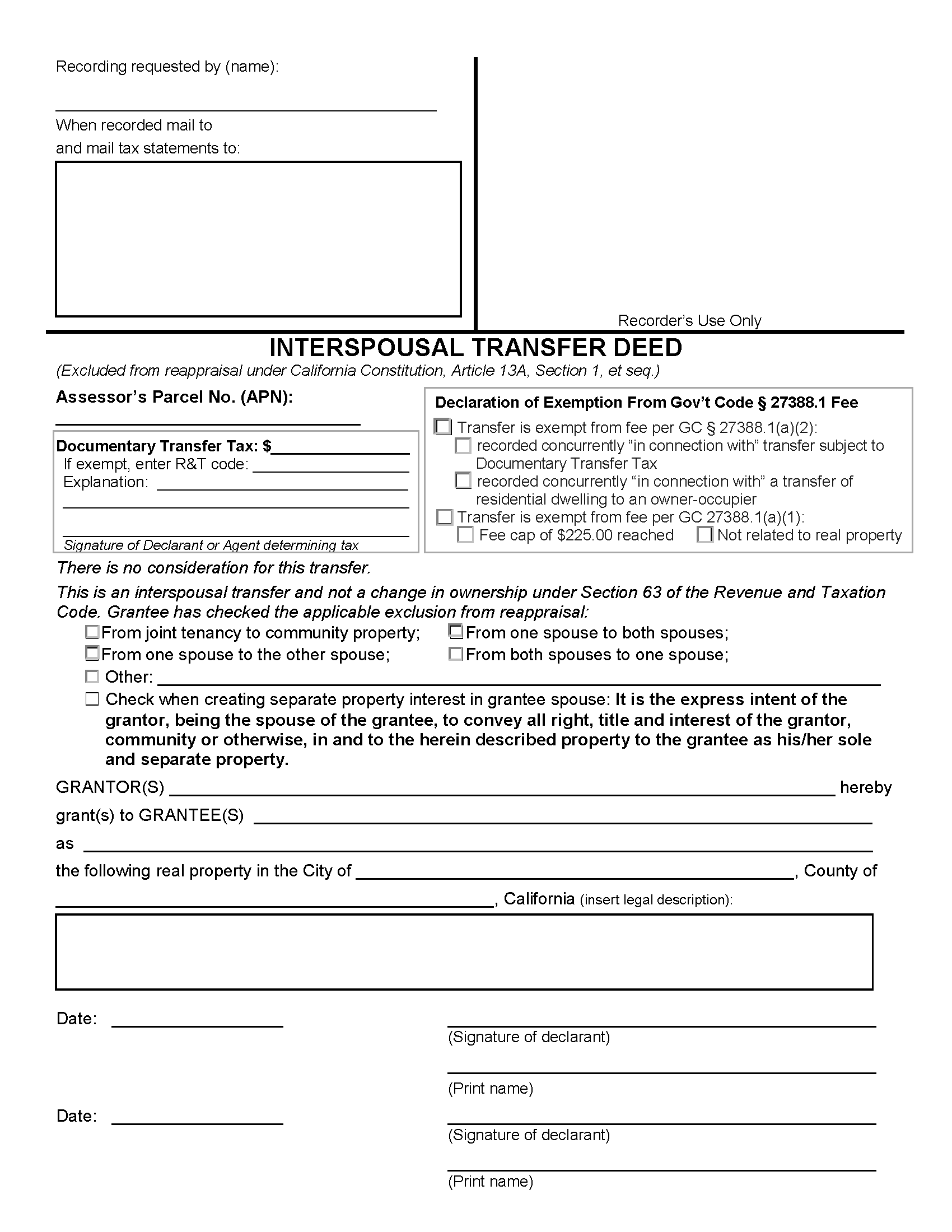

Interspousal Transfer Deed – Conveys a property from one spouse to another (often used for divorce). Interspousal Transfer Deed – Conveys a property from one spouse to another (often used for divorce).

Download: PDF |

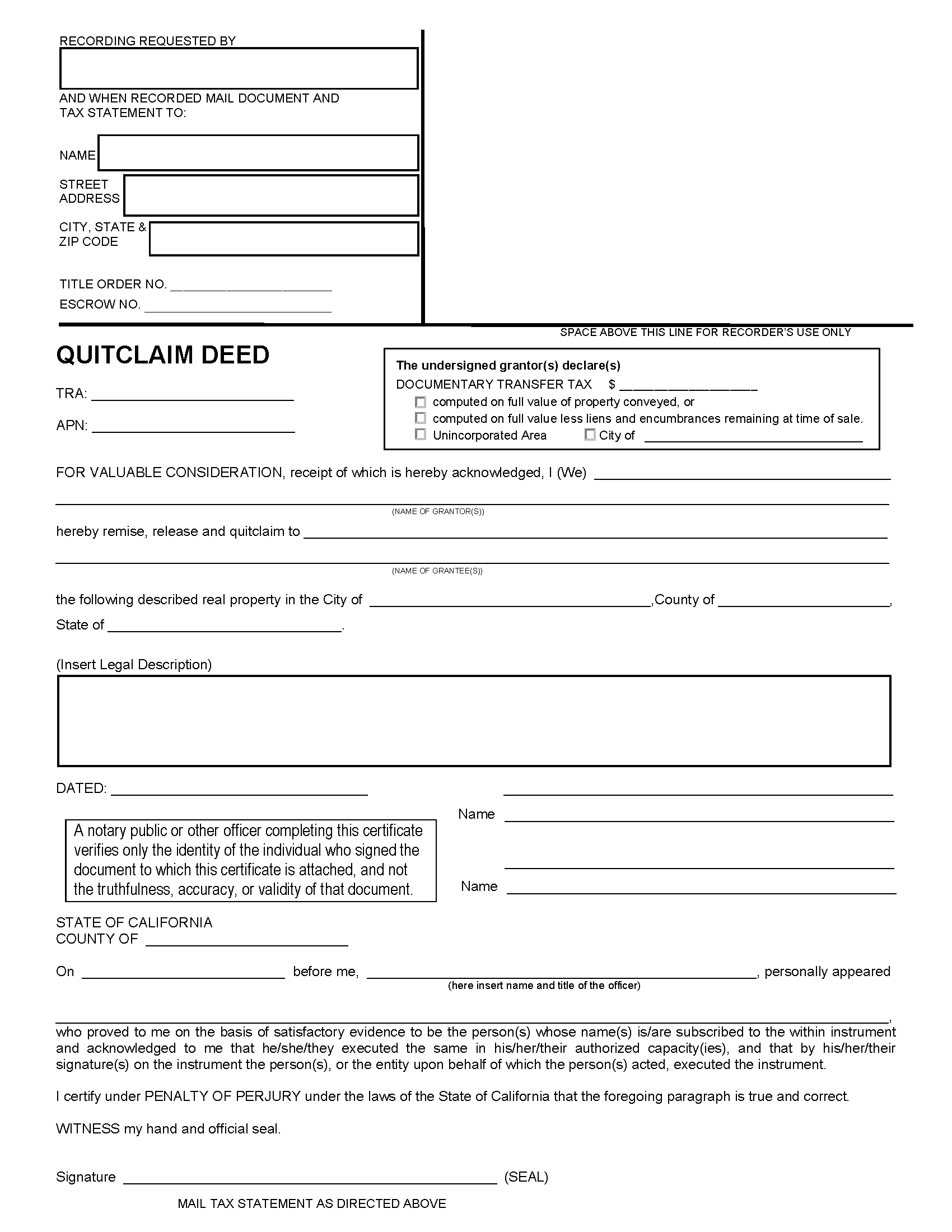

Quit Claim Deed – Transfers property ownership without warranty. Quit Claim Deed – Transfers property ownership without warranty.

Download: PDF |

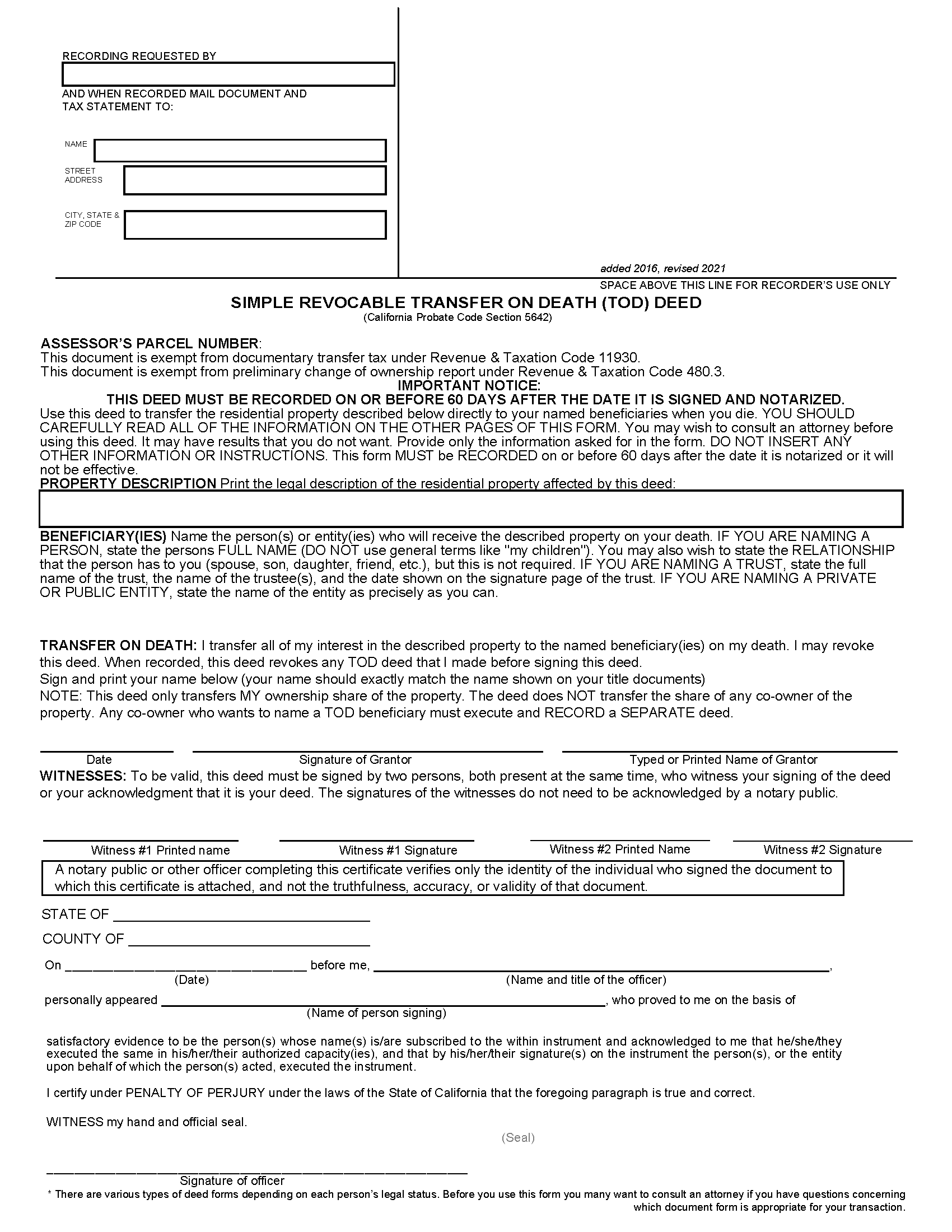

Revocable Transfer on Death Deed – Names a beneficiary who will receive full ownership of the grantor’s property when the grantor dies. Revocable Transfer on Death Deed – Names a beneficiary who will receive full ownership of the grantor’s property when the grantor dies.

Download: PDF |

Formatting

Recording

Signing Requirements – Deeds require the grantor’s signature with a notary acknowledgment.[3]

Where to Record – Deeds are recorded at the County Recorder’s Office with jurisdiction over the conveyed property.[4]

Cost – $10 for the first page, and $3 for each additional page (as of this writing).[5] An additional fee of $75 will apply unless exempt.

Additional Forms

Preliminary Change of Ownership Report – Real estate transferees must file this document with any deed changing a property’s ownership.[6]