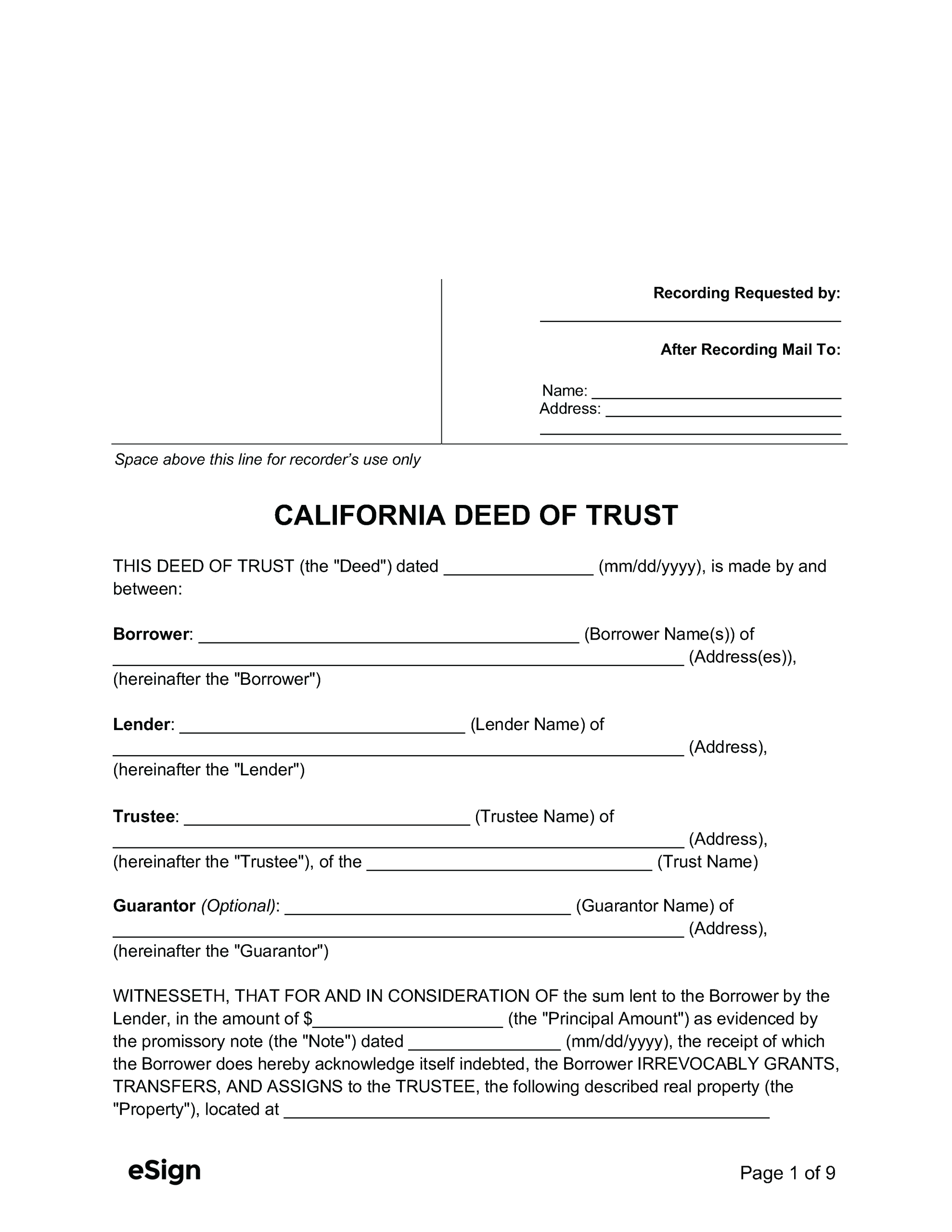

Deed Requirements

The borrower must execute the deed and acknowledge their signature before a notary.[1] Deeds are recorded with the County Recorder.[2]

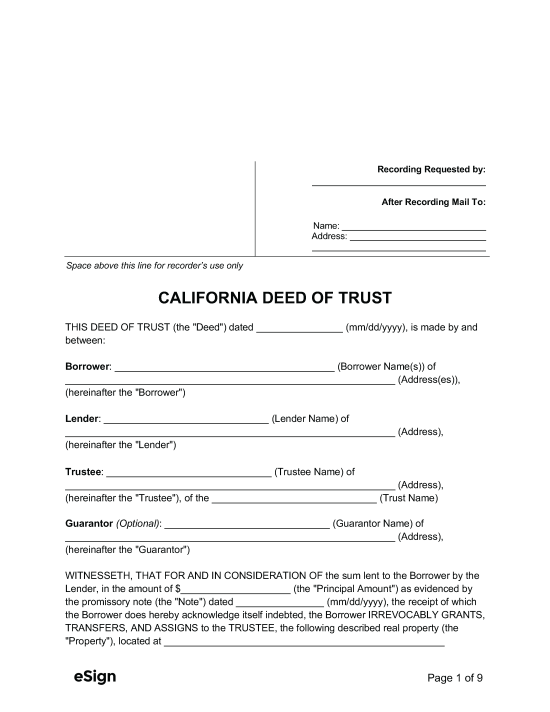

The following formatting standards must be met before submitting a deed for recording[3]:

- Between 8.5″ x 11″ and 8.5″ x 14″ in size

- 0.5″ side margins, and min. 2.5″ top margin with 3.5″ space in top left of first page

Deed of Trust Foreclosure

Once a borrower satisfies their loan obligation, the title is returned to them by a Deed of Reconveyance. In the event of a default, a deed of trust foreclosure goes as follows[4]:

- At least 30 days before a Notice of Default is recorded, the lender must contact the borrower and attempt to find a foreclosure alternative.[5]

- After at least 120 days from the initial default, the Notice of Default can be recorded by the trustee or lender.[6]

- If the borrower cannot resolve the default within three months of the Notice of Default’s recording, the trustee or lender can record a Notice of Trustee Sale specifying when the property will be sold.[7]