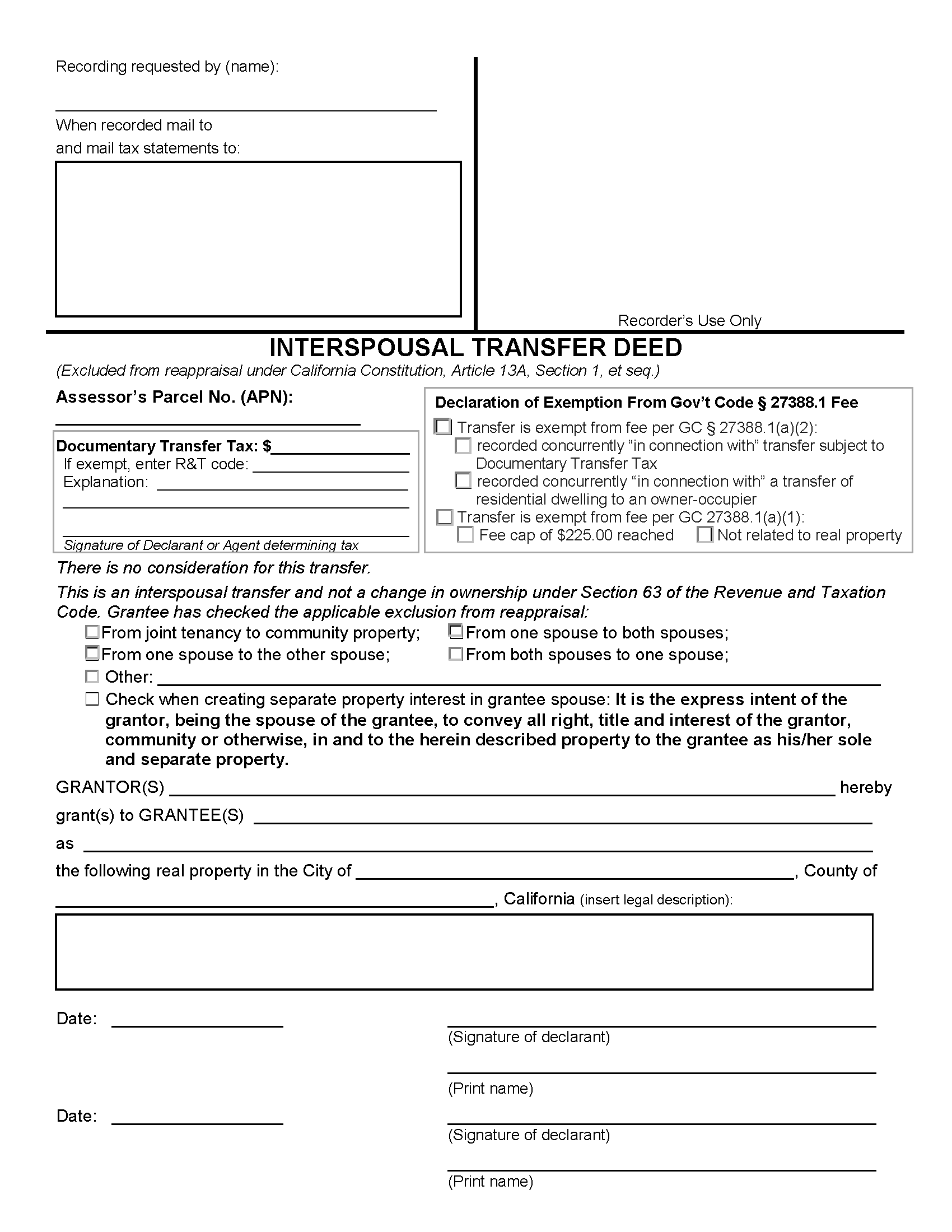

Recording Deeds in California

Deeds must be filed with the County Recorder’s Office where the conveyed property is located.[1] Recording fees as of this writing are $10 for the first page and $3 each for any other pages.[2]

Deeds must be signed by the person conveying property and notarized. The following formatting standards are required[3]:

- Maximum dimensions of 8.5” x 14” (8.5” x 11” preferred)

- Side margins must be at least 0.5”

- Top margins must be at least 2.5”

- A 3.5″ empty space at the top left of the first page for return addressee info

Required Forms

Preliminary Change of Ownership Report– This report must be filed with every deed where property changes ownership.[4]