Revocation of Revocable Transfer on Death Deed – The TOD deed can be revoked by executing this form.

Recording and Resources

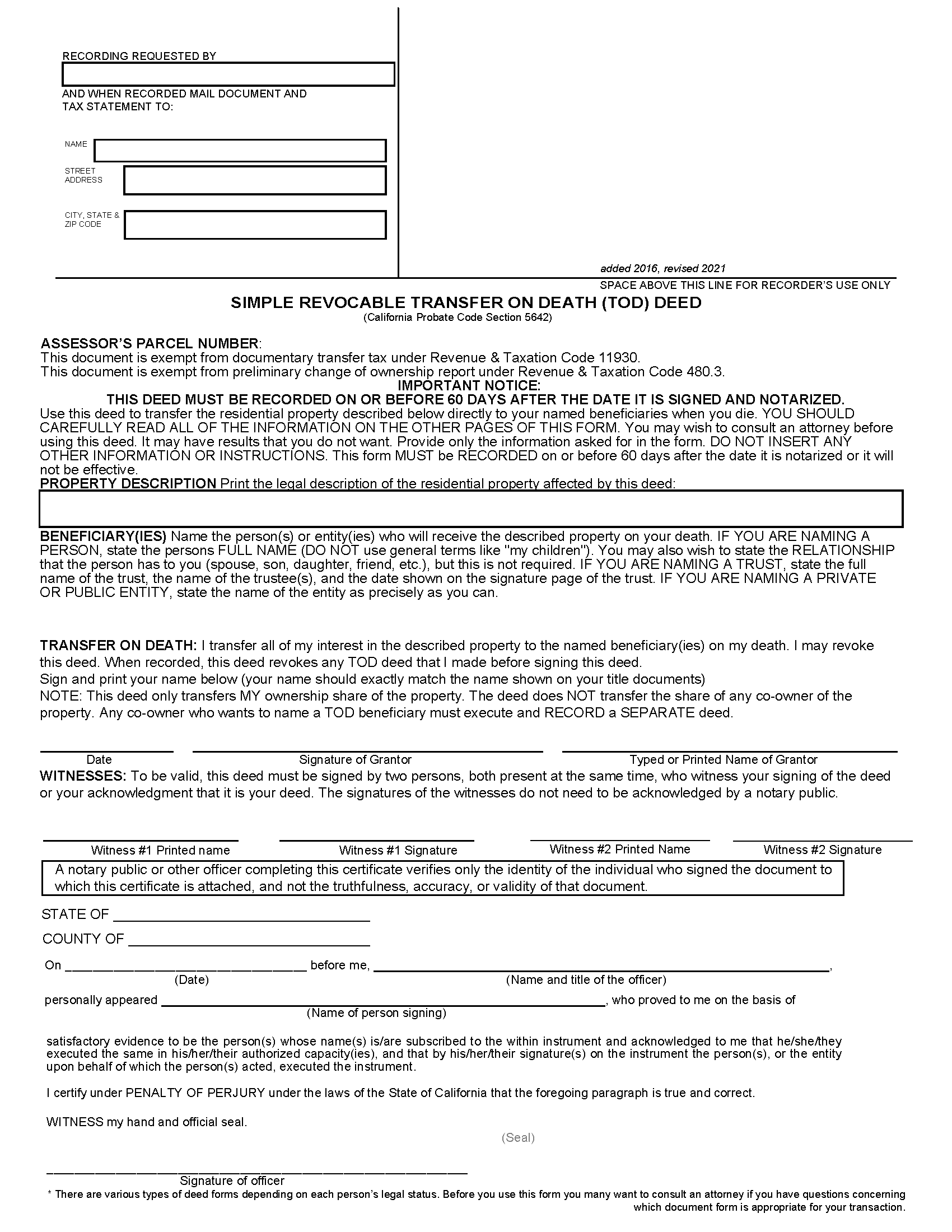

Formatting

- Paper: 8.5″ x 11″ (standard) or 8.5″ x 14″ (accepted)[1]

- Margins:

- 2.5″ top margin on the first page – 3.5″ left side of this for return address, information of the submitter

- 0.5″ side margins[2]

Signing and Recording

- Signing Requirements: Grantor, two witnesses, notary public[3]

- Where to Record: County Recorder’s Office[4]

- Recording fees: $10 for first page + $3 each additional page (as of this writing)[5]

Resources