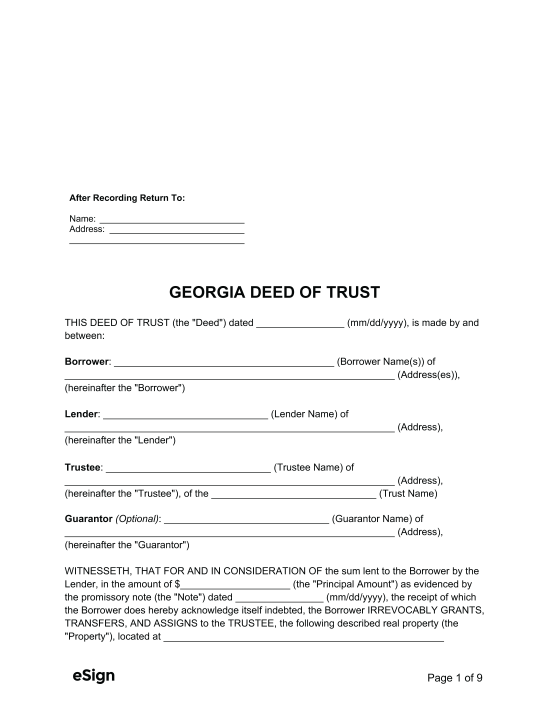

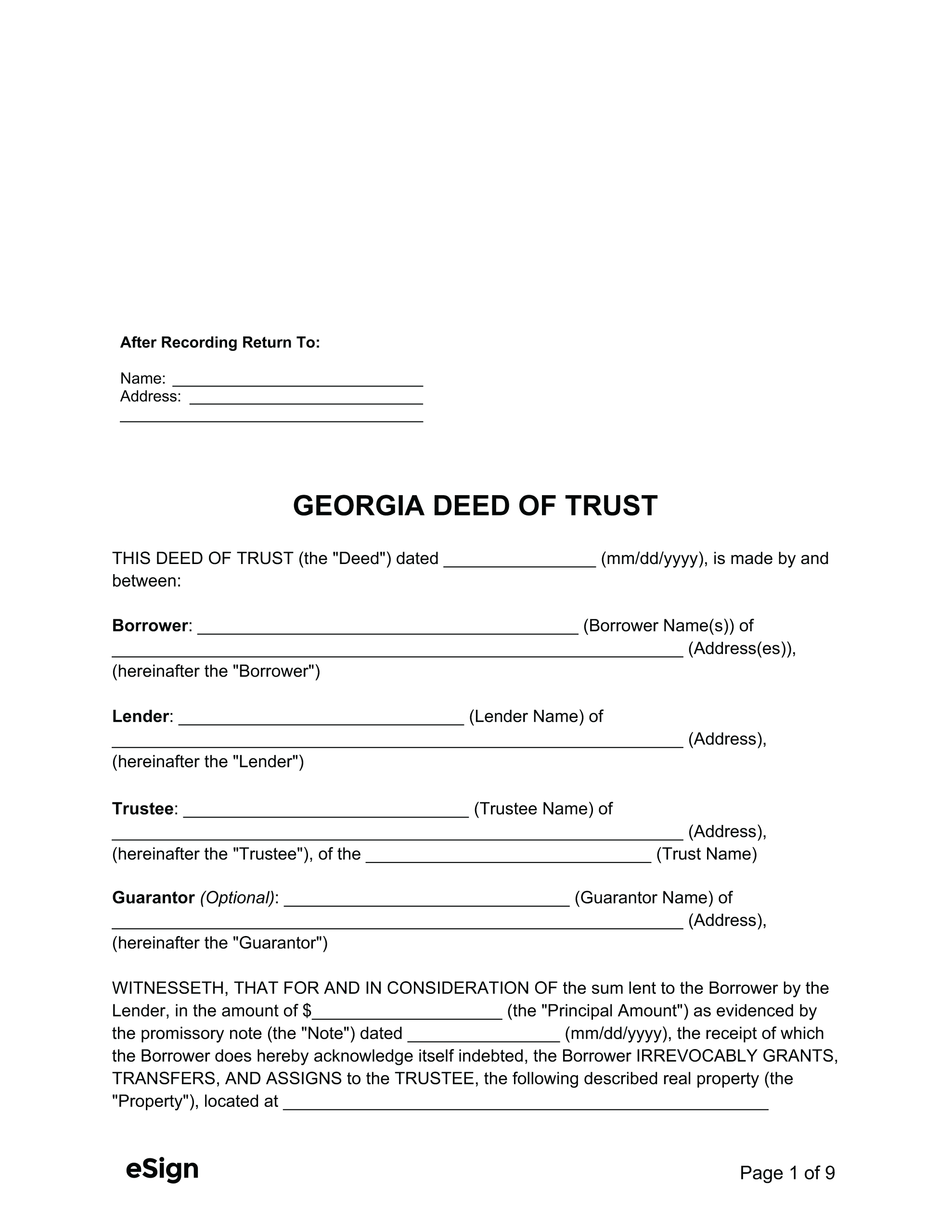

Deed Requirements

Deeds must be signed by the borrower and a witness, and notarized.[1] Individuals filing their own deed must do so online.[2] If a representative is filing on another’s behalf, they must do so in person with the Superior Court Clerk.[3] A deed is eligible for filing if[4]:

- The paper size is between 8.5″ x 11″ and 8.5″ x 14″

- The first page has a 3″ top margin

Deed of Trust or Mortgage

Both mortgages and deeds of trust are permitted in Georgia. A mortgage places a lien on a title and requires court action to foreclose if a default occurs. A deed of trust transfers a title to a third-party trustee who may foreclose the property without court approval.

However, a “security deed” is more commonly used in Georgia for securing a loan with a property title.