Deed Requirements

After the borrower has signed the document and acknowledged their signature before a notary, it can be brought to the County Recorder for recording.[1]

Documents must be 8.5″ x 14″ or smaller in size to be accepted for filing.[2]

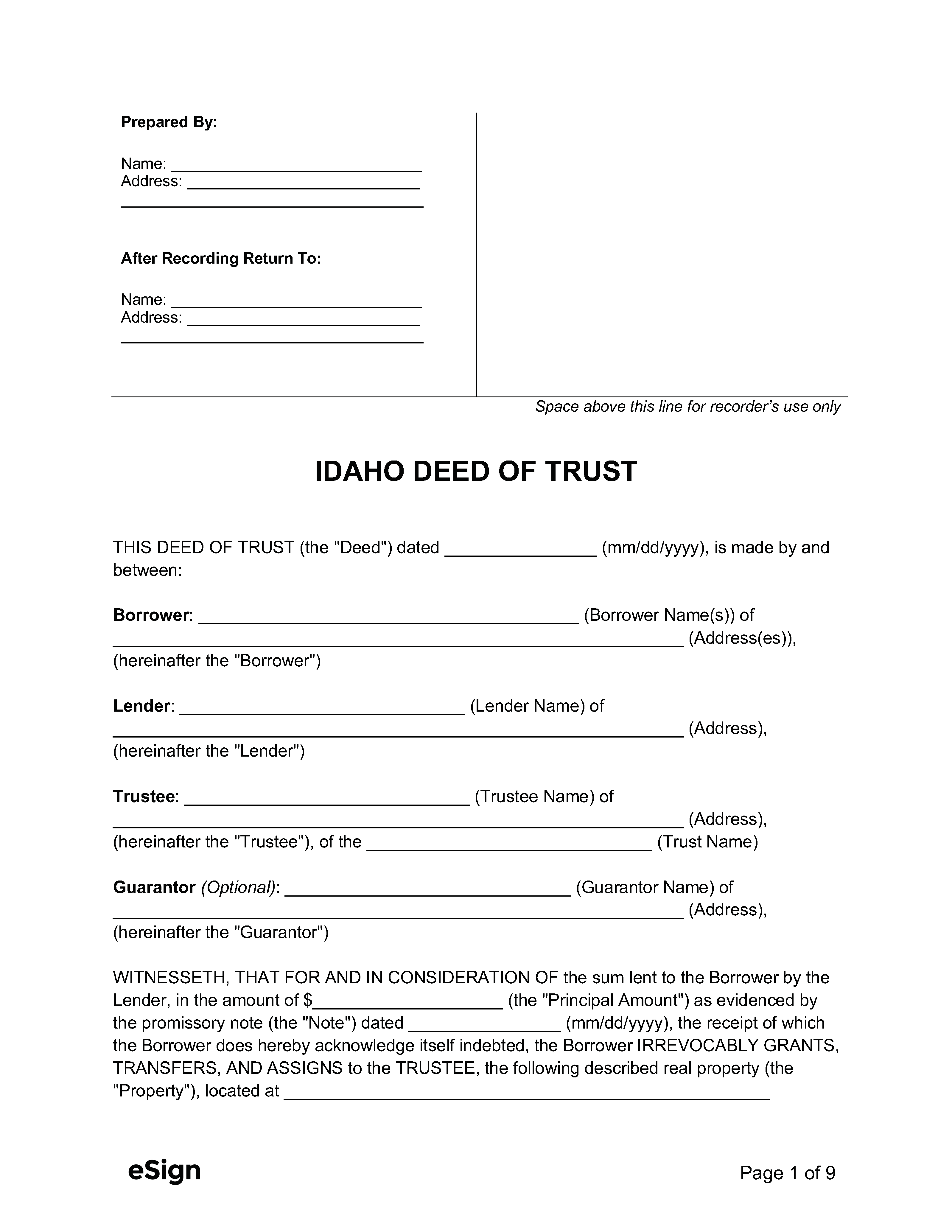

Deed of Trust in Idaho

Deeds of trust are valid in Idaho, allowing the borrower’s property to be used as security for a loan. By entering into a deed of trust with “power of sale,” the parties acknowledge that the trustee may initiate a non-judicial foreclosure if the borrower defaults on the agreement.[3]